HEALTH THEME: Actuarial ...

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

QUARTERLY MAGAZINE OF THE ACTUARIAL ASSOCIATION OF EUROPE

2 5 9

GOOD POLICY STARTS HOW TO PRIORITISE DECISION-MAKING

WITH GOOD DATA VACCINATION IN UNCERTAINTY

12 18

THEME:

HEALTH

EIOPA OPINION ON SOLVENCY II

REVIEW: CONCERNS OF AAE

15 16

COLUMN:

SOLVENCY II REVIEW

N O 25 XIII ITALIAN THE 2020 AAE

ACTUARIAL CONGRESS PRESIDENTS' MEETING

MAR 2021INTERVIEW

GOOD POLICY

STARTS WITH

GOOD DATA INTERVIEW BY

ANDRÉ DE VOS

The Dutch handling of the

corona pandemic is driving

Maurice de Hond crazy.

According to this Dutch

political pollster, medical

professionals wield far too

much power when it comes to

curbing the virus. ‘We need

to make decisions based on

good data, not on the medical

opinions of a small group of

specialists.’

MAURICE DE HOND has

a background in market

research and runs his own

polling agency View/Ture.

He started publishing MAURICE DE HOND

blogs and scientific

publications on corona on

his website Maurice.nl in

March 2020.

2

THE EUROPEAN ACTUARY NO 25 - MAR 2021 GOOD POLICY STARTS WITH GOOD DATA‘F

irst they ignore you, then De Hond had his ‘Eureka in the lead. It’s virologists

they ridicule you and in the moment’ at the beginning of and epidemiologists who are

end they say they knew all April 2020 when he saw a video determing Dutch policy. They

along.’ Maurice de Hond is not by a Japanese professor that have become very powerful

the person to shy away from a showed how aerosols move because the government chooses

public quarrel. De Hond became around in a closed space. ‘That to heed their advice exclusively.

well-known in the Netherlands video explained most convincingly The dominant view in the medical

with his method for predicting how the virus is spread and why profession is that every Covid-

the outcome of general elections. all these ‘superspreader events’ death is one too many. Hence the

Since then he has been in the always occur indoors. And lock-down, the closing of schools

Dutch media with an array of why good ventilation systems and shops, the 1.5 metre rule.

topics ranging from proposals are essential. In Japan and Even though we don’t know how

for the improvement of the many other countries this was effective each measure is.’

educational system to trying to the dominant theory from the

revoke a conviction in a murder beginning. In the Netherlands we

case. stuck to the droplet-theory, and ‘Virologists and epidemiologists

based all corona measures on it. are scaring people, the media

Mistakenly so.’ are making it worse, the general

His interest in corona started public gets scared and politicians

when news of the outbreak in feel forced to react with even

Wuhan first hit the headlines. It took a while before mouth starker measures. The medical

By the end of January 2020 he masks were accepted in approach hardly leaves room for a

included a question about the the Netherlands to prevent different view. The mass hysteria

novel virus in his own periodic spreading. In the beginning they is fuelled by doctors. They’ve

poll amongst Dutch citizens. ‘Is were regarded as useless by RIVM become part of the problem.’

this going to be as bad as the and the government. Instead the

Spanish flu?’ focus was on hand washing and

keeping a distance of 1.5 metres. A good illustration is a recent

Only recently and not quite interview with a prominent

He decided to dive into wholeheartedly has RIVM, and Dutch health official who cited

international scientific research the Dutch government, admitted the death of a 17-year-old to

on viruses and even launched that aerosols might play a role demonstrate that Covid-19

a website where he publishes in spreading the virus. And that doesn’t only affect the elderly.

his views and that of scientists good ventilation is important. ‘I checked the statistics in that

from around the world. From the period and there was only one

beginning De Hond has been a death under 25 in the whole of

strong defender of the theory ‘ The mass hysteria is the Netherlands: exactly the

that the coronavirus is spread person that was mentioned by the

through the air by aerosols rather

fuelled by doctors. official. You can’t use that as an

than by small droplets that hit They’ve become part example! Unless your goal is to

nose or mouth. The latter theory of the problem.’ scare people. I might counter with

is the one that is embraced by the case of the 90-year-old that

the national Dutch institute jumped from a balcony because

for public health (RIVM) and De Hond explains the he couldn’t stand the isolation

the World Health Organisation stubbornness of the government anymore.’

