What you need to know: The 2020 IMO fuel sulphur regulation - Hydramotion

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

What you need to know:

The 2020 IMO fuel sulphur regulation

Written by Lee Hong Liang, Asia Editor, Seatrade Maritime News

The bunker fuel supply and availability landscape is set to change when IMO’s global 0.5% fuel sulphur content

cap regulation is enforced from 2020. Shipowners have a few options to choose from for them to comply with the

regulation, while refiners are expected make changes to refinery configuration and production in response to market

demand. Thus far, there is no silver bullet solution ahead of 2020 and the involved parties will have to decide on the

most appropriate approach to take so as to suit their operations and remain commercially sustainable in the long run.

www.linkedin.com/groups/4843168 www.facebook.com/SeatradeGlobal/ twitter.com/Seatrade

www.seatrade-maritime.comIMO Marpol Annex VI sulphur limits timeline

Executive summary

The International Maritime Organization (IMO) will enforce a new 0.5% global sulphur

cap on fuel content from 1 January 2020, lowering from the present 3.5% limit. The

global fuel sulphur cap is part of the IMO’s response to heightening environmental source: Wartsila

concerns, contributed in part by harmful emissions from ships.

The 2020 deadline was confirmed at the 70th session of IMO’s Marine Environment Protection Committee

(MEPC) held in October 2016. 1A) The IMO fuel sulphur regulation: global cap

The more stringent sulphur regulation has led to shipowners and operators mulling over which options From 1 January 2020, the IMO Marpol Annex VI regulation on limiting sulphur content of bunker fuel to

they should choose in order to comply with the IMO regulation, and refiners considering whether a maximum of 0.5% will enter into force. At present, the global sulphur content cap on bunker fuel is at

to produce more low-sulphur fuel to meet possibly higher demand, as both parties anticipate an 3.5%, a level considered easy to comply with for vessel operators.

unprecedented change in the marine fuels supply landscape. The IMO Marpol Annex VI ‘Prevention of Air Pollution from Ships’, first adopted in 1997 and came into

The issue with the 0.5% sulphur cap regulation is that it has turned into a textbook conundrum for refiners force in 2005, has established limits on sulphur content in bunker fuel, as well as the creation of ECAs in

(the fuel suppliers) and shipowners (the fuel buyers), caught in a quandary whereby suppliers are unable designated sea areas setting stricter sulphur content limits at just 0.1%.

to commit on how much to produce as buyers do not know how much is needed, vice versa. Marpol Annex VI started with a global sulphur cap of 4.5% before it was lowered to 3.5% in 2012. The

steep reduction to a global 0.5% sulphur cap by 2020 was decided in October 2016 by the IMO Marine

The refiners, though they are not regulated by IMO, cannot pretend that nothing has happened as they

Environment Protection Committee (MEPC).

have a commercial interest to cater to market needs through changes to production configuration so as to

maximise margins. The IMO had commissioned a review to assess whether sufficient compliant fuel oil would be available

to meet the 2020 date, and this review/study was carried out by independent research and consultancy

The shipping industry, the one on the receiving end of the IMO regulation, will have to deal with not only organisation CE Delft. This study was then submitted to IMO member states to help them in their

the upcoming global 0.5% sulphur cap, but also the existing 0.1% sulphur cap in designated Emission deliberations.

Control Areas (ECAs).

Going forward, MEPC will look into approving a new output on consistent implementation of the sulphur

There are three options set out in this paper that shipowners can consider in order to comply with the IMO regulation of Marpol Annex VI. The scope of the work, to be completed during two sessions of the

regulations. First, shipowners can install exhaust gas cleaning systems on their ships. Second, owners Sub-Committee on Pollution Prevention and Response, during 2018 and 2019, could include considering

can simply buy compliant fuels at higher costs. Third, ships can run on the clean gas LNG as fuel. a number of preparatory and transitional issues surrounding the shift to the new 0.5% limit from 2020.

www.seatrade-maritime.comOn the receiving end – shipping

1B) The IMO fuel sulphur regulation: ECAs Heavy fuel oil (HFO), which is high in sulphur content and considered the bane in terms of

Ships trading in designated ECAs have to burn bunker fuel with a sulphur content of no more than emissions for environmentalists, is the traditional source of energy to power ships.

