Update of the Business Plan 2022 Resilience and Value - Milan July 3, 2020 - UBI Banca: update Business Plan 2022

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

UBI Banca: a story of sustainable growth and solidity in the interest of all stakeholders

April 2007: merger between two solid banks, BPU Banca and Banca Lombarda.

The first Bank to forecast the economic crisis in Italy:

1 bln € capital increase announced in March 2011, before all other competitors.

Announcement followed in April by ISP.

First Cooperative

Bank to become a

Strong consolidation capabilities with highly performing and scalable

Joint Stock Company

IT system (10 migrations carried out in 15 months, strong execution capabilities). in October 2015

Single Bank project: merger of all 7 Network Banks into UBI Banca approved in October

2016 and completed in February 2017.

Systemic role: Acquisition of Banca Etruria, Banca Marche and Carichieti in April 2017; all

Banks (4 different IT systems) merged into UBI Banca within February 2018.

Throughout the years, Sustainable Dividend Policy allowing continuous internal capital generation and constant

shareholder remuneration.

Only Bank in Italy to have always paid a cash dividend since inception, and this without recourse to

sale of strategic assets.

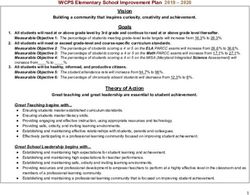

2UBI Banca: a credible 2022 Business Plan

2017- 2020 Business Plan: all targets in the hands of management exceeded.

Different macroeconomic scenario impacting revenues, as for all Banks.

Business Plan 2022 very well received by the market

UBI share +5.5% in a few hours on 17/02 on top of +11.2%* after presentation of 2019

FY Results.

Full performance of the Bank to be unleashed from 2020: excellent January and

February 2020 performance leading to increased net profit for the 1st quarter notwithstanding

March lockdown.

Covid 19 «stress test» confirming the Bank’s IT Capabilities and the Flexibility of systems and Staff

Capital Strength built over the years,

Impact of Covid19 estimated relatively contained thanks to

full Availability of Group Assets (product factories and other value reserves) and Solid Management of all Risk

Factors.

* Performance from 7 February to 14 February

3UBI 2019: a solid starting point

Growing core revenues1 Decreasing Improving Growing capital ratio and strong

with healthy mix cost baseline credit quality protection for senior bondholders

Core revenue mix, % Operating costs (stated), € mln NPE ratio (gross), % CET1 FL ratio, % Total capital + SNP, %

Net Net interest

Commissions income +1.0 p.p.

12.3 19.1

-2.6 p.p. 11.3 2.6 SNP

3,369 3,387 10.4

2,448 -3% 3.5 Tier 2

2,368 7.8

47% 49% 0.7 AT1 2

12.3 CET1

53% 51%

2018 2019 2018 2019 2018 2019 2018 2019 2019

1. Core revenues include net interest income and net commissions

4 2. AT1 issued in 2020 and included in the calculation of the total ratioThe 2017-2020 Business Plan: over-delivery of all targets in the hands

of the management

FL CET1 ratio, % NPE ratio (gross), % Texas ratio, %

11.4% 12.3% 12.3% 100% 87%

13.0% 11.9% 56%2

7.8%1

2017 2019 BP target 2017 2019 BP target

2017 2019 BP target

2019 2020

2020

Excluding cost of

LLP ratio, bps massive disposals Branches, #

Default rate, % not included in BP

79 61 63 1,838 1,565 1,667

2.0% 1.1% 1.4%

2017 2019 BP target 2017 2019 BP target 2017 2019 BP target

2020 2019 2019

-300 resources

Operating costs, € mln Cost/Income, % Staff, # (cost already

Excluding systemic charges Excluding systemic charges sustained in 2019)

21,412 19,940 19,500

2,3573 2,261 2,445 65.9% 62.1% 58

2017 2019 BP target 2017 2019 BP target 2017 2019 BP target

2019 2019 2020

1 . 12.8% Business Plan Target in 2019

2. 98% Business Plan Target in 2019

5

3. Operating costs include full year for UBI Banca and 9 months for the 3 acquired banksAgenda Covid19: reaction of the Group and new

behaviours

Premises of the Business Plan update

Update of the Business Plan

Closing remarks

6Covid 19: quick reaction of the Group, thanks to Flexibility of staff and systems, allowing

all activities to be fully guaranteed during the crisis with high operating performance (1/2)

Internal organisation

▪ 20,000 remote workstations (vs approx. 19,600 employees) enabled with VPN and VDI access

▪ Over 5,000 new portable PCs purchased and distributed to the workforce in addition to those

already available

▪ 85% of Central Units in smart work (and approx. 50% of all staff)

▪ Strengthened central IT infrastructures to allow remote work and increased cyber-risk monitoring

Quick reaction to

Covid19 challenges ▪ Branches equipped with Covid19 precautions (protective equipment, increased cleaning services,

limited access and only on appointment, etc..)

