The Impact of Payment Frequency on Consumer Spending and Subjective Wealth Perceptions

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

The Impact of Payment Frequency on

Consumer Spending and Subjective Wealth

Perceptions

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

WENDY DE LA ROSA

STEPHANIE M. TULLY

Payment frequency is a fundamental yet underexplored feature of consumers’

finances. As higher payment frequencies are becoming more prevalent, consumers

are receiving more frequent yet smaller paychecks. An analysis of income and ex-

penditure data of over 30,000 consumers from a financial services provider demon-

strates a naturally occurring relationship between higher payment frequencies and

increased spending. A series of lab studies support this finding, providing causal

evidence that higher (vs. lower) payment frequencies increase spending. The effect

of payment frequency on spending is driven by changes in consumers’ subjective

wealth perceptions. Specifically, higher payment frequencies reduce consumers’

uncertainty in predicting whether they will have enough resources throughout a pe-

riod, increasing their subjective wealth perceptions. As such, situational factors that

reduce prediction uncertainty for those paid less frequently (e.g., the timing of con-

sumers’ expenses, income levels) moderate the impact of payment frequency. The

effects of payment frequency on subjective wealth and spending can occur even

when objective wealth favors those with lower payment frequencies. More broadly,

the current work underscores a need to understand how timing variations in con-

sumers’ income impact their perceptions, behaviors, and general well-being.

Keywords: payment frequency, subjective wealth, consumer spending, consumer

finance, uncertainty

P ayment frequency is a fundamental feature of consum-

ers’ finances. An increase in the number of people

who hold multiple jobs, lower payroll processing costs,

Wendy De La Rosa (wendyde@wharton.upenn.edu) is an Assistant

Professor of Marketing at The Wharton School, University of

and payroll technology advancements have made it in-

Pennsylvania, 3730 Walnut Street, Philadelphia, PA 19104, USA. creasingly common for consumers to receive more frequent

Stephanie M. Tully (smtully@stanford.edu) is an Assistant Professor of (albeit smaller) paychecks. Indeed, the percentage of US

Marketing and Business School Trust Faculty Scholar 2020-2021 at the

Stanford Graduate School of Business, Stanford University, 655 Knight

employers that will increase their employees’ payment fre-

Way, Stanford, CA 94305, USA. This research is based on the lead author’s quency is expected to quadruple to 20% by 2023 (Gartner

dissertation. Please address all correspondence to Wendy De La Rosa. The Research 2019). Nevertheless, despite this growing popu-

authors wish to thank Jennifer Aaker, Itamar Simonson, Jeffrey Pfeffer, larity, it is largely unknown how higher payment frequen-

Paul Brest, Dan Ariely, John Lynch, Jonathan Levav, Carey Morewedge,

Fred Feinberg, Broderick Turner, Kalinda Ukanwa, Jonathan Jean-Pierre, cies (i.e., smaller, more frequent paychecks) will impact

Martha Felipe, and the entire review team for their helpful feedback during consumers’ perceptions and behaviors compared to lower

the preparation of this article. Supplementary materials are included in the payment frequencies (i.e., larger, less frequent paychecks).

web appendix accompanying the online version of this article.

Prior research has demonstrated that higher payment fre-

quencies impact when consumers spend. Compared to

Editor: J. Jeffrey Inman

lower payment frequencies, higher payment frequencies

lead to more distributed consumption patterns throughout

Associate editor: Manoj Thomas the month (Berniell 2018; Parsons and Van Wesep 2013;

Shapiro 2005; Stephens 2003, 2006; Stephens and

Advance Access publication 22 September 2021

Unayama 2011). In the current work, we examine whether

VC The Author(s) 2021. Published by Oxford University Press on behalf of Journal of Consumer Research, Inc.

This is an Open Access article distributed under the terms of the Creative Commons Attribution-NonCommercial License (https://creativecommons.org/licenses/by-nc/4.0/), which permits

non-commercial re-use, distribution, and reproduction in any medium, provided the original work is properly cited. For commercial re-use, please contact journals.permissions@oup.com

Vol. 00 2021

DOI: 10.1093/jcr/ucab052

12 DE LA ROSA AND TULLY

getting paid more frequently impacts consumers in ways Kamenica 2010). In the current work, we examine payment

that extend beyond merely the timing of their consumption. frequency, a ubiquitous aspect of consumers’ finances.

We suggest that higher payment frequencies lead to in-

creased spending. Specifically, we posit that higher pay- Payment Frequency and Spending

ment frequencies decrease consumers’ uncertainty in

Consumers’ income can vary across three dimensions:

predicting whether they will have enough resources

level (the amount of income earned), structure (the rate of

throughout a period, increasing consumers’ subjective

payment per unit of effort), and timing (any variations in

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

wealth perceptions. These higher subjective wealth percep-

the temporal patterns of when pay is disbursed to employ-

tions lead consumers to increase their spending.

ees for a given level and structure) (Parsons and Van

The current research uses real-world spending data and

Wesep 2013). We focus on an essential aspect of payment

controlled lab studies to examine the impact of payment

timing, which is payment frequency. Payment frequency

frequency on spending. First, we analyze banking transac-

does not refer to the frequency at which consumers earn

tions of more than 30,000 consumers from a financial serv- their income but rather the frequency at which they receive

ices provider. Using natural variation in payment their income. Traditionally, payment frequency has been

frequency, we find a naturally occurring relationship be- described as the recurring cycle by which employers pay

tween higher payment frequencies and increased spending their employees (e.g., weekly, bi-weekly, or monthly). In

(study 1). Next, we test the causal impact of payment fre- the current research, we define payment frequency from a

quency on spending using an online life simulation. consumer’s perspective, reflecting the number of times a

Consistent with the real-world spending analysis, we dem- consumer receives income within a given period. This

onstrate that higher payment frequencies lead to more more comprehensive definition allows payment frequency

spending than lower payment frequencies (study 2). We to reflect common payment frequencies when consumers

then show that the effect of payment frequency on spend- are paid cyclically by one employer (e.g., weekly, bi-

ing is driven by consumers’ subjective wealth perceptions weekly), as well as payment frequencies that may result

(study 2). These subjective wealth differences stem from from multiple sources of income, irregular work, or incon-

differences in consumers’ uncertainty in predicting sistent pay schedules (Golden 2015; Rothwell 2019; U.S.

