WAREHOUSE AND INDUSTRIAL - MARKET RUSSIA | MOSCOW - Colliers International

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

2

Warehouse and industrial market | Colliers International

January 2020 | Moscow

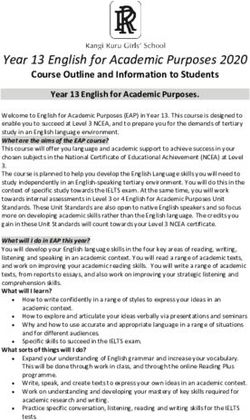

KEY MARKET INDICATORS

2017 2018 2019

Total warehouse stock, million sq m 13,551 15,371 16,623

Completions, thousand sq m 676 541 798

Total take-up, thousand sq m 1,264 1,461 1,419

Volume of lease deals, thousand sq m 968 1,134 1,192

Volume of sale deals, thousand sq m 296 327 227

Vacancy,% 7.9% 6.2% 3.7%

Average rental rate, RUB/sq m/year 3,600 3,700 3,950

OpEx, RUB/sq m/year** 900 –1,200 900 – 1,200 900 – 1,200

Average sale price, RUB/sq m** 35,000 35,000 40,000

* Excl VAT (20%) and OpEx Source: Colliers International

** Excl. VAT (20%)

SUPPLY

In 2019, supply in the warehouse and industrial market increased by 798,000 sq m

including 347,000 sq m of speculative warehouse space. Four large distribution centers

were commissioned in 2019: DC Leroy Merlin (140,000 sq m), DC VkusVill (108,000

sq m), DC Ikea (90,000 sq m) and DC Lenta (71,000 sq m). The share of BTS-projects

reached 54%.

Speculative construction has been decreasing annually since 2014. Tenants’ higher

quality requirements have been an obstacle for development of speculative market,

while, at the same time, this has been an incentive for built-to-suit/built-to-rent

construction.

CHART 1: 200

181 179

141

NEW CONSTRUCTION

Thousand sq m

180

BY QUARTERS, 2019 160

140

115

120

100 90

80

60 44 48

40

20

0

0

Q1 Q2 Q3 Q4

Speculative BTS3

Warehouse and industrial market | Colliers International

January 2020 | Moscow

CHART 2:

NEW CONSTRUCTION

IN SPECULATIVE

AND BTS-FORMAT,

2012 – 2019

CHART 3:

GEOGRAPHIC DISTRIBUTION

OF TAKE-UP AND NEW

CONSTRUCTION, 2019

TABLE 1: WAREHOUSE COMPLEXES COMMISSIONED IN 2019

NAME DEVELOPER SIZE, SQ M TYPE OF BUILDING LOCATION

34 km from MKAD,

DC Leroy Merlin in Beliy Rast PNK Group 140,000 BTS

Dmitrovskoe hwy

0.5 km from MKAD,

DC VkusVill in Veshki PNK Group 108,064 BTS

Altufievskoe hwy

33 km from MKAD,

DC in Solnechnogosrk A Plus Development 90,000 BTS

Leningradskoe hwy

33 km from MKAD,

DC Lenta in Valishchevo PNK Group 71,420 BTS

Simpheropolskoe hwy

25 km from MKAD,

Atlant Park, building 32 PSK Atlant Park 54,485 Speculative

Gorkovskoe hwy

26 km from MLAD,

PNK Park Koledino PNK Group 53,316 Speculative

Simpheropolskoe hwy

Logistics Park Vnukovo, 23 km from MKAD,

Logistic Partners 51,000 Speculative

phase 3, bld 11 - 14 Kievskoe hwy

Source: Colliers International4

Warehouse and industrial market | Colliers International

January 2020 | Moscow

TAKE-UP

Total take-up in the Moscow region amounted to 1.4 million sq Lease deals dominated in the Moscow region and amounted to

m. The main drivers of warehouse space consumption were 84% of the total take-up. The remaining 16% was sold to end-

retailers (29%). The share of logistic companies demonstrated users. The share of built-to-suit/built-to-rent deals reached 17%

rapid growth of 8 p.p. to reach 26%. The activity of logistics (+3.85 p.p. compared to 2018).

companies grew due to the development of the online-sales

The highest take-up was in the south (627,000 sq m) and north

market. New distribution centres and space for last-mile delivery

(231,000 sq m) of the Moscow region. In Moscow and near the

are being built in the Moscow region in order to speed up delivery

MKAD 30,000 sq m of warehouse premises was consumed.

of products to end-users. Online-retailers are focused on city-

logistics (1,000 – 5,000 sq m), which explained the low share

of this segment in the total take-up (6%). More than 25% of total

deals involved food&drink operators.

