HLB tolerant rootstocks - Australian, Indonesia trials commence 6 - Citrus Australia

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

WINTER 2021

HLB tolerant rootstocks

Australian, Indonesia trials commence

P 29

6 Export roadmap 9 Australian and 13 Granulation

reveals extra international in Imperial

competition ahead expansion mandarinsWINTER 2021

Australian Citrus News is written and

published by Citrus Australia Limited.

(ACN 130 238 792) In this issue...

94 Lemon Avenue Mildura Vic 3502

PO Box 10336, Mildura Vic 3502 Australia

T: (03) 5023 6333

F: (03) 5023 3877 CEO REPORT BIOSECURITY

E: admin@citrusaustralia.com.au

4 HLB tolerant rootstocks a new 22 Biosecurity a passion for new team

www.citrusaustralia.com.au addition to biosecurity strategy member Jessica

24 Identifying challenges of urban

NEWS plant biosecurity

MANAGING EDITOR & ADVERTISING

Stephen Cooke

5 Jackie on board to help growers

Industry Engagement Manager

with labour options INNOVATION

Citrus Australia Limited 6 Export roadmap reveals 29 HLB tolerant rootstocks arrive

M: 0427 124 437 extra competition ahead in Australia

E: stephen.cooke@citrusaustralia.com.au 9 Australian and 30 Establishing HLB tolerant

international expansion rootstock trials for the Australian

DESIGN & LAYOUT

citrus industry

Clare De Luca 12 Further citrus exports to the

Fresh Republic US within reach 32 Review your postharvest fungicides

M: 0413 563 654

E: clare@freshrepublic.com.au

MANAGEMENT

13 The effect of seasonal conditions

on granulation in Imperial

mandarins

CITRUS 16 The changing face of solar

FUND

18 The days of being an

island are over

Australian Citrus News has been funded by

Horticulture Innovation Australia Limited

using the national citrus levy and funds from

the Australian Government.

DISCLAIMER: Citrus Australia Limited

(CA) acknowledges contributions made

by private enterprise through placement

of advertisements in this publication.

Acceptance of these contributions does not

endorse or imply endorsement by CA of any

product or service advertised by contributors.

Any advice provided in articles contained in

Australian Citrus News is intended as a source Cover image: HLB tolerant rootstocks imported from the USA are being grown and will be tested in

of information only. Always read the label Australia.

before using any of the products mentioned.

CA and its officers do not guarantee that

OUR CORPORATE PARTNERS

the publication is without flaw of any kind

or is wholly appropriate for your practical

purposes and, therefore, disclaim all liability

R

for any error, loss or any other consequence

that may arise from you relying on the

information in this publication. All articles

and other material published in this journal

is CA copyright (unless otherwise stated)

and may not be reproduced in part or full CITRUS

without the written permission of the authors FUND

and publisher.CEO REPORT

HLB tolerant rootstocks

a new addition to

biosecurity strategy

It’s always satisfying to share the news of industry research and other work being undertaken

by the Citrus Australia team on behalf of its members and growers nationwide.

I’m particularly excited to share news and Disease Prevention Committee agreements with partner nations,

in this edition of the HLB tolerant throughout the year. there will be processes that need to

rootstock trials in Australia. be bedded down in Australia and in

Citrus Australia will advocate for

partnering countries.

Australia has the advantage of additional Federal Government

preparing for an incursion of the funding to shore up plant-based Although the visa will be in place

Asian Citrus Psyllid/HLB; a luxury not biosecurity measures, including a by September 30, it is unrealistic to

available to the Florida citrus industry, nursery registration scheme, as well expect large numbers of workers will

which was decimated by the disease. as additional biosecurity measures on be available until mid-2022 at the

the frontline. earliest. This means most businesses

For example, we now have a world

will need other labour sources to

class industry propagation facility in The government this year allocated

fill the ongoing worker shortage,

Auscitrus, which has implemented $84m over four years in frontline

particularly those picking Valencias,

the latest methods in disease and measures, including detector dogs and

lemons and limes this year, and

pest protection. enhanced screening technology.

mandarins early next year.

As discussed in the magazine, However, our industry is worth almost

We are unlikely to see any volume

importing tolerant rootstock seeds $900m annually in farmgate sales,

of backpackers until 2024 and it is

gives the citrus industry a head start including $500m in exports, and

unclear whether working rights in

on local evaluation. It will enable funding for risk prevention should be

holiday visas will be further eroded in

industry to gain a good understanding allocated accordingly.

that time. The Citrus Australia team will

on how they react to being in

Citrus Australia will continue to work to ensure government plays their

Australian soils and our climate, and

work with government and other part in improving quarantine pathways

growing Australian varieties.

horticulture bodies to ensure our and providing access to workers, but

I look forward to updating you on the requirements, both long-term and we advise all citrus businesses to start

results through this magazine and our short-term, are met. planning their workforce for next year

other communication channels. when this harvest concludes.

Biosecurity at all levels remains an There has been much publicity about We understand how difficult the

important focus for Citrus Australia. worker shortage has been for many

the new Ag Visa and we believe it

this season. For help on navigating

Areas of concern, potential solutions, will become an important long- available options, I encourage you to

and accessing additional government call Jackie Heaysman at the Citrus

support are discussed and actioned term tool in providing a sustainable

Australia office on 03 5023 6333.

by Citrus Australia’s Citrus Pest workforce for all citrus businesses.

As a very difficult season heads toward

the finishing point, I ask you to check

Thank you and welcome We are consulting with industry and in on your neighbours and friends.

advising government to ensure the visa Some people prefer to chat, others

to our new members fits businesses of all sizes, focussing prefer to sit quietly, maybe with a

on areas including accreditation, drink. Doing it together has a bigger

Auddino's Produce

sponsorship and portability, whilst impact than you may think.

Hutchison Vineyards P/L

balancing the amount of red tape.