whether they will have sufficient resources throughout a Bureau of Labor Statistics 2019). Since payment frequency

period (studies 3–5). As such, situational factors that re- does not impact consumers’ total income, those with lower

duce differences in prediction uncertainty, such as consum- payment frequencies have larger and less frequent pay-

ers’ income level (study 1) and the timing of consumers’ checks, whereas those with higher payment frequencies

expenses (study 4), moderate the effect of payment fre- have smaller and more frequent paychecks.

quency on spending and subjective wealth. Finally, we Recent employment and technological changes are mak-

demonstrate that the effects of higher payment frequencies ing the study of payment frequency increasingly important.

persist even when those with lower payment frequencies First, the rise of gig economy platforms has made it easier

are objectively more wealthy (studies 3 and 5) or when ac- for consumers to have multiple sources of income. Data

cess to higher payment frequency is optional, and consum- suggest that approximately a quarter of US workers have

ers must request additional paychecks (study 6). more than one job (Gallup 2018). That number increased

to 29% in 2019, reflecting a 21% increase (Rothwell

THEORETICAL FRAMEWORK 2019). As consumers increase their income streams and re-

ceive paychecks from multiple sources, their payment fre-

Prior research has demonstrated that consumers readily quency also increases. Second, the ability to transfer funds

attend to and automatically encode the frequency of events electronically and automatically has reduced some of the

(Hasher and Zacks 1979, 1984). Processing frequency in- cost and logistical considerations that previously dictated

formation seems to be a fundamental human ability, as employers’ payment frequency decisions (Stell 2016). In

even kindergartners have been shown to automatically en- addition, an increase in competition has led many payroll

code frequency information (Hasher and Zacks 1979). providers to decrease their pricing and eliminate the elec-

Frequency information can influence consumers’ judgment tronic transfer fees associated with making a payroll trans-

and decision-making, especially in complex situations fer (Wakefield Research 2019). Thus, employers can now

(Alba et al. 1994, 1999; Alba and Marmorstein 1987). For choose a wider variety of payment frequency options for

example, when product prices vary widely, the frequency their employees, including higher payment frequencies like

of price discounts influences consumers’ price estimates daily pay. For example, Walmart, the largest employer in

and their product choices (Alba et al. 1999). Thus, the fre- the United States, allows its workers to receive their in-

quency at which an event occurs may be particularly im- come daily (Corkery 2017). Given the greater flexibility of

portant in the financial domain, where consumers often employers to select payment frequencies based on factors

make difficult and complex decisions (Iyengar and other than logistical considerations, a natural question thatJOURNAL OF CONSUMER RESEARCH 3

arises is whether and how payment frequency impacts Sharma and Alter 2012), planning behavior (Fernbach et

consumers. al. 2015), spending and borrowing decisions (Ailawadi et

The existing literature on payment frequency primarily al. 2001; Karlsson et al. 2005; Sussman and Shafir 2012;

focuses on how payment frequency impacts the timing of Tully et al. 2015), and post-consumption behaviors like

expenditures (Berniell 2018; Parsons and Van Wesep word-of-mouth (Paley et al. 2019).

2013; Shapiro 2005; Stephens 2003, 2006; Stephens and

Unayama 2011). For example, Stephens and Unayama Payment Frequency and Subjective Wealth

(2011) demonstrated that Japanese retirees exhibited

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

greater consumption smoothing when they received one re- Although subjective wealth perceptions are typically im-

tirement paycheck every two months instead of one pay- pacted by the level of one’s financial resources, subjective

check every three months. In other words, consumers wealth perceptions are not simply a measure of objective

spread their expenditures throughout the year more evenly wealth (Gasiorowska 2014; Netemeyer et al. 2018; Sharma

when paid once every two months instead of every three and Alter 2012; Sussman and Shafir 2012; Tang et al.

months. In this work, rather than considering when con- 2004; Tully et al. 2015; Zauberman and Lynch 2005).

sumers spend, we examine whether payment frequency Indeed, consumers with objectively similar levels of finan-

impacts how much consumers spend. cial resources can vary in their perceptions of subjective

Some research suggests that payment frequency should wealth (Sussman and Shafir 2012). Instead, wealth percep-

not impact consumers’ spending. Such an outcome is in tions are a subjective assessment of the sufficiency of fi-

line with the Permanent Income Hypothesis (Friedman nancial resources relative to a benchmark, typically one’s

1957). The Permanent Income Hypothesis suggests that spending needs (Berman et al. 2016; Fernbach et al. 2015;

barring any liquidity constraints, consumers spend money Paley et al. 2019; Tully et al. 2015; Zauberman and Lynch

based on their expected lifetime earnings rather than cur- 2005). Although some research focuses on perceptions of

rent earnings. Thus, the Permanent Income Hypothesis financial oversufficiency (i.e., financial slack; Berman et

would argue that because payment frequency does not im- al. 2016; Zauberman and Lynch 2005) and other research

pact consumers’ total income, payment frequency should focuses on perceptions of financial insufficiency (i.e., fi-

not impact consumers’ spending. nancial constraints, financial deprivation; Fernbach et al.

Other research suggests that higher payment frequencies 2015; Paley et al. 2019; Sharma and Alter 2012; Tully et

should reduce consumers’ spending because getting paid al. 2015), in the current work, we refer to perceptions of

more frequently results in smaller amounts of money per sufficiency across the continuum as subjective wealth

paycheck. Research shows that consumers evaluate money perceptions.

and costs on a relative basis (Buechel and Morewedge In evaluating their subjective wealth, consumers often

2014; Kassam et al. 2011; Thaler 1985). More specifically, predict whether their financial resources are sufficient rela-

Morewedge, Holtzman, and Epley (2007) showed that con- tive to their spending needs (Berman et al. 2016; Fernbach

sumers spend less when thinking about a small account et al. 2015; Paley et al. 2019; Tully et al. 2015; Zauberman

(e.g., the money in their wallet) as compared to a large and Lynch 2005). Consumers can experience uncertainty

account (e.g., the money across their financial accounts) in making this prediction. Indeed, prior research has shown

because purchases made from a small account feel more that consumers often express uncertainty when predicting

expensive than purchases made from a large account. their future financial resources (Ben-David et al. 2018;

Thus, if consumers focus on their average paycheck size, Dominitz and Manski 1997a, 1997b). Such feelings of un-

which by definition decreases as one’s payment frequency certainty may be an important driver of subjective wealth

increases, then higher payment frequencies may make perceptions. Compared to those with lower prediction un-

costs feel larger and reduce one’s spending. certainty over their finances, consumers with higher pre-