(WHO). It’s also the theory upon in ignoring alternative

which official Dutch corona explanations looking at the

policy is based. Dutch approach to controlling De Hond would rather see a

the pandemic. ‘Doctors are broad range of professionals

3

THE EUROPEAN ACTUARY NO 25 - MAR 2021 GOOD POLICY STARTS WITH GOOD DATAadvising the Dutch government all kinds of relevant questions. De Hond suggests the use of

how to address the pandemic. We would’ve had a gold mine of open data that are accessible

Not just virus specialists, information by now, a database to everybody. ‘Good data can

but economists, behavioural with 8 million responses, for good be gathered. Good analysis is

scientists, psychologists, data- policy building. But even now we difficult. We’re spending billions

specialists, you name it. ‘The are installing new regulations on corona. I would surely spend

problem with the current medical without knowing how they will a few millions more on data

monopoly is that they don’t get work out, and without knowing analysts in every hospital. Make

to see the drawbacks of the how to get back to normal, data accessible. You would be

policy they are defending. Shops because we haven’t got the right surprised by the smart models

and cafes that go under, the data. When the contaminations that even interested civilians can

increasing number of children go down, are we going to open up come up with. Why not use that

facing psychological and learning the hairdressers, or the schools? intellectual power?’

problems because they can’t go to Nobody knows.’

school.’

The vaccination in the

‘ I would surely spend Netherlands – which only started

‘The medical focus on avoiding in the beginning of January – is

every single Covid-death doesn’t

a few millions more just as clumsily organized as

make sense. Hundreds of traffic on data analysts in the corona measures, says De

deaths can be avoided every every hospital. Make Hond. ‘At the beginning of the

year if we start driving 30 km per pandemic in 2020 we should have

data accessible.’

hour on our inter-city highways. nationalised and centralized

But nobody in his right mind health organisations. We would

would suggest such a thing. Why have been prepared for a second

not have the same approach The problem according to De wave and vaccination. Now we

to corona? The risks for under Hond is that neither medical make the same mistakes all over.

60-year-olds aren’t that much professionals nor their We have discussions on who

bigger than those of a common organisations are very good to vaccinate first. It’s all very

flu. There’s no need to keep all with statistical data. ‘That makes bureaucratic.’

those people in lock-down. It’s you miss out on a lot of relevant

the over 60’s you want to protect. information. Data are my job, my

Base your policy on that.’ life, it’s what I do. It’s a different De Hond didn’t contract corona

angle altogether. At the beginning himself. He keeps himself safe by

of the pandemic you could see avoiding badly ventilated and dry

Good policy starts with good the pattern that the regions spaces. He carries a CO2-meter

data, according to De Hond. And most affected all had the same that tells him if enough fresh

that’s where he thinks it all went climatic conditions: temperature air is circulating. He agrees that

wrong in the Netherlands. ‘Good between 4 and 12 degrees, low western countries can’t battle

data have been lacking from the humidity. That’s no coincidence. Covid-19 the way China does. So

beginning. The Covid-data in It had been affirmed by a group it will have to be done in a clever

the Netherlands are still horrific. of scientists that these are perfect way. With the acknowledgment

Only now do we get reliable daily circumstances for the spread of that it’s impossible to avoid all

figures on the number of positive corona. Based on these data I corona deaths. ‘We need to learn

tests per day. Ten months into predicted that New York would to cope with the risks of this virus.

the pandemic! When we started become the new Bergamo. The As we do with traffic risk, or all

testing in the spring, we could data also explained why there kind of other risks in daily life.’

have asked each positive tested were no extra deaths in Rome in

person to fill out a survey with March and April.’