It is important that our citrus

Witchbank Citrus businesses understand that the Ag

Visa will not likely deliver many staff

GSH International

for most next season simply because

Arkie Investments

of the range of negotiations and

regulations that need to be completed NATHAN HANCOCK

River Road Citrus Packers as part of this process. For example, Chief Executive Officer,

officials will need to negotiate bilateral Citrus Australia

4 | Australian Citrus NewsNEWS

Jackie on board to help

growers with labour options

Growers can contact new Citrus Australia team member Jackie Heaysman for help on available

options for sourcing labour, both immediate and for next season.

Jackie has joined Citrus Australia as

Seasonal Workforce Industry Support

Officer and aims to help growers

gain a better understanding of labour

options and government assistance.

“I am available to talk to growers

about any workforce challenges they

are facing and to hopefully provide

them with some ideas and point them

in the right direction to finding some

solutions,” Jackie said.

Jackie’s past roles have included

working for the Sunraysia Institute of

TAFE for 17 years and the Victorian

Government, where she managed

a range of economic development

initiatives for businesses to facilitate

growth opportunities.

“I’m excited with this opportunity

to help growers and give them some

tools to help source workers, and help

them navigate the system. Jackie said the pandemic has “It’s all about planning and that’s

clearly presented new challenges where this year they were caught a

to industry with growers finding bit by surprise.”

“I see myself as being able to listen to themselves in a completely new

people’s concerns and questions, find We encourage our growers to call

situation finding workers.

out what they need and then find a Jackie on 0456 628 560 or at Jackie.

solution or help them find a solution, “Growers are capable of adapting heaysman@citrusaustralia.com.au.

pointing them in the right way.” to these changes, but they need

the knowledge, and they need to plan,”

she said. Funding for this position was provided

by Agriculture Victoria.

Winter 2021 | 5SPECIAL REPORT

Export roadmap reveals

extra competition ahead

In March 2021, Citrus Australia finalised the Australian citrus industry export strategy (2021

– 2025) which aims to provide a roadmap for the industry to maintain and further develop its

export success over the next five years.

The strategy was funded by Hort pandemic as the sector capitalises on

Innovation using the citrus research Key points new technology and channels to reach

and development levy and funds from and deliver product to consumers.

the Australian Government.

Export strategy 2021-2025 Global expansion

In developing the strategy, Citrus

Australia consulted with its Australian Pandemic creates Aggressive expansion of Australian

and overseas network that spans the challenges citrus plantings is reported but

entire citrus value-chain. plantings in other southern hemisphere

Aggressive global citrus producing nations are also

As the citrus export trade continues expansion

to grow, so too do the risks and expanding at extraordinary rates.

challenges. For the industry to While the Australian citrus industry

maintain its growth trajectory, there is currently boasts a reputation

a large amount of work to be carried a commitment to achieving all for superior quality, colour and

out — and leadership at the national requirements in export markets. flavour, competitors are improving

level is needed. their product offerings with new

Global pandemic varieties and more advanced

Conditions of trade remain challenging

and are seldom liberalised, with cultivation practices.

The impacts of the global pandemic on

importing countries regularly raising the export trade, both short and long

their phytosanitary expectations. term should not be underestimated. South Africa, Chile, Peru and

On the other hand, Australia’s Access to reliable shipping routes, Argentina represent formidable

agrichemical toolbox for pest and freight and logistics will most threats in Australia’s major

diseases is under constant threat as certainly represent challenges for the

products are withdrawn from use foreseeable future. export markets.

and residue limits are lowered to

exceedingly low levels — levels that are This will impact on Australian citrus

difficult for exporters to achieve. exporters but also Australia’s southern Markets identified as having growth

hemisphere competitors. potential, albeit with various market

Government processes for export maintenance and market development

accreditation, inspection and Changes to the retail landscape have

also been accelerated as a result of the challenges are South Korea, Indonesia

certification are also becoming more and India.

complex and struggling to keep up

with new technology.

As the Australian Government moves

towards co-regulatory approaches to

export certification and accreditation,

industry contribution to process

improvement (including technical and

commercial advice) will very much

be needed.

Food safety remains a looming

issue with retailers, consumers

and regulators in export markets

demanding higher levels of protection

and information on the products

they receive.

While the industry is well-prepared

to meet these challenges, it must

continue to address risk, confront

new issues as they arise, and Access to reliable shipping routes, freight and logistics will most certainly represent challenges for the

maintain systems that demonstrate foreseeable future.

6 | Australian Citrus NewsSPECIAL REPORT

exploited in the past due to the strong

focus on China.

Moreover, there may be opportunities

to identify niches within existing

markets that have typically been

categorised as class-2 markets,

that may provide higher returns for

premium grade fruit.

Increased competition

Irrespective of the fractured trade

relationship with China, the citrus

India is one market identified as having growth potential.

industry was already at a stage

where it needed to explore other

Vietnam has also been identified as A number of Australian export export opportunities.

a market of good potential given the industries have already been targeted

This was obvious even prior to the

trading history and strong forecasted by the Chinese authorities in an effort

time that the dispute with China

economic growth. to influence Australian policy decisions.

became apparent. Given the large

Noting the difficulties of achieving It is unlikely that the differences amount of recent investment and the

changes to protocol and import between the two governments will be fact that the China market demands

administrative arrangements, the resolved in the short to medium term. specific size and quality parameters,

quickest gains could be expected to On that basis, it is imperative that additional volumes of Australian citrus

apply to South Korea and Indonesia the industry look to further develop will become available over the next

exports respectively. existing trade relationships in markets decade that do not necessarily meet

other than China. market requirements in China.

