Anti-Crisis Stimulus Package for Economic Recovery

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Anti-Crisis Stimulus Package

for Economic Recovery

(Developing Efficient State Debt Management Policy)

The project is implemented in the framework of The East-West Management Institute’s (EWMI) Policy, Advocacy, and Civil Society

Development in Georgia (G-PAC) Program, funded by United States Agency for International Development (USAID). The project is made

possible by the generous support of the American people through the USAID. The content is the responsibility of the implementing

organizations and does not necessarily reflect the view of USAID, the United States Government, or EWMI.Anti-Crisis Stimulus Package

for Economic Recovery

(Developing Efficient State Debt Management Policy)

The project is implemented in the framework of The East-West Management Institute’s (EWMI) Policy, Advocacy, and

Civil Society Development in Georgia (G-PAC) Program, funded by United States Agency for International Development

(USAID). The project is made possible by the generous support of the American people through the USAID. The content is

the responsibility of the implementing organizations and does not necessarily reflect the view of USAID, the United States

Government, or EWMI.

© Economic Policy Research Center (EPRC). All rights reserved.

2014Contents Introduction......................................................................................................................................................................................................5 Main findings....................................................................................................................................................................................................5 State debt of Georgia.....................................................................................................................................................................................7 Necessity of State Debt Management Strategy................................................................................................................................ 14 International experience........................................................................................................................................................................... 15 Debt Management Strategy..................................................................................................................................................................... 16 Ensuring and coordinating procedures for borrowing and organizing debt management....................................... 18 Seeking source of debt financing and determining a schedule............................................................................................ 18 Determining an amount of borrowing, evaluating risks, managing, and keeping quality statistics........................ 18 Key components of state debt management strategy................................................................................................................... 19 Conclusions.................................................................................................................................................................................................... 22

Introduction

This report was prepared within the framework of the project Anti-Crisis Document for Economic Recovery Stimu-

lus Package implemented with the financial assistance of East-West Management Institute’s (EWMI) program Policy,

Advocacy, and Civil Society Development Project in Georgia (G-PAC) financed through USAID. The overall objective

of the project is to establish the culture of crisis management in Georgia and provide expert guidance to the govern-

ment in creation of an anti-crisis document for economic recovery stimulus package.

Drawing on international experience this paper aims to provide recommendations facilitating the development of a

strategy for efficient state debt management. The paper analyzes the current situation in regards to state debt man-

agement in Georgia and develops main components of debt management strategy.

Main findings

• s of March 2014, the total external debt of Georgia, which includes the borrowings of governmental sector,

A

the National Bank, commercial banks, other sectors and intercompany debts, comprised 13.1 billion USD.

Some 32 percent of the total external debt (i.e. 4.1 billion USD) accounts for the government debt whilst 20

percent is the share of commercial banks’ borrowings in the total external debt. The weighted average inter-

est of Georgia’s debt comprises 1.9 percent;

• T he share of Georgia’s credit resources in total budgetary means increased from three percent in 2013 to 12

percent in 2014. Such a high indicator was observed in 2009 and 2010, i.e. during the global financial crisis

and in the aftermath of the Russia-Georgia war, when the state was implementing a policy geared to stimu-

late the budget;

• T he ratio of external debt of Georgian government to the country’s Gross Domestic product (GDP) has not

reached a critical point yet. The Maastricht Treaty of the European Union (EU) require from the Eurozone

member states to keep the levels of their state debts up to 60 percent of their GDPs. As recommended by the

World Bank and the International Monetary Fund, an amount of external debt of a country should not exceed

150 percent of a country’s exports and 250 percent of its budget revenues. As of 2014, the external debt of

the Georgian government stands at 26.9 percent against the country’s GDP whilst the entire external debt

comprises 35.6 percent of the GDP. Consequently, the indicators of state debt in Georgia are significantly

lower than the upper limits of the external debt;

Anti-Crisis Stimulus Package for Economic Recovery 5• S ome 94 percent of the external debt is denominated in foreign currencies; this enhances the currency risk

as well as the threat that against the fluctuations in exchange rate may increase the pressure of liabilities;