4

THE EUROPEAN ACTUARY NO 25 - MAR 2021 GOOD POLICY STARTS WITH GOOD DATAHOW TO PRIORITISE

VACCINATION

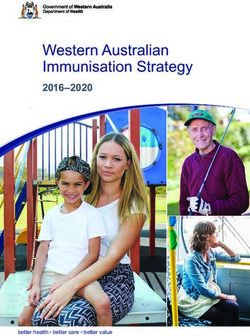

Remarkably, mankind has developed a range of vaccines in little more than 12

months since the identification of the novel coronavirus in late 2019. The big

issue as we enter 2021 is how should those vaccines most responsibly be rolled

out? Stuart McDonald, Yifei Gong and John Roberts, three actuaries working on

demographic and epidemiological data, have been to the fore of analysis of the

benefits of the strategic distribution of early vaccines to the most vulnerable

categories of the population. We set out here a summary of their recent work.

IN THE UK, THERE WERE 9 PRIORITY

GROUPS IDENTIFIED. BROADLY SPEAKING

THEY WERE:

1 residents in care homes, together with

care home workers

2 over 80s, together with health care staff

3 over 75s

4 over 70s and clinically vulnerable

5 over 65s

6 people under 65 with health issues

7 over 60s

8 over 55s

9 over 50s

10 the rest

5

THE EUROPEAN ACTUARY NO 25 - MAR 2021 HOW TO PRIORITISE VACCINATIONUsing actuarial techniques, the groups were The population of England was analysed to

analysed to see what proportion of COVID-19 categorise the population by group and to

deaths had occurred in each segment of analyse the death data into the same groups.

the population and what proportion of the Some approximations were needed but the

population fell into each category. Acquiring majority of the age-related categories were easily

suitable data in an emerging pandemic is extracted. A table was then built up to show the

difficult but Governments have collected proportion of deaths that might have been saved

copious material to enable them to monitor the with an effective vaccine having been delivered

situation. The modelling was done on the basis to that category. Clearly, the vaccine might not

of COVID-19 attribution featuring on certificates be totally effective and vaccination not carried

of death as a reasonably objective piece of out to the full, but the relative impact of each

information. category is clearly seen in the data.

At its simplest, how many vaccinations are

required to prevent one death:

Priority Group Percentage Number of vaccines Percentage of Lives

of Population required to save a Saved (Cumulative)

(Cumulative) life

1 2% 10 32%

2 15% 90 67%

3 19% 180 78%

4 28% 360 88%

5 33% 570 93%

6 47% 2000 96%

7 50% 900 97%

8 55% 1800 98%

9 60% 3500 99%

The rest 100% 23000 100%

FIGURE 1. DEATHS PREVENTED VS POPULATION VACCINATED BY PRIORITY GROUP

rest

100%

90%

80%

70%

60%

50%

40%

Death Averted

30%

20%

10%

0%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Population Vaccinated

6

THE EUROPEAN ACTUARY NO 25 - MAR 2021 HOW TO PRIORITISE VACCINATIONIt can be seen that the first four priority groups There is a logical order to studying the impact of

(targeted by mid-February 2021 in the UK) cover the virus. Cases precede hospitalisations (and in

28% of the population but 88% of the probable some cases intensive care), with deaths following.

deaths. We also needed to build in the period before the

vaccine becomes effective in preventing illness

It is also important to note that there are good – we know from the medical trial data that it is

reasons to get vaccinated beyond reducing our possible to be infected up to two weeks after the

own risk. We get vaccinated to protect others, by first shot. The impact of this additional period will

breaking chains of transmission, as much as to be important to understand, as an anxious public

protect ourselves. is waiting to see the first positive effects of the

vaccination programme.

This work also uses a simple analysis of death

counts rather than an alternative such as Quality

Adjusted Life Years (QALYs), which would place INFLUENCING FACTORS

more value on younger lives. Whilst a QALY The overriding influence is the prevalence of

approach would have merit, a simple analysis the virus. For simplicity, the analysis assumed

seems appropriate here, given the relatively constant prevalence, and so recent falls since

short time interval expected between the the latest lockdown started will add to the

different priority groups becoming eligible for the benefit shown. The vaccination will not be

vaccine and the likelihood that full population 100% effective, and neither will we see a

vaccination will not be long delayed in any case. 100% take-up from those offered the vaccine.

