Clarion Housing Group Value for Money Statement 2018

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Value for Money Statement 2018

Highlights

£426m ERP

This report outlines the performance of

the organisation in 2018 and the journey

we have commenced to establish a fully

Clarion Housing Group is a business for integrated Clarion Housing Group:

social purpose. First and foremost we are This year we invested £426 million in new We launched the first phase of our new

a social landlord and our charitable aims homes and £119 million in existing homes. That enterprise resource planning (ERP) systems

represents 347% of our annual surplus. with further investment in new and streamlined

£15m

are to house people who cannot meet

processes and ways of working, in time this will

their housing needs in the market. We

lead to reducing costs and redirecting resources

build new affordable homes and we invest

£11m

to create added value.

in maintaining our estate. Being efficient We expect to complete the integration of

and effective is critically important. We Circle Housing and Affinity Sutton releasing

do not distribute profits, so every penny

£15m

savings by year three of c. £80 millon compared

we earn is reinvested in the business to to our pre merger costs, and bringing the We invested £11 million in community investment

deliver our charitable aims. Clarion operating cost per unit down below programmes to benefit our residents and this is

that of the former Affinity Sutton cost. In planned to continue next year. We expect to help

This is the first full reporting year for Clarion 4,000 people each year into employment, and We spent over £15 million on safety work to our

the last 12 months, excluding one-off costs

Housing Group following the completion of the 1,500 youngsters to sustain their education and homes including electrical compliance testing

of merger and taking account of inflation,

merger of Circle Housing and Affinity Sutton training. and fire safety measures.

operating costs have reduced by £15 million.

in November 2016 creating the largest social

housing group in England. Our merger created

2%

an organisation with the capacity to deliver a Our Financial Golden Rules create a solid

One

significant programme of new homes, however risk framework to balance essential financial

our first priority has been to restore effective strength with maximum investment in new and

and efficient services to our customers. We existing homes.

We have set a three-year budget which will see

have made significant progress over the year We completed the simplification of the Group’s

operating costs reduce by 2% in 2018/19.

culminating in the restoration of our regulatory legal structures creating a single asset owning

gradings in March 2018, confirming G1 and housing association, to replace the 10 legacy

V1, but we are not complacent. We know that

5,000

associations we inherited at merger.

in parts of Clarion the service pre and post

merger was poor, and that this has left a legacy

of issues which we must work hard to resolve.

We are committed to addressing a legacy of

underinvestment in some homes and we have

embarked on a significant transformational

homes 70,000

We have consolidated our in-house repairs

programme of change which will deliver long We expect to be building 5,000 homes a year providers creating Clarion Response which

lasting benefits for our residents. by 2022 and to sustain this level of output in delivers responsive repairs and services to

the future. We will maximise the amount of 70,000 of our homes.

affordable homes we build with a minimum

ambition that two thirds of our programme

will be at below market prices. At the end of

this year we had more than 14,000 homes

in our development pipeline with anticipated

completion dates over the next three years.

2 Clarion Housing Group - Value for Money Statement 2018Value for Money Statement 2018 Introduction Both Affinity Sutton and Circle Housing before the merger had embarked on transformational change programmes. The driving force behind these programmes was to enable our customer offer to be as good as some of the leading customer service businesses in the country. We know from our customer insights that our customers increasingly want to access services digitally. Our legacy systems did not support that ambition. We also know that investing in new ways of working and new systems will deliver longer lasting efficiencies, which will benefit our current and future residents. Given our commitment to providing a blend of excellent service and value for money we are investing in a major programme of business change that will transform the way we do business and further reduce our operating costs. This Value for Money report sets out our ongoing commitment to achieve value for money for residents, stakeholders and investors. The report highlights a number of measures we have taken to drive further efficiencies, despite ongoing uncertainties in our operating environment. 4 Clarion Housing Group - Value for Money Statement 2018

Value for Money Statement 2018

Our financial strength

additional £44 million capital

expenditure on homes this

year compared to the previous

year. Despite that, the indicator

demonstrates the robustness

of the Group’s overall financial

position. Our 10 year forecast

anticipates that EBITDA MRI

will be at or above 160%.