• T he state debt should not be considered a problem for the country’s economy. There is no country whatsoev-

er in the world which does not have external debts. Several countries have external debts of such a size that

they are facing a threat of default (for example, Greece, Iceland, Argentina). Some countries take out external

debts to implement anti-crisis package to stimulate their economies (for example, Georgia at the end of

2008). There are countries who achieved economic success owing to external debts borrowed by their gov-

ernments. Among such countries is, for example, Japan which financed the rehabilitation of its infrastructure

destroyed as a result of the World War II mainly with loans taken out from foreign sources;

• arious reasons may cause the rise in debts: in the 1990s, the depreciation of local currencies led to a sig-

V

nificant increase in external debts (for example, in Argentina, Brazil, Russia and Indonesia). In some other

countries (such as Turkey, Thailand, South Korea), the state debt was increased due to liabilities to commer-

cial banks. The 2008 global financial crisis, for its part, clearly showed the necessity and advantage of devel-

oping and implementing debt management strategies for countries, especially for low-income and medi-

um-to-low-income countries;

• eorgia’s strategic document on debt management must cover the following points: providing organiza-

G

tional procedures for borrowing and managing the debt; seeking sources of financing and defining a sched-

ule; determining the size of debt; evaluating and managing risks; and keeping quality statistical data;

• T he government’s borrowing must be agreed with all government entities specified in the law and must be

in line with state interests. It is important to limit state guarantees for loans taken out by the private sector.

An entity responsible for attracting and managing loans must be identified and procedures of borrowing or

servicing debts must be set out in detail with the involvement of all participants and responsible entities;

• E arnings of those economic sectors or projects on which state debts are to be spent must be higher than the

debt expenditures. Feasibility studies of these projects must be conducted. Social and infrastructure projects

to be financed by state debts must be evaluated through cost-benefit analyses. For the implementation of

those projects which produce quick positive results may be financed by loans taken out from international

capital markets whilst social services must be financed with much softer loans taken out from relevant finan-

cial institutions;

• T he state debt management strategy must describe the advantage of internal debt in specific circumstances

and the need to replace external debt with the domestic one (for example, treasury bills). In a longer term the

internal debt might prove to be cheaper than the external debt because the external debt involves interest

costs as well as costs of sterilization and exchange rate.

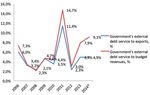

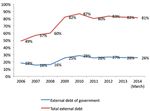

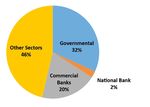

6 Anti-Crisis Stimulus Package for Economic RecoveryState debt of Georgia As of March 2014, the total external debt of Georgia, which includes borrowings of the governmental sector, the Na- tional Bank, commercial banks, other sectors and intercompany debts, made up 13.1 billion USD. Some 32 percent of the total foreign debt (i.e. 4.1 billion USD) is the government debt whilst 20 percent is the share of commercial banks’ borrowings in the total external debt (Charts 1 and 2). During the period of six years beginning in 2006, the total external debt of the country was marked with an upward trend. Since 2012, however, a gradual though insignificant decrease in the debt has been observed. In contrast to the total external debt, a relatively slow increase is seen in the external debt of the Georgian government, which reached 4.1 billion USD by March 2014. This figure is slightly less than the corresponding indicator in 2013 (Chart 1). Nonetheless, the share of Georgia’s credit resources in total budgetary means increased from three percent in 2013 to 12 percent in 2014. Such a high indicator was observed in 2009 and 2010, i.e. during the global financial and in the aftermath of the Russia-Georgia war, when the state was implementing a policy geared to stimulate the budget. Chart 1: Government and external; debts (USD million) Source: National Bank of Georgia Anti-Crisis Stimulus Package for Economic Recovery 7

