International Wind Power Developer - Company Presentation - NBT

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Important information

This presentation (the “Presentation”) has been prepared by NBT AS (“NBT AS” or the “Company” and together with its subsidiaries the "NBT Group“ or “NBT”). The Presentation has been

prepared and is delivered for information purposes only. It has not been reviewed or registered with, or approved by, any public authority, stock exchange or regulated market place.

The contents of the Presentation are not to be construed as financial, legal, business, investment, tax or other professional advice. Each recipient should consult with its own

professional advisors for any such matter and advice.

The Company makes no representation or warranty (whether express or implied) as to the correctness or completeness of the information contained herein, and neither the Company nor

any of its subsidiaries, directors, employees or advisors assume any liability connected to the Presentation and/or the statements set out herein. This Presentation is not and does not

purport to be complete in any way. By receiving this Presentation you acknowledge that you will be solely responsible for your own assessment of the Company, its financial position and

prospects and that you will conduct your own analysis and be solely responsible for forming your own view of any refinancing and the potential future performance of the Company’s

business.

The information included in this Presentation may contain certain forward-looking statements relating to the business, financial performance and results of the NBT Group and/or the

industry in which it operates. Forward-looking statements concern future circumstances and results and other statements that are not historical facts, sometimes identified by the words

“believes”, “expects”, “predicts”, “intends”, “projects”, “plans”, “estimates”, “aims”, “foresees”, “anticipates”, “targets”, and similar expressions. The forward-looking statements contained in

this Presentation, including assumptions, opinions and views of the Company or cited from third party sources are solely views and forecasts which are subject to risks, uncertainties and

other factors that may cause actual events to differ materially from any anticipated development. None of the Company or any other company in the NBT Group, or any of its advisors or any

of their parent or subsidiary undertakings or any such person’s affiliates, officers or employees provides any assurance that the assumptions underlying such forward-looking statements are

free from errors nor does any of them accept any responsibility for the future accuracy of the opinions expressed in this Presentation or the actual occurrence of the forecasted

developments. The Company and its advisors assume no obligation to update any forward-looking statements or to conform these forward-looking statements to the NBT Group's actual

results. Investors are advised, however, to inform themselves about any further public disclosures made by the Company.

This Presentation does not constitute any solicitation for any offer to purchase or subscribe any securities and is not an offer or invitation to sell or issue securities for sale in any jurisdiction,

including the United States. Distribution of the Presentation in or into any jurisdiction where such distribution may be unlawful, is prohibited. The Company and its advisors require persons

in possession of this Presentation to inform themselves about, and to observe, any such restrictions.

This Presentation speaks as of the date set out on the front page, and there may have been changes in matters which affect the NBT Group subsequent to the date of this Presentation.

Neither the issue nor delivery of this Presentation shall under any circumstance create any implication that the information contained herein is correct as of any time subsequent to the date

hereof or that the affairs of the NBT Group have not since changed, and the Company does not intend, and does not assume any obligation, to update or correct any information included in

this Presentation.

This Presentation is subject to Norwegian law, and any dispute arising in respect of this Presentation is subject to the exclusive jurisdiction of Norwegian courts with Oslo City Court as

exclusive venue.

By receiving this Presentation, you accept to be bound by the terms above.

2Investment highlights

Number of value triggers positioning company for future monetization

ATTRACTIVE • 150MW producing ~357 GWh/year in China

PORTFOLIO OF

• Syvash 245.7MW under construction expected on line in Q3/Q4 2020

>1,000MW OF

WIND FARMS • Zophia I-III 792.5MW under development, COD expected in phases in Q1/Q3/Q4 2022

UKRAINE IS A • Following turmoil in 2014-2016, Ukraine has de-risked significantly, evidenced by sovereign yields approaching 5%

BOOMING

RENEWABLES • An energy sector heavily dependent on nuclear and coal: strategic goal for government is to shift electricity production into

renewables and reduce dependence on Russian fossil fuels

MARKET

PROVEN • NBT developed Syvash in less than 9 months from project acquisition to initial financial close