While opportunities in new markets This is even more so the case in

China

are limited, there are a number of the mandarin category. Critically,

opportunities that have not been fully

Continued page 8

The success of the Australian citrus

industry over the last decade has been

fueled by growing demand and strong

prices for Australian citrus in Asia. Challenges and threats to export success

The market in Greater China in

particular has grown at a remarkable A number of specific challenges and • restrictions on the production

rate, importing 116 000 tonnes at threats to maintaining the current regions eligible to export to the

its peak in 2019. This represented export success were identified in the United States

approximately 40 per cent of total strategy including: • ongoing importing country audits

Australian citrus exports in the and inspection arrangements

2019 season. • geopolitical tensions with the (e.g. pre-clearance inspection)

Chinese government • absence of accurate real-time

In response to the success in China,

the Australian citrus industry has • ongoing changes to importing shipping data to inform export

undergone structural adjustments with country conditions on the marketing decisions

strong investment in new plantings use of agrichemical inputs • inequitable quota allocations for

and other capital equipment — with including changes to maximum citrus imports into Indonesia

a specific focus on servicing the residue limits

• food safety requirements for

China market. • changes to importing exports to Indonesia

country conditions on food

While the industry can boast • high tariffs applied to Australian

safety assurance

impressive export volumes into China, citrus exports in a number of

it is also important to recognise that • increased scrutiny of Australia’s destinations including India

it is the highly profitable China export phytosanitary controls by and Sri Lanka

trade that has kept the industry afloat importing authorities, particularly

in relation to fruit flies including • transaction costs associated

for nearly the last decade. with applying in-transit cold

‘other lesser-known’ species

Without the export opportunities disinfestation

• ongoing challenges to the

in China, the industry will most • a number of quarantine pests are

integrity of South Australia’s

certainly require structural adjustment difficult to control (e.g. Fuller’s

Riverland Fruit Fly Pest Free Area

once again. rose weevil, California red scale)

and suspensions by a number of

Current tensions between the trading partners • onerous orchard and packing-

Australian and Chinese governments • restrictions on the citrus house accreditation requirements

represent a significant threat to varieties that may be exported for some export markets.

the viability of the industry and it to Japan under in-transit cold

is likely that the industry is facing disinfestation procedures

strong headwinds.

Winter 2021 | 7SPECIAL REPORT

From page 7

competition in China from other The South American countries, namely focusses primarily on oranges,

southern hemisphere citrus producing Peru and Chile both have a presence mandarins and lemons. An export

nations continues to grow. and there is strong evidence that strategy for Australian limes had already

they are both increasing production been developed under a tropical fruits

South Africa has already established

volumes and improving their project funded by Hort Innovation. On

a strong presence with plantings and

product offerings. that basis, Australian limes were not a

production volumes increasing at an

focus of this body of work.

astonishing rate. The citrus industry export strategy

Future steps required • continued investment in research

and development to underpin

inspections, audits and verification

visits conducted by the

and prosecute cases for improved overseas authorities

In response to the challenges,

market access arrangements as well

the strategy identified a range of • provide commercial and technical

as defending the current position

market development and market advice to government on citrus

maintenance activities that should • maintain technical resources within industry expectations in relation

take place for the citrus industry the sector to work with government to future free trade agreement

to maintain its current trajectory. to develop efficiencies in assurance, negotiations

Activities include: verification, inspection and

• continue to work with state and

certification of citrus exports

• monitor and respond to regulatory Commonwealth government

• continued investment in technology departments to defend the

changes to phytosanitary,

to support the export accreditation Riverland Fruit Fly Pest Free Area

food safety and agrichemical

process for growers and packers and to reinstate recognition by

residue regulations

• assist industry participants to certain countries

• maintain technical resources within

understand and fulfil regulatory • explore options to further reduce

the sector to provide technical and

requirements in relation to the costs associated with in-transit

commercial advice to government

phytosanitary, food safety, chemical cold disinfestation

to improve market access

residues and other technical

conditions and resolve trade issues • engage with other citrus producing

specifications (e.g. grading,

when they arise nations to protect agrichemical

packaging and labeling)

• maintain effective communications options for citrus and prosecute

• maintain resources within the sector cases for appropriate residue limits.

to value chain participants

to coordinate and accommodate

8 | Australian Citrus NewsSPECIAL REPORT

Australian and international expansion

The Australian citrus industry continues to expand but it is not alone, as a competitor analysis reveals the

production capacity of other southern hemisphere citrus producing nations.

The Australian citrus industry export increase from approximately 10,000 Oranges are South Africa’s strongest

strategy (2021-2025) examined the tonnes 14,000 tonnes over the next export category, exporting 1.25 million

state of the current plantings in five years. tonnes in 2020 with the predominant

Australia in the most recent citrus tree varieties being Midknight, Valencia

census and determined that there Southern hemisphere competition Late, Delta, and Turkey (Juvalle).

are currently 27,963 hectares of land

South Africa is the leading southern It is increasingly obvious that it is the

planted with citrus across Australia.

hemisphere nation producing more South African industry’s ambition is to

The average annual production volume than 3.2 million tonnes of citrus “push east” due to ongoing quarantine

is in the range of 700,000 – 750,000 annually, of which more than two- and agrichemical residue challenges

tonnes, although in some ‘on’ years thirds is destined for export. in Europe.

the total volume can be as high as

Production in Argentina and Peru While South Africa can boast

850,000 tonnes.

is also substantial (in excess of one impressive trade volumes in the orange

Based on modelling, it is predicted that million tonnes annually) although these export trade, it also has substantial

annual production of navel oranges two nations are still developing their market share in other categories.

will increase from 320,000 tonnes export capacity.

In 2020, South Africa exported a

to 375,000 tonnes over the next

Chile and Uruguay are small producers remarkable 458,000 tonnes of lemons,

five years.

but certainly warrant the attention of with the bulk of that volume exported

Similarly, over the next five years, Australian citrus exporters, in the case to Europe and the Middle East.

the production of Murcott (and of Chile at least.