This year the Group invested

£119 million in capital major

works, which represents a

This year the Group made a net surplus of £157 long-term investment in our

million on a turnover of £829 million generating existing housing stock with an

an operating margin (excluding disposals) of 33.3% additional £426 million invested

which demonstrates a strong financial performance in new homes for a range of

in a year of great change for the business. tenures. We completed 1,263

new homes during the year and

79% of our turnover is derived to deliver our social housing these homes were delivered

from our core business of ambitions. with limited grant funding. Our year on year focus We have made a start in

social rents and service For every £1 generated from continues to be to keep agreeing a three year budget

charges which delivered Social At 33.3% (2016/17: 31.7%) the

operations we spent £1.07 operating costs under control which will reduce our operating

Housing Interest Cover of operating margin (excluding

on new homes, this is money and to forecast no growth in costs by 12% below current

167%, demonstrating strong disposals) of the Group at year

generated from our own underlying costs. At the year costs by 2021 in real terms.

underlying performance and end remains strong despite

resources and demonstrates end the Group had a headline Each year we maintain a

showing that we place no some very real cost pressures

our commitment to investing social housing operating costs savings register and we validate

reliance on asset sales or build during the year, principally

in new homes in line with our of £4,510 per home. This is all entries at the year end.

for sale - just 13% is derived arising from additional repairs

charitable mission to provide higher than previous years This year specific efficiency

from development sales. As a and maintenance spend on

homes for those excluded and reflects the significant initiatives across the Group

business we have been keen to former Circle Housing owned

from the market. Running the effort during the year to tackle resulted in savings of more

limit our diversification to what properties to rectify historic

business as efficiently as we previous service performance than £16 million.

is required to support our core underspend, and fire safety

can enables us to maximise this issues. Our clear ambition is to

social mission given limited work in the aftermath of the

investment. During the year we achieve costs which are lower

government support in recent terrible tragedy at Grenfell

started construction on 1,428 than the operating costs of the

years for rented housing. Our Tower.

new homes, and at the year end former Affinity Sutton, which

plans for the next decade EBITDA MRI which measures we had c. 14,000 new homes in we expect to deliver within 3

will see us develop a greater the headroom the business has the development pipeline. years.

proportion of homes for sale, from which to meet its long

double our current programme, Our investment in new and

term interest costs is 152.1%

but we are committed only to existing homes at £545 million,

at year end, the reduction

doing what we need to be able was 3.5 times greater than our

in this indicator reflects the

annual surplus.

6 Clarion Housing Group - Value for Money Statement 2018 7Value for Money Statement 2018

Delivering social value in

our communities

We run our business on commercial lines, with a service helped a record 3,035

keen eye on both effectiveness and delivering value people to find work. In addition

to this, we also achieved

for money, and clear distinction between commercial

another record by providing 218

and charitable activity. It is because of this that we apprenticeships, helping those

are able to channel so much of the money we make young people to learn vital work

into delivering social benefits for the communities in skills.

which we operate. Our community foundation,

The work we have produced communities. Post merger Clarion Futures, has prioritised

with HACT to develop a set the Board agreed to prioritise future investment in young

of financial values which can a significant increase in our people who are residents and

be attributed to particular spending on communities the children of residents. Over

interventions is increasingly from just under £7 million of the next few years we expect to

being adopted by other our own resources growing be helping 15,000 young people

landlords in the sector. to £10 million this year and to annually to fulfil their potential

Being able to quantify the continue at that level. This will through apprenticeships,

impact of our investment on enable the Group to offer a training support and bursaries.

people’s wellbeing has proved comprehensive service for all The Group continues to

invaluable, not only in helping our residents wherever they prioritise financial inclusion

us to understand the return live. work and debt advice services

on our investment, but also which are more in demand than

as we refine and develop An important element of

our community investment ever. Helping our residents to

our community investment access affordable loans saved

programmes. programme is our employment

service. We believe that finding an estimated £16 million in

This year we have achieved a our residents work is the best reduced payments and debt

social benefit of £96 million, route we can offer to financial write-offs.