Personnel, Customers

and IT ▪ At the very peak of the crisis and notwithstanding the concentration in Bergamo and Brescia, 80% of

branches were kept open. All branches are currently open

▪ Insurance policy integration to cover Covid19 emergency

▪ On-line training: from 16/3 to 17/6, 216,000 training courses corresponding to 38,300 hours of

training, involving 16,000 staff

▪ «Back to work» project (~ 2 months) aiming at a better work / life balance, maximum use of

digitalisation, leveraging on Covid19 experience, and cost saving.

7Covid 19: quick reaction of the Group, thanks to Flexibility of staff and systems, allowing

all activities to be fully guaranteed during the crisis with high operating performance (2/2)

Customer service

▪ Progetto Vicinanza: calls to customers to understand their needs under Covid19

▪ Client Support through Contact Center structure, fully working in remote

Quick reaction to

▪ 4,700 Relationship Managers enabled to carry out full remote selling

Covid19

▪ Acceleration of further digitalisation of commercial activity, with priority to

challenges - credit/debit card/current account related services,

Personnel, - financing products, including personal loans and pre-authorised digital lending

Customers and IT - insurance products

- advisory and securities related services

▪ Launch and implementation of «Rilancio Italia», a 10 bln€ project to provide financing to

the economy (anticipating by approx. 2 weeks Government action)

8Covid 19: customer response/behaviour accelerate the way towards digital model

services, confirming all projects in the Business Plan published on February 17th

Use of digital by Retail and Business customers Increased remote sales through digital processes

Transactions 87% 87% Home mortgages

migrated on 80% ▪ As at 31st May, home mortgages granted remotely

digital channels reached 15% of total.

(% of total ▪ Requests for new home mortgages received through the

transactions) 2019 May 20 Target ‘22 Online Channel: 5 months 2020 +43% vs 5 months 2019

BP17/02

37.0 58.7

Mobile channel Car insurance policy renewals

app accesses +58.6% ▪ On-line or through the Contact Center

(# of accesses, +47.7% ▪ Remote renewals:

in mln) 5m 2019 5m 2020 1Q20/1Q19 May 2020: 38% of total renewals

SOURCE: CRM

9Web Tablet Smartphone

UBI customers already have access to best-in class digital capabilities

Main Functionalities* UBI Banca Intesa Sanpaolo BPER

Payment functionality ▪ Bill payments (Blank template / MAV / RAV)

▪ Cash orders

(no basic) and utilities

▪ Bill payments to Public Administration (Pago PA)

Tax payments ▪ Local and national taxes (F24)

▪ Vehicle road tax

Digital payments ▪ Bancomat Pay

▪ Apple/Samsung Pay

▪ Google Pay

Investments and ▪ Securities/funds: portfolio status and history

insurance ▪ Securities/funds: tax position

▪ Insurance: status

Financial assets

▪ Trading of equities and bonds

▪ Funds operations (UCITS, capital accumulation plans)

Advanced account

▪ Inflows vs outflows, movements clustering, budget

management ▪ Movements customization

Loans ▪ Personal loans (status and amortization plan)

and ▪ Mortgages (status and amortization plan)

general settings ▪ Change password, address, e-mail

▪ Security Settings

Average App Rating (as at 03/07/2020) 4.5 4.5 4.0 4.6 3.5 2.1

Rating from 1 to 5: Android Google Play Store1 and IOS Apple Store2

Average App ranking (from 1 - lowest - to 5 – highest -)

*SOURCE: Osservatorio Digital Banking Reply - 31 March 2020 1 Num. of reviews: UBI 61,116, Intesa Sanpaolo 122,294, BPER 11,864

10

2 Num. of reviews: UBI 13,474, Intesa Sanpaolo 238,152, BPER 1,151The Covid experience has led to a further acceleration of Digital, Data and Analytics

to support the transformation of the business model

The COVID emergency Programs Accelerated

▪ Launched UBIConto, first account & debit card that can be

Digital & Data # Mobile app active +32% subscribed via Mobile App

as key elements digital clients May20/May19 ▪ Launched PrestiFatto, fully digital salary backed loans

▪ Launch in Q3 of new digital and data-driven lending process

in managing the dedicated to SMEs

Covid19 # Hybrid & Ricariconto +50%

▪ Launch in Q3 of UBI Banca account aggregator, to extract value

emergency, thus Commercial Self Installment Plan

from third party’s transactions in terms of lending and wealth

5M20/5M19 management opportunities

accelerating our ▪ Data driven customer purchase propensity and pricing model

roadmap to (ongoing releases)

▪ Data Driven omnichannel customer journeys and marketing

Enhanced # Car Insurance 5x automation (ongoing releases)