Reasonable volumes were also shipped

Murcott type) mandarins is expected

to Hong Kong and Singapore. South

to increase from 48,000 tonnes to

Africa also exports significant volume

68,000 tonnes annually. South Africa embarks of soft citrus (mandarins) with 19 per

Production of Afourer (and Afourer

type) mandarins is expected to more

on ‘aggressive cent average annual growth over the

last five years.

than double from 43,000 tonnes expansion’ In 2020, South Africa exported a total

to 102,000 tonnes annually. The

of 390,000 tonnes of mandarins with

resurgence in lemon plantings over the

the main export markets being Europe,

last five years is predicted to have a

South Africa the Middle East and North America.

dramatic impact on production which

is forecast to increase from 61 000 Alarmingly for Australian exporters,

tonnes to 95,000 tonnes annually. South African exporters are active in the trade in South African mandarins

all of the same markets that Australia to China and the United States is

While only a minor crop in Australia

is active in but unlike Australia, they growing at impressive rates.

compared to other parts of the world,

grapefruit production is expected to also have a strong presence in Europe. The main mandarin varieties currently

cultivated in South Africa are the

Afourer ‘type’, Nules (a Clementine

‘type’), Nova, TangoTM and Orri.

The Nova variety is believed to be

robust and capable of withstanding

the harsh conditions of cold

disinfestation.

Grapefruit exports from South Africa

are also substantial with a total of

244,000 tonnes exported in 2020.

The main markets for South African

grapefruit are Europe, China, Japan,

Russia, North America and South

Korea. It would be very difficult to see

Australia compete against South Africa

in the grapefruit trade.

There is strong evidence that South

African citrus plantings are in a

state of aggressive expansion with

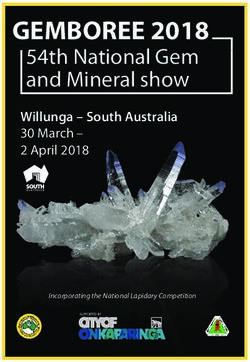

The South African citrus industry poses a formidable threat to Australia’s major export markets. Continued page 10

Winter 2021 | 9SPECIAL REPORT

From page 9 Vietnam are markets that have also

been identified for further growth.

South American

growth in both the mandarin and Lemon plantings in South Africa are

countries continue

lemon categories. also experiencing strong growth. In expansion

In 2016, South Africa was granted 2010, reports were that South Africa

rights to the TangoTM mandarin had a total of 4,667 hectares planted

variety (a seedless Afourer “type”) to lemons. In 2020, this had increased

Chile

which is expected to compete with the to 18 000 hectares.

standard Afourer variety. The most popular variety of lemons

The area planted to mandarins is planted in South Africa is the Eureka Chile has recently emerged as the

forecast to increase by 10 percent in accounting for 76 percent of the second largest exporter of citrus in

2021. Many growers are establishing area planted, followed by Lisbon the southern hemisphere, exporting

new orchards under netting which (8 percent) and the 2PH Seedless a total of 396 000 tonnes in 2020,

has improved water efficiency, yields (5 per cent). distributed among oranges (30 per

and the overall quality of soft citrus cent), mandarins (43 per cent), lemons

South Africa’s production of lemons is (27 per cent).

production in South Africa. expected to continually increase due

In addition, there is an increasing trend to the high number of new plantings in As a competitor to Australia, the

towards late varieties being planted, the past five years soon entering into Chilean citrus industry competes

which has seen the peak harvest full production. primarily in the United States where

of soft citrus shift from week 20 it has built a substantial presence and

While there will be substantial captured much of the market share

(beginning of May) to between weeks increases in lemon and mandarin

21 to 30 (mid-May to July). that once belonged to Australia.

production in South Africa, production

While the authors of this report have of grapefruit and oranges is expected Chile’s status as a fruit-fly-free

not seen the evidence, there is a wealth to only marginally increase in the next country means that it has significant

of information in the media predicting five years. advantages over other southern

that South African production volumes hemisphere exporting nations.

Reports indicate that orange plantings

will increase by 500,000 tonnes over have increased from 42,000 hectares Its technical market access

the next 3 – 5 years. in 2016 to 46,000 hectares in 2020. negotiations with trading partners

are less complicated (and can

This would represent an increase of However, the new orange plantings will often be expediated) and its fresh

15 per cent on existing production. be partially offset by growers in other produce items do not require cold

Much of that volume is likely destined regions transitioning to mandarins. disinfestation, leading to reduced

for the United States. Relatively speaking, grapefruit is only transaction costs and a superior

The Citrus Growers Association a minor crop in South Africa with a quality product.

of South Africa has openly stated reported 8,200 hectares planted in 2021

from a base of 7,200 hectares in 2016. This second point provides a

that China, India, Philippines, Japan,

substantial advantage insofar that

some citrus products (e.g. lemons)

suffer chilling injury as a result of cold

disinfestation.

The Chilean citrus industry has

undergone significant change in the

past three decades. In 1990 production

was split equally between oranges

and lemons, with almost no mandarin

plantings recorded.

In the next 30 years, orange

production changed focus from

Valencia oranges to late navels

but growth in overall hectares was

only marginal.

In that same time, Mandarin

production increased rapidly and now

accounts for more than one-third of

citrus plantings in Chile.

The area planted to citrus has

increased from 13 000 hectares in

1990 to a reported 20 606 ha in 2018

including 7 672 hectares of mandarins,

6 178 hectares of navel oranges and 6

489 hectares of lemons.

In 2020-21, the Chilean Fruit Exporters

South Africa is expected to compete strongly in the mandarin export market. Association Citrus Committee

10 | Australian Citrus NewsSPECIAL REPORT

provided an export capacity estimate As a competitor to Australia, Argentina development and looking towards

of 349 000 tonnes although this competes primarily in the United some earlier and later maturing

was a “light” year due to range of States and Canada. In Asia, the varieties. The Orri, Ortanique and

unfavourable weather conditions. two key markets where Argentina Primosole have attracted some

competes are the Philippines attention in Peru.