Despite the aforementioned possibilities, in the current diction uncertainty have been shown to safeguard their

work, we argue that higher payment frequencies increase financial resources (Ben-David et al. 2018; Caldwell,

consumers’ spending by increasing consumers’ subjective Nelson, and Waldinger 2021) and believe they will need

wealth perceptions. Subjective wealth perceptions reflect €

more financial resources in the future (Ulkümen, Thomas,

consumers’ assessments about the sufficiency of their fi- and Morwitz 2008). These findings provide suggestive evi-

nancial resources. These perceptions are important for dence that greater prediction uncertainty decreases con-

researchers to understand as they predict a wide range of sumers’ subjective wealth perceptions.

outcomes (Ailawadi, Neslin, and Gedenk 2001; Fernbach, We suggest that because payment frequency inherently

Kan, and Lynch 2015; Frank 1999; Karlsson et al. 2005; changes the resource inflows and outflows that consumers

Paley, Tully, and Sharma 2019; Shah, Mullainathan, and experience throughout a period, payment frequency

Shafir 2012; Sharma and Alter 2012; Sussman and Shafir impacts consumers’ uncertainty over predicting their re-

2012; Tully, Hershfield, and Meyvis 2015). Wealth percep- source sufficiency and thus their subjective wealth percep-

tions impact consumers’ attention (Shah et al. 2012; tions. Consider the temporal patterns of consumers’4 DE LA ROSA AND TULLY

resources as a function of their income and expenses. If higher payment frequencies increase consumers’ per-

Consumers incur expenses very frequently, with the aver- ceptions of subjective wealth, then higher payment fre-

age consumer incurring approximately 70 expenses per quencies should also lead to more spending. Indeed,

month (Greene and Stavins 2018). Therefore, compared to consumers’ subjective wealth perceptions have been shown

those with higher payment frequencies, those with lower to predict their spending decisions, above and beyond their

payment frequencies experience larger and more frequent objective wealth (Karlsson et al. 2005). Thus, changes to

daily decreases in their overall resource levels, as expenses subjective wealth perceptions are likely to influence con-

occur very frequently with no income to offset them. For

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

sumers’ spending. More formally, we hypothesize:

example, a consumer with a weekly payment frequency

typically experiences a resource increase four times per H4: Higher payment frequencies will increase consumers’

month and a resource decrease on all other days when there spending compared to lower payment frequencies.

is an expense, resulting in a general pattern of resource H5: Subjective wealth perceptions will mediate the effect of

decumulation. In contrast, a consumer with a daily pay- higher payment frequencies (vs. lower payment frequencies)

ment frequency will experience smaller and less frequent on spending.

daily resource decreases as their income offsets expenses We test these hypotheses across six studies (and four

as they occur. This reduced pattern of resource decumula- supplemental studies in the web appendix). Data from

tion resulting from higher payment frequencies ought to re-

study 1 are proprietary and the legal data sharing agree-

duce consumers’ uncertainty in predicting their resource

ment prohibit the dissemination of these data. All other

sufficiency throughout a period. Thus, higher (vs. lower)

data including data from our web appendix studies, as well

payment frequencies should lead to lower prediction uncer-

as the relevant pre-registrations, can be found in Research

tainty over their resource sufficiency, and consequently,

higher subjective wealth perceptions. More formally, we Box #231 (https://researchbox.org/231).

propose the following hypotheses:

STUDY 1: PAYMENT FREQUENCY AND

H1: Higher payment frequencies will increase consumers’

perceptions of their subjective wealth compared to lower REAL-WORLD SPENDING

payment frequencies.

In study 1, we explored the relationship between natural

H2: Consumer’s prediction uncertainty over their resource variations in consumers’ payment frequency and their

sufficiency will mediate the effect of higher payment fre-

spending. To do so, we analyzed a large dataset from a fi-

quencies (vs. lower payment frequencies) on subjective

nancial services provider, which included consumers’ in-

wealth perceptions.

come and expenditure data. We hypothesized that higher

We have argued that higher payment frequencies in- payment frequencies would be associated with increased

crease consumers’ subjective wealth perceptions by de- spending.

creasing consumers’ prediction uncertainty over whether

they will have enough resources throughout a period. If

true, then the effect of payment frequency on subjective

Data

wealth should depend on differences in prediction uncer- We received data from a financial services provider that

tainty. Thus, situational factors that reduce differences in gathered consumers’ income and expense transactions

prediction uncertainty, such as consumers’ income or their across their debit and credit cards for 2014. The data in-

expense profile, should attenuate the effect of payment fre- clude both credits (income) as well as debits (expenses).

quency on subjective wealth. For example, the impact of The dataset contained the amount, date, and currency for

payment frequency on spending should be attenuated at each transaction for 30,963 consumers. It also included a

very high levels of income, as consumers with very high tag for whether the transaction was a credit or a debit. A

incomes likely face little to no uncertainty in predicting summary of the dataset can be found in web appendix A.

their resource sufficiency. As an additional example, if the We identified consumers for whom analysis of their in-

timing of expenses is such that a consumer with lower pay- come and expense transactions was possible. As such, we

ment frequency can assess whether they will have enough excluded 132 consumers with foreign exchange transac-

money throughout a period with the same level of uncer- tions as the dataset did not provide enough information to

tainty as a consumer with higher payment frequency, then convert foreign exchange transaction amounts to the home

the impact of payment frequency on subjective wealth currency. Further, we excluded three consumers who had

should also be attenuated. In sum: missing transaction-level data, such as the amount of the

H3: Situational factors that reduce differences in prediction transaction. Thus, the final dataset contained income and

uncertainty will attenuate the impact of payment frequency expense transactions for 30,828 consumers, accounting for

on subjective wealth perceptions. over 5.3 million transactions.JOURNAL OF CONSUMER RESEARCH 5

Results Log ðSpendingÞit ¼ b1 Payment Frequencyit þ b2

Spending. We first analyzed the number of consumers’ Log ðIncomeÞit þ ai þ it (5)

expenditures as a function of their payment frequency Log ðSpendingÞit ¼ b1 Payment Frequencyit þ b2

and income. To do so, we conducted a series of fixed- Log ðIncomeÞit þ Montht þ ai

effect regressions in which we regressed the number þ it

of expenditures that consumers made each month on (6)

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

their payment frequency, using the following model

specifications: Again, consistent with our hypothesis, all models identi-

fied payment frequency as a significant predictor of total

Number of Expendituresit ¼ b1 Payment Frequencyit spending, with higher payment frequencies predicting

more total spending (model 6: b ¼ 0.05, t(20389) ¼ 21.81,

þ ai þ it

p < .001, Cohen’s f2 ¼ .03, see table 1 for all models).