Digital Self Renewal 5M20/5M19 ▪ Robot4Advisory (early 2021)

capabilities,

Advanced ▪ New app to help employees

in managing social ▪ New data Driven Planning & Control

Analytics, and Non- distancing measures ▪ Automation of compliance and audit controls

Innovation commercial ▪ New predictive remote ▪ Know-Your-Customer & AML

teams controls implemented ▪ Advanced risk early-warning systems

during the emergency

11Organize-to-innovate: A New Way of Working

Results achieved during

the COVID emergency Business Plan Targets

▪ New workplace concept & Real ▪ 20.000 remote Smart work adoption; % (*)

Flexible Estate rightsizing based on workplaces enabled in a ~85%

Exploit workplace unassigned physical desks, remote short time ~30-40%

positive access IT tools and collaboration ▪ 85% of employees of

solutions ~5%

central units working NEW

lessons ▪ Increased adoption of Smart remotely during the peak

learned in Working, with Welfare support of the crisis Pre Covid Covid 2022

managing the ▪ nearly 50% of all loan Agile adoption; %

Bank at a requests under 25K€

Covid ▪ Additional boost in agile adoption, ~30%

new speed with focus on continuous delivery

during the first week

emergency, in coming from UBI Banca. ~5% ~15%

based on minimum viable products NEW

terms of work Fastest bank in managing

these loan requests

productivity, Pre Covid Covid End 2021

agility, time to ▪ Adoption of a new Cyber & ▪ 85% of processes of

Business Resilience Culture central units managed

market and Resilience ▪ All processes to be digitalized for remotely (including Cloud adoption; %

business remote work Contact Center and

>30%

resilience ▪ Boost in Cloud architectures Market Trades)

~5%

adoption, to manage increased ▪ No significant cyber or

volumes during crisis events fraud events intercepted

▪ Continuous crisis simulations during the emergency Pre Covid 2022

(*) In Central Organizational Units

12Agenda Covid19: reaction of the Group and new behaviours

Premises of the Business Plan update

Update of the Business Plan

Closing remarks

13The Update of the Business Plan: a new perimeter, different capital allocation and the

exploitation of some value reserves allow mitigation of Covid 19 impacts and higher

dividend1 over the BP horizon

Drivers of the Update

▪ Confirmation of all strategic actions and drivers set out in the 17/02 Business Plan

▪ Estimate of Covid 19 impact on all BP years, based on crisis reality check and on a new macroeconomic

Update of the scenario

17/02 BP based on ▪ Impact of actions delayed because of the Intesa Public Exchange Offer (redundancies/hirings,

the Resilience of bancassurance agreements, renegotiation of securities services agreement, etc…)

the Bank and ▪ Enlargement of Group perimeter through the internalisation of life insurance business (acquisition of

on the high level of 100% of Aviva Vita) enabling revenue growth (return on invested capital higher than 10%). Merger with

Flexibility allowed BAP

by operating ▪ Re-allocation of capital to implement measures set out in government decrees to guarantee the

systems, staff resilience of businesses and households over the medium term (over 6 billion of state-guaranteed loans

quality, capital and to be granted in 2020, with impact on spreads, RWAs, default rates, etc... ). Impact of different timing of

regulatory measures introduction (Basel IV, CRD V, SME supporting factor, etc..).

balance sheet

indices ▪ Use of some of the Group’s unrealised Value Reserves for approx. 350 mln€ net in 2021 (optimisation

of equity investments and merchant acquiring business)

▪ Renegotiation of securities services agreement

▪ Significant Dividend increase over the BP horizon (the BP also assumes distribution of 2019 dividend)

1. Subject to EBC recommendations

14UBI 2022: a conservative macro-economic scenario, with a deep dive in 2020 and

limited recovery in following years

Real GDP, %, year on year growth

Euribor 3M, %, annual average

-0.31 -0.32 -0.36 1.7 0.7 0.3 4.5 1.5

-0.42 -0.42 -0.42

-8.8

Specific GDP

Unvaried vs 17/02 BP scenario

-10.3% scenario used

in the determination

of impact of Covid19

2017 2018 2019 2020 2021 2022

on credit parameters -10.3

(+2.8% in 2021 and -0.2% in 2022)

17/02 BP scenario 2019 0.1, 2020 0.3, 2021 0.6, 2022 0.7

2017 2018 2019 2020 2021 2022

SOURCE: Servizio Studi UBI

15Italy GDP estimates 2020 and 2021

Italy: Gross Domestic Product (base 100 = 2019)

101

100

99

98

97 96,4

96 96,3

95,5 95,5

95 95,2 95,2

94

93 92,7

92 92,2

91

90

89

88

87

86

2019 2020 2021

Bank of Italy UE Commission Confindustria

Italian Government (DEF) IMF Prometeia

UBI Banca (baseline) UBI Banca (worst)

(scenario used for credit parameters)