Mandarin export capacity was forecast

and Indonesia.

to be 173 00 tonnes, oranges are In 2016, Peru exported 129,000 tonnes

forecast to be 85 000 tonnes and the At this stage, Argentina is not and by 2020 this figure reached

lemon forecast is 90 000 tonnes. considered a large threat to the 265,000 tonnes. Mandarins make up

Australian citrus export trade in Asia the bulk of Peruvian citrus exports,

but is most certainly competitive in with exports reaching more than

Argentina North America. 215,000 tonnes (81 per cent) in 2020.

The top five markets for Peruvian

Argentina is a large citrus producing Peru mandarins include the United States

nation with a forecast production for (105,000 tonnes), the United Kingdom

2021 of more than 2.6 million tonnes. (26,000 tonnes), the Netherlands

Peru is another large citrus producing (23,000 tonnes), Canada (16,000

Volumes have been as high as 3.3 tonnes) and Russia (13,000 tonnes).

nation that has produced more than

million tonnes within the last five years.

one million tonnes annually for the last Exports to China have been

More than half of the volume produced

five years. progressively building over the last

is lemons, forecast to be 1.55 million

tonnes in 2021. Data indicate that Peru’s production five years and broke the 10,000 tonne

forecast for the 2020-21 season mark in 2018. In 2020, China imported

Oranges make up the next largest 12,500 tonnes of mandarins from Peru,

is a total of 1.26 million tonnes.

share at 675,00 tonnes and mandarins only marginally lower than the volume

Oranges make up the majority of the

make up 293,000 tonnes. of Australian mandarin exports to

production volume at 509,000 tonnes,

Grapefruit production is also mandarins account for 482,000 China that year.

substantial with a forecast of 96,000 tonnes, and lemons/limes account for In 2019, Peru gained official market

tonnes. Based on figures over the last 262,000 tonnes. access to Japan and exported 46

five years, Argentinian citrus exports While Peru records impressive tonnes of mandarins.

are typically between 10 and 12 per production volumes, its export

cent of total production. Argentina has In 2020, this figure had increased to

performance over the last decade 824 tonnes. Anecdotally, author of this

quite a strong domestic market and a has been below average, with annual

large processing sector. report (David Daniels) understands

exports only representing between that the Peruvian product has been

Lemon plantings in Argentina have 10 and 15 per cent of the total well-received and Japanese buyers are

expanded over the last few years both production volume. looking to import substantial volumes

with new entrants to the industry and The industry has however of Satsuma mandarins from Peru this

re-working existing orchards with demonstrated impressive export coming season.

higher density plantings. growth over the last five years with Peru competes with Australia primarily

However, the area planted to lemons export volumes more than doubling in North America.

is expected to remain unchanged at in that time as the Peruvian industry

approximately 50,000 hectares. has progressed an aggressive market Where once considered “noise” in

access agenda. China, Peruvian mandarins are now

Orange and mandarin plantings earning their place.

are following a similar trend with Data from 2019 indicates that there are

no significant investment in recent approximately 65,000 hectares of land The Japan market is certainly one to

years, with the industry consolidating, planted to citrus in Peru. watch. Media reports indicate that the

not expanding. Peruvian citrus grower’s association

Orange plantings made up 26,017

(ProCitrus) has strong ambitions to

Reports indicate that there are 39,000 hectares, lemons accounted for 25

open up market access in Thailand,

hectares of orange plantings and 840 hectares, mandarins accounted

Vietnam and India. Negotiations with

28,000 hectares of mandarin plantings. for 12,429 hectares, with only minor

Thailand are reported to be in the

plantings of grapefruit at 852 hectares.

Smaller producers are struggling final stages.

to compete and when they exit the When examining the FAO (Food and

business, tend to sell their orchards to Agriculture Organisation) data for the

larger operators that are focused on previous five years, it appears that

improving land management practices plantings of oranges and mandarins This special report was written by

and increasing productivity. have seen a slight decline while lemon Citrus Australia General Manager,

and grapefruit plantings of have Market Development, David Daniels,

In 2020, Argentina exported 374,000 remained stable. Media reports indicate who developed the Australian citrus

tonnes to nearly 50 different export that overall production this season industry export strategy (2021 - 2025).

destinations. The five top markets in (2020-21) will increase by 5 per cent.

descending order were Russia, Spain,

the Netherlands, Paraguay and the The main mandarin varieties CITRUS

United States. cultivated are the Satsuma, Afourer

type, Clementine and the tangelo.

FUND

The industry is investing in variety

Winter 2021 | 11BREAKING NEWS

*** BREAKING NEWS ***

Further citrus

exports to the US

within reach

Citrus growers from Queensland, inland New South Wales

and Western Australia are a step closer to exporting

Australian citrus to the USA.

The United States Department “Our technical market access request

of Agriculture’s Animal and Plant with APHIS has had a long history, well

Health Inspection Service (APHIS) over a decade, and there has been a

has announced it will revise the lot of work going on behind the scenes

requirements for the importation of to make this happen,” Nathan said.

fresh citrus from Australia.

“This has been an issue for Australia for

The announcement was made two decades, and Citrus Australia has

following successful negotiations been working on it for the last 12 years.

from the Australian Government In the last few years we’ve used every

Department of Agriculture, Water and resource available to us to achieve

the Environment. our goal.

Until now, citrus could only be “I would like to commend Citrus

exported to the US from NSW’s Australia General Manager, Market

Riverina, SA’s Riverland and the Development, David Daniels, as well

Sunraysia region of Victoria/NSW. as the technical officers and trade

negotiators from the Department of

Citrus Australia CEO Nathan Hancock

Agriculture, Water and the Environment

said the decision was welcome news

who have worked tirelessly through the

for citrus growers.

negotiations for more than a decade.”

“Growers are looking to diversify

their export markets as new

plantings enter full production so

this is welcome news,” Nathan said.

“The USA has historically been a very

strong market for exports from our

south east regions and we feel that

there are some good opportunities for

fruit from other regions.”

Nathan cautioned that while

the decision was announced on

the Federal Register on August

18, commencement of trade is

contingent upon agreement between

governments on an operational

work plan.