Vaccine effectiveness will also affect measures

A further public debate has concluded in the UK in different ways. For instance, an effectiveness

with the decision to prioritise the first dose of a of 70% may only reduce cases by that amount,

two-dose vaccination programme on the basis but would hopefully reduce serious illness and

that it is likely (though not demonstrably certain) death by a much greater percentage. In contrast,

that most of the life-saving and hospital-saving the take-up rate will affect each measure in a

impact will arise with the first dose and that it is consistent and intuitive way. However, as the

better to administer one dose to twice as many early phases are concentrated on the most

people as two doses to the first groups. Clearly vulnerable, and those who are caring for them,

it is possible that the second dose to the highest it is reasonable to assume that there will be a

categories just might save more than the first relatively high take-up rate – certainly greater

dose to the accelerated lower categories but than would typically be seen with the annual flu

the data to demonstrate this does not exist and vaccination programme.

a political decision was taken in the UK unlike

most other states.

Cases

The analysis considered how long it is likely to

HOSPITAL ADMISSIONS be before we start to see an effect in the various

The public debate is further coloured by reported statistics. It should be noted that

discussion about whether the focus should these are estimated average delay periods. In

be on the avoidance of preventable deaths or reality there is a spread of actual delays around

hospitalisations and consequent pressures on the mean. Allowing for the two-week period

the health system, with the ensuing impact on after vaccination before protection kicks in, a

the conduct of non-urgent normal healthcare. further three to four days is typical for the first

Fortunately, the data does lend itself to further symptoms to occur, and we should allow another

analysis of the impact of vaccination on reducing two to three days for a test to be taken and the

hospital admissions. results to be reported in the data published.

Overall 20 days was assumed.

7

THE EUROPEAN ACTUARY NO 25 - MAR 2021 HOW TO PRIORITISE VACCINATIONFIGURE 2. VACCINE EFFECT (GROUPS 1 TO 4 ONLY)

100%

Proportionate Effect on Key Metrics

80%

60%

Cases

Admissions

40%

ICU

PHE Reported Deaths

20%

ONS Reported Deaths

0%

01 Jan 15 Jan 29 Jan 12 Feb 26 Feb 12 Mar 26 Mar

Hospitalisations in some instances. However, and an even smaller impact on

Added to the two-week given that the majority of deaths intensive care (ICU) admissions,

effectiveness delay, following are recorded within a week, where very few of the oldest

infection there is typically a the analysis assumed a further patients will be considered

10-day period before admission delay of 3 days. Adding this to clinically to benefit from the

to hospital, plus two days for the 31 days from the hospital treatment available.

reporting which translated to an deaths estimate above gives a

assumption of 26 days. total period of nearly nine weeks This is a moving subject and one

produced an assumption of 47 where actuaries have been able

days. to produce information of critical

Hospital deaths (PHE) importance to public policy

These are on average 6 to 8 days The modelling then took these decision-making, particularly

after hospitalization plus around periods of time and identified by elected politicians making

3 days for reporting delays which these with the schedule for a balance of judgments. There

resulted in an assumption of 34 vaccination drawn up by the will be more decisions to take on

days. authorities for these priority the way and the speed at which

groups in order to show the likely society’s normal behaviour

impact on the reported data can commence again and

ONS Deaths and the implied pressures on professional actuarial modelling

(National Statistics) hospitals and their Intensive care of this kind should enable better

With a focus on excess deaths, as facilities. judgments to be made.

reported by ONS, it is also useful

to understand the additional The graph above shows the

delay period before these begin currently estimated timescale

to be impacted. Registrations impact from vaccinating the first

are reported weekly, with a 10 four priority groups on the likely

to 16 (average 13) day lag from reduction both in deaths and in

registration, to which the period hospitalisations. It shows clearly

between death and registration that whilst we should expect a

should be added. This latter rapid fall in deaths, the first four

delay can be very variable, priority groups will have a lesser

and extend into many weeks impact on hospital admissions,

8

THE EUROPEAN ACTUARY NO 25 - MAR 2021 HOW TO PRIORITISE VACCINATIONDECISION-MAKING

IN UNCERTAINTY

BY PETER KINGSLEY The finance, pensions and insurance sectors have long relied

on data and mathematical models to justify decisions, many

backed by the authority of actuarial practice. Everything

from projecting life expectancy to aligning long-term pension

obligations and capital allocation decisions are measured,

creating a shared set of norms. Risk is traded. Value exchanged.