Source: Elaborations by UBI Banca Research Department

16UBI 2022: BTP-Bund spread assumptions higher than consensus

Bps Government bonds yields spread : Italy vs Germany, 10 year benchmark

350

325

300

275

250

225 223

200

175

175 193 UBI Banca

150

150

125 146Agenda Covid19: reaction of the Group and new behaviours

Premises of the Business Plan update

Update of the Business Plan

Closing remarks

18Value creation confirmed even including Covid19 impacts

€ millions 2022 targets Vs

Main results after the Covid19 impact assessment Targets 2022 17/02 BP, € mln

-31%

▪ By 2022, higher cost of risk vs 17/02 738 509

Growth in net profit to BP but still contained thanks to the

€562 million (vs 665 in quality of the Bank’s assets and of (122)

17/02 BP) including the risk control processes 20191 2022

impact of Covid19 and 17/02 BP: 387 in 2022

the internalisation of

Aviva ▪ Operating costs (net of systemic -3.0%

2,252 2,130 2,185

charges) very much under control

and decreasing notwithstanding

-5.4%

inclusion of 100% of Aviva. All (49)

investments to “change the Bank” 20191 2022 escl. 2022 incl.

Return on Tangible are confirmed / increased Aviva

17/02 BP: 2,136 in 2022

Aviva

Equity to 7.1% (vs 8.3%

in 17/02 BP) 3,638 3,599 3,716 +2.1%

representing high

▪ Overall resilience of revenues,

growth potential for the -1.0% 41

also benefiting from the inclusion

share

of 100% of Aviva

2019 2022 escl. 2022 incl.

Aviva

17/02 BP:3,675 in 2022

Aviva (130)

1 Restated IAS 40

19Credit quality: a high quality loan portfolio as a starting point

The starting point

High-risk performing loans, % of total

A performing portfolio performing loans, mgmt accounts

mainly focused on low

risk rating classes 8.4

2.9 2.7

2012 2019 March 2020

Secured gross non-performing and Transparency exercise June 2020, on data as

High level of guarantees performing loans, % of total at 31 Dec 2019 - % Collateralised gross NPEs

85% in UBI vs Italian Average

79% 77%

73% 71% 70%

68% 66% 66% 67%

+26 pp

+19 pp

+11 pp

UBI BPER BAMI ISP UCG Households SMEs Other

SECURED GROSS NPEs SECURED GROSS PERF. LOANS Non-financial

Data as at 31 December 2019, Table A.3.2 notes to the financial reports companies

20Credit quality: levels of NPEs, coverage

Current gross NPE ratio Considering the SMEs bad loan disposal UBI Banca LLP ratio in 1Q20 already includes

and LLP ratio announced in 2019, UBI Banca has the second significant additional provisions on UTPs in

9.3% lowest gross NPE incidence,* % of gross total loans sectors impacted by Covid19,* in bps

pro- 69

forma 110 104 incl.Covid

11.1%

recent 8.8% 79 73 provisions

7.5% 7.1% 6.7%

sale 4.9% 40 to risks

and

charges

BPER BAMI UBI ISP UBI proforma UCG BPER UCG BAMI UBI ISP

Source: Annual Reports, reclassified income statements

Coverage of NPEs and (Real estate + Cash coverage) / Total Coverage of Performing Loans*

performing loans Gross NPEs**

81% 79% 78% 0.69%

75% 75%

0.55%

0.41%

0.36%

0.30%

UBI BPER Unicredit Intesa SP BancoBPM Unicredit UBI Intesa SP BancoBPM BPER

*

*As at 31 March 2020, presentations and Company documents

21 **As at 31 December 2019, Table A.3.2 of the consolidated accountFrom 2020 to 2022, more than €700 mln (85 bps) of additional cumulated cost of risk

Macroscenario Default rate, (%)

Use of conservative macroeconomic scenario (GDP -10.3% in

2020, +2.8% in 2021 and -0.2% in 2022) 1.1 1.28

2019 2020 2021 2022

NPE Ratio (gross), (%) Confirmed disposal of SME bad Cost of risk, (bps)

loan portfolio (no other massive Confirmed approx. 100 bps including

disposal over plan horizon) residual cost of SME massive disposal

announced in 2019

7.80

87

7.20 62

2019 2020 2021 2022 2019 2020 2021 2022

22Quick response to new decrees and credit quality control as a means to reduce losses

Organisational measures Moratoria, #

80.000

Dedicated 70.000

Enhancement of ▪ Focused organisation to implement FTE (2020) 60.000

50.000

organisation to new Decrees measures 40.000

deal with new Centralized unit for the management of 60 30.000

20.000

households

Decrees Government Decree Moratoria 10.000 businesses

imprese

0

Intervention on Credit processes to allow early

management and granting of State guaranteed

loans Financing up to €25,000, € mln

▪ Focus on end-to-end NPE management, 1,060 >1,300

Centralised leveraging on an excellent in-house credit

control of NPE recovery platform

management 30 June 2020 Target 2020

confirmed 2008 Centralization of bad loan recovery 160

Other Financing (law 662 and SACE), € mln

2017 Centralization of UTP management 270

2,300* >4,700

2020 Centralization of "high risk" and past-due 50

clients

540 30 June 2020 Target 2020

* Includes financing granted and in the pipeline (approved and to be granted)