0.1% since 1 January 2015, against the limit of 1% when ECAs were first introduced in 2010. In 2016, global demand for HFO accounted for 70% of a mixed grade of bunker fuels, including the low-sulphur

The Marpol Annex VI ECAs are the Baltic Sea area, the North Sea area, the North American area marine gas oil (MGO) with below 0.5% sulphur content and the ultra low sulphur fuel oil (ULSFO) of 0.1%

(covering designated coastal areas off the US and Canada), and the US Caribbean Sea area maximum sulphur content. The switch to burning either MGO or ULSFO is an option for shipowners to be in

(around Puerto Rico and the US Virgin Islands). compliant with the IMO regulation, and two other alternatives are installing abatement technology such as

scrubbers or using LNG as fuel.

Further formation of country-based or continent-wide IMO-approved ECAs, however, is not an easy

process. In the case of establishing a region-wide ECA, it may take up to five years to complete Unni Einemo, IMO representative, media and communications manager, International Bunker Industry Association

an entire assessment and consultation process including gathering agreement from all the Marpol (IBIA), warned that the global sulphur regulation is “not step changes but brutal changes”, requiring “paradigm

Annex VI signatory countries and receiving submission of emission inventories. shifts on ship engines” that are designed to run on HFO.

Many emerging economies, and even some established ones, see designating their territorial “We are looking at a virtually overnight shift from 3.5% fuel sulphur content to 0.5%. There is a real risk that the

waters on ECAs as discounting their ports’ competitive edge. But there are exceptions as some change would cause a period of severe product shortages and inflated prices,” she said.

countries have voluntarily made positive steps to clamp down on shipping emissions in view of their

own environmental agenda. Moreover, the production and supply of up to 3.5% sulphur marine fuels would need to continue until the day

China has its own version of ECAs, enforced in phases since April 2016, requiring ships berthing before the 0.5% requirement kicks in, and immediately demand for HFO will shrink dramatically the day after,

at 11 ports to use 0.5% sulphur fuel. The 11 ports are Guangzhou, Huanghua, Nantong, Ningbo- creating a never before known situation of severe supply/demand mismatch.

Zhoushan, Qinhuangdao, Shanghai, Shenzhen, Suzhou, Tangshan, Tianjin, and Zhuhai. Einemo said the transition from 3.5% to 0.5% Rotterdam bunker prices – IFO380 vs MGO source: Ship & Bunker

Hong Kong has required all ocean-going veswsels to switch to fuel not exceeding 0.5% while at is “not as easy as flicking a switch” as she

berth starting 1 July 2015. highlighted the near-impossible undertaking for

While Sydney, Australia has imposed a 0.1% sulphur limit for cruise ships berthing at the port. global refining to switch production overnight,

the need for huge logistics involving transport

Some areas touted as possible future ECAs include Japan, Norway, Mexico and the Mediterranean. between refineries, storage and delivery vessels,

Existing ECA zones and possible future ECAs and the massive work for ships to clean out fuel

systems to avoid sulphur contamination.

Analyst Wood Mackenzie suggested that the shipping

industry would need to fork out an additional $60bn

annually by 2020, based on an expected rise in MGO

and ULSFO demand and their premiums over HFO.

According to data from specialist bunker news and price provider Ship & Bunker, the premium of MGO over 3.5%

sulphur 380 cst in Rotterdam, for example, has averaged $255 per tonne over the last five years between 1 March

2012 to 1 March 2017. At present, shipping is consuming around 3.2m barrels per day (bpd) of HFO and 700,000-

800,000 bpd of MGO. From 2020, this proportion will change to 700,000 bpd of HFO and 3.4m bpd of MGO.

Sushant Gupta, director - Asia Pacific, refining and chemicals research, Wood Mackenzie, noted that switching to

the use of the compliant low sulphur products is a costly solution for shipping, hence the industry will try to pass the

cost to consumers and freight rates from the Middle East to Singapore could increase by up to $1 a barrel.

Higher bunker bills, on the other hand, may make the installation of scrubbers a more attraction solution as the

price differential between low sulphur fuels and HFO would widen and consequently the scrubber repayment

source: DuPont period would be quicker.

www.seatrade-maritime.comWhat it means for the refiners

It is without doubt that the 0.5% sulphur rule will have huge implications for the global refining The world’s three leading oil majors – BP, ExxonMobil and Shell – have not mentioned anything on a mass

sector in terms of refinery configuration and operations. Simple refineries that produce a production of 0.5% blends, neither have they announced commitments to invest in reconfiguring their crude runs

on a global scale to produce 0.5% fuels. “At present, we have not heard of new refinery investments announced

substantial share of their crude run into HFO may face margins pressure, while complex

as a result of this regulation. It is too early to have that, as IMO’s decision in July will influence many of these

refineries may potentially boost margins with a larger production of low-sulphur products. uncertainties,” said Serena Huang, research analyst-downstream, Asia Pacific, Wood Mackenzie.