• Total Eren is 53.5% equity partner; €262m senior debt by EBRD, FMO, Proparco, IFU, Green for Growth Fund,

DEVELOPMENT

Finnfund, NEFCO and Black Sea Trade and Development Bank

CAPABILITIES &

BLUECHIP • 150MW developed in China, with AEI Energy and Datang Renewables as partners

PARTNERS • Achieved first project financing for a wind farm in China, provided by HSBC and Bank of Communications

• Syvash: 245.7MW, ~€80m+ EBITDA/yr, tariffs locked in at €92/€102 per MW until year-end 2029, fixed WMSA for 15+5 years

ATTRACTIVE &

• Zophia I-III: ~792.5MW, tariffs expected at €84 per MW until year-end 2029

PREDICTABLE • Senior financing covering 50% of capex expected from ICBC, China Exim Bank, China Construction Bank

ECONOMICS • Currently awaiting key clarifications from regulatory authorities in Ukraine and working with financial advisors to secure

remaining financing. Discussions with both strategic and financial investors proceeding constructively albeit somewhat

delayed due to Covid-19 situation

3This is NBT

Introduction UKRAINE - CORE

Independent wind power developer with attractive and advanced portfolio under

development with strong cash flow potential

Established in 2004, incorporated in Norway

150MW built to date, 245.7MW under construction and 792.5MW in advanced

development

246MW under construction

793MW under development

Attractive tariffs and high margins

Bluechip partners and financing providers (Total Eren, EBRD, PowerChina & State Grid

Corporation of China)

OTHER ASSETS

Attractive Ukrainian green tariffs of €84/€90/€102 per MW, capacity factors from 41-44%

and long-term, fixed costs WMSAs bring EBITDA margins above 90%

150MW producing ~357

GWh/year

Foundation for NBT’s development

capabilities

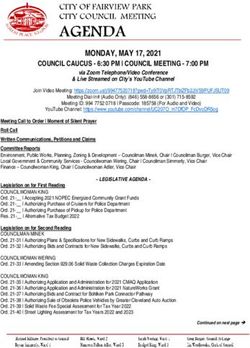

4Well defined milestones to a future IPO

IPO targeted in 2021/2022 when current development pipeline is de-risked

€m

300 2020e 2021e 2022e 2023e

Key events:

• Zophia I COD Q1

Project

250 EBITDA1)

• Zophia II/IIICOD Q3/Q4

Key events:

• New development projects being

firmed up

• First full year of production from

200 Key events: Syvash

• Initial Syvash WTGs on line • Good visibility on construction

• Closing of equity financing of progress from Zophia

Zophia projects

150 • Expected refinancing of secured • New development projects being

bond firmed up

• Syvash COD

• Closing of senior financing of

Zophia projects

100 • Commencement of construction of Dividend capacity

Zophia

• Expected refinancing of convertible

bond and Zophia development

bond

50

0

2020 2021 2022 2023

Note 1) Project EBITDA contribution, 100% for Zophia and 46.5% from Syvash

5Strong core team

JOAR VIKEN

CEO

ERLING THIIS THORSTEIN JENSSEN EUGENE GELLER MARTIN ROSELL KYRRE LUND VLAD KAZAK

CFO SVP DEVELOPMENT & PROJECT INVESTMENT DIRECTOR GENERAL COUNSEL SVP BUSINESS DEV CEO Zophia

FINANCE

WALTER CHANG LARS JOHNSEN BØRGE TVORG EYAL BARAZANI MAGNUS JOHANSEN LUO BIN

CEO ASIA OPERATIONS PROJECT FINANCE DIRECTOR VP PROJECT FINANCE SENIOR BUSINESS VP BUSINESS DEVELOPMENT PRESIDENT CHINA

DEVELOPMENT OPERATIONS

KEY CAPABILITIES PROJECT SOURCING FINANCE ENGINEERING

UKRAINE PROJECT

KNOWLEDGE DEVELOPMENT CONSTRUCTION OPERATIONS

6Proven development capabilities

Due Diligence SPA Signed ESIA Syndication Finance Documents

Start: May 2017 February 2018 Start: April 2018 Start: August 2018 Start: October 2018