(1) Though the number of days a consumer receives a de-

Number of Expendituresit ¼ b1 Payment Frequencyit posit in a month is arguably the most straightforward

þ b2 Log ðIncomeÞit þ ai means of identifying payment frequency, we performed a

þ it series of robustness checks operationalizing payment fre-

(2) quency in different ways. Specifically, we used the follow-

Number of Expendituresit ¼ b1 Payment Frequencyit ing alternative operationalizations of payment frequency:

þ b2 Log ðIncomeÞit (1) the number of days in a month a consumer received a

þ Montht þ ai þ it deposit that was explicitly labeled as income (e.g., “Salary/

(3) Paychecks,” “Wages Paid”) and (2) the number of individ-

ual deposits a consumer received throughout a month.

Payment frequency was operationalized as the number Furthermore, we identified consumers who were in the

of days in which a consumer received income in a month. dataset for at least three months and calculated the average

Payment frequency was positively correlated with total in- number of days each consumer received income per month.

come (log-transformed) in this dataset (r ¼ .61, p < .001). As such, we relied on between-person (rather than within-

Thus, model 2 includes total income (log-transformed) re- person) variability in consumer’s monthly payment fre-

ceived by consumer i in month t. Model 3 includes month quency and spending. Across all three of these robustness

fixed effects to account for differences in total spending checks, payment frequency predicted both the number of

throughout the year. Across all models, we included a con- purchases and the amount of spending (log-transformed)

sumer-level fixed effect, ai, to account for consumer-level (see web appendix B for more details).

heterogeneity. As such, we relied on within-person vari- Payment Frequency and Income. We have suggested

ability in consumer’s monthly payment frequency and that the relationship between payment frequency and

spending. All standard errors were clustered at the con- spending should depend on situational factors that impact

sumer level. These models were run using the felm func- prediction uncertainty. Since prediction uncertainty should

tion in the lfe R package. As hypothesized, all models decrease as one’s income increases, we next analyzed

found that consumers’ payment frequency was a significant whether consumers’ monthly income level moderated the

predictor of the number of expenditures consumers made, relationship between payment frequency and spending.

such that higher payment frequencies predicted a greater Indeed, we found a significant interaction between con-

number of expenditures (model 3: b ¼ 3.35, t(20389) ¼ sumers’ payment frequency and their income level on the

18.50, p < .001, Cohen’s f2 ¼ .06, see table 1 for all number expenditures (b ¼ 0.55, t(20388) ¼ 6.26, p < .001)

models).1 as well as their total spending (b ¼ 0.03, t(20388) ¼ 22.18,

We then performed the same analysis with consumers’ p < .001), such that the relationship between payment fre-

total spending amount during the month as our dependent quency on spending was attenuated at higher-income lev-

variable (log-transformed). As such, we had the following els, see table 2 and web appendix B for more details).

model specifications:

Discussion

Log ðSpendingÞit ¼ b1 Payment Frequencyit þ ai þ it

This study found that payment frequency predicted

(4) spending. Higher payment frequencies were associated

with higher spending both in terms of the number of expen-

1 The relationship between payment frequency and spending is sig- ditures and the amount of spending. The relationship be-

nificant using a Poisson regression or a negative binomial regression. tween payment frequency and spending was robust to the6 DE LA ROSA AND TULLY

TABLE 1

THE OBSERVED RELATIONSHIP BETWEEN PAYMENT FREQUENCY AND SPENDING (STUDY 1)

Dependent variable

Number of expenditures Log(spending)

(1) (2) (3) (4) (5) (6)

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

Payment frequency 3.771*** 3.525*** 3.350*** 0.071*** 0.048*** 0.046***

(0.186) (0.178) (0.181) (0.002) (0.002) (0.002)

Log(income) 1.569*** 1.527*** 0.143*** 0.143***

(0.220) (0.217) (0.008) (0.008)

Month fixed effects No No Yes No No Yes

Consumer-level fixed effects Yes Yes Yes Yes Yes Yes

Observations 51,230 51,230 51,230 51,230 51,230 51,230

Note: þp < .01; *p < .05; **p < .01; ***p < .001.

TABLE 2

THE OBSERVED INTERACTION BETWEEN PAYMENT FREQUENCY AND INCOME ON SPENDING (STUDY 1)

Dependent variable

Number of expenditures Log(spending)

(1) (2) (3) (4)

Payment frequency 2.072** 2.058** 0.232*** 0.232***

(0.787) (0.775) (0.013) (0.013)

Log(income) 0.505* 0.500* 0.090*** 0.090***

(0.208) (0.206) (0.007) (0.007)

Interaction term (payment frequency Log(income)) 0.564*** 0.545*** 0.028*** 0.028***

(0.088) (0.087) (0.001) (0.001)

Month fixed effects No Yes No Yes

Consumer-level fixed effects Yes Yes Yes Yes

Observations 51,230 51,230 51,230 51,230

Note: þp < .01; *p < .05; **p < .01; ***p < .001.

inclusion of multiple controls, as well as various operation- we created a life simulation where participants earned in-

alizations of payment frequency. The results indicate that come, incurred expenses, and made a series of binary

getting paid every workday as opposed to once a week spending decisions. We varied the frequency with which

would increase monthly spending by approximately $20. participants got paid such that some participants were paid

Furthermore, the results suggest that the relationship of weekly (lower payment frequency), whereas others were

payment frequency on spending may be attenuated at high- paid daily (higher payment frequency). We expected

income levels. higher (vs. lower) payment frequency to result in more

Of course, as with any correlational data, it is not possi- spending, and for these differences in spending to be medi-

ble to establish causality. Furthermore, while we try to con- ated by consumers’ subjective wealth perceptions.

trol for consumers’ monthly income, we recognize that the

amount of money deposited into a consumer’s account is

Method

an imperfect measure of their entire financial situation.