T

he problem is that these based assessments of possible

models are cultural —distinct from probable—

constructs rooted in outcomes.

historical experience. They

rely on collective confidence. This challenges tradition and

In ‘edge of chaos’ conditions convention. After all, one of the

dominated by high levels of assumptions in financial markets

interdependence, complexity is that history-based modelling

and uncertainty, this confidence has predictive authority. This

is under growing threat. may work in the short-term,

but when it matters most—in

If actuarial and risk modelling political, market or financial

is to remain relevant, crisis—models fail. History is a

anticipation is paramount. poor guide to possible futures

Above all, practices shared by when shocks begin to cascade

actuaries, financial analysts and through tightly coupled systems.

investors are necessary but no Models fail to capture real-world

longer sufficient to meet the complexity, particularly in crisis

challenges facing leadership when base-level assumptions

teams in government, financial break down.

institutions and corporations.

DATA ARE OFTEN INCOMPLETE

THE CLIMATE CRISIS AND and inaccurate, giving little help

COVID-19 show that if strategic to decision-makers in preventing

advice is to be relevant to policy system failures. This can be a

and board-level decision-makers, matter of life and death.

it must both anticipate potential In extreme conditions, options

shocks and make intelligence- narrow at exponential rates and

9

THE EUROPEAN ACTUARY NO 25 - MAR 2021 DECISION-MAKING IN UNCERTAINTY‘

These realities cannot be modelled

or forecast in conventional, logical,

rational, statistical, or probabilistic

terms.

wait for definitive evidence and

certainty, they are destined to

deliver ‘too little, too late’. Faced

with radical uncertainty, they

have to make imaginative, pre-

emptive judgments.

NOR ARE EMERGING SOLUTIONS

to these challenges necessarily

the answer. The most recent

artificial intelligence applications

have great value and potential,

but the machine learning

paradigm is narrow, brittle and

limited to specialised tasks

that cannot adapt to changing

system dynamics. Even the

most advanced models are

fragile in chaotic environments,

as some quantitative funds

have discovered. They are

typically based on ‘small world’

perspectives that focus on

what can be measured, rather

than what is essential. They

often fail to capture, to take

one example, how weak signals

gain momentum, or how social

interaction shapes behaviour.

PETER KINGSLEY MACHINES DO NOT YET REASON,

or model cause and effect. There

is not even a consensus about

leave little room for manoeuvre. THE VIRUS HAS SPREAD by what ‘reason’ means. A growing

COVID-19 has illustrated that the time signals are picked up, body of research suggests that

data are too often lagging data validated, and models human reason is not about how

indicators. developed. If policymakers to deal with abstract logical

10

THE EUROPEAN ACTUARY NO 25 - MAR 2021 DECISION-MAKING IN UNCERTAINTY‘

The underlying challenge for financial

professionals is that, to recap,

anticipation, not measurement,

is paramount for leadership teams.

problems but rather to meet the markets depend ‘nearly entirely THE UNDERLYING CHALLENGE

challenges of living in collaborate on human imagination and for financial analysts, fund

social groups. emotion.’ We act in the present managers and actuaries is

In other words, decision-making on imagined futures. Or fail to. that, to recap, anticipation, not

leadership teams are embedded Asset values in low lying cities measurement, is paramount for

in social environments and like Miami will collapse long leadership teams.

shaped by cultural forces. before rising sea levels make Decision-makers are searching

To compound the problems, them uninhabitable. for answers to the problem of

decisions are influenced by how how to deliver resilience in a

individuals and groups imagine world of well forecast ‘wild card’

the future. These are primary—if TAKE ANOTHER EXAMPLE, in shocks such as COVID-19 and

not dominant—cultural realities. December 2016, the first signs the momentum of weak signals

Imagined futures shape political that major energy companies suggesting runaway climate

decisions, policy, corporate would come under sustained change is underway. They are

stewardship, sustainability and investor pressure emerged asking how they can imagine,

set innovation agendas. These when they were asked to explain navigate and make stewardship-

realities cannot be modelled their long-term strategies in based judgments about the long-

or forecast in conventional, the context of climate change. term and hedge against worst-

logical, rational, statistical, or Primary asset owners began case scenarios.