At this time, the work plan is still a Citrus Australia CEO Nathan Hancock said the

live conversation. decision was welcome news for citrus growers.

12 | Australian Citrus NewsMANAGEMENT

The effect of seasonal

conditions on granulation in

Imperial mandarins

Seasonal conditions play an important role in the granulation of Imperial mandarins, according to

Queensland Department of Agriculture and Fisheries Senior Horticulturist, Helen Hofman.

Current research began in the 2017/18 Helen is testing the hypothesis that

season, and in that year and the Key points too much moisture availability in the

following year there were high levels early stages of fruit development

of granulation. tends to lead to granulation in

Over availability of water Imperial mandarins.

This season, however, Helen found at early fruit development

there was ‘very little granulation’ in her “It may seem counterintuitive: the

trials thanks in part to a dry start to Low levels of plant fruit is dry so growers may believe the

the growing season. nutrition trees need more water, but our trials to

date are suggesting that actually too

“‘In the months September to Vigorous rootstocks much water in the early stages of fruit

November in Bundaberg, for example, contribute development leads to granulated fruit.”

there was 42 mm of rain this year,

compared to 656 mm in 2017/18 and The underlying hypothesis is that

203 mm in 2018/19,” Helen said. granulation is linked to high water

reflecting a strong flowering, limited

potential in juice cells in early

“Which is a good thing for the growers flush in Spring, a heavy crop load

fruit development.

but it’s a bit annoying when you’re on trees and dry conditions in early

a researcher.” fruit development. She has identified two main factors

that appear to cause granulation:

Helen has several trials in Queensland

one, over-availability of water in the

focusing on three farming management “Where you’ve got a good flowering early stages of fruit development,

practices that may help to reduce and a heavy initial fruit set, plus dry and two, low levels of solutes in the

granulation: irrigation, fertilisation and

conditions in Spring, you tend to juice cells. These are directly affected,

flush manipulation through the use of

respectively, by over-irrigation and low

plant growth regulators. get less granulation and that seems levels of plant nutrition, particularly

Trials recorded the lowest granulation to be what’s happened this year,” low levels of nitrogen applications.

of all four years of study to date,

Helen said. Continued page 15

www.nu-edge.com.au

STEFAN BEKKER 0429 924 190 ∙ MORNE LAKER 0457 856 760 ∙ CRAIG DAVISON 0447 684 886

Winter 2021 | 13Keep citrus pests pinned down. Stop the suckers wherever they’re hiding in your citrus crop, with the two-way systemic action of Movento : • Protects the whole tree, including inner leaves • The only registered Group 23 insecticide • Low impact to most beneficial species, when used as directed With long-lasting protection, Movento can be effectively used as part of your integrated pest management program. To learn more and download the citrus crop guide, visit crop.bayer.com.au/movento or talk to your local Bayer Crop Science representative. 14 | Australian Citrus News

MANAGEMENT

From page 13

“I am also looking at the effect of flush

because the vegetative growth seems

in some cases to compete with fruit

quality,” Helen said.

Other types of citrus can granulate

but Imperial mandarins tend to be

particularly prone to granulation

because they are an early variety,

Helen said.

“You’ve got a lot of very rapid fruit

development early in the season which

seems to exacerbate the problem

where the flush and fruit growth are

competing, whereas the fruit of other

citrus varieties will take several more

months to mature so they’re growing

more slowly, and they’ve got time to

Helen Hoffman conducting granulation research in the field.

develop properly.

“Another aspect is that growers

tend to grow Imperials on vigorous Seven Fields Citrus (Nutrano) and government) and contributions from

rootstocks to get fruit to market as the Mundubbera Fruit Growers the Australian Government.

early as possible and that exacerbates Association Inc.

the problem as well,” Helen said. Since March 2020, funding has

Helen’s research was initially funded been provided by Hort Innovation, CITRUS

by the Department of Agriculture and

Fisheries (Queensland government)

using the Hort Innovation citrus

research and development levy, co-

FUND

with contributions in cash and in- investment from the Department of

kind from Spencer Ranch Pty Ltd, Agriculture and Fisheries (Queensland

Quality “Seedless” Mandarin

HORTICULTURE

FRESH

AUSTRALIA

“working with

Australian Growers”

Winter 2021 | 15MANAGEMENT

The changing face of solar

Like so many high-demand industries, solar has continued to change and adapt at a record pace. As a

result, what you may have considered only five years ago may be a relic to what options you have today.

A wider market opening options Tech advancements maximise incentives, thanks to advancements in

output and lower costs technology and manufacturing.

As a market grows, so do your options.

As a result of commercial solar Thanks to advancements in As a result, businesses across Australia

energy’s growing popularity, we have technology, modern solar panels are are turning to solar as a more feasible

seen more manufacturers offering a now not only more cost effective than investment that can prove to be cash

range of budget to premium options. they were five years ago, but they are flow positive from day one.

also functioning more effectively.

But like all machinery and appliances,

Government support is at hand

you truly do get what you pay for. Once, a panel in a semi-shaded spot

While cheaper components are would compromise the output of Recent circumstances have made solar

available, and might knock a few the entire system - such as if your even more affordable thanks to two

hundred dollars off your panels and roof space is closer to another taller key government inputs.

system, the past five years has proven building, or a nearby grove of trees.

to us where the real quality lies. At present, the Australian government’s

Now, a range of Panel Level Optimisers Renewable Energy Target (RET) offers

Your commercial solar system is (PLO) effectively reduces this block. two types of Technology Certificates,

designed to last 20 - 25 years, making which act as a rebate on a solar system,

Modern Solar Panel Optimisation

it a long game investment when it offering an immediate discount.

means your new system can work

comes to saving significant money on

harder and more effectively, pushing With this is the Instant Asset Tax Write

your orchard’s energy bills.

up that output and potentially cutting Off (IATWO) scheme, an opportunity

A few hundred saved initially might not your costs even further. that furthers the affordability of solar

stack up if it means years of missed not seen five years before.