The International Energy Agency (IEA) mentioned that by 2020 the price of fuel oil is expected to drop in

tandem with demand. This will in turn put pressure on (fuel oil) cracks and simple refineries with high fuel In general, oil majors and refiners are looking to support the shift in bunker fuel demand arising from the

oil yields. On the other hand, it could become more attractive to modern, complex refineries who have the new sulphur regulation in various ways. Firstly, refiners can increase ULSFO production by extracting low

secondary units capable of upgrading fuel oil into higher value lighter products. sulphur fuel oil streams that are currently blended into LSFO or HSFO to be made available to the market

as ULSFO. ExxonMobil, for instance, has launched a relatively new product, Heavy Distillate Marine ECA

The IEA stated: “Global refiners will be put under enormous strain by the shifting product slate. If refiners 50 (HDME 50), that can be handled onboard like HFO and has only 0.1% sulphur content.

ran at similar utilisation rates to today, they would be unlikely to be able to produce the required volumes

of gas oil. If they increased throughputs to produce the required gas oil volumes, margins would be Secondly, refiners in general have an issue of managing their surplus residue. “In some instances,

adversely affected by the law of diminishing returns. In order to increase gas oil output, less valuable exploring residue destruction investments may make sense, but this option comes with higher risk on

products at the top and bottom of the barrel would be produced in tandem, which would likely see cracks returns of investment, as gas oil demand is predicated on shippers’ uptake of alternative options such as

for these products weaken and weigh margins down.” scrubber installation and LNG bunkering,” said Huang.

Thirdly, refiners can raise LNG bunker supplies in major bunkering hubs. In Singapore, Shell and

ExxonMobil are working with Maritime and Port Authority of Singapore (MPA) to supply LNG as fuel. In

Rotterdam, Shell this year launched a LNG bunker tanker to supply LNG from Rotterdam’s Gate Terminal.

www.seatrade-maritime.comShipping options

4A) Abatement technology 4B) LNG

The use of exhaust gas cleaning systems, also known as scrubbers, is a commercially available option for The viability for ships to burn LNG as fuel depends very much on the availability of a worldwide network

the shipping industry. Ships installed with scrubbers mean they can continue to burn high-sulphur bunker of LNG bunkering infrastructure, which to-date is severely underdeveloped. Global LNG bunkering

fuel from 2020 and comply with the 0.5% sulphur limit. infrastructure is considered to be at an infant stage today, as most LNG-powered ships are mainly coastal

The abatement technology works by spraying alkaline water into a vessel’s exhaust to remove sulphur and vessels limited to European waters, and major bunkering ports in the world have yet to develop full-scale

other unwanted chemicals, either via open-loop system, closed-loop system, or hybrid (open-and-closed LNG bunkering facilities.

loop) system. There continues to be interest in some countries such as Singapore, Japan and the Netherlands in pursuing

The use of scrubbers will enable the eradication of almost all the harmful emissions from ships, with major the development of LNG bunkering infrastructure. But there has not been any indication that developments

scrubber manufacturers like Alfa Laval, DuPont and Wartsila having systems that eliminate 97-98% of will blossom to a global scale to offer any real change for LNG to become a viable option come 2020.

sulphur oxides (SOx) and 70-80% of particulate matter (PM), which makes up most of the visible smoke. The LNG option in itself is facing a ‘chicken and egg’ situation. There is a need for demand to increase

Despite an initial hefty investment ranging from $5m to $10m per vessel, depending on the number and in order to generate greater supply, but the same is true vice versa. LNG as bunker fuel continues to face

capacity of the main engines, installing scrubbers can potentially be an economically attractive option, issues such as the need for increased and dedicated storage space, a gap in supply chain logistics,

according to Wood Mackenzie. Shipowners can expect a high rate of return of between 20-50% depending and requirements for costly modifications to existing port infrastructure. Additional costs to carry out

on investment cost, MGO-HFO price spread and ships’ fuel consumption. LNG bunkering include delivery of the clean gas to the import terminal, breakbulk charges, the need for

shuttle vessels delivering to LNG bunker tankers, and the fee of bunker tanker delivering LNG fuel ship-to-

The uptake of scrubbers could be limited by access to finance, scrubber manufacturing capacity, drydock

ship. Moreover, there is the unforeseen factor of fossil fuel prices, which have now fallen and making the

space and technological uncertainties. Wood Mackenzie forecast that the retrofitting or installation of

economic business case for LNG less attractive.

scrubbers will not pick up substantially until 2020 while McQuilling Services noted that players with difficult

access to financing for a scrubber can look to potential cooperation with trading companies as alternatives Another dampener is the retrofitting of ships to burn LNG as it is a sophisticated, complex operation that

to banks and investors. The availability of dry-docking space at shipyards is definitely an issue if a large require modification of existing engines or addition of gas tanks, as well as the huge cost of fitting LNG

number of ships are sent for scrubber retrofit work. tanks and gas piping systems. The LNG option makes more sense for newbuilds rather than conversions

of existing ships. On top of these, a good-sized LNG bunker tanker costs $60-80m to build, vastly more

expensive than a fuel oil barge.