Thus, the following study uses a more controlled lab envi- This study was pre-registered on AsPredicted.org

ronment to examine the causal link between payment fre- (https://aspredicted.org/hn2am.pdf). Four hundred and five

quency and spending. participants completed the study on Prolific Academic in

exchange for monetary compensation. Participants were in-

STUDY 2: PAYMENT FREQUENCY’S formed that they would play a life simulator game in which

IMPACT ON SPENDING AND they would work, incur expenses, and make spending deci-

SUBJECTIVE WEALTH sions just as they would in real life. All participants were

given the same starting balance in their checking account

Study 2 aimed to examine the impact of payment fre- ($850). Participants could spend more than was in their

quency on spending in a more controlled setting. To do so, checking account, but to increase realism they wereJOURNAL OF CONSUMER RESEARCH 7

informed that if their balance ever went negative, they Results

would incur a $35 overdraft fee (the most common amount

Four participants failed the attention check and were ex-

charged for overdrafting; see Bankrate 2018). Participants

cluded from all analyses, leaving a final sample of 401 par-

were asked to make decisions as they would in their every-

ticipants (Mage ¼ 32.07, 48% female). Overall, participants

day life.

All participants received the same total amount of in- reported making decisions as they would in real life, with

come during the five weeks ($2,800). However, the dis- the median response rating being a 7 out of 7 (M ¼ 6.63,

bursement of these funds varied by condition. At the SD ¼ 0.70).

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

beginning of the study, participants in the high payment Spending. We first examined our primary dependent

frequency condition read that they would receive $140 per measure: the number of times a participant chose the more

day, every Monday through Friday. In contrast, those in expensive option across the 15 decisions in the life simula-

the lower payment frequency condition read that they tion. Consistent with our hypothesis, participants in the

would receive $700 per week, every Friday. As participants higher payment frequency condition chose the more expen-

worked and earned income, participants were informed of sive options significantly more often than those in the

their earnings (i.e., “You earned $700 this week”). lower payment frequency condition (Mhigher payment frequency

Participants incurred bills (e.g., rent, phone bill, utilities) ¼ 6.17, SD ¼ 2.55 vs. Mlower payment frequency ¼ 5.16, SD ¼

and made 15 binary spending decisions (e.g., whether to 2.09), t(399) ¼ 4.35, p < .001, Cohen’s d ¼ .43.

eat out or not, whether to go to a concert or not, whether to As a secondary dependent measure, we examined

buy expensive or cheap sneakers) throughout the life simu- whether payment frequency impacted the total amount of

lation (see web appendix C for a complete list of decisions money consumers’ spent overall. Aggregating the amount

and a short video preview of the simulation). For each of of money spent across the 15 decisions, participants in the

the 15 decisions, there was a more expensive option and a higher payment frequency condition spent more money

less expensive option. For example, in one decision, con- than those in the lower payment frequency condition

sumers could choose to eat out or cook dinner at home (Mhigher payment frequency ¼ $404.35, SD ¼ $122.26 vs.

(more expensive vs. no expense decision), and in another

Mlower payment frequency ¼ $363.55, SD ¼ $107.73), t(399) ¼

decision, they could choose to buy an expensive or cheap

3.55, p < .001, Cohen’s d ¼ .35.

pair of jeans (more expensive vs. less expensive). The

number of times a person chose the more expensive option Subjective Wealth Perceptions. We combined the four

across the 15 decisions served as our primary dependent questions assessing participants’ subjective wealth percep-

measure. Participants were always shown their current tions into a single index, reverse-coding the last two ques-

checking account balance at the bottom of every screen in tions (Cronbach’s a ¼ 0.77). As expected, participants in

order to control for any differences in the potential saliency the higher payment frequency condition reported higher

of their checking accounts (e.g., “Current Checking subjective wealth perceptions relative to those in the lower

Account Balance: $850”). payment frequency condition (Mhigher payment frequency ¼

After participants finished the life simulation, they were 2.86, SD ¼ 1.22 vs. Mlower payment frequency ¼ 2.24, SD ¼

asked to write down any reflections they had regarding 1.01), t(399) ¼ 5.53, p < .001, Cohen’s d ¼ .55. Thus,

their experience. Next, participants answered four ques- even though participants in the daily condition ended the

tions assessing their subjective wealth perceptions through- life simulation with objectively less money (since they

out the simulation: Based on your experience in the life spent more), they felt that they had more financial

simulation, how often did you. . . (1) feel like you had ex- resources.

cess money?, (2) feel like you had more than enough We then examined whether perceptions of subjective

money?, (3) feel like you had a low checking account bal- wealth mediated the effect of payment frequency on the

ance?, and (4) make a decision you did not want to make number of times participants chose the more expensive op-

because you had a low checking account balance? (all 7- tion. To do so, we utilized the bootstrapping mediation

point scales, 1 ¼ Never, 7 ¼ Always). method outlined in Hayes (2017) (PROCESS, Model 4). In

Participants were then given a list of three decisions, line with our predictions, subjective wealth perceptions

where two were decisions they made during the simulation, significantly mediated the effect of payment frequency on

and one was not. They were asked to select which of the the number of expensive decisions (indirect effect ¼ 0.27,

three decisions listed was not a decision they had to make 95% CI [0.12, 0.46], 10,000 resamples).

during the life simulation. This measure served as an atten-

tion check to filter out participants who had not paid atten-

tion throughout the simulation. Finally, participants

Discussion

reported to what extent they made decisions as they would In study 2, participants paid more frequently spent more

have made in real life on a 7-point scale (1 ¼ not at all, than participants who were paid less frequently. Moreover,

7 ¼ very much) and shared their demographic information. this study found that the effect of payment frequency on8 DE LA ROSA AND TULLY

spending was explained by differences in consumers’ per- participants made the same expenditures totaling $2,600.

ceptions of their subjective wealth. In this study, partici- Participants in the higher payment frequency condition re-

pants were allowed to spend as much as they wanted, even ceived $100 each day, while participants in the lower pay-

if it meant having a negative checking account balance. ment frequency condition received $700 each week. As

However, the overdraft fee may have created the sense of such, all participants earned $2,800 in the simulation.

having liquidity constraints. Thus, across two additional Each day, participants saw their income, expenses, and

web appendix studies, we examine the effect of payment checking account balance. Importantly, participants in the

frequency on spending in contexts where lack of liquidity daily pay condition started the simulation with $20 while

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

is not a concern. These results demonstrate that higher pay- participants in the weekly pay condition started the simu-

ment frequency increases spending even in the absence of lation with $500. Thus, participants in the daily pay con-

any overdraft fees or when account balances and spending dition had a lower average daily balance ($322 vs. $513)

opportunities are constructed such that participants can and a lower minimum balance than the weekly pay condi-

never run out of money (web appendices D and E). tion ($20 vs. $44; see web appendix F for daily account

balances).