probabilistic terms. to project transitions to

autonomous electric vehicles, If the actuarial profession is

solar and wind power five, ten to meet these challenges and

DECISIONS ARE MADE NOT and more years ahead. The remain relevant at the highest

SIMPLY by careful cost-benefit pressure was rooted in imagined levels, it has to think about how

analysis, but by leadership teams futures and the narratives that to combine imaginative foresight

looking for stories that make described them. The future with traditional strengths. After

sense of volatility, particularly once again showed it can deliver all, professional services firms

in times of crisis and when the shocks in the here and now. have to re-invent themselves,

future is deeply uncertain. When leading, not following, their

the stories change and new ones Too much attention focuses on clients. If they cannot picture the

gain momentum, financial and fine-tuning data, measurements long-term, they will struggle to

economic shocks emerge. and models, rather than on how offer strategic advice.

real-world decision-makers use

To illustrate, we might assume them. Models can act as anchors

that financial analysts are but are often ignored or used PETER KINGSLEY is

interested only in data, even to give legitimacy to intuitive Chairman of The Oracle

in low volatility conditions. judgments. More often, they are Partnership.

The reality, as David Tuckett challenged, poorly understood, https://

points out, is that financial or deliberately distorted. oraclepartnership.com/

11

THE EUROPEAN ACTUARY NO 25 - MAR 2021 DECISION-MAKING IN UNCERTAINTYEIOPA OPINION ON

SOLVENCY II REVIEW:

CONCERNS OF AAE

BY JENNIFER BAKER

I

This article is a summary of n February 2021, the However, the primary demand

the official AAE Position Paper Actuarial Association of for the insurance sector to better

Europe (AAE) set out its serve the long-term needs for

main positions regarding European citizens and to act

the Solvency II 2020 review. as long-term investors requires

an appropriate valuation of

long-term business and a

While acknowledging that risk-adequate treatment of

Solvency II is intrinsically a long-term investments as well.

well-functioning, risk-based It is a requirement that such

framework, the AAE believes that a valuation aims at reducing

the experience of the past five volatility and thus prevents

years of application, along with procyclical behaviour. An

the low interest environment, appropriate valuation of the

reveal a need to change parts of obligations resulting from

the current framework. the contracts in a portfolio is

indispensable.

The overall aim is to ensure

policyholders protection and Solvency II together with the

financial stability in Europe, Long-term guarantee (LTG)-

and as such it is important not measures has worked well

to change the fundamental in terms of safeguarding the

principles of the Solvency II policyholders in the past and

framework, such as confidence should not be jeopardised by

level underlying calibration inappropriate new requirements.

of capital requirements or the Our main concerns are related

market-consistent basis for the to: the treatment of long-term

valuation of the balance sheet. business with guarantees;

12

THE EUROPEAN ACTUARY NO 25 - MAR 2021 EIOPA OPINION ON SOLVENCY II REVIEW: CONCERNS OF AAEthe enabling a well-diversified, An identified last liquid point the role of the UFR caused

sustainable and persistent (LLP) is the starting point for an by waiving the convergence

investment strategy; and the extrapolation. Currently, for the requirements. Convergence

proposed extensions of the Euro, this LLP is 20 years and to the UFR is determined by

Solvency II framework by should not be changed, as that the last liquid forward rate

macroprudential elements. would have a significant market (LLFR) and a mean reversion

impact which needs to be taken factor alpha, which is – without

carefully into account. scientific justification – set to

‘The availability 10%. The LLFR aims to take

of deep, liquid into account information from

Another essential criterion is DLT-markets post-LLP and

and transparent

the requirement to reach the is the starting value for the

(DLT) markets is Ultimate forward rate (UFR) extrapolation. It can be highly

a precondition within a given convergence volatile and affects the entire

for the required period (currently 40 years for RFR. Convergence is modelled

the Euro) with a given tolerance. independent from capital

market-consistent This UFR reflects a long-term markets by applying fixed

valuation in the expectation or a mean-reversion factors depending solely on the

current framework.’ level, annually determined by mean reversion factor. Therefore

EIOPA in accordance with the the method cannot compensate

method published in 2017. short- or mid-term distortions

of capital markets (e.g. resulting

The availability of deep, liquid from ECB-activities, Covid-19).

and transparent (DLT) markets is The alternative extrapolation These are carried forward to the

a precondition for the required method proposed to the entire RFR and thus increase

market-consistent valuation in European Commission leads volatility of undertakings’

the current framework. to a significant weakening of capital position.