3 Months 3 Months + 3 months

4 Months

5 Months

3 Months

SPA negotiations SPA Closing EBRD on board Financial Close

Start: September 2017 April 2018 July 2018 January 2019 and April 2019

7Overview of key assets

Key milestones Project details

Q4 2019 … Q2 2020 Q3 2020 … Q1 2021 Q2 2020 Q3 2020 … 2029 PARTNERS ECONOMIC PARAMETERS

• Co-investor: • Tariff: €102/92/MWh

245.7 MW

Feed-in tariff ends • Lead lender: • P50 load factor: ~41%

expected on line

SYVASH Construction Production of electricity • Total investment: € 382m

246MW • EPC:

46.5% INTEREST 133MW • Annual revenues: € 83m

expected on line • Turbines:

• Target EBITDA%: ~90%1)

• Lead lenders: • Tariff: 84€/MWh

Feed-in tariff ends • P50 load factor: 40.3%

ZOPHIA I-III • EPC: • Total investment: ~€ 1.2bn

792.5 MW Permits Financing Construction Prod.

793 MW online by • Annual revenues: € 231m

100% INTEREST Permits in place Financial close Q1/Q3/Q4 2022 • Turbines:

completed for all • Target EBITDA%: ~90%2)

phases

• Co-investors: • Tariff: RMB 0.54-0.61/kWh

OTHER: • Annual prod: ~300 GWh

Gantt LLC

LINXI & • Lenders:

In operation since 2010 • Total investment: RMB 1.48bn

BAICHENG

150 MW • Turbines: • Annual revenue: RMB 161m

33-49% INTEREST

• Annual EBITDA generation: ~81%

Note: 1) Estimated EBITDA margin in P50 wind case 2) Target of similar economics as the Syvash project

8Syvash 245.7MW expected on line Q2/Q3 2020

Key project details Location

CAPACITY • 245.7MW

LOCATION • Northern shore of Lake Syvash, Kherson Region

• 13+ months wind data from 80m tower onsite has been collected so far,

WIND DATA two new 120m towers and Lidar continually collecting additional wind data

with another 9 months so far

WIND SPEED • 7.9m/s at 120m (estimated)

TARIFF • € 0.102 / € 0.0918/kWh for wind turbines erected in 2019 / 2020 Syvash

CAPACITY FACTOR • Approximately 41.7%

PERMITS • All secured

• Secured, 35kV to 330kV substation under construction with 2 x 330kV

GRID CONNECTION 20 km

transmission lines nearby

CO2 ELIMINATION • 635,000 tons

• Flat terrain, degraded farm land

Key partners

SITE CONDITION

• Spans 1,320 hectares, 49-years land lease

Senior lenders Equity partner

• Turn key EPC contract of €288.3m with PowerChina

EPC

• Wind turbines (3.9MW) and 15+5 years WMSA from Nordex

• 15+5 year WMSA

OPEX • Coverage for €200m, 3 years, non-callable war and terrorism insurance

• In total around €6m per year, inflated

• €262m senior debt lead by EBRD + other DFIs

• €79m co-investment (preferred equity) from Total Eren convertible into EPC contractor Turbine manufacturer

FINANCING

53.5% of equity

• €34m contributed from NBT AS

CONSTRUCTION

• Under construction with first wind turbine erected in November 2019

STATUS

COD • Phased COD in Q3 / Q4 2020

9Syvash project finance structure

NBT AS

Ownership organized through Swedish holding

100% companies

– Tax effective ownership, tax-free dividends can be

brought to NBT

EAST RENEWABLE AB

Total Eren has co-invested EUR 79m in a

Swedish holding company

€35m 46.5%

53.5%1)

EAST RENEWABLE The senior lenders, led by EBRD, sit in the

EUR 79m

UKRAINE AB Ukraine entity

100%

EAST RENEWABLE

ENERGY AB

100%

SYVASHENERGOPROM EUR 263m senior debt

LLC EBRD & 7 other banks

Note: 1) Structured as preference share, convertible into 53.5% ordinary shares in 2022. Post second completion each ordinary and preferred share will carry one vote in the company