23Confirmed IT investments in “Change the Bank”

“Change the Bank” IT spending “Run the Bank” IT spending

€ mln, Other adm exp, D&A and Staff costs € mln, Other adm exp and Staff costs

+24% -15%

259

207 209 206

175 198

169

116

139 162

35 82

2015 2018 2019 2022 incl. Aviva 2015 2018 2019 2022 incl. Aviva

UBI stand-alone UBI stand-alone (including

Other

Innovation and business 3 banks

development acquired 17/02 BP scenario 2022: 165

17/02 BP scenario 2022: 143

in 2017)

Cumulated IT investments

€ mln, Other adm exp and investments

+24%

6451

520 30 Aviva

320

2014-2016 2017-2019 2020-2022

UBI stand-alone incl. Aviva

17/02 BP scenario 2022: 610

1. Of which ~€175 mln Other administrative expenses, ~€440 mln investments and €30 mln relating to BAP-Aviva integration and development. 2020 data include technological investments

24 necessary to run activities in covid 19 framework.Solid cost control confirmed, even including internalisation of Aviva

Cost evolution (excluding non recurring items), € mln Main drivers

Cost

▪ Confirmed approx. 2,000 exits (net of approx. 1,000 hirings) :

New

reduction investments2 Aviva - including 300 already accounted for in 2019, all exiting in 2020

- most exits are expected in 2021, consistently with trade union

2,341 -216 +120 2,245 +55 2,300

2,125 negotiations to be launched.

Expense for the exits, expected to be mostly sustained in 2021,

will be more than offset by use of some value reserves.

Synergies at full regime in 2022 (over 100 mln€ net).

Total Operating Operating

Operating

pre-Transformation Costs 2022

Costs 20191

Plan

Costs 20223

incl Aviva - Benefits from new way of working (e.g.expected 30-40% of FTE

in smart work every year, rationalisation of working space, etcc..)

-4,1%

-5.4%

Net of systemic contributions ▪ In 2020, Covid 19 expenses (approx. €44 mln) will be offset by

further savings.

1. 2019 Restated IAS 40. Net of non-recurring

25 2. Year 2022 P&L impact, Other Administrative expenses and D&A

3. There are no non-recurring items in 2022Focus on Net Interest Income

Net interest margin, Updated BP vs 17/02 BP, € mln Main trends

1,725 1,680 -41.5 +0.6 +11.6 -0.6 1,650

▪ Trends in first months of 2Q2020:

May and April 2020 evidences show resilience of NII, with both

months in line with the respective budget included in the 17/02

Business Plan

▪ Net interest margin 2022 target (-30 mln€ vs 17/02 BP 2022

2019 2022 Lending Funding Securities Interbank 2022 target) influenced by effects of Covid19:

Restated

IAS 40

17/02 BP and IFRS9 and Other Updated

BP

- Lower volumes of S/T lending (expected lower economic

activity) and lower spreads on M/L term State guaranteed

lending (although with a high RoRaC)

- Slightly higher profitability of bond portfolio

26Focus on Net Commission income

Net commission income in April and May 20 vs budget, € mln Main trends

Apr20 vs Apr budget May20 vs May budget ▪ Trends in 2Q2020:

-4.7% Net commission income was mainly affected in April 2020,

due to market performance, lower sales and transactions in

-17.5% lockdown period.

Confirmed strong rebound in May 2020, which was close to

budget included in the 17/02 Business Plan

First June 2020 evidences appear to confirm the positive trend

Net commission income 2022 target, € mln

+3.6% 1,722

1,662

▪ Net Commission 2022 target lower vs 17/02 BP 2022 target

due to sale of merchant acquiring activities in 2021 (approx.

-€25 mln)

2019 2022

27CET1 ratio before 2020-2022 dividends (but net of FY 2019 dividend) to 13.9% in 2022

Of which: Main change vs +110 bps in the 17/02 BP due to the Main change vs -100 bps in the 17/02 BP due to

+38 bps: change in real estate valuation criteria; total additional expected cost of credit for COVID-19 and the postponement of BASEL4 impact from 2022

+26 bps: dividend accrued for 2019 and not due to the representation gross of dividends 2020-2022 to 2023

distributed (but net of FY 2019 dividend)

+10 bps 14.5% -60 bps

+35 bps -45 bps +35 bps 13.9%

+130 bps

12.86%

12.29% +57 bps

Main changes vs -75 bps in the 17/02 BP due

to the positive impact of 662 and SACE

guarantees (2020) partially offset by

Bancassurance internalization capital impact

(2021)