13

THE EUROPEAN ACTUARY NO 25 - MAR 2021 EIOPA OPINION ON SOLVENCY II REVIEW: CONCERNS OF AAEParticularly in a low interest rate In terms of interest rate stress, regard to recovery, resolution

environment a more volatile we see the need for corrections, and IGS, different treatments

and significantly lower risk-free as currently no stress is applied across Europe could lead to

rate, might prevent insurers to negative interest rates. flaws in policyholder protection.

from maintaining their long- Considering the one-year Harmonisation should consider

term business model, holding horizon required by Solvency cross-border business, already

long-term investments in a II, risk parameters should only available solutions and

sustainable way and offering be applied to the liquid part of proportionality aspects.

products with guarantees. the extrapolated curve. This

stressed liquid part should be

extrapolated. First stress – then Coherence of the Solvency II

‘ In terms of interest extrapolate! framework should be considered.

rate stress, we Additional burden for the

undertakings resulting from

see the need

We welcome the attempt to macroprudential measures to

for corrections, reduce the risk margin by reduce risk should be assessed

as currently no introducing a factor lambda to together with the existing

stress is applied to attenuate the impact of future prudential framework in order

SCR. The proposed floor should not to go beyond the current

negative interest be omitted as the margin needs 99.5% VaR requirement.

rates.’ further analysis, especially on

the way it works for long-term

insurance liabilities. In short, the Solvency II review,

Volatility adjustment needs should aim for an appropriate

reconsideration. EIOPA’s valuation of long-term liabilities

proposal is still based on a Same risk, same capital is a basic but also offer better possibilities

reference portfolio calibrated principle of Solvency II. Therefore to support a sustainable relaunch

on EU-level. Considering neither green supporting, of the EU economy in the

undertaking specific aspects nor brown penalising factors aftermath of Covid-19. We must

in the ALM and liquidity should be introduced. Capital also ensure that new, emerging

application ratios plus a quicker requirements should consider risks are properly considered.

and smoother activation of the quality of investments and But the focus must remain on

the country component aims the inherent risk. policyholder protection and the

at better consideration of prevention of insolvency risk – it

undertakings risk. It leads to a is important not to overstretch

higher degree of complexity, Solvency II is a risk-based – Solvency II and to preserve it as a

but this will not remedy the although microprudential principle-based framework.

identified deficiencies on over – framework, and EIOPA

or undershooting resulting from acknowledges that risks for

differences between own assets financial stability, liquidity Position papers of the aae can

and the reference portfolio. risk, etc. in insurance are not be found here: https://actuary.

Taking own assets as a basis comparable to those observed in eu/publications/positions-

should still be definitively part banks. Any extension of Solvency discussion-papers/

of the Risk Management System II should be based on a thorough

and ORSA exercise. analysis of current options. With

14

THE EUROPEAN ACTUARY NO 25 - MAR 2021 EIOPA OPINION ON SOLVENCY II REVIEW: CONCERNS OF AAEXIII ITALIAN ACTUARIAL

CONGRESS POSTPONED

T

he XIII Italian Actuarial Congress It is at the same time a step forward

was announced early for June especially for the mentality and a

2020 and postponed due to the confirmation of the Italian strategy, that

Covid situation. We now aim to organize is to consolidate the traditional fields

it for November 2021 (10-12) in Milan. (insurance, pension) and in parallel to

develop the wider fields.

The title will be:

In this context all the sessions are

Technological innovation oriented in this direction. Moreover

and systemic risks: actuary some specific sessions are reserved

as a global assessor of to the international topics with the

uncertainty. participation of IAA, AAE, AFIR-ERM,

ASTIN; another session is dedicated to

the topic of "governance" where the

It is a logical evolution of the Italian Actuary is more and more present. Other

strategy for the actuarial profession's important sessions will concern IFRS17,

development and the congress is a very IORP2, Welfare. We will keep you up to

important moment to take stock of the date on developments.

situation, but also to launch messages

for the future. The message in this case Giampaolo Crenca

will be very ambitious: from Manager

Actuary to the Global Actuary, in order

to enlarge actuarial minds and activities

especially towards systemic risks and the

wider fields.