this compares to £85 million in independence and reduced We have also continued to

the previous year, and reflects dependency on welfare. Over invest in Welfare Advice

our increased emphasis on this the last year we have also been Services for our residents

work post merger. We want all the lead agent for a group of helping them to claim benefits

our residents to benefit from housing associations who have which they are entitled to. This

the investment we make. rolled out employment services work alone has benefitted our

across London with funding residents by securing an extra

Clarion’s investment has from the Greater London

a significant direct impact £7 million in income they would

Authority and the European otherwise have foregone.

on improving the lives of Social Fund. This year the

our residents and their

8 Clarion Housing Group - Value for Money Statement 2018 9Value for Money Statement 2018

Our assets New homes Procurement

The Group has nearly 125,000 properties across England. Some of these homes Clarion aims to be a developer of homes at a The Group maintains a savings register which

date back to the turn of the last century while others, for example those from significant scale. Over the last year we have built is independently verified and lists all savings

1,263 new homes across a range of tenures. achieved through procurement. We strive to

local authority stock transfers were built in the 1950s, 60s and 70s.

Central to our development programme is consistently realise savings in procurement on a

It is incumbent on all housing associations this year to tackle some of the historic under ensuring we are able to focus on those who year on year basis delivering value through both

to make the best use of their assets and we investment in the homes previously owned are failed by the market. Those homes were tender processes and contract management.

continue to improve on our approach. We have by Circle Housing. It will take time to bring all developed with just 4.4% of public subsidy.

Supporting a programme of this scale has Procuring long-term suppliers to deliver

two main tools by which we inform our future our homes up to the same standard but a key

required us to undertake commercial activities better core services has been a focus of our

investment and disposal decisions: priority this year has been on safety works and in

to generate returns to fill the gap left by work since merger. This has involved bringing

particular fire safety measures.

1. The first is a qualitative scoring system for our shrinking public funds. together different legacy arrangements to

estates based on a range of management and Last year the Group carried out 294,560 deliver consistent services across our homes.

customer indicators, helping us understand responsive repairs. At the year end we delivered This year’s financial surplus of £157 million Total savings achieved in 2017/18 which offer

how much effort an estate takes to manage 67% of all repairs service in-house through should be seen in the context of the £439 million significant levels of savings in future years

and the desirability of the estate to current Clarion Response. The remaining services were long-term investment we made in social housing stand at £7.8 million compared to existing costs.

and prospective tenants. This is informed provided through contracts awarded to long over the last twelve months. We invested £320 Procurement aims to ensure value for money

by tenant turnover, current tenant average term partner contractors. 90,000 heating repairs million into the construction of new social and is achieved at the awarding of contracts

stay, re-let times, contact volumes, account were undertaken, reflecting heightened demand housing properties. More than twice our annual and extends to strategic delivery. We expect to

balances, void loss and repairs volumes. It during the cold period but also influenced by a surplus was applied to our core social housing deliver additional value from the tender process

can be used to compare estates and can then legacy of under investment in some homes. Post activity through a programme of planned as well as ongoing contract management.

be used to measure impact gained due to any merger there has been a significant amount improvements, as well as the development of

interventions we make. of work to do to integrate both legacy services new social housing.

and to ensure the arrangements provide a good

2. The second is a discounted cashflow service for residents. We have taken several

model that provides net present values, initiatives this year to improve the efficiency

yields and vacant possession values for of our in-house service including reducing the

our properties, helping us understand how use of sub contractors, absorbing the impact of

much our properties will make (or cost) us inflation on running costs and improving our void

over the coming 30 years in today’s money. and empty property turnaround times. We are

Our reinvestment team use the model to developing a ‘Clarion Homes’ standard which

identify poorly performing estates based on all our homes will meet, and which will set the

their financial performance and carry out an benchmark for our future investment plans.