10Zophia 792.5MW developed in multi-stage approach

Key project details Location

CAPACITY • 792.5MW (Zophia I, II & III)

LOCATION • Yakymovskij District of Zaporizhia Region

• 25+ months of wind data from a 120m met tower onsite has been collected

WIND DATA so far, with additional 4 new 120m met towers collecting data since early

2020

Zophia I - III

WIND SPEED • 8.01m/s at 120m

TARIFF • Expected to EUR 0.0836/kWh

CAPACITY FACTOR • Approximately 42%

BUILDING PERMIT • Secured for 792.5 MW

GRID CONNECTION • Secured 20 km

CO2 ELIMINATION • 2,050,000 tons

• Located about 15km southwest of the major city of Melitopol

SITE CONDITION

• Stretches for 42km from north to south and 23km from east to west Key partners

• Relatively flat; the elevations of the expected wind turbine area range from

approximately 5m to 30m above sea level Senior lenders

• EPC contracts for 750MW signed with CET, the EPC subsidiary of State

Grid Corporation of China

EPC • Covers all turbine supply, civil works, electrical works, substations, required

grid connections to the interconnection points, new overhead line and grid

capacity upgrades

EPC contractor Turbine manufacturer

• Zophia I: €40m being secured from Ukrgasbank

• Zophia II-III: €500m expected from ICBC, China Exim Bank, China

FINANCING Construction Bank

• Additional €330m to be secured through additional syndicate banks

• Financial close expected Q3 2020 for Zophia II and III

• Zophia I – Q1 2022 / Phased COD Zophia II – Q3/Q4 2022 / Phased COD

COD

Zophia III – Q3/Q4 2022

11Zophia investment structure

NBT AS

100% Each Swedish holdco will be

owned by another layer of

EAST RENEWABLE Swedish companies

TOPCO AB

This will be the joint venture

100% companies where co-investors

enter

EAST RENEWABLE

ZOPHIA SUPER HOLDCO This layer will be owned by a

AB common holding company which

100% 100% 100% will be owned indirectly by NBT

EAST RENEWABLE EAST RENEWABLE EAST RENEWABLE

ZOPHIA INVESTMENTS I ZOPHIA INVESTMENTS II ZOPHIA INVESTMENTS III

AB AB AB

100% 100% 100%

EAST RENEWABLE EAST RENEWABLE EAST RENEWABLE

ZOPHIA I AB ZOPHIA II AB ZOPHIA III AB

100% 100% 100%

AZOVINVESTPROM LLC AZOVPROMENERGO LLC ZOPHIA III LLC

42.5MW 300MW 450MW

UKRGASBANK

Senior

(Project loan with share CHINESE AND INTERNATIONAL BANKS

funding

security post COD)

12Other assets

China Other opportunities

Assets located in Inner Mongolia and Jilin, China

Developed when NBT was first started

Instrumental for the organizational development and

becoming an experienced emerging market developer

Linxi

Size: 100 MW

Interest: 49%

Partner: Datang Renewables

Annual Revenues*: ~RMB 101m (€13m)

Annual EBITDA*: ~RMB 79m (€10m)

Baicheng

Global Cooperation Agreement with CET / State Grid

Size: 50 MW Corporation of China to develop new renewable projects

Interest: 33%

Currently evaluating selected projects in Serbia, Greece,

Partner: initially AEI Energy, now Gantt

LLC

Georgia, Uzbekistan and Montenegro

Annual Revenues*: ~RMB 51m (€7m)

Annual EBITDA*: ~RMB 20m (€3m)

* Annual Revenues and EBITDA are based on 100% ownership basis.