Alongside this comes a reduction in

savings due to a broken or poorly

the price of solar panels, especially This tax write-off revision opens

designed system.

when coupled with the government up numerous options for citrus

businesses, not just investment in a

renewable energy solution.

The main advantage of optimisers Advantages for citrus businesses

• Packing sheds run during the day,

which is when solar is at its prime,

maximising the sunshine to offset

daytime energy costs.

• With high temperatures through

summer, cool rooms consume

high amounts of energy. Research

50% 50% 50% 50% suggests solar panels can provide

2-4 degrees of insulation in warmer

climates.

Without an optimiser, a partially shaded panel • Energy distribution costs (the costs

brings down the output of all other panels for the energy to reach the site)

in rural areas are extremely high.

Leveraging your roof as a local

power station can eliminate high

distribution costs.

50% 100% 100% 100% This article supplied by Choice

Energy

Optimisers reduce this issue and allow

panels to act independently

For illustrations purpose only

16 | Australian Citrus NewsWinter 2021 | 17

MANAGEMENT

The days of being an

island are over

Carl Robinson is a fourth-generation citrus grower in Gayndah, Queensland, working with the

family business since he left school.

His role as Operations Manager Packing Shed

oversees the orchard production Key points The current packing shed has been

from growing, pruning, packing and

in operation since 2010. The new

marketing the fruit grown on the

property. Developed Empress shed predominately exports to

variety international markets and domestically

Glenellen, located in the North to independent retailers.

Burnett Region of Queensland, has New shed built in 2010

The Robinsons have always packed

approximately 120 hectares of citrus.

their own fruit on the property. The

The orchard, approaching its centenary

original packing shed still stands as a

year, currently grows Eureka lemons,

“Soil and leaf tests are another helpful reminder of days past.

Imperial mandarins, Low Seeded

Murcotts, Honey Murcotts and their tool we use to monitor and implement Carl’s mother, Allison, managed the

own variety, the Empress-A mandarin. the nutritional needs of the orchard,” packing shed for over 50 years. Local

Carl said. folklore considered it to be one of the

When Citrus Australia visited his farm

“The nutrition of the trees is forever oldest working citrus packing sheds

earlier this year, Carl said “the days

changing due to climatic conditions in Australia.

of being an island” were coming to a

close, as it becomes more challenging and weather patterns. Trace elements, Carl said when it came to the

to grow and market citrus. foliar and dry fertilisers, together with management of a large working

compost help produce a healthy tree packing shed, communication

“We have begun to work together with and top-quality fruit. and building relationships are two

our neighbouring farms and help each

“This approach has proven to be important elements.

other, instead of competing against

each other in the same marketplace,” successful over many years, however “The main benefit to growing and

Carl said. you always have to be willing to work packing your own fruit, is knowing

with and adapt with mother nature.” your product and being able to build

Carl’s father, the late Frank Robinson,

good relationships with marketers.”

spent 20 years developing the

Empress - a mandarin variety - and

Carl said it has been extremely popular

on the export market.

“Dad was quite passionate about

the citrus industry and was very well

respected,” Carl said.

Frank Robinson became known as one

of the first growers to successfully plant

mandarin trees on granite country.

“The hilly country on the property

provided a new area for development,”

Carl said.

“At the time, the citrus trees were

predominately grown on the river flats

of the Burnett River. In the early years,

dynamite was used to break up the

rock shelves. This was a new concept

and proved to be successful.

“To this day, granite promotes good

tree growth on the property.”

Tree health is paramount and Glenellen

uses agronomic nutritional advice from

local consultants.

Steve Bryant, Carl Robinson and Shane Rothe on Glenellen in Queensland.

18 | Australian Citrus NewsLoyalty has been a large part of the

marketing program and relationships

have been built with both domestic

and export buyers over decades.

“Transparency in production and sales

of our fruit is important to us. It gives

pleasure as a grower to know your fruit

is well received in the marketplace by

the consumer.”

Carl said he had noticed a shift in the

consumer trends in the marketplace.

“There are now fewer independent

retailers who we sell to with a

greater supply of fruit going to the

supermarket chains. The consumers

are shopping in one place for all their

needs and essentials, and this includes

where they purchase their fruit.

“We embrace the many challenges

ahead of us and look forward to

providing top quality mandarins to

Australia and the rest of the world for

many years to come.”

Picking at Glenellen earlier this year.

Winter 2021 | 19Fruit protection starts with Exirel

®

Exirel® controls pests like Kelly’s citrus thrips and Light brown apple moth that hit your citrus early and can damage fruit

early and your bottom line. Once these pests come into contact with Exirel® treated crops, they will rapidly stop feeding

providing almost immediate crop protection.

Exirel® is designed for effective crop protection early to help achieve high quality fruit at harvest.

Visit www.fmccrop.com.au for more information.

ALWAYS READ AND FOLLOW LABEL DIRECTIONS. Copyright © 2019. All rights reserved. Exirel® is a registered trademark of FMC Corporation or its affiliates.

FMC Australasia Pty Ltd

Phone: 1800 066 355

20 | Australian Citrus News www.fmccrop.com.auSave time and money with Exirel

®

If you’re exporting citrus to Korea, China or Thailand, you’ll know Exirel® as the product of choice for citrus growers.

A foliar option for Fullers rose weevil, Exirel® improves your process of meeting export market protocols while

maintaining a healthy orchard.

Visit www.fmccrop.com.au for more information.

ALWAYS READ AND FOLLOW LABEL DIRECTIONS. Copyright © 2019. All rights reserved. Exirel® is a registered trademark of FMC Corporation or its affiliates.

FMC Australasia Pty Ltd

Phone: 1800 066 355

www.fmccrop.com.au Winter 2021 | 21BIOSECURITY

Biosecurity a passion for

new team member Jess

Dr Jess Lye takes over the reins of Jeff Milne’s position at Citrus Australia as National Citrus

Surveillance Coordinator, launching a new 5-year-long biosecurity program as part of her role.

