Retail - The Future of Retail is Stores that Aren't Stores - By Deborah Weinswig - ULI Asia Pacific Summit

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Retail – The Future of

Retail is Stores that

Aren’t Stores

By Deborah Weinswig

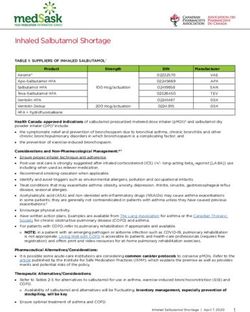

deborahweinswig@fung1937.com 1One in Five Department Stores Will Have Closed

Over 1,000 department stores could close by 2023, reducing total

sector store numbers by one-fifth.

deborahweinswig@fung1937.com 3One in Five Department Stores Will Have Closed

US: Number of Full-Line Department Stores

1,100–1,200 Closures

5,900

6,000

5,000 4,750

4,000

3,000

2,000

1,000

0

2017 2023E

Figures exclude off-price department stores.

Source: Euromonitor International/Coresight Research

deborahweinswig@fung1937.com 4Shoppers Will Be Redirecting a Further $78 Billion

in Spending from Retail to Services

By 2023, we expect consumers will be redirecting an additional $78 billion

to discretionary services at the expense of discretionary goods.

deborahweinswig@fung1937.com 5Shoppers Will Be Redirecting a Further $78 Billion in

Spending from Retail to Services

US Discretionary Spending: Split of Goods vs. Services (%)

Discretionary Goods Discretionary Services

58.0

56.7

56.4

56.0

55.7

56.0 55.4

55.0

54.6 54.7

54.2

53.7

54.0 53.1 53.1 53.1

52.7 52.6 52.8

52.5

51.7 52.0

51.6

52.0 51.3

50.4 50.7

50.0

50.0

50.0

49.6 49.3

48.0 48.7

48.4 48.3 48.0

$78 Bil. in "Lost" Spending

47.5 47.3 47.4 47.2 46.9

46.0 46.9 46.9

46.3

45.8

45.4 45.3

44.0 45.0

44.6

44.3

44.0 43.6 43.3

42.0

Source: US Bureau of Economic Analysis/Coresight Research

deborahweinswig@fung1937.com 6Consumers Will Buy $73 Billion More Worth of

Apparel Online

Online apparel sales will more than double between 2017 and 2023,

meaning an additional $73 billion of apparel purchases will switch from

stores to e-commerce.

deborahweinswig@fung1937.com 7Consumers Will Buy $73 Billion More Worth of Apparel Online

E-Commerce Clothing and Footwear Sales as a Share of Total

Clothing and Footwear Sales (%)

35.0 $73 Billion More 34.2

Spent Online

30.0

25.0

20.4

20.0

15.0

10.0

5.0

0.0

2017 2023E

Source: Euromonitor International/Coresight Research

deborahweinswig@fung1937.com 8Millennials Will Control $5 Trillion of

Consumer Spending

We estimate that US millennial households will wield over $5 trillion of

spending power by 2023

deborahweinswig@fung1937.com 9Millennials Will Control $5 Trillion of Consumer Spending

US: Gen Zers and Millennials as % of Population (Left Axis)

and Midpoint of Millennials’ Age Range (Right Axis)

Gen Zers Millennials Millennials: Age Midpoint

60.0%

32 33 35

30 31

28 29 30

50.0%

26 27

28.4% 28.3% 25

40.0%

28.5% 28.4%

28.6% 28.5%

28.7% 28.6% 20

30.0%

15

20.0%

10

24.8% 25.9% 27.1% 28.2%

10.0% 20.2% 21.3% 22.5% 23.6%

5

0.0% 0

2016 2017 2018E 2019E 2020E 2021E 2022E 2023E

We define millennials as being born between 1980 and 2000 and Gen Zers as being born after 2000, so Gen Zers include children.

Source: US Census Bureau/Coresight Research

deborahweinswig@fung1937.com 10Retail-as-a-Service Will Peel Away $17 Billion

from Traditional Retail Channels

By 2023, US shoppers will be spending an estimated $17 billion on online

meal kits, beauty and personal care subscriptions, online apparel resale

and online apparel rental.

deborahweinswig@fung1937.com 11Retail-as-a-Service Will Peel Away $17 Billion from Traditional

Retail Channels

Market Size of Selected Retail Alternatives (USD Bil.)

Online Meal Kits Beauty and Personal Care Subscriptions

Apparel Resale Sites Online Apparel Rental

20.0

17

16% Average Annual

Growth

15.0

10.0

7

5.0

0.0

2017 2023E

Source: Coresight Research

deborahweinswig@fung1937.com 12RETAIL OUTLOOK

deborahweinswig@fung1937.com 13Retail M&A Activity

Industry M&A activity continues at a healthy pace.

Selected Retail/Apparel Transaction Announcements

Date Acquirer Target Company Value (USD Mil.)