Chart 2: Total external debts as of March 2014 Source: National Bank of Georgia Data on government or external debts, when taken separately, does not tell much. The sustainability of external debt and the ability of the country to repay can be evaluated by using percentage ratios of the debt to the Gross Domestic Product (GDP), the budget revenues and the exports of a country. According to Maastricht Treaty of the European Union (EU), the Eurozone member states are required to contain the levels of their state debts within the range of 60 percent of their GDPs. For developing countries this indicator ranges from 25 percent to 40 percent. As recommended by the World Bank and the International Monetary Fund, an amount of external debt of a country should not exceed 150 percent of country’s exports and 250 percent of its budget revenues. As seen from the chart, the ratio of external debt of the Georgian government to the country’s GDP has not reached a critical point yet (Chart 3) and has shown a downward trend since 2010. As of 2014, the external debt of the Georgian government stands at 26.9 percent against the country’s GDP whilst the entire external debt comprises 35.6 percent. However, as already mentioned above, for developing countries the upper limit of the debt amount is much lower. Moreover, of utmost importance is the purpose of attracted loans and the share of credit resources in the total budget means. The financing of infrastructure projects positively affects the economy, though this financing cannot often be ensured by budgetary means and the necessity to take out external credit resources arises. 8 Anti-Crisis Stimulus Package for Economic Recovery

Chart 3: Government debt to Gross Domestic Product. Source: Finance Ministry of Georgia In contrast to government’s foreign debt, the total external debt of Georgia, which includes the debt of commercial banks and other sectors to the rest of the world, is rather high – 81 percent of the GDP (Chart 4). This indicator peaked in 2010 reaching 87 percent, though thereafter it started declining. The external debt of the government does not exceed the upper limits of its ratio to budget revenues and exports as set by the World Bank and the International Monetary Fund. Even more, it is way lower of those limits. As of 2014, the amount of government debt stood at 99 percent as compared to that 150 percent ratio to budget revenues which is deemed acceptable. It must however be noted that the total government debt (external and domestic debts taken together) reached 131.1 percent of budget revenues, which is a significant increase on the previous year’s indicator comprising 124 percent. This increase is the result of attracting high credit resources in 2014; in particular, 1.6 billion GEL of which 600 million GEL is the amount obtained through the issuance of treasury bills whereas 1.2 billion GEL represents the loans to be issued by international credit institutions. Anti-Crisis Stimulus Package for Economic Recovery 9

Chart 4: Government and external debts to Gross Domestic Product. Source: Finance Ministry of Georgia Chart 5: Government debt to budget revenues, exports; percent. Source: Finance Ministry of Georgia 10 Anti-Crisis Stimulus Package for Economic Recovery

The debt service play no less important role in analyzing the country’s financial sustainability and its liquidity. In 2014, Georgia has planned to spend 9.1 percent of budget revenues for servicing the government’s external debt, up by 1.2 percent on the indicator of the previous year. Given the increase in exports, the rise in the indicator of external debt service keeps the debt service ratio to exports unchanged in 2014, comprising 4.9 percent. According to the debt sus- tainability indicator set by the World Bank and the International Monetary Fund, the acceptable limit of debt service ratio to exports ranges between 15 percent and 25 percent. Chart 6: Government’s external debt service. Source: Finance Ministry of Georgia As of 30 June 2014, creditors of 68 percent of Georgian government’s debt are international organizations. The largest creditors are the World Bank and the International Development Association as well as the Asian Development Bank and the International Bank for Reconstruction and Development. In terms of bilateral liabilities, the largest creditors by separate countries are Germany, Japan and Russia. Anti-Crisis Stimulus Package for Economic Recovery 11

Chart 7. Creditors of Georgian government Out of the foreign debt borrowed by the Georgian government, 70 percent is a long term liability, namely, with the maturity of more than one year, whilst the remaining is a short-term liability borrowed for less than one year. The most of long-term liabilities represent a soft loan with a rather low interest rate. As of today, some 73 percent of the entire external debt portfolio of Georgia is a loan with a fixed interest rate. The weighted average interest rate of the external state debt stands at 1.9 percent. Chart 8. External debts by maturity. Source: Finance Ministry of Georgia 12 Anti-Crisis Stimulus Package for Economic Recovery

Some 94 percent of the external debt is denominated in foreign currencies thereby increasing the currency risk and

the threat that against the backdrop of exchange rate the pressure of liabilities may enhance. A change in exchange

rate increases the amount of total payment and the debt/GDP ratio. For example, at the end of 2013, when GEL ex-

change rate against USD dropped by two percent over the period of two months, a threat of external debt service

becoming expensive emerged because the debt service required a larger amount of national currency than it did

before that depreciation.

