Shifting Retail Landscape Poses Big Questions for CMBS Borrowers and Lenders - HubSpot

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

March 2015

CRE Research

Shifting Retail Landscape Poses Big Questions for

CMBS Borrowers and Lenders

Trends

Online shopping has placed brick and mortar which often drives business online despite the

retailers in a unique position. The convenience purchase decision being made in a physical store.

of straight-to-your-door services and a nearly

A barbell effect seems to have taken hold in

infinite selection has curbed the appetite for

retail property investment, as large retail REITS

physical stores, but the demand to see, feel, and

are shedding underperforming assets and

touch a product is still at the core of the retail

pumping money into high-end luxury malls and

experience. Tech integration, on top of the overall

storefronts in urban “high street” retail areas.

transition to sustainability, has put pressure on

On the other end, grocery stores, pharmacies,

retailers and property owners to upgrade and

discount retailers, and other consumer essentials

redesign facilities with integrated technology to

tenants that anchor smaller retail properties are

draw customers away from their screens and

performing fairly well. Second tier regional malls,

into stores. Rather than use stores like small

the power centers built more than thirty years

inventory warehouses, retailers are shifting more

ago that are anchored by beleaguered big box

toward the showroom and omni-channel models.

tenants like JC Penney, Sears, and Best Buy,

Retail stores are now just one part of the are the properties suffering the most. It is these

purchase process, which has grown to include properties that are causing the most damage

online connectivity, brand engagement through to legacy CMBS loans, as large parcels slowly

social media, and experiential flagship stores. become vacant.

Landlords are increasingly redeveloping retail

properties to cater to the expanded technological

Historical Performance

needs of tenants and, in many cases, their lower

square footage requirements as a result of having

For the most part, delinquency rates have settled

less inventory on premises. Retailers themselves

down since the wild effects of the financial

are grappling with performance measurements

crisis hit the market. Trepp’s rate for retail loan

of brick and mortar stores under this new model,

delinquencies in February was 5.38%, down

www.trepp.com 1CRE Research March 2015

22 basis points from January’s rate and 286 of the maturing balance will come from loans

basis points from its peak in March 2012. Retail backed by retail properties. Loans that are current

delinquencies recovered more rapidly than now may end up defaulting as they near maturity

other major property types, as special servicers and borrowers assess their sale or refinance

were faster to cut their losses and foreclose on options.

distressed retail properties, as opposed to the

When the maturing retail loans are broken

‘extend and pretend’ approach taken with a lot

down by the underlying properties’ reported

of large office and multifamily loans during the

occupancy rates, a quarter of the loans provide

slow recovery. The office delinquency rate, by

cause for concern with regards to their tenancy.

comparison, was 6.15% in February.

Higher vacancy rates lead to lower income and

This year is the first of the oncoming ‘wave of ultimately lower valuations, possibly causing

maturities,’ which is the more than $300 billion trouble for these loans when it comes time to

of 2005 through 2007 vintage 10-year loans due refinance.

to mature over the next three years. Nearly 30%

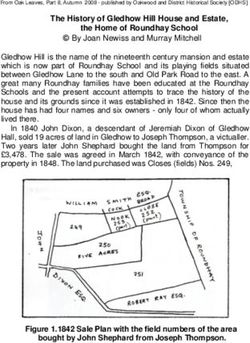

Figure 1. Retail Delinquencies Figure 2. Volume of Loans Maturing

8.50%

140 26.45%

8.00%

$ Billions

28.42%

120

7.50%

100

7.00%

80 29.43%

6.50%

60

6.00%

40

5.50% 17.77%

20 30.87% 48.86%

5.00%

0

4.50%

2015 2016 2017 2018 2019 2020

1/10

5/10

9/10

1/11

5/11

9/11

1/12

5/12

9/12

1/13

5/13

9/13

1/14

5/14

9/14

1/15

Maturing Loans (excld. retail) Retail Loans Maturing

Figure 3. Occupancy of Maturing Retail Loans

100% 100

80% 98

60% 96

40% 94

20% 92

0% 90

2015 2016 2017 2018 2019 2020

0-49 50-74 75-84 85-89

90-94 95-99 100 Avg Occ

www.trepp.com 2CRE Research March 2015

To get a clearer picture of what losses may look of foreclosure, so it is highly likely that these

like as the wave of maturities hits, we look to properties will report losses upon disposition.

the status of the loans coming due from now An additional 2% of 2015 maturities are currently

until 2017. Of the maturing retail loans, 7.93% with the special servicer. Another 7% and 7.7%

are current but have been assigned appraisal of 2016 and 2017 retail maturities are already

reduction amounts (ARAs), while 7.68% are delinquent, respectively.

delinquent with an ARA. ARAs can serve as both

Historically, average loss severity on retail

a warning and estimate on the level of losses

dispositions has been volatile due to varying

that may result based on the borrower’s missed

maturities, prepayments, foreclosures, and

principal and interest payments. Looking at 2015

the overall state of the commercial real estate

retail maturities alone, over 14% were reported

market. Over the last ten years, 19% of retail

as delinquent in February. The majority of the

loan dispositions resulted in a loss, with an

delinquencies are either REO or in the process

average loss severity of 51.55%.