Jess will be taking over coordination

of the citrus surveillance network,

setting up traps for early detections of

pests such as Asian Citrus Psyllid and

other high priority exotic pests.

There are a number of objectives to

Jess’s role, one is to continue trapping

and diagnostics in the production

areas nationally.

“Another big part of the role is to start

building that surveillance capability

in urban areas, engaging with home

gardeners to try to increase our

surveillance in places like Melbourne,

Sydney and Adelaide, because

statistically large populations are high

risk,” Jess said.

This new biosecurity program is run in

partnership with the NT Department

of Industry, Tourism and Trade, and is

led by Plant Health Australia.

As a part of the program Jess will

also be looking at where the industry

requires training and education on

exotic pests. Pest identification is

a focus but improving knowledge

of how to manage these pests is

another aspect.

“We’ll support growers and other

industry members to become more extension activities, and before that “Which makes this biosecurity

aware of how to effectively manage at AusVeg leading biosecurity and program a really great fit,” she said.

these pests so that if we do have an pest management projects for the

incursion, and if eradication isn’t an Jess likes to get outside as much

vegetable and potato industries.

option, which would be unfortunate, as possible either with her horses,

we can move into management as “When I started my degree, I actually hiking or maintaining her garden.

seamlessly as possible,” Jess said. started as a geology major and then Her favourite citrus hands down is

I decided to throw myself into the a lemon, which she enjoys most in

When it comes to biosecurity, Jess biology side of things,” she said. lemon tarts and her next grab would

said the most important thing you can be a gin and tonic with a bit of lime.

do is be prepared. Jess worked in several science

communication roles after completing Jess will be delivering new findings

“Preparing industry and growers for her studies, when she felt that and organising training on digital

the worst-case scenario is crucial, researchers were doing a lot of great platforms for growers and industry

so if we have an incursion of a pest work but weren’t getting information in the upcoming years. Keep an eye

we have the tools and knowledge to about that work to the people who out for future stories on projects

survey the spread, how to contain and needed to be hear about it. by Jess.

eradicate it, or if it can’t be eradicated,

understanding how businesses can “I saw myself working more in a

move forward if that pest is in your field where I could be involved in CITRUS

region,” Jess said. the science but as someone who

was helping build relationships

FUND

Before coming to Citrus Australia Jess between the users of science and the

worked at entomology research group scientists themselves.

Cesar Australia leading agricultural

22 | Australian Citrus NewsWinter 2021 | 23

BIOSECURITY

Identifying challenges of

urban plant biosecurity

Citrus greening, Asian citrus psyllid, citrus canker, Citrus variegated chlorosis, Xylella fastidiosa,

Glassy winged sharpshooter… You have likely heard about these exotic diseases and the vectors of the

pathogens that cause them.

The Australian citrus industry has been good indicator of the ease with which a

active in surveillance, preparedness Key points biosecurity response could be enacted.

and, where needed, response to these

exotic threats. A changing urban context

Urban areas a may support a movement

Based on the overseas experience, biosecurity risk

urban landscapes can act as refugia towards improving urban plant

for these pests, masking their presence Surge in urban agriculture health (and biosecurity)

until populations increase in density In looking at major cities in Australia

and providing a diversity of hosts Focus on engaging

(particularly Sydney and Melbourne)

to support populations throughout urban residents we can predict some significant

the year. challenges on the plant health front.

For example, after initially being Using Melbourne as an example,

detected in 2008, the current boundary lines, a greater number of

the population is forecast to grow

distribution of Asian citrus psyllid in land managers per set area, a greater

significantly over the next three

California is still largely confined to variety of skills, knowledge, attitudes

decades, but the Melbourne food bowl

urban-residential areas in that state. and values, diversity of culture and

will drop in production capacity by

language, and importantly (at a

Spatial modelling by Bayles et al. more than 20%.

broad scale) there is less social capital

(2017) has indicated that spread of the and cohesion. This will largely be due to climate

psyllid into California has in part been change, changes in lifestyle

driven by human-assisted dispersal, Social capital is characterised by

expectations (‘tree-changers’) and

with psyllid hotspots being identified the strength of informal networks,

further predicted expansion of the

in urban areas. opportunities to improve skills

city’s Urban Growth Boundary.

and knowledge, and regularity of

The risk posed by high density urban organisational collaborations. As a result, supply chains will become

areas as an entry and establishment longer as more city businesses source

zone for exotic pests has long The strength of social capital is directly

fresh produce. In addition, future

been recognised. related to the resilience of a community

reductions in urban forest canopy

and its ability to recover after upheavals

Exotic plant pest transmission cover will lead to more temperature

such as a climate event, an epidemic,

pathways are often closely associated extremes at the level of the

or a pest incursion. Therefore, it is a

with the movement of people or Continued page 26

products, with major Ports of Entry,

in turn, being associated with high

density residential urban areas and

arterials, which can lead directly to

production zones.

It is becoming increasingly evident

that a greater surveillance focus

should be placed on these landscapes.

However, plant biosecurity activities

in urban environments throw up

a variety of challenges that can

complicate awareness, surveillance and

response efforts.

Why do urban areas represent

a challenging environment for

plant biosecurity engagement,

surveillance and response?

In comparison to rural areas, land is

extremely fragmented, there are more

24 | Australian Citrus NewsBIOSECURITY

Citrus growers,

don’t gamble

with frosts.

Extreme temperature ranges are here to stay.

That means managing frost risk to avoid

devastating losses.

Calculate the R.O.I. by installing a quiet,

reliable and efficient FROSTBOSS C49.

bossthefrost.com.au

Ian Mason

M +64 448 111 384

P 1800 797 629

E info@aussiefrostfans.com.au

aussiefrostfans.com.au

FRF 1035

Winter 2021 | 25You can also read