CET1 % Impact CET1 % Retained Deferred Evolution OCI NPE CET1 % Evolution CET1%

December March 2020 March Earnings Tax Assets of volumes Reserve Strategy December of regulation December 2022

2019 vs 2020 (net of taxes (no new DTAs and 2022 and internal including

December and 2019 dividend recognised lending mix (before models regulatory

2019 But before in P&L 20-21-22 Headwinds/Tailwinds

20-21-22 in the Plan) dividends) (before 20-21-22

dividends) dividends)

28Agenda Covid19: reaction of the Group and new behaviours

Premises of the Business Plan update

Update of the Business Plan

Closing remarks

29UBI 2022: clear roadmap following thorough Covid19 impact analysis

A Notwithstanding Covid19 all main strategic drivers are confirmed,

including a strategic choice for the Bancassurance business

B Impact of Covid19 is estimated as:

▪ +85 bps of Cost of Credit over the 3-year BP Horizon

▪ -1% of RoTE in year 2022

No major impact on Costs and Revenues

C Higher dividend thanks to Capital Management and use

of some Value Reserves

30UBI 2022 targets: confirmation of a solid and attractive value creation plan, with

enhanced dividend compared to 17/02 BP expectations

Improved credit quality

notwithstanding Covid impact Increased resilience Optimized operating structure

NPE ratio (gross), % Texas ratio, % Cost/income2, %

7.8 7.2 55.1 61.9 58.8

43,7

2019 2022 20191 2022 20191 2022

Business Plan17/02/2020: 2022 5.2 Business Plan 17/02/2020: 2022 32.6 Business Plan 17/02/2020: 2022 58.1

Improved profitability Stronger capital Growing cash dividend over

Normalised ROTE, % CET1 FL ratio, %

13.9 plan horizon

12.3 12.5

7.1

4.4 Up to full excess capital

compared to 12.5% CET1

ratio floor

20193 2022 2019 2022 CET1 Floor

Before

Business Plan 17/02/2020: 2022 8.3 2020-2021-2022 dividends

but net of 2019 dividend

1. Restated IAS 40.

31 2. Excluding systemic contributions (Deposit Guarantee Scheme and Resolution Fund)

3. Restated IAS 40. LLPs related to wholesale disposals are not normalisedHigh return for investors over three main pillars

2022

13.9%

12.9%

Return on 7.1% CET1 ratio 12.5%

12.3%

tangible 4.4% much higher

equity than target

20191 2022 2019 03/20 2022 CET1

before floor

2020-2021

-2022 dividend2

1. +60% increase in RoTE 2. Approx. € 840 mln of excess

represents High Growth potential capital to be distributed (over 73 cents per

for the share share cumulated in the three

year period)

3. All strategic assets remain as

additional value reserves (product

companies, NPE recovery platform, etc..)

1. Restated IAS 40. 2019 RoTE is net of non-recurring items, 2022 RoTE does not include any non recurring items.

32 2. But net of 2019 dividendAgenda Annexes 33

Significant value creation to shareholders over the next three years

2019 2022 3-years CAGR,

2022 3-years CAGR, %

Restated IAS 40 Revised Revised %

Balanced revenue mix Operating income € mln 3,638 3,675 3,716 +0.3% +0.7%

o/w net commissions % 45.7 47.6 46.3

o/w net interest income % 47.4 45.7 44.4

Total financial assets (TFA1) € bln 196 209 205 +2.2% +1.3%

o/w direct banking funding € bln 95 93 91

o/w Institutional funding € bln 18 20 19

o/w AUM + bancassurance € bln 73 88 85

Net loans to customers2 € bln 83.7 83.7 82.7

o/w net performing loans € bln 79.5 81.0 79.2

Operating costs € mln -2,3416 -2,235 -2,300 -1.5% -0.6%

Continued cost reduction

o/w staff costs € mln -1,428 -1,361 -1,374

o/w other administrative expenses3 € mln -603 -517 -576

Operating costs (net of systemic contributions) € mln -2,252 -2,136 -2,185 -1.7% -1.0%

Cost/income (net of systemic contributions) % 61.9 58.1 58.8

Lower cost of credit Cost of risk bps 87 46 62

LLPs € mln 738 387 509 -19.3% -11.7%

NPE ratio (gross) 4 % 7.8 5.2 7.2

NPE coverage incl. write offs % 50.9 51.5 51.2

Significant value Stated net income (normalised in brackets) € mln 233 (331) 665 (665) 562 (562)

creation for shareholders ROTE normalised % 4.4 8.3 7.1

Stronger capital CET1 ratio % 12.3 12.5 13.9 7

and structural position Texas ratio % 55.1 32.6 43,7

RWA (fully loaded) € bln 58.1 61.5 58.9

Tangible equity5 € bln 7.5 8.0 7.9

1. Includes direct and indirect funding, excludes repos with CCG 2. Excludes repos with CCG 3. Excluding systemic contributions