CHART 4:

DISTRIBUTION OF DEALS

BY TYPE, 2018 - 2019

TABLE 2: BIGGEST DEALS IN MOSCOW REGION, 2019

NAME SECTOR FORMAT SIZE, SQ M PROPERTY

VkusVill Retail BTR-lease 108,064 PNK Park Veshki

Tablogix Logistic Renewal 56,983 MLP Tomilino

Mistral Manufacturing Sale 53,313 PNK Park Koledino

Faberlic Retail Renewal 48,563 MLP Northern Domodedovo

PTI Retail Sale 45,767 WC Mareven Food

Bacardi Distribution Renewal 42,969 WC Raven Istra

John Deere Manufacturing Renewal 41,900 South Gate

Yandex.Market Online-retail BTR-lease 39,131 LP Sofyino, building 3.1

Sportmaster Retail Lease 35,044 Industrial Park Kholmogory

KSE Logistics Lease 32,611 WC Tomilino Development

Centos Logistics Lease 30,210 Kryokshino Logistic Park5

Warehouse and industrial market | Colliers International

January 2020 | Moscow

CHART 5:

DISTRIBUTION OF LEASE AND SALE

DEALS IN THE MOSCOW REGION,

2014 – 2019

CHART 6:

DISTRIBUTION OF LEASE AND SALE

DEALS BY BUSINESS-SECTOR, 2019

1%1%

2% 2%

3%

4%

26%

5%

6%

Food and beverages

Fashion

Cosmetics 7%

Sport equipment

Pharma

Household appliances

17%

Goods for pets

10%

Other

Alcohol

Goods for children

Furniture 16%

Construction materials6

Warehouse and industrial market | Colliers International

January 2020 | Moscow

VACANCY

The vacancy rate in the Moscow region (class A and B) reached 3.7%, which is 2.5 p.p.

lower than in the previous year.

This decrease was due to the high take-up and insufficient volume of new speculative

construction. Net absorption amounted to 1,185,000 sq m, which points to favorable

conditions in the warehouse market.

The lowest vacancy was in the north-east of the Moscow region (1.1%) and the highest

was in the south-west (10.9%).

CHART 7:

VACANCY RATE, 2012 -2019

RENTAL RATES

The average rental rate in the Moscow region is 3,950 RUB/sq m/year excl. VAT and

OpEx. The highest rental rate (excluding the area within the MKAD) was in the west and

south-west of the region (4,150 RUB/sq m/year excl. VAT and OpEx and 4,000 RUB/sq

m/year excl. VAT and OpEx) respectively.

More rapid growth of rental rates is held back by the fact that a large number of

warehouse complexes in the region have become obsolete. The majority of class A

and B warehouses in the region were built in 2000–2014. More complicated technical

requirements have also led to greater demand for built-to-suit/built-to-rent options.

CHART 8:

GEOGRAPHIC DISTRIBUTION

OF RENTAL RATES,

EXCL. VAT (20%) AND OPEX7

Warehouse and industrial market | Colliers International

January 2020 | Moscow

FORECAST

The Moscow region warehouse market in 2019 demonstrated a positive trend. Business

activity among companies increased leading to a higher demand for large warehouse

units. We expect that the average asking rate for a unit will continue to grow due to

the growth of retail turnover (including online retail) and the development of solvent

demand in the Moscow region and in the regions of Russia. Many federal developers

are choosing centralised logistics models in order to service regional markets from

Moscow. The development of online-retail and city logistics will continue to influence

the warehouse market in the Moscow region. The Moscow market (inside MKAD) will

show rapid growth. In the short-term, the volume of class A and B warehouse stock will

increase twofold.

In 2020 volume of new speculative construction will increase, however this won’t

become a tendency. Vacancy will get to 3.5%. Rental rates will continue to grow and

would be in range 4,300 – 4,500 RUB/sq m/year excl. VAT and OpEx.

TABLE 3: THE BIGGEST SPECULATIVE WAREHOUSE COMPLEXES TO BE COMMISSIONED IN 2020

NAME DEVELOPER SIZE, SQ M LOCATION

PNK Park MKAD – M4 PNK Group 117,504 0.5 km from MKAD, M4 - Don

PNK Park Medvedkovo, bld 1, 2 PNK Group 104,895 Moscow, 1.4 km from MKAD

Warehouse complex Kholmogory,

Rusich 90,000 31 km from MKAD, Yaroslavskoe hwy

phase 2, building 1

Logistic park Vnukovo 2, bld 9-10,

Logistic Partners 64,185 23 km from MKAD, Kievskoe hwy

15-17

Atlant park, bld 33 PSK Atlant Park 45,936 25 km from MKAD, Gorkovskoe hwyCONTACTS

WAREHOUSE & INDUSTRIAL RESEARCH DEPARTMENT MARKETING & PR DEPARTMENT

DEPARTMENT

Veronika Lezhneva Olga Bakulina

Svetlana Pronina Director Regional Director

Regional Operations Director +7 495 258 5151 +7 495 258 5151

+7 495 258 5151 Veronika.Lezhneva@colliers.com Olga.Bakulina@colliers.com

Svetlana.Pronina@colliers.com

Artyom Shikunov

Analyst

+7 495 258 5151

Artyom.Shikunov@colliers.com

Copyright © 2020 Colliers International 123112 Moscow

This report gives information based primarily on Colliers International data, which may be helpful in anticipating trends in the 10 Presnenskaya Embankment

property sector. However, no warranty is given as to the accuracy of, and no liability for negligence is accepted in relation to, the BC Naberezhnaya Tower, Block C, 52 floor

forecasts, figures or conclusions contained in this report and they must not be relied on for investment or any other purposes.

This report does not constitute and must not be treated as investment or valuation advice or an offer to buy or sell property. +7 495 258 51 51

(January 2016) © 2016 Colliers International. www.colliers.ru

Colliers International is the licensed trading name of Colliers International Property Advisers UK LLP which is a limited liability

partnership registered in England and Wales with registered number OC385143. Our registered office is at 50 George Street,

London W1U 7GA. 00000 Research & ForecastingYou can also read