STUDY 3: OBJECTIVE VERSUS After the simulation, participants were asked six ques-

SUBJECTIVE WEALTH tions measuring their subjective wealth perceptions on a

101-point scale (0 ¼ not at all, 100 ¼ very much): As you

Study 2 demonstrated that higher payment frequency were going through the simulation, to what extent did you

increases consumer spending by increasing subjective feel like you (1) had a lot of money? (2) had more than

wealth perceptions. Study 3 aimed to examine the link be- enough money? (3) had excess money? (4) lacked money?

tween payment frequency and subjective wealth percep- (5) did not have enough money, and (6) were going to run

tions. In particular, study 3 was designed to disentangle out of money? Participants then answered four questions

differences in subjective wealth from differences in objec- regarding their prediction uncertainty on a 101-point scale

tive wealth. Because getting paid more frequently often (0 ¼ disagree, 100 ¼ agree): My daily income and expenses

results in receiving funds earlier, those paid more fre- made (1) it easy to predict whether I would have enough

quently often have greater accumulated wealth on any money throughout the simulation, (2) it difficult to predict

given day compared to those paid less frequently. Indeed, whether I would have enough money throughout the simu-

in the previous study, while total income and possible lation, (3) me feel confident predicting whether I would

expenditures were held constant across conditions, partici- have enough money throughout the simulation, and (4) me

pants in the higher payment frequency condition had a feel uncertain predicting whether I would have enough

higher average daily account balance than participants in money throughout the simulation.

the lower payment frequency condition. To isolate the im- Participants were then asked if they believed they had

pact of payment frequency on subjective wealth, in this taken part in a similar study in the past. We asked partici-

study, those paid less frequently were endowed with more pants to answer this question honestly and assured them

money than those paid more frequently. that their answer would not affect their compensation for

Moreover, study 3 examined why, if not for differences the study. Next, participants were asked three attention

in objective wealth, payment frequency increases subjec- check questions: (1) how often they were paid, (2) how

tive wealth. We have suggested that getting paid more fre- much they were paid per paycheck, and (3) the typical

quently decreases consumers’ uncertainty in predicting range for their daily expenses. Finally, participants

whether they will have enough resources throughout a pe- reported their demographic information.

riod, which leads to higher subjective wealth perceptions.

To examine this explanation for changes to subjective Results

wealth, we measured subjective wealth, as well as consum- Thirty-one participants reported taking a similar study in

ers’ prediction uncertainty. the past and nine additional participants failed our attention

checks. Consistent with the exclusion criteria used in all of

Method our lab studies, these participants were excluded from

One hundred and fifty-two participants completed the all analyses, leaving a final sample of 112 participants

study on Amazon Mechanical Turk in exchange for mone- (Mage ¼ 36.59, 41% female).

tary compensation. This study was similar to the previous Subjective Wealth Perceptions. We combined the six

life simulation, except that the life simulation included 28 subjective wealth perception measures into an index

“days.” To isolate the impact of payment frequency from (Cronbach’s a ¼ 0.93).2 Consistent with our hypothesis,

the impact of objective wealth, all expenses were held con-

stant. Specifically, all participants saw the same daily 2 We conducted a principal component analysis to understand

expenses, and no expenses were optional such that all whether our subjective wealth and prediction uncertainty measuresJOURNAL OF CONSUMER RESEARCH 9

but in contrast to what would be predicted by objective frequencies are more likely to lead to a pattern of daily re-

wealth levels, participants in the higher payment frequency source decumulation, which should increase consumers’

condition reported higher subjective wealth perceptions prediction uncertainty. When the frequency and timing of

than participants in the lower payment frequency condition expenses enable consumers with lower payment frequen-

(Mhigher payment frequency ¼ 44.40, SD ¼ 25.55 vs. Mlower pay- cies to avoid patterns of resource decumulation, differences

ment frequency ¼ 34.57, SD ¼ 24.17), t(110) ¼ 2.09, p ¼ in prediction uncertainty and subjective wealth across pay-

.039, Cohen’s d ¼ .40. ment frequencies should be attenuated. We tested this mod-

eration in study 4.

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

Prediction Uncertainty. We combined the four predic-

In study 4, we also examined two alternative explana-

tion uncertainty measures into an index (Cronbach’s a ¼

tions for the effect of payment frequency on subjective

0.92). Consistent with our hypothesis, participants in the wealth. One alternative explanation is that because con-

higher payment frequency condition indicated feeling less sumers prefer receiving segregated (vs. aggregated) gains

uncertainty than participants in the lower payment fre- (Thaler 1985, 1999), consumers who receive higher pay-

quency condition in predicting whether they would have ment frequencies—and thus receive income in their pre-

enough resources throughout the simulation (Mhigher payment ferred manner—may feel better about their financial

frequency ¼ 35.29, SD ¼ 23.16 vs. Mlower payment frequency ¼ situation, resulting in greater subjective wealth. Another al-

50.34, SD ¼ 28.63), t(110) ¼ 3.05, p ¼ .003, Cohen’s ternative explanation is that segregated gains are miscalcu-

d ¼ .58. lated to be larger than their equivalent sum. Both of these

Mediation. As predicted, the impact of payment fre- explanations suggest that expense frequency should be ir-

quency on subjective wealth perceptions was mediated by relevant in moderating the effect of payment frequency on

differences in prediction uncertainty (indirect effect ¼ subjective wealth perceptions.

8.22, 95% CI [2.55, 13.89], 10,000 resamples).

Method

Discussion This study was pre-registered on AsPredicted.org

In study 3, participants paid more (vs. less) frequently (https://aspredicted.org/np53c.pdf). Five hundred and

felt greater subjective wealth. This effect emerged despite ninety-nine participants completed the study on Prolific

the fact that initial endowments differed across conditions Academic in exchange for monetary compensation. This

such that those paid more frequently had objectively less study used the same design as study 3 with the following

money than those paid less frequently. These subjective two exceptions. First, all participants received the same ini-

wealth differences were explained by differences in con- tial endowment amount ($500). Second, aside from manip-

sumers’ prediction uncertainty. ulating consumers’ payment frequency, we also

manipulated the frequency of consumers’ expenses. In the

higher expense frequency conditions, participants paid

STUDY 4: MODERATING THE EFFECT expenses every day. In contrast, in the lower expense fre-

OF PAYMENT FREQUENCY ON quency condition, participants’ expenses were aggregated

SUBJECTIVE WEALTH and paid once a week (on Fridays). Thus, this study used a

2 (payment frequency: higher vs. lower) 2 (expense fre-

Studies 2 and 3 demonstrate that payment frequency

quency: higher vs. lower) design. Importantly, the total

impacts subjective wealth perceptions (hypothesis 1).