34 4. Net NPE ratio: 5% in 2019 and 3.1% in 2022, 4.25% in 2022 Revised 5. Net equity excluding profit and AT1– intangible assets 6. net of non-recurring items

7. Net of 2019 dividend but gross of 2020-2021-2022 dividendsDetails on regulatory headwinds/tailwinds following recent regulatory updates

Cumulated

2020-2022 2020 2021 2022

Total Regulatory -0.6 0.3 -0.2 -0.7

Headwinds/Tailwinds impact

Regulation and internal 0.0 0.3 1

-0.2 -0.1

model evolution

EBA guidelines -0.6 - - -0.6 22

Basel IV 3 - - - -

Impacts on the

CET1 Ratio CET1 MDA Buffer

On average > 530 bps

before dividends, bps

CET1 BP target 4

423 bps

MDA Buffer, bps

5

CET1 Ratio MDA trigger, % 8.27%

6

CET1 Ratio, % year-end ~ 13.9%

Notes:

1. Advance application to 2020 of CRR2 (extended supporting factor for SMEs, new

weighting for salary backed loans and new treatment of software – overall 40 bps)

Preliminary SREP + Addendum + Calendar 2. Postponed to 2022

3. Postponed to 2023

-0.3

Pillar 2 impact provisioning 4. CET1 ratio target 12.5%

5. Advance application of CRDV (art 104a) following receipt of ECB decision.

6. Net of 2019 dividend but before 2020-21-22 dividends

MDA: Maximum Distributable Amount

35Structural balance and flexibility

CET1 Ratio – Average buffer on MDA1 Total Capital Ratio – Average buffer on Leverage Ratio – Average buffer on

trigger, bps MDA1 trigger, bps expected minimum requirement, bps

>530 >450

423 >340

>260 >240

>180

2017-2019 2020-2022 Vs CET1 Target 2017-2019 2020-2022 2017-2019 2020-2022

before dividends 12.5% before dividends before dividends

LCR2 – Liquidity Buffer – Average NSFR3 - Available stable funding – MREL5 and minimum subordination

buffer on minimum requirement, € bln Average buffer on minimum requirement

requirement net of TLTRO4 contribution, Binding starting from June 2020

>8 € bln ~8

>5 Well above the two

minimum requirements

Well above the two over the business plan

>3 expected minimum horizon and still

requirements since compliant also excluding

2019 eligible retail funding

2017-2019 2020-2022 2017-2019 2020-2022 2017-2019 2020-2022

1 Maximum Distributable Amount 2 Liquidity Coverage Ratio 3 Net Stable Funding Ratio 4 Targeted

36 long-term refinancing operations 5 Minimum Requirement for own funds and Eligible LiabilitiesA very thorough process to estimate impact of Covid19 on credit quality

Assessment of credit trends

▪ Use of specific macroeconomic scenario (GDP -10.3% in 2020, +2.8% in 2021 and -0.2% in

Macro-economic forecasts and 2022)

estimate of default rates ▪ Estimate of expected default rates through stress models to define correlation with shock on

macroeconomic scenario

▪ Use of CERVED financial forecasts (over 500 micro-sectors)

▪ Estimate of financial impacts:

- single name analysis for Large Corporates (approx. 400 Economic Groups)

Economic sector dynamics and Stress - financial sustainability models for the rest of the portfolio, based on financial forecasts

analysis by counterpart ▪ Correction of sectorial forecasts on the basis of expected dynamics of cash flows for smaller

companies

▪ Estimation of debt/income evolution to assess financial sustainability for private individuals

▪ Single name stress analysis on samples and propagation to those sectors most impacted by

UTP migrations

Covid

Mitigations allowed by measures ▪ Correction of the 2020 risk parameters based on the provisions of the recently issued decrees

included in Decrees (state-guaranteed loans)

37Internalisation of Aviva Vita and merger with BAP in July 2021

Main assumptions AVIVA + BAP, € millions

▪ in 2021 exercise of the call option to purchase 100% of Aviva

Vita (today UBI owns 20% of the joint venture) Technical reserves Premiums

▪ return on invested capital higher than 10% ~ 18,300 ~ 19,100

~ 3,640

3,291

▪ capital absorbed for the internalisation of Aviva: approx. 50

bps in 2021

▪ increase in contribution to Group net profit by 40 mln€ in

2022 (vs contribution of 12.1 mln€ in 2019)

2019 2022 2019 2022

Drivers of the internalisation

Revenues (pro-forma) Operating expenses (pro-

▪ merger between BAP and Aviva Vita forma)

303 324 of which

▪ new production mix with a progressive increase of the 212

241

approx.