5/2/18 Macy’s Story Undisclosed

4/30/18 Sainsbury’s Asda $9,667

3/19/18 Authentic Brands Nautica Undisclosed

3/16/18 L’Oréal ModiFace Undisclosed

2/27/18 Amazon Ring $1,000

2/5/18 EG Group Kroger convenience stores $2,150

2/2/18 Albertsons Rite Aid $3,063

1/22/18 Richemont Yoox Net-a-Porter $3,119

1/11/18 Shareholders Puma $4,267

12/13/17 Target Shipt $550

Source: Bloomberg

deborahweinswig@fung1937.com 14Store Closures Continue to Exceed Store Openings

Major US Store Closing Announcements: Year to Date 2018

740

Walgreens 600

267

Best Buy 250

200

Mattress Firm 200

110

Sears and Kmart 103

100

Southeastern Grocers 94

94

Claire's 92

Gap

71

70

63

Total: 3,335 Total: 10,000

Abercrombie & Fitch 60 announced store closures expected store closures in 2018

49 year to date

Bon-Ton 47

24

Vera Bradley 17

13

J.Crew

Macy’s

13

12

11

Total: 1,769 Total: 7,066

10 announced store openings

JCPenney 8 announced store closures

6 year to date in 2017

Island Pacific 6

4

Nordstrom 1

0 100 200 300 400 500 600 700 800

Year to date through April 13. Coresight Research has calendarized the announcements of store closures, which involves an estimation for some retailers. Ascena Retail will close 268–667

stores by July 2019, depending on negotiations with landlords. The Children’s Place will close 300 stores by 2020. Gap will close 200 stores by 2020. Vera Bradley will close 50 stores by 2021.

Source: Company reports/Coresight Research

deborahweinswig@fung1937.com 15Retail Bankruptcies Continue

Retail Bankruptcy Announcements

YTD 2018 vs. Same Period in 2017

2018 2017

Month Revenue Month Revenue

• Six US retailers have filed for Company

Announced (USD. Mil)

Company

Announced (USD. Mil)

bankruptcy year to date as of A’gaci Jan 39 American Apparel Jan 545

the end of April, compared Kiko USA Jan 9 The Limited Jan 10

with 10 in the same period in

2017. Bon-Ton Feb 2,541 Wet Seal Feb 342

The Walking Company Mar 230 Eastern Outfitters Feb 446

• Bankruptcy filings seem to be Claire’s Mar 1,338 RadioShack Mar N/A

slowing relative to last year, Nine West Apr 1,910 Gordmans Stores Mar 632

when they hit a record—but

they are still at a HHGregg Mar 1,770

postrecession high. Gander Mountain Mar 219

Vanity Mar N/A

• More are likely to come. Payless ShoeSource Apr 266

Year to date through April 30

Source: Company reports

deborahweinswig@fung1937.com 16Amazon Continues to Outpace Retail and US E-Commerce

US: E-Commerce’s Share of Total Retail Sales (Left Axis) and

Amazon’s Share of E-Commerce Sales (Right Axis)

25.0% 23.5% 25.0%

20.3%

20.0% 18.7% 20.0%

15.0% 15.0%

10.0% 8.9% 10.0%

8.1%

7.3%

5.0% 5.0%

0.0% 0.0%

2015 2016 2017

US E-Commerce/Retail Amazon/E-Commerce

Source: Amazon/US Census Bureau/Coresight Research

deborahweinswig@fung1937.com 17Grocery Delivery Wars Are Escalating

• Amazon recently expanded its Amazon Key program to include delivery to car trunks

to deter “porch pirates.”

• Other retailers are partnering with delivery services for same-day grocery delivery.

Retailer Activities/Partners

Amazon • Amazon Prime Now delivery in 1–2 hours

• Whole Foods local delivery

• Amazon Key delivers inside homes and cars

Target • Announced acquisition of Shipt for $550 million in cash

• Expanded delivery to Northeast and NV, CO, TN, SC, LA, MS, TX, etc.

Walmart • Testing package delivery by employees

• Partnership with DoorDash

Kroger • Offers same-day home delivery in 45 markets

• Recently expanded partnership with Instacart

Source: Company reports

deborahweinswig@fung1937.com 18Healthy Retail Private-Label Activity

Retailers are boosting their private-label offerings.

Amazon offers 76 private-label Target offers 41 private-label and exclusive Walmart offers 28 private-label

brands, up from 35 in April 2017 brands, up from 33 in January 2017 brands, up from 26 in January 2017

76 brands, including: Selected brands: Selected brands:

Source: Company reports

deborahweinswig@fung1937.com 19Kohl’s Is Embracing New Formats

Kohl’s appointed doug howe as chief merchandising officer on may 2. He previously served as

global chief merchandising officer at qurate retail group, parent of QVC and HSN.

deborahweinswig@fung1937.com 20RETAIL TREND

deborahweinswig@fung1937.com 21VR in Retail

Alibaba launched the trial of Buy+, a VR set through which users can

access a virtual shopping experience that simulates shopping trips to

iconic locations such as Macy’s store on 34th Street in New York.