13A highly advanced pipeline – not including additional potential

opportunities with COD beyond 2025

Unrisked portfolio of c. 3 GW wind capacity Net quarterly annualized electricity generation

Gross Net Risked

Country Project Status1) MW Share MW Risk MW LF% Unrisked

China Baicheng In operation 49 33% 16 100% 16 25% Net GWh 11 642 11 642

Linxi I In operation 50 49% 25 100% 25 30% 10 968 11 975

12 000 10 130 Country 5

Linxi II In operation 50 49% 25 100% 25 30% 9 663

Firm

10 000 8 799 Country 4

Ukraine Syvash Construction 246 47% 114 100% 114 41% 7 791

Country 3

Zophia I Fully permitted 43 100% 43 100% 43 41% 7 791

8 000

Country 2

Zophia II Fully permitted 300 100% 300 100% 300 41% 5 943

6 000 5 604

Zophia III Fully permitted 450 100% 450 100% 450 41%

4 255

Country 1 Project 1 In DD 168 100% 168 75% 126 37% Country 1

4 000 3 421

Project 2 In DD 93 100% 93 75% 70 37%

1 805 Ukraine

2 000 575 575

Project 3 In DD 140 100% 140 75% 105 37% 164

575 575 575 575 727 China

164 164

Project 4 In DD 120 100% 120 75% 90 37% 0

In DD 75 100% 75 75% 56 36% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Country 2 Project 5

2020 2021 2022 2023 2024 2025

Project 6 In DD 100 100% 100 75% 75 36%

Project 7 In DD 23 100% 23 75% 17 36% Risked

Net GWh

Project 8 In DD 85 100% 85 75% 64 36%

8 045 8 233

9 000

Pipeline

Project 9 In DD 18 100% 18 75% 14 36% 7 195 8 045 Country 5

8 000 6 932 7 667

Project 10 In DD 7 100% 7 75% 5 36% 6 446 Country 4

7 000 Assumption that 5 879

Project 11 Opportunity 591 60% 355 75% 266 36% Country 3

75% of new 5 879

Project 12 Opportunity 240 60% 144 75% 108 36% 6 000 4 840

pipeline projects Country 2

5 000 4 649

Project 13 Opportunity 185 60% 111 75% 83 36% are realisable 3 890

Project 14 Opportunity 267 60% 160 75% 120 36% 4 000 3 421 Country 1

Project 15 Opportunity 132 60% 79 75% 59 36% 3 000

1 805

Country 3 Project 16 In DD 50 100% 50 75% 38 40% 2 000 Ukraine

575 575

1 000 164 575 575 575 575 727

Project 17 In DD 50 100% 50 75% 38 40% 164 164 China

Country 4 Opportunity 200 100% 200 75% 150 37% 0

Project 18 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

Country 5 Project 19 Opportunity 50 50% 25 75% 19 37% 2020 2021 2022 2023 2024 2025

Total 3,781 2,975 2,474

Source: NBT AS

Note: 1) NBT has secured exclusivity and is performing a due diligence with a view to acquire the project. Opportunity: NBT is negotiating with owner to with a view to enter into a due diligence process 14Ukraine has a pro-west government undertaking structural

reforms to facilitate future growth of its economy

Ukraine economy overview International reserves

Political climate Months of

– Denis Shmygal elected as the new PM in early March 2020 3.0x 3.0x 3.2x 3.3x 4.7x 4.5x 4.6x 4.0x 4.3x

imports

– The conflict in eastern Ukraine, more strained relations with Russia and the Coronavirus

pandemic continue to hurt the economy USDbn

– Reforms have been adopted to promote household consumption, the consolidation of public

finances and prudent fiscal and monetary policies, and a flexible exchange rate regime have 30.0 27.3 27.2

25.3 24.9 24.6

helped to reduce budget and current account deficits 25.0

Economic environment 20.8

20.0 18.8

– According to the IMF, GDP grew at 3.2% in 2019, slightly down from 2018 (3.3%), however

15.5

due to the COVID-19 outbreak, GDP growth is forecast to fall to -7.7% in 2020 and pick up to 15.0 13.3

3.6% in 2021, subject to the post-pandemic global economic recovery

– Interest rates on the interbank market and yields on hryvnia domestic government securities 10.0

have been gradually declining

5.0

– International reserves increased to USD 27bn, and now cover four months of future imports