External debt denominated in foreign and local currencies, percentage to the total external debt

2006 2007 2008 2009 2010 2011 2012 2013 31/03/2014

In foreign currency 96% 97% 95% 96% 95% 95% 94% 94% 94%

In national currency 4% 3% 5% 4% 5% 5% 6% 6% 6%

Table 1. Source: National Bank of Georgia

The external debt of the National Bank of Georgia comprises two percent of the total external debt and shows a

declining trend since 2009 (Chart 9). The National Bank plans to totally cover its external debt this year and conse-

quently, 2014 will be the first year since 1992 when the National Bank of Georgia will no longer have the external debt.

Chart 9. External debt of National Bank of Georgia, USD million.

Source: National Bank of Georgia

Anti-Crisis Stimulus Package for Economic Recovery 13Since 2009, the debt of National Bank of Georgia includes Special Drawing Rights (SDR), an international reserve as- set created by the International Monetary Fund, which is redistributed among member states of the Monetary Fund proportionally to their respective quotas. In particular, this is a type of liability which does not have a maturity and actually, the obligation to repay it will not occur until Georgia remains a member of the International Monetary Fund. It should be noted here that the amount of distributed SDR is reflected on the asset side of the National Bank and con- sequently, net liabilities of the National Bank equals zero. By 2014, the SDR amounted to 222.5 million USD. In August 2014, the executive council of the International Monetary Fund (IMF) approved 36-month-long SDR for the Georgian government. The amount of financing totals 154 million USD. This type of loan is issued to IMF member states, thus enabling them to pay off external financial liabilities and over- come crises through sustainable economic growth. This funding allocated by the IMF also helps the country replenish international reserves. The indicator of reserve assets dropped from three billion USD in July 2013 to 2.4 billion USD in 2014. This 20-percent drop in international reserves is the record high indicator in the past few years. It is the result of sharp fluctuation of the exchange rate of the national currency which have been observed since late 2013. Necessity of State Debt Management Strategy Efficient management of state debt is one of guarantees of financial stability of a country. As of today, there is no country whatsoever in the world which does not have external debts. There are several countries with such high lev- els of external debt that they are facing a threat of default (for example, Greece, Iceland, Argentina). Some countries take out huge external debts to implement anti-crisis stimulus program for their economies (for example, Georgia at the end of 2008). There are other countries whose economic success was largely conditioned by external debts taken out by their governments. Among such countries is, for example, Japan which financed the rehabilitation of its infrastructure destroyed as a result of the World War II mainly with loans taken out from foreign sources. The state debt should not be viewed as a problem for the economy of a country. The problem may arise as a result of inefficient management of the state debt and in case of borrowing higher amount of state debts than needed and the failure to service the debt. In general, when servicing a state debt, the national government must ensure the sustainability of the debt, must define criteria for taking out loans, and clearly identify those projects and sectors for which loans must be taken out. Besides, the dependence on additional loans must be minimized. It is also important to define a mechanism of foreign debt service and maintain a low coefficient of debt service. More importantly, the role and functions of responsible government entities must be determined. The amount of debt and management thereof is especially important for developing countries, especially for those being in crisis and post-crisis situation. Many countries have debt management strategies that provide a detailed 14 Anti-Crisis Stimulus Package for Economic Recovery

description of all those necessary obligations, conditions or measures which a country’s government must take into account when managing the debt. Georgia lacks such a strategy; however, the country developed a vision of and approaches towards the debt management and the law defines the functions and responsibilities of an entity respon- sible for the debt management (the Finance Ministry). The Georgian legislation also specifies powers of other state institutions (the National Bank of Georgia, the Georgian government, the Parliament of Georgia) in borrowing and managing debts. The debt management strategy is directly linked to the country’s macroeconomic and financial policies. The main goal of state debt management policy is to ensure that the country gets economic and financial benefit from external and internal financing so that it avoids emergence of macroeconomic problems and maintains stability of the balance of payments. In order to avoid negative effects of the state debt on the economy, the debt management must be an integral part of macroeconomic policy. Many countries start to manage debt during crisis which might be a belated step because the debt management process is needed to avert the crisis. In response to the government’s financial needs, a body responsible for debt management (in often cases the Min- istry of Finance) has to make a difficult choice among various potential alternative instruments. For example, if an interest rate in the international financial market is lower than in the local market, it is naturally more attractive to take out loans from international financial institutions. However, one should also take into account a risk of exchange rate which may make a loan denominated in a foreign currency more expensive. Hence, the debt management strategy must explain all possible risks and suitability of all possible choices related to these risks. It should also be noted that external debts are not always cheap and a certain amount of domestic death is also required for a healthy and normal functioning of a country’s financial sector. International experience Taking into account the experience that is mainly based on the 2008 global financial crisis, the International Monetary Fund and the World Bank, in 2009, developed a systemic and detailed framework document which countries may use for drawing up an efficient Medium-Term Debt Management Strategy - MTDS. An earlier financial crisis in the late 1990s showed the importance of the composition of a state debt portfolio in protecting the economy against exter- nal shocks. According to the IMF and World Bank data, the depreciation of national currencies of several countries (Argentina, Brazil, Russia and Indonesia) in the 1990s led to a significant increase in debt. All this is shown in the chart provided below. Anti-Crisis Stimulus Package for Economic Recovery 15