Last but not least, there is an absence of a global regulatory standard on LNG fuel propulsion. All the

above factors make LNG as bunker fuel a distant option for shipowners.

www.seatrade-maritime.comShipping options continued Conclusion

4C) Compliant fuels The shipping industry is faced with several options ahead of 2020

The most straightforward way for ships is to simply switch to burning MGO or ULSFO to meet IMO’s with no silver bullet solution.

sulphur limits. The operators will have to either absorb the cost of the higher fuels or pass it on to their If refiners indeed move to significantly restrict the sale of HFO as they see higher margins from

customers whenever possible. selling MGO, ships fitted with scrubbers and potential scrubber users would be left wondering if

Baseload demand for fuel oil in Asia has already been steadily declining in recent years, falling by about there will be enough supply of HFO to use. The surge in use of MGO will then lead to the question of

20% from 2011 to 2016. The HFO imports into Asia – mainly Singapore, China and Japan - averaged what how will refiners deal with all the surplus of HFO which is a natural by-product of the cracking

about 6.92m tonnes each month last year, down from the monthly average of about 8.5m tonnes between process. The double-edge sword is that refiners also worry that any extra production of MGO would

2011 and 2012. go unsold if more ships continue to equip themselves with scrubbers and seek to purchase the less

Operators can procure the ULSFO of 0.1% maximum sulphur content, a grade that already exists and is costly HFO.

used in the ECA zones as a cheaper alternative to MGO. The ULSFO is a category of fuel that sits between Refiners are certainly not taking the plunge first by making huge investment costs to change

MGO and HFO. The ULSFO has lower sulphur content than HFO but higher viscosity and low volatility production configurations, while most shipowners are adopting a wait-and-see approach as they

than MGO. The quality difference also means a price difference with ULSFO typically trading at $20 pmt or consider the options before them. It is a dilemma for the parties involved.

more discount to MGO in Rotterdam, according to Platts data. All the different options will be assessed by all the involved parties and they will have to choose one

In 2016, the use of ULSFO has risen by 9% year-on-year in the North Sea and ARA (Amsterdam- that they consider the most cost effective, suitable for their operations, and commercially sustainable

Rotterdam-Antwerp) region and inched up about 2% on a worldwide scale, according to data from Veritas for the long term.

Petroleum Services (VPS).

By 2020, there will be around 900,000 bpd of ULSFO made available to the market by various stream

optimisation, according to Huang of Wood Mackenzie. “In case there is a hard deadline from IMO in 2020,

we expect the MGO demand could increase from 1.3m bpd in 2019 to 3.4m bpd in 2020. This will be new ExxonMobil

demand from the marine sector and meeting the compliant fuels demand from the shipping sector will

bring a big step-change for refiners. Refiners will be challenged to increase global refining run rates to

unprecedented levels.”

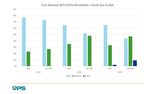

Wood Mackenzie expects a Fuel usage 2014-2016: Worldwide vs North Sea & ARA

shift in bunkering locations

starting 2020 based on

compliant fuels availability, with

Singapore potentially losing

some of its market share to

China as fuel buyers look for

alternative locations that have

a surplus of compliant fuels.

China is anticipated to continue

to hold ample MGO supply

and will be well positioned to

attract fuel buyers looking for

MGO. Singapore, currently

the world’s largest bunkering

port, will need to repurpose

some storage tanks and other

infrastructure to prepare for

a shift from HFO to MGO

source: VPS

bunkering.

www.seatrade-maritime.comExhibit Now

The largest Workboat and

25-27 September 2017

Offshore Marine event

Abu Dhabi National Exhibition Centre

Abu Dhabi, UAE outside of the USA

Make this your opportunity to get in front of the

right people, all under one roof.

5,175+ 220 62

represented

visitors companies countries

BOOK NOW!

For more information about available stand options, please contact:

Chris Adams, Group Sales Manager

T: +44 1206 201557

E: chris.adams@ubm.com

Gold Sponsors Silver Sponsors

Go to www.linkedin.com Seatrade @SeatradeME

and join Maritime Events

Seatrade Maritime Events group

for information and updates

www.seatradeoffshoremarine.com/exhibitYou can also read