– Consumer inflation down from 3.2% yoy in Jan to 2.4% in Feb, expected to decline further 0.0

– The NBU has moved to ease monetary policy due to inflationary pressure and has cut the key 2015 2016 2017 2018 2019 Q1 2020 Q2 2020 Q3 2020 2020E

policy rate by 100 bps – to 10.0% in March

CPI change and key policy rate FX dynamics State and state-guaranteed debt

CPI Key policy rate 79.1 80.9 71.8 60.9 50.3

USD/UAH UAH/USD as of

Average Inflation Target inflation 01 May’20: 26.92 -9.8 2.4 2.5 3.3 3.2 -7.71)

25.0 1.0 USDbn

22.5 30 100

20.0 18.0% 0.8 84 80

28 76 78

17.5 80 71 10 10

14.0% 14.5% 66 11 11

15.0 13.5% 0.6 10

26 60 10

12.5 13.9% 14.4% 10.9%

8.0%

10.0 7.9% 0.4 24 40 74

65 67 71

7.5 10.3% 56 61

4.5% 22 20

5.0 0.2

2.5 5.0% 20 0

0.0 0.0 1/1/2016 1/1/2017 1/1/2018 1/1/2019 1/1/2020 1/1/2021 2015 2016 2017 2018 2019 Mar’20

2016 2017 2018 2019 2020E State-guaranteed debt GDP growth % (real)

Ukrainian hryvnia was the best performing

foreign currency versus the US dollar in 2019 State debt Total debt (% of GDP)

Source: Ukrainian Ministry of Finance – Ukraine Investor Presentation June 2019, IMG World Economic Outlook (April 2019), Bloomberg, European Bank for Reconstruction and Development (EBRD)

1) 2020E

15Improving national credit profile translates to narrowing

spreads

Ukraine credit overview Ukraine credit profile

Commitment to further reforms, macro support programs from IMF, EU, US and IFIs Long term credit ratings (April 2020)

and sound macro performance in 2019, has boosted international investors’ interest in

Ukrainian sovereign debt

Caa1 B B

– In Dec 2019, signed a 3-year agreement with IMF for a new USD 5.5bn extended credit

facility to boost the country's growth and economic reforms (Positive) (Stable) (Stable)

In January 2020, the Ukrainian Government went back on the market with a EUR

1.25bn 10 year Eurobond which was supported by 5.6x oversubscription leading to

reduction of factual yield at issuance of 62.5 bps from the IPT

– The total indications of interest peaked in excess of EUR 7bn from 350+ investors globally

Ukraine Sovereign Yield Evolution Secondary Sovereign Curve Evolution

The yield of the sovereign Eurobond is up by almost 350bps since issuance and is as Yield % 1 May ’19 1 Jan ’20

Yield % UK 2024 UK 2030

of April 30 trading at a yield of 7.85% p.a. 030 Oct ’19 30 Apr ’20

14.0 UK 2026 16

The backward-looking approach of rating agencies, which accounts for the 2014 and

15

2015 crisis years, does not capture the noticeable credit profile improvements of 13.0

Ukraine in 2019 14

12.0

Both initial demand of the Eurobond and current secondary trading yield assert our 13

expectations on the soonest credit rating upgrade shifting Ukraine to BB universe 11.0 12

11

10.0

The Ukraine government bond January 2020 10

9.0

9

Issue amount: EUR 1.25bn

8.0 8

Order book at final yield: > EUR 4.75bn

7.848% 7.0 7

6

5.000% 4.750% 4.5%(+/-0.125) 4.375% 6.0

5

5.0

4

4.0 3

IPT Guidance FPG Final pricing Current trading 1Y 2Y 3Y 4Y 5Y

4/1/2019 7/1/2019 10/1/2019 1/1/2020 4/1/2020

(30 April 2020)

Source: Bloomberg as of 01 May 2020

16Contact Information

For more information, please contact:

Mr. Joar Viken

CEO

Mobile: +47 916 19785

Email: joar.viken@nbtas.no

17NBT AS Company presentation May 2020

You can also read