Chart 10. Currency depreciation and state debt In some other countries (for example, in Turkey, Thailand, South Korea) the state debt increased because of liabilities to commercial banks. The 2008 financial crisis, however, clearly showed to countries the necessity and advantage of developing and implementing debt management strategies, which is especially important for low-income and me- dium-to-low-income countries. The International Monetary Fund and the World Bank have also developed the Debt Sustainability Ratio – DSF, accord- ing to which acceptable limits of debt and debt service ratios to GDP, exports and revenues are defined. The DSF are basically developed for low-income, poor countries. According to the International Monetary Fund/World Bank recommendations and the experience of various coun- tries, the strategy covers the entire debt of non-financial public sector. This includes the debts of the central gov- ernment, local governments and non-financial public corporations. Many countries, however, mainly focus on the management of the debt of the central government as the information about the amount and sources of such debts is more easily available and of high quality. Debt Management Strategy A debt management strategy is a concrete plan with its corresponding time schedule which helps the government achieve a desirable, optimal composition of state debt portfolio. The strategy must include a procedure of borrowing and managing a debt and describe all risks associated with the debt management and the factors causing those risks. 16 Anti-Crisis Stimulus Package for Economic Recovery

The existence of strategy helps government identify, evaluate and manage risks, coordinate activities of fiscal and monetary authorities of the state, decrease the cost of debt service and ensure transparency of the debt management process. The debt management strategy must be in full conformity with all instruments of the country’s economic policy – fiscal and monetary policies, exchange rate and balance of payment, local financial sector. The debt manage- ment strategy must also be in conformity with the strategy of country’s economic development and other significant documents. Since the strategy aims at minimizing macroeconomic risks, it must include a description of those advantages which domestic debt has in certain circumstances and the need of replacing an external debt with an internal one (for ex- ample, with treasury bills). It should be taken into consideration that in a longer term the internal debt might prove to be cheaper than the external debt because the external debt involves interest costs as well as sterilization and exchange rate costs. The strategy is successful in those countries where a corresponding favorable environment exists. This first of all im- plies a macroeconomic policy with a consistent fiscal and monetary policies. Moreover, it is necessary for the success of the strategy that a country has the well-drafted legislation, institutional arrangement, and modern and efficient debt registration methods that are in compliance with international standards in place. As regards the design and preparation of the strategic document itself, the process of its drafting should go through the following stages: 1. Identifying goals and scope of state debt management; 2. Formulating current debt management strategy and evaluating the price and risks of existing debt; 3. Identifying and analyzing potential sources of financing, evaluating their risks; 4. Identifying directions and risks of fiscal, monetary, external economic and internal market development; 5. Reviewing long-term structural factors of the country’s economic development; 6. Evaluating alternative strategies for debt management risks and conditions; 7. Evaluating possible interaction of strategy with fiscal and monetary policies, internal financial market operation; 8. Finally agreeing and releasing the strategy. Proceeding from the above said, the content the state debt management strategy consists of several interlinked com- ponents from which one can distinguish three main ones: • Ensuring procedures for borrowing and organizing debt management; • Seeking source of debt financing and determining a schedule; • Determining an amount of borrowing, evaluating risks, managing, and keeping quality statistics. Anti-Crisis Stimulus Package for Economic Recovery 17