options appraisal looking at the fabric of the

buildings and wider environmental works Each year we dispose of housing stock which

involving a number of different departments in is no longer suitable for the provision of social

the organisation. rented accommodation. In 2017/18 year we

generated a surplus from disposals of £29.2

It is critically important that we manage our million. Our long term financial plan anticipates

assets carefully in order to derive the most a programme of sales of social housing to other

value from them. Our total maintenance spend registered social landlords which will generate

in 2017/18 was £313 million, which reflects money we can use to develop new homes, whilst

day to day maintenance spend, investment in keeping those we sell in social housing. We will

replacement components such as kitchens, begin to pilot work in this area shortly to test

bathroom, boilers and windows as well as the market appetite for disposals in sector and

energy efficiency, environmental and estate to work with our residents to identify suitable

improvement works. We have worked hard landlords.

10 Clarion Housing Group - Value for Money Statement 2018 11Value for Money Statement 2018

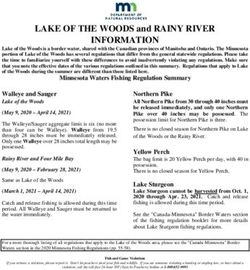

Transparency and scrutiny Clarion Housing Group - Sector Scorecard

Our Group is committed to transparency. We details of the pay and reward offered to our

2017/18 2016/17

publish detailed information about our spending, staff and board, as well as key statistics and

both on our website and in financial statements. performance information. Operating margin (excluding disposals) 33.3% 31.7%

This year we have taken the opportunity to

include in our Value for Money Statement the Our residents remain at the heart of everything Operating margin (social housing lettings) 36.2% 34.5%

we do. Regional Scrutiny Boards (RSBs) and

metrics developed by the sector led Efficiency Interest cover – EBITDA (MRI) 152.1% 173.3%

Working Group which we think helps illustrate Service Improvement Panels, for example,

the outcomes we achieve. are engaged in examining our performance in New supply delivered: absolute (social and non-social) 1,263 1,340

core areas of the business and making service

Our website contains details of payments to top improvement recommendations to the Board. New supply % (social and non-social) 1.07% 1.14%

suppliers, action taken to combat tenancy fraud, This has included recommendations on door Gearing 50.4% 48.7%

delivery performance on our affordable homes entry systems, communal lighting, untidy

programme, our current regulatory rating, gardens, measuring success, and the roles of Customer satisfaction 80.0% 76.7%

our code of conduct and the results of resident estate based staff. Reinvestment 8.0% 5.4%

scrutiny. Our Annual Report and Accounts show

Investment in communities* £10.8m £7.9m

Return on capital employed (ROCE) 4.0% 4.0%

Occupancy 98.5% 98.4%

Transforming the way we do business

Ratio of responsive repairs to planned maintenance 63.6% 84.7%

The Group recognises that simply driving cost savings will ultimately result in diminishing

returns and also runs the risk of reducing levels of service. In order to mitigate this we have Headline social housing cost per unit £4,510 £4,371

invested in a major programme of transformational activity that goes beyond traditional Management cost per unit £750 £758

continuous change processes and will deliver ongoing benefits to residents and a significant

return on investment. Service charge cost per unit £530 £558

This group-wide change programme, ‘FF2’ will is equipped for future growth in line with the Maintenance cost per unit £1,558 £1,657

result in a transformation of service provision, Group’s ambitious growth strategy as well as

Major repairs cost per unit £229 £225

working practices and customer experience. providing a step change in the level of service to

We launched the first phase of this work in our customers, staff and business partners. Capitalised major repairs cost per unit £1,089 £696

April 2018 and we expect to have the whole

business working on fully integrated common This programme is ambitious and timely, and it is Other social housing costs cost per unit £355 £478

unique in the sector. It will provide an integrated

systems by early 2019, just over two years post Rent collected 99.8% 99.8%

the largest merger in the social housing sector. solution which is scalable for the business and

These changes will ensure that the business which we can use as a platform to grow. Overheads as a percentage of adjusted turnover 10.5% 11.8%

12 Clarion Housing Group - Value for Money Statement 2018 *This includes external funding 13Clarion Housing Group Level 6 6 More London Place Tooley Street London SE1 2DA 320.07.18

You can also read