amount of income and expenses was held constant across

Study 3 suggests that the effects of payment frequency are

all conditions.

not solely the result of objective wealth differences. After the simulation, participants answered the same

Instead, study 3 demonstrates that the effect of payment questions as in study 3.

frequency on subjective wealth perceptions is explained by

differences in consumers’ prediction uncertainty (hypothe-

Results

sis 2). If so, situational factors that reduce differences in

consumers’ prediction uncertainty should attenuate the ef- Thirty-seven participants reported taking a similar study

fect of payment frequency on subjective wealth percep- in the past and 34 additional participants failed our atten-

tions (hypothesis 3). tion checks. As pre-registered, these participants were ex-

According to our account, the frequency of expenses can cluded from all analyses, leaving a final sample of 528

impact consumers’ prediction uncertainty. Due to the high participants (Mage ¼ 32.06, 47% female).

frequency of expenses and the inability to offset these Subjective Wealth Perceptions. We combined the six

expenses as they occur, lower (vs. higher) payment subjective wealth measures into an index (Cronbach’s a ¼

loaded onto two different factors. Indeed, they did (see web appendix 0.89). We then regressed participants’ subjective wealth

G for more details). perceptions on their payment frequency (higher payment10 DE LA ROSA AND TULLY

frequency ¼ 1, lower payment frequency ¼ 1), expense Discussion

frequency (higher expense frequency ¼ 1, lower expense

Study 4 shows that differences in subjective wealth

frequency ¼ 1), and the interaction term between these across payment frequencies result from differences in

two factors. The model revealed a significant main effect experiencing resource decreases. Specifically, lower (vs.

of payment frequency (b ¼ 5.57, t(524) ¼ 5.42, p < .001) higher) payment frequencies typically result in larger and

and a significant main effect of expense frequency (b ¼ more frequent resource decreases, which increase consum-

6.05, t(524) ¼ 5.90, p < .001) on consumers’ subjec- ers’ uncertainty in predicting whether they will have

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

tive wealth perceptions. Importantly, these effects were enough resources throughout a period. As such, when con-

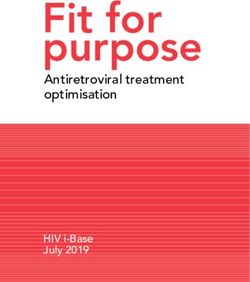

qualified by a significant interaction (b ¼ 4.10, t(524) ¼ sumers with lower payment frequencies did not experience

3.99, p < .001, Cohen’s f ¼ .17) (figure 1). When expenses larger, more frequent resource decreases than those with

were incurred on a daily basis, we replicated the effects in higher payment frequencies, the effect of payment fre-

previous studies, such that higher payment frequency led to quency on subjective wealth was attenuated.

higher subjective wealth perceptions compared to lower

payment frequency (b ¼ 19.32, t(524) ¼ 6.66, p < .001). In STUDY 5: PAYMENT FREQUENCY’S

contrast, when expenses were incurred on a weekly basis, IMPACT ON PREDICTION

payment frequency did not significantly impact subjective UNCERTAINTY, SUBJECTIVE WEALTH,

wealth perceptions (b ¼ 2.94, t(524) ¼ 1.01, p ¼ .311).

AND SPENDING

Prediction Uncertainty. We combined the four predic- Study 5 was designed to examine the full model, whereby

tion uncertainty measures into an index (Cronbach’s a ¼ higher payment frequencies decrease prediction uncertainty,

0.91). We then regressed participants’ prediction uncer- thereby increasing subjective wealth, and in turn, spending.

tainty on their payment frequency, expense frequency, and To do so, we returned to the version of the life simulation

the interaction term between these two factors using the where participants could make spending decisions (as in

same effect coding as in the previous analysis. The model study 2). Moreover, we aimed to ensure that differences in

revealed a significant main effect of payment frequency subjective wealth were not the result of differences in objec-

(b ¼ 3.16, t(524) ¼ 2.70, p ¼ .007) and a significant tive wealth by using a context in which higher payment fre-

main effect of expense frequency (b ¼ 4.46, t(524) ¼ 3.82, quencies result in a lower average daily account balance than

p < .001) on consumers’ prediction uncertainty. Again, lower payment frequencies. Instead of varying initial endow-

ments as in study 3, in study 5, participants were paid either

these effects were qualified by a significant interaction

daily or bi-weekly, but we changed the bi-weekly pay sched-

(b ¼ 5.28, t(524) ¼ 4.52, p < .001, Cohen’s f ¼ .20).

ule so that participants received their first bi-weekly pay-

When expenses were incurred on a daily basis, higher pay-

check after the first week and their last bi-weekly paycheck

ment frequency significantly decreased consumers’ predic- in the second to last week. Thus, total pay was held constant

tion uncertainty compared to lower payment frequency across conditions, but those paid bi-weekly had a higher av-

(b ¼ 16.87, t(524) ¼ 5.11, p < .001). In contrast, when erage daily balance than those paid daily. If differences in

expenses were incurred on a weekly basis, payment fre- spending result from differences in objective wealth levels,

quency did not significantly impact prediction uncertainty then those in the lower payment frequency condition should

(b ¼ 4.24, t(524) ¼ 1.28, p ¼ .200). spend more than those in the higher payment frequency con-

dition. However, if higher payment frequencies increase per-

Moderated Mediation. A moderated mediation analysis ceptions of subjective wealth by decreasing prediction

was conducted using PROCESS Model 7 (Hayes 2017). uncertainty, then those in the higher payment frequency con-

We found support for the expected moderated mediation dition should spend more than those in the lower payment

(indirect effect ¼ 4.86, 95% CI [2.71, 7.13], 10,000 resam- frequency condition despite the differences in objective

ples). The analysis showed that when consumers experi- wealth. Moreover, these differences in spending should be

enced daily expenses, their prediction uncertainty mediated explained by differences in subjective wealth perceptions

the effect of payment frequency on subjective wealth (indi- that result from differences in prediction uncertainty.

rect effect ¼ 3.88, 95% CI [2.32, 5.52], 10,000 resamples). We considered the possibility that the effect of payment