Ensuring and coordinating procedures for borrowing and organizing debt management The government’s borrowing must be agreed with all government entities specified in the law and be in line with the national interests. It is important to limit state guarantees for loans taken out by a private sector. An entity responsible for attracting and managing loans must be identified and procedures of taking out loans or servicing them be set out in detail with the involvement of all participants and responsible entities. As noted above, in Georgia, just like in many countries worldwide, an entity responsible for the management of state debt is the Finance Ministry which in agreement with the Na- tional Bank of Georgia annually defines the amounts of domestic and external debts and conditions of borrowing thereof. The Georgian legislation provides for the coordination among state entities and the involvement of the National Bank, the Parliament of Georgia, the Georgian government and the Ministry of Sustainable Economic Development in the process of borrowing and managing the debt. The state debt register is also kept in accordance with the legislation. As mentioned above, the coordination of monetary and fiscal authorities is important. Persons responsible for debt management, repre- sentatives of the Finance Ministry or National Bank must regularly exchange information. Ensuring publicity and transpar- ency of the process is also important. Debt management audit must take place on an annual basis. Seeking source of debt financing and determining a schedule Given that developing countries experience shortage of capital the governments of these countries and private sec- tor seek loans from developed countries where the capital is available and consequently, interest rates are lower. In such a case, both borrowing and lending countries are interested in investing loans into profitable projects, in promoting exports, investments that would ensure the debt service. At the same time, however, one must take into account a possible crawling interest rate risk which we will discuss later. To ensure the efficient state debt management, the government must properly devise a schedule of debt service, must predict and plan amounts of tax revenues, export revenues and other revenues and availability of funds in future. Earnings of those economic sectors or projects on which state debts are to be spent must be higher than the debt expenditures. Feasibility studies of these projects must be conducted. Naturally, investments that are wrongly planned and implemented, do not contribute to the economic growth. It is better not to borrow at all than to invest borrowed amounts incorrectly. Social and infrastructure projects to be financed by debts must be evaluated by applying cost-benefit analyses. The imple- mentation of those projects which produce quick positive results may be financed by loans taken out from international capital markets whilst social services must be financed with much softer loans taken out from relevant financial institutions. Determining an amount of borrowing, evaluating risks, managing, and keeping quality statistics Borrowing excess external debt increases the cost of debt service and impedes the economic development of the country as the investments decline, public expenditures decrease and the government makes efforts to receive high- 18 Anti-Crisis Stimulus Package for Economic Recovery

er revenues. All this, in turn, pushes the consumption down. The government of a country, and this especially con- cerns the governments of developing countries, must maintain a maximally small amount of state debt in order to be able to take out new loans in case of need. The debt management process also requires the monitoring and evaluation of the use of debt refinancing potential in order to ensure instant reaction to the decrease in exports or the increase in imports. The debt management is impossible without statistical information. For example, it is necessary to regularly keep statistics on the debt to GDP ratio, debt service ratio to export and budget revenues, the average interest rate, the percentage share of debt in foreign currency in the total debt, the amount of debt per capita, the classification of debt by their maturities as short-term and long-term, et cetera. Risk management is important in the debt management strategy. This refers to risks of changes in refinancing, ex- change rate, interest rate or commodity prices. To evaluate risks, a team responsible for debt management must regularly conduct the so-called stress test of debt portfolio for potential economic and financial shocks which a gov- ernment and a country may come to face. Key components of state debt management strategy As regards the key components of debt management strategy, which must be detailed in the strategy and which must represent a routine work of the entity in charge of managing debt, they may be formulated as following: 1. Public sector definition and administrative and legislative coordination of state debt management. It is im- portant that the strategy specifies which debt is classified as a state debt. According to the Georgian legislation, a state debt is the debt borrowed by the public sector of Georgia and a debt taken out under state guarantees. As for the external debt it is classified as the entirety of those amounts denominated in foreign currencies which gave rise to liabilities specified in agreements signed by the Finance Ministry on behalf of Georgia and under the Ministry’s guar- antee, by other authorities or entities; or proceeds from the placement of state securities denominated in foreign cur- rencies and amounts received from the financial resource approved for Georgia by the International Monetary Fund. A debt borrowed by the National Bank of Georgia shall not be qualified as a state debt under the legislation; however, the National Bank’s borrowing is included in the state debt in the documents published by the Finance Ministry. The public sector definition is important as much as it must be in full compliance with the international practice and must clearly define which liabilities are considered as state debt and which are considered as external state debt. Yet another important component is the so-called political consensus on having a debt management process agreed and implemented in accordance with those rules that have been agreed and written down, which, in turn, must be reflect- Anti-Crisis Stimulus Package for Economic Recovery 19