Figure 4. Wave of Retail Maturities Figure 6. Maturing Retail Delinquencies

6.0 4.5

$ Billions

5.0

$ Billions

4.0 4.0

3.0 0.24%

3.5

2.0 2.82%

1.0 3.0

0.0 3.24%

2.5

12/15

12/16

12/17

3/15

6/15

9/15

3/16

6/16

9/16

3/17

6/17

9/17

1.27%

0.27%

Current Delinquent Current w/ ARA Delinquent w/ ARA 2.0 3.07%

4.26%

1.5

Figure 5. Losses on Disposed Retail Loans 10.07%

1.0

7.19%

4.0 75% 5.82%

0.5

$ Billions

3.0 60%

45% 0.0

2.0 2015 2016 2017

30%

1.0 REO Foreclosure

15% Non-Perf BydMat 90+ Days

0.0 0% 60 Days 30 Days

Loans w/ Spc Srv

12/10

10/11

11/13

2/10

7/10

5/11

3/12

8/12

1/13

6/13

4/14

9/14

2/15

Disposed w/o Loss

Disposed w/ Loss

6 per. Mov. Avg. (Loss Severity)

www.trepp.com 3CRE Research March 2015

New Issuance Interest-only loans have made up a growing

proportion of new retail origination over the last

Issuance of retail loans in CMBS has been

year. In general, IO terms are considered riskier

trending upward since the recession despite

than amortizing loans that that pay down principal

a slight drop in 2014. Beginning in 2012, single

over their term.

asset/single borrower deals accounted for a

growing proportion of annual issuance. The large The loan-to-value ratios on loans being issued

trophy type assets or portfolios financed by these also serve as a good measure of where

deals, paired with their relatively easy-to-analyze underwriting standards are in the market. In

structure, made them more appealing to wary the case of retail loans, weighted average LTVs

CMBS investors. Growing use of this deal type don’t give much away, but it does appear that

also supports the theory that the capital markets lenders are originating loans at slightly higher

are shifting their assets toward high-end, luxury, leverage points so far in 2015. One reason LTVs

prime-location retail properties. may be staying fairly flat is a coinciding drop

in capitalization rates. Cap rates measure net

As more capital enters the market and lenders

operating income (NOI) in relation to property

compete harder for lending assignments,

value, so the downward trend in cap rates implies

underwriting standards are on the radar of

that property values are increasing for the same

investors and ratings agencies. One measure

amount of NOI.

of underwriting standards is the percentage of

interest-only (IO) loans being originated in CMBS.

Figure 7. Retail Issuance by Deal Type Figure 8. Retail Amortization Types

30 100% 8.0

$ Billions

$ Billions

22.8% 22.2% 19.5%

% of Amort. Tpye

25 80% 35.1%

48.6% 6.0

21.9%

20

60% 32.1%

48.0% 4.0

15 28.1%

40%

10 35.8%

58.6%

45.7% 2.0

5 20% 36.8%

29.2%

15.6%

- 0% 0.0

2010 2011 2012 2013 2014 2015

YTD Interest Only Partial IO

Conduit Large Loan SnglAsset/Borr

Amortizing Volume (RHA)

www.trepp.com 4CRE Research March 2015

Many middle-of-the-market malls continue

Figure 9. Weighted Average LTV & Cap Rates

to underperform, some of which have gone

70.00 7.10%

completely dark, while high-end shopping

7.00% centers benefit from access to capital and higher

6.90% foot traffic. Simon Property Group’s recent

65.00 6.80%

6.70% bids for Macerich may point to a trend toward

60.00 6.60% consolidation in the retail REIT market that could

6.50%

advance the process of culling underperforming

6.40%

55.00 6.30% assets and investing in high performing

2014Q1 2014Q2 2014Q3 2014Q4 2015Q1TD

properties. Ultimately, owners and tenants will

WtdAvgLTV AvgCapRate

have to revitalize space by integrating technology

to enhance consumer engagement and compete

Outlook with online outlets with less overhead.

Rents in urban markets soared last year and The high volume of retail loans coming due

will remain competitive as the move toward over the next three years will lead to increasing

urbanization continues and millennials stay new CMBS origination in this space. However,

unmarried and live in cities longer than the many of the properties up for refinancing will be

generation before them. Large anchors in malls reappraised in a retail environment very different

continue to struggle to stay relevant, and many from what it was ten years ago. Depending on

staples in the industry have either faded, like the landscape in the next five years, this could

Sears, or fallen, like RadioShack. Now, both put pressure on borrowers to contribute more

companies are trying out the store-within-a-store capital or sell properties at discounted values.

model, with Sears carving up parcels to sublease

unnecessary space, and RadioShack teaming up

with Sprint to lower expenses and better utilize

their existing square footage.

For inquiries about the data analysis conducted in this research, contact press@trepp.com or call 212-754-1010.

For more information about Trepp’s commercial real estate data, contact info@trepp.com.

About Trepp

Trepp, LLC, founded in 1979, is the leading provider of information, analytics and technology to the CMBS, commercial real estate and

banking markets. Trepp provides primary and secondary market participants with the web-based tools and insight they need to increase

their operational efficiencies, information transparency and investment performance. From its offices in New York, San Francisco and

London, Trepp serves its clients with products and services to support trading, research, risk management, surveillance and portfolio

management. Trepp is wholly-owned by dmg b2b, the information publishing division of the Daily Mail and General Trust (DMGT).

5You can also read