deborahweinswig@fung1937.com 22AR in Retail

Starbuck Reserve Roastery in Shanghai using AR technology to enhance

user experience and customer loyalty

deborahweinswig@fung1937.com 23AI in Retail

Walkways fused with artificial intelligence, an on-site farm for picking vegetables, and smart

lavatories that offer a health diagnosis

deborahweinswig@fung1937.com 24The CORE Framework for AI in Retail

Communication Optimize Pricing

Personalization, chatbots, voice Forecasting, competition and

dynamic pricing

Rationalize Inventory Experiential Retail

Demand forecasting, allocation, Engage, discover, shop, pay

auditing

deborahweinswig@fung1937.com 25VC Funding for AI Is Exploding and Was Up 240% in 2017

$16.0

$14.2

$14.0

$12.0

$10.0

$8.0

$6.0

$4.2

$4.0 $3.0

$1.7 $2.2

$2.0 $0.7 $0.7

$0.0

2011 2012 2013 2014 2015 2016 2017

Q1 Q2 Q3 Q4

Source: Venture Scanner

deborahweinswig@fung1937.com 26US Look to China, a New Leader in AI

New Retail refers to the integration of online and offline retail, logistics and data across a single value chain—AI and

automation are the keys to making everything work.

Offering New Pickup Options Such as Click-and-

Collect

Rolling Out O2O Services on Mobile Devices and

Social Networks

Pure Plays Opening Experiential Stores

Enhancing Mobile Payment Services In-Store

Forming Strategic Alliances with Internet

Companies to Drive Synergies

Using QR Codes In-Store to Encourage Customers

to Buy Online; Driving Online Traffic to Physical

Stores

deborahweinswig@fung1937.com 27AI Helped Alibaba and JD.com Achieve Record Sales

on Singles’ Day

Singles’ Day Online Sales

Key stats from the 2017 11.11 Global (USD Bil.)

Shopping Festival (Singles’ Day): 30

25.3

• Alibaba reported Singles’ Day sales of 25

$25.3 billion, up 39% year over year. $44.4 billion 19.14

20 17.8

in 2017

• JD.com reported sales of $19.14 billion, 15

14.3

up 50% year over year.

9.3 9.57

10

• Alibaba’s mobile penetration was 90%, 5.8

up from 82% in 2016. 5 3.0

0

• Alibaba processed 812 million packages, 2012 2013 2014 2015 2016 2017

up from 657 million in 2016.

Singles' Day (Alibaba) JD.com

Alibaba figures are sales made on November 11 (Singles’ Day); JD.com sales cover 11 days of transactions,

including Singles’ Day.

Source: Company reports

deborahweinswig@fung1937.com 28China’s Singles’ Day vs. US Thanksgiving Weekend Sales: 2017

30 60.0%

25 50.0% 50.0%

25.3

20 39.0% 40.0%

Sales (USD Bil.)

YoY % Change

19.1

15 30.0%

10 18.3% 16.9% 17.9% 20.0%

16.8%

7.9

5 6.6 10.0%

5

2.9

0 0.0%

Thanksgiving Black Friday Thanksgiving-Black Cyber Monday* Singles' Day Singles' Day

Friday (Alibaba)** (JD.com)***

*Estimate as of 10 p.m. on Cyber Monday

**Includes sales from Alibaba’s 11.11 pop-up stores and other physical stores

***Includes sales from November 1–11, 2017

Source: Adobe/ShopperTrak/company reports

deborahweinswig@fung1937.com 29AI Offers Personalization and Higher Conversion Rates

Alibaba uses AI to integrate data across a single value chain.

Merchants generated 60 billion personalized

Alibaba’s AI-based marketing platform

shopping pages on Taobao and Tmall during

generated 400 million ad banners on Singles’

Singles’ Day 2017

Day 2017

Conversion rates were 20% higher

Alibaba’s AI customer service handled

on personalized landing pages than on

95% of inquiries on Singles’ Day 2017

nonpersonalized pages on Singles’ Day 2016

Source: Alizila.com

deborahweinswig@fung1937.com 30Recommendation Types Differ on Amazon and Alibaba

Recommends More Paintbrushes (i.e., Goods) Recommends a Painting Class (i.e., Experiences)

deborahweinswig@fung1937.com 31Robotics for “Smart Warehousing” and Fulfillment

Walmart is testing at select locations is the Bossa Nova robot. It scans shelves for out of stock

items, incorrect shelving and wrong labels.

deborahweinswig@fung1937.com 32Robotics for “Smart Warehousing” and Fulfillment

Alibaba’s AGV Warehouse Robots

China is leading the charge when it comes to embracing

industrial robotics.

• China is the world’s biggest purchaser of industrial robots,

representing ~35% of global sales, according to the

International Federation of Robotics.

• Chinese appliance manufacturer Midea acquired German

robotic factory automation company Kuka for $5 billion.

At Alibaba’s smart warehouse in Huiyang, 60 automated Kuka Fulfillment Robot

guided vehicles (AGVs) can process 1 million shipments per

day.

• These Wi-Fi-equipped, self-charging machines are responsible

for moving goods in the warehouse.

• AGVs cut the time required to process an item for an order by

two-thirds and increase output threefold, according to

Alibaba.

Source: YouTube

deborahweinswig@fung1937.com 33Thank You

Deborah L. Weinswig

deborahweinswig@fung1937.com

deborahweinswig@fung1937.com 34You can also read