ed in the strategy. For example, although state guarantees can be issued under the legislation and in theory, in prac- tice guarantees are not issued in Georgia and this is the correct thing to do in such a country as Georgia. Borrowing by local self-government bodies is also restricted and is not practiced (in developed countries self-governments may borrow). The current practice in Georgia in this respect is efficient and matching economic realities of our country. In case of Georgia, however, one must take into account that the debt registration must be kept in accordance with the international classification. Firstly, there is a mismatch of terms because the law uses the term state debt whilst published official data use the term “government debt.” While the Law of Georgia on State debt does not specify a debt of the National Bank and state owned companies as a state debt, published documents include the National Bank (in accordance with international classification) and hence, there is a mismatch between the law and official sta- tistics. A mismatch is also observed in defining maturities of liabilities. The Law provides the definitions of short-term (up to one year), medium-term (from one to 10 years) and long-term (above 10 years) periods whereas the National Bank classifies the external debt only into short-term (up to one year) and long-term (more than 1 year) liabilities in accordance with the international classification. The Law needs to be brought in line with the international classifica- tion and terms need to be corrected. Otherwise, the strategy will come into conflict with the legislation. 2. Debt intolerance. The ratio of state debt to Gross Domestic Product or Gross National Income is the best means to evaluate a debt burden on the economy and to determine upper limit of the debt. Given that international financial markets are not readily available for developing countries the upper limit of a debt amount for these countries is lower than for developed countries. While the acceptable limit of state debt to GDP ratio is set at 60 percent for developed countries, including EU member states, a corresponding limit for developing countries, including Georgia, ranges between 35 percent and 40 percent. As of today, this ratio in Georgia is within the acceptable range. In par- ticular, in 2013 it stood at 34.4 percent, in 2014 it is expected to be at 35.6 percent whilst in 2018 at 32 percent. It is notewor- thy that the strategy of social and economic development adopted by the government of Georgia, “Georgia 2020,” sets the ceiling of state debt against the GDP at 40 percent in 2020 whereas the Finance Ministry’s target of this ratio is 32 percent in 2018. A debt management strategy must be in line with the document of country’s strategic development; however, it is the fact that there is a huge difference between the target of the Finance Ministry and the figure quoted in the strategy. An upper limit of medium-term targeted debt must be determined on the basis of historic “reasonable” level of debt and country’s economic capacities so that to maintain a targeted level against macroeconomic forecasts. A targeted level of the debt must not be unrealistically or insufficiently ambitious. It must reflect fiscal abilities of the country and be in harmony with parameters of monetary policy. Several scenarios must be worked out; for example: 1) a scenario assuming that the existing policy will not change; 2) a scenario envisaging the increase in revenues; 3) a scenario implying an active, aggressive privatiza- tion; or 4) a combination of several scenarios. Expected, forecasted indicators must then be spread over several years. 3. Debt service ratio. Ratio of debt service to exports and tax revenues. According to Debt Sustainability Ratio (DSF) of the International Monetary Fund and World Bank, an acceptable limit of debt service to exports ratio ranges be- tween 15 percent and 25 percent. As it has already been said, the DSF is mainly developed for low-income, poor coun- 20 Anti-Crisis Stimulus Package for Economic Recovery

tries. Given that the external debt is denominated in hard currencies, the lower the indicator of that upper limit the

healthier the international financial position of a country, because it is thus more conducive to the economic growth

of the country as export is the main source of foreign currency inflows to the country with remittances from abroad

and revenues from tourism added to them.

The debt service relation to budget revenues, which is mainly measured in terms of tax revenues, shows a country’s

capacity to finance debt service from domestic sources.