However, this mediation was not observed when consum- frequency on spending may be multiply determined. Thus,

in addition to measuring subjective wealth as the primary

ers experienced weekly expenses (indirect effect ¼ 0.98,

mechanism, we examined other potential mechanisms. One

95% CI [2.47, 0.51], 10,000 resamples).3

possibility is that due to the shorter time period between

paychecks, higher payment frequencies reduce the extent

3 For the curious mind, results are consistent and significant when

allowing for a direct effect of expense frequency on subjective wealth to which consumers plan for future expenses, which could

as well (PROCESS Model 8). increase spending. Another possibility is that, becauseJOURNAL OF CONSUMER RESEARCH 11

FIGURE 1

THE EFFECT OF PAYMENT FREQUENCY AND EXPENSE FREQUENCY ON SUBJECTIVE WEALTH PERCEPTIONS (STUDY 4)

100

*** NS

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

Subjective Wealth Perceptions

75

53.89

49.98 50.95

50

30.65

25

0

Higher Expense Frequency (Daily Expenses) Lower Expense Frequency (Weekly Expenses)

Higher Payment Frequency (Daily Pay) Lower Payment Frequency (Weekly Pay)

Notes: Expense frequency moderated the effect of payment frequency on consumers’ subjective wealth perceptions (study 4). Error bars represent 95% confidence

intervals. Significance levels: þp < .1; *p < .05; **p < .01; ***p < .001.

segregated gains have a larger effect on affect than aggre- hundred participants completed the study on Prolific

gated gains (Morewedge et al. 2007), spending differences Academic in exchange for monetary compensation.

across payment frequencies may be a function of affect Participants played a four-week life simulator where they

differences. Although the compensatory and retail therapy had to work and make spending decisions. All partici-

literature would suggest that negative affect increases pants started with an $875 checking account balance.

spending (Atalay and Meloy 2011), some research sup- Participants were then randomly assigned to either a

ports the possibility that positive affect increases spend- higher payment frequency condition or a lower payment

ing (Babin and Darden 1996). To examine these frequency condition ($140 daily, every Monday through

possibilities, in study 5, we measured planning behavior Friday vs. $1,400 bi-weekly, every other Friday), with

and affect. For each measure, we aimed to explore those in the lower payment frequency condition receiving

whether the potential mechanism was operating, and if so, their first bi-weekly paycheck on the first Friday of the

whether it was a better explanation for the effect of pay- simluation. This ensured that with no differences in

ment frequency on spending than subjective wealth differ- spending, the average daily balance in the lower payment

ences. Finally, we also measured participants’ financial frequency condition would be higher than the average

literacy and intertemporal discount rates to examine daily balance in the higher payment frequency condition

whether either of these factors moderated the effect of ($2,516 vs. $2,371; see web appendix H for complete

payment frequency on spending. details). In this life simulation, all expenses (including

bills) had a decision associated with them and partici-

pants made one spending decision per day (28 in total,

Method see web appendix I for the complete list of decisions).

This study was pre-registered on AsPredicted.org For each decision, one option was more expensive and

(https://aspredicted.org/zd5xz.pdf). One thousand two the other option was either less expensive or resulted in12 DE LA ROSA AND TULLY

no spending. As in study 2, the number of times a partici- Results

pant selected the more expensive option served as our pri-

Seventeen participants failed the attention check ques-

mary dependent measure. There were no overdraft fees in

tion and 66 participants reported previously participating

this study.

in a similar experiment. As pre-registered, these partici-

After going through the life simulation, participants com-

pants were excluded from all analyses, leaving a final sam-

pleted the subjective wealth and prediction uncertainty meas-

ple of 1,120 participants (Mage ¼ 32.71, 52% female).

ures from studies 3 and 4. They also answered the same

attention check question as in study 2. To measure planning Spending. First, we examined the number of times a

Downloaded from https://academic.oup.com/jcr/advance-article/doi/10.1093/jcr/ucab052/6373900 by guest on 30 December 2021

behavior, participants indicated their level of agreement with participant selected the more expensive option across the

the following three statements: During the life simulation. . . 28 decisions. Replicating the results of study 2, participants

(1) I actively tried to plan for large upcoming bills (rent, cell- in the higher payment frequency condition selected the

phone, TV and internet, health insurance, gas and electricity, more expensive option significantly more often than those

etc.), (2) I actively tried to budget for future expenses, and (3) in the lower payment frequency condition, (Mhigher payment

I consulted my checking account balance to budget how to frequency ¼ 17.00, SD ¼ 3.63 vs. Mlower payment frequency ¼

spend my money for the next few days (all on 7-point scales: 15.21, SD ¼ 3.30), t(1,118) ¼ 8.64, p < .001, Cohen’s d ¼

1 ¼ disagree, 7 ¼ agree). Participants were then asked to think .52. In addition, participants in the higher payment fre-

back to their experience in the life simulation and report their quency condition spent more money on their purchases

valence, arousal, and power during the simulation using the compared to participants in the lower payment frequency

3-item Self-Assessment Manikin scale (Bradley and Lang condition (Mhigher payment frequency ¼ $2,919.58, SD ¼

1994). $198.39 vs. Mlower payment frequency ¼ $2,816.52, SD ¼

In addition, we measured participants’ financial literacy $175.98), t(1,118) ¼ 9.19, p < .001, Cohen’s d ¼ .55. We

(8 items, Lusardi and Mitchell 2011) and intertemporal also analyzed each of the individual spending decisions

discount rates (16 item titration task) to explore whether across the 28 days (see figure 2 and web appendix K for

either of these factors moderated the effect of payment more details).

frequency on spending. As in prior studies, in order to Aside from having a lower average daily balance over-

ensure the naivety of our sample, we asked participants all, participants in the higher payment frequency condition

whether they believed they had taken this study in had a lower checking account balance than those in the

the past. Finally, participants completed demographic lower payment frequency condition on 20 out of the

questions. 28 days. Thus, we ran an additional analysis to understand

FIGURE 2

PARTICIPANTS SPENDING DECISIONS ACROSS DAY AND PAYMENT FREQUENCY CONDITION (STUDY 5)

+

Choosing the More Expensive Option

100%

** **

Percentage of Participants

*

75% ***

** *

+ ***

50%

*** *** ***

*** **

25% ***

**

0%

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28

Day (1−28)

Higher Payment Frequency (Daily Pay) Lower Payment Frequency (Bi−Weekly Pay)

Notes: Participants’ spending decisions across day and payment frequency condition (study 5). Higher (vs. lower) payment frequency led to more spending through-

out the period. Error bars represent 95% confidence intervals. Significance levels: þp < .1; *p < .05; **p < .01; ***p < .001.You can also read