incidence of unit linked e index linked products (from 32% to 66 €18 mln of

55 integration

45%) costsv

▪ structure of products in line with the actual situation in terms 157 175

of up-front, management fees, etc…

▪ in 2022 administrative expenses equal to 0.25% of reserves 2019 2022 2019 2022

excluding integration costs o/w contribution to o/w UBI Group, Pramerica

Group’s operating

o/w Operating Expenses

▪ target Solvency ratio >180% revenues

~ €150mln

38Sustainability: targets confirmed and activities already started in the first months of 2020

2022 Targets: confirmed Achievements as of today

Chief Variable 1.5 Lending linked to Setup of Group wide Sustainability

CSO Sustainability >10% remuneration € bln sustainability Program to coordinate and promote

themes across organization, as a

Officer to linked to development in

first step toward the Chief

coordinate sustainability Italy Sustainability Officer

Group-level goals for top in the next 3

sustainability management years Formalization in the manifesto

efforts “Rilanciamo L’Italia per bene” of

UBI strategic view on the role of the

Bank in the post COVID 19 phase

2 New Social and Complete CO2 emissions1 (www.ubibanca.com/manifesto)

€ bln Green bonds O2 "green" product -61%

issued catalogue Signatory of United Nations to the

(current account, Principles for Responsible Banking

mortgage, credit

card, personal Reinforcement of UBI active

loan, investment participation to national and

products) international initiatives related to

sustainability (e.g. EBA voluntary

Beneficiaries of Increase in the Of Pramerica UCI exercise on climate risk)

52,000 financial +20% share of Women 25-30% AUM in ESG

education in managerial strategies Development of internal

programs roles (over total commercial tools focusing on ESG

strategies (e.g. ESG funds rating

delivered to women tool)

external employed)

communities

1. Target 2022 Scope 1 + Scope 2 Market based, unit of measure CO2, with Baseline as at 31/12/2007, date of inception of UBI Banca

39Disclaimer

This document has been prepared by Unione di Banche Italiane S.p.a. (“UBI Banca”) for informational purposes only and for use at the presentation of the Industrial Plan of UBI Banca held on 3th July

2020. It is not permitted to publish, transmit or otherwise reproduce this document, in whole or in part, in any format, to any third party without the express written consent of UBI Banca and it is

not permitted to alter, manipulate, obscure or take out of context any information set out in the document or provided to you in connection with the above mentioned presentation.

The document includes certain informations, opinions, estimates and forecasts which have not been independently verified and are subject to change without notice. They have been obtained from,

or are based upon, sources we believe to be reliable but UBI Banca makes no representation (either expressed or implied) or warranty on their completeness, timeliness or accuracy. Nothing

contained in this document or expressed during the presentation constitutes financial, legal, tax or other advice, nor should any investment or any other decision be solely based on this document.

This document contains statements that are forward-looking: such statements are based upon the current beliefs and expectations of UBI Banca and are subject to significant risks and uncertainties

(e.g. macroeconomics assumptions do not include a second wave of Covid-19 etc..). These risks and uncertainties, many of which are outside the control of UBI Banca, could cause the results of UBI

Banca to differ materially from those set forth in such forward looking statements.

All forward-looking statements included in the document are based on information available to UBI Banca as at 3th July 2020.

This document is for information purposes only. This document (i) is not, nor may it be construed, to constitute, an offer for sale or subscription or of a solicitation of any offer to buy or subscribe for

any securities issued or to be issued by UBI Banca; (ii) should not be regarded as a substitute for the exercise of the recipient’s own judgement; and (iii) should not be considered as an investment

advice and is therefore not falling within the scope of the requirements governing the provision of investment advisory services within the meaning of the Directive no. 2014/65/EU. In addition, the

information included in this document may not be suitable for all recipients. Therefore the recipient should conduct their own investigations and analysis of UBI Banca and securities referred to in

this document, and make their own investment decisions without undue reliance on its contents. Neither UBI Banca, nor any other company belonging to the UBI Banca Group, nor any of its

directors, managers, officers or employees, accepts any direct or indirect liability whatsoever (in negligence or otherwise), and accordingly no direct or indirect liability whatsoever shall be assumed

by, or shall be placed on, UBI Banca, or any other company belonging to the UBI Banca Group, or any of its directors, managers, officers or employees, for any loss, damage, cost, expense, lower

earnings howsoever arising from any use of this document or its contents or otherwise arising in connection with this document. UBI Banca undertakes no obligation to publicly update and / or

revise forecasts and estimates following the availability of new information, future events or other matters, without prejudice to compliance with applicable laws. All the forecasts and subsequent

estimates, written and oral, attributable to UBI Banca or to persons acting on its behalf are expressly qualified, in their entirety, by these cautionary statements.

By receiving this document you agree to be bound by the foregoing limitations.

40You can also read