The DSF classifies low-income countries into three categories by debt service ratio limits, namely, into strong, medium

and weak countries.

Debt service ratio to exports and revenues for low-income countries

To exports To revenues

Strong 15% 18%

Medium 20% 20%

Weak 25% 22%

It is therefore important that countries, when planning a strategy, observe the limits of debt service ratios both to

exports and to tax revenues. The upper limit of ratio may rise if export declines, export becomes more expensive and

tax revenues decrease. Expected, forecasted indicators must then be spread over several years in the strategy.

4. Risk of refinancing. A risk of refinancing arises when debt service cannot be financed or it cannot be replaced with

a new debt or it is replaced with a debt borrowed at a higher interest rate. Such an instance exacerbates a debt crisis

and causes serious problems to the whole of economy. The debt management strategy must envisage conditions

of insuring against such risks, especially for countries like Georgia as international financial resources are not easily

available for them.

5. Interest rate risk. This implies a risk arising from a possible change in interest rate. The debt management strategy

must describe a risk associated with so-called “crawling interest rate” and must provide a weighted average interest

rate especially on the external debt. It is recommended to have a fixed interest rate and a body responsible for debt

management must bear in mind that a current low interest rate does not mean that the interest rate will remain un-

changed after 10 or 15 years. In the period of crisis or post-crisis in which the world is today, the interest rate is low

to stimulate the economy. However, the recovery of world economy will trigger inflationary processes and banks

and international financial corporation will raise interest rates thereby making loans more expensive. Therefore, it is

important that the strategy considers the importance and the necessity of fixed rates.

6. Exchange rate risk. The cost of debt service may change monthly alongside changes in exchange rate. Deprecia-

tion of local currency makes debt service of external debts, rendered in foreign currency, more expensive when debt

service is financed from local sources.

Anti-Crisis Stimulus Package for Economic Recovery 21Conclusions

• S tate debt does not pose a problem to a country if the country has enough resources to service the debt and

if the debt is efficiently managed and spent. The problem may arise as a result of inefficient management

of the state debt and a higher amount of borrowing than needed and the failure to service the state debt;

• In servicing a state debt, the national government must ensure the sustainability of the debt, must define

criteria of borrowing and clearly identify those projects and sectors for which the debt must be taken;

• any countries worldwide have debt management strategies which detail all those necessary obligations,

M

conditions or measures which the government of a country must take into account when managing a debt;

• T he strategy is directly linked to a country’s macroeconomic and financial policies. In order to avoid a neg-

ative impact of the state debt on a country’s economy, the debt management must be an integral part of

macroeconomic policy. Many countries start debt management in the period of a crisis which might prove

belated because it is exactly for avoiding this crises that the debt management process is needed;

• In 2009, the International Monetary Fund and the World Bank drew up a systemic and detailed framework

document which countries may use for developing an efficient Medium-Term Debt Management Strategy

- MTDS. The International Monetary Fund and the World Bank have also developed the Debt Sustainability

Ratio – DSF, according to which acceptable limits of debt and debt service ratios to GDP, exports and reve-

nues are defined;

• I n terms of its content the state debt management strategy consists of several interlinked components from

which three main components can be distinguished: 1) ensuring procedures for borrowing and organiz-

ing debt management; 2) seeking source of debt financing and determining a schedule; 3) determining an

amount of borrowing, evaluating risks, managing, and keeping quality statistics;

• T he strategy must describe the advantage of internal debt in specific circumstances and the need to replace

external debt with the domestic one (for example, treasury bills). In a longer term the internal debt might

prove to be cheaper than the external debt because the external debt involves interest costs as well as ster-

ilization and exchange rate costs;

• ey components of management strategy are: 1) public sector definition and administrative and legislative

K

coordination of state debt management; 2) debt intolerance; 3) debt service ratio; 4) risk of refinancing; 5)

interest rate risk; 6) exchange rate risk.

22 Anti-Crisis Stimulus Package for Economic RecoveryEconomic Policy Research Center (EPRC)

85/24 Paliashvili/Mosashvili str. Building I. Floor IV. 0162. Tbilisi.Georgia.

Tel/Fax: (995 32) 2 207 305

e-mail: info@eprc.ge

www.eprc.geYou can also read