15

THE EUROPEAN ACTUARY NO 25 - MAR 2021 XIII ITALIAN ACTUARIAL CONGRESS POSTPONEDTHE 2020 AAE

PRESIDENTS' MEETING

BY GIAMPAOLO CRENCA

In 2020 this important meeting was held over two days, in two parts and virtually, due

to the Covid situation. The first meeting was on the 12th of November and the second

on the 4th of December.

T

he AAE Presidents' • climate change, ON THE FIRST DAY three

Meeting is a moment topics were discussed: climate

of confrontation and • communication, change, communication, and

discussion among all the professionalism (particularly

Member Associations (MAs) and • professionalism education). About climate

so it assumes a strategic value. (particularly education), change the answers to the survey

were observed and substantially

• mutual recognition all the countries think that it is

Particularly in this case agreement (MRA), an important and strategic topic

five important topics were for actuaries and AAE. Moreover

introduced by the AAE's Board • the role of the actuary. it is clear that it belongs to the

and discussed during the two wider world of the wider fields

meetings: because it is a systemic risk. Is

this just about measurement

16

THE EUROPEAN ACTUARY NO 25 - MAR 2021 THE 2020 AAE PRESIDENTS' MEETINGor also a model ? This question A VERY IMPORTANT TOPIC to develop the wider fields also

was very deeply debated and was the role of the actuary, with the support of very strong

the conclusion was that if we especially about the legal role, communication work.

develop models we can also because under the AAE there

focus on one or more indices, are different situations from

thus satisfying both. AAE could country to country. The goal is Other interesting discussions

organise a congress about this to find, if possible, a same legal followed with two experiences

topic. role valid for all the MAs and related to Hungary and Denmark.

officially recognized in the whole

of Europe.

THE SECOND TOPIC was THE AAE'S PRESIDENT,

communication, absolutely Wilhelm Schneemeier,

strategic and strictly connected ON THE SECOND DAY of the encouraged everyone to follow

with the Board that set up a meeting there were two this already well-designed path.

specific working group just important discussions, the

for developing this project. first concerning the "Legal

Communication is internal recognition workstream Task

as well as external. External Force Roles of Actuaries" and

concerns many different the second "Wider Fields". Both

stakeholders and we must try were a logical deepening of

to reach everyone with different the topics discussed during the

channels, approaches and first part. The speakers in the

languages. Channels are very first discussion emphasized the

important and the AAE could importance of understanding

use with greater intensity the well the situation in each MA, and

communication tools already so a consultation process was in

available (for instance the course. Afterwards the goal is to

magazine The European Actuary, evaluate the following steps and

Actuview) and, if necessary, to individuate a legal role for the

identify other tools. actuary in Europe valid for each

MA.

THE THIRD TOPIC,

professionalism, resulted THE SPEAKER about wider fields

in a discussion concerning emphasized the importance of

education and, in particular, the this topic that is now in its own

contents of the core syllabus right under the AAE's strategy.

and the implementation by the He indicated some of these

Member Associatons (MAs). fields and the need to be very

MRA must be reviewed for prepared to face this challenge

some reasons, Brexit the most especially addressing education GIAMPAOLO CRENCA

important, especially now that needs. So, the strategic proposal is Past President Consiglio

an agreement with the UK was is to consolidate and develop Nazionale Attuari.

found about their staying in the the traditional fields (insurance,

AAE. pension) and at the same time

17

THE EUROPEAN ACTUARY NO 25 - MAR 2021 THE 2020 AAE PRESIDENTS' MEETING18

COLUMN COLOPHON

The European Actuary (TEA) is the

quarterly magazine about international

actuarial developments. TEA is written for

HOW TO PREDICT THE INTEREST RATE European actuaries, financial specialists

IN 2081? and board members. It will be released

primarily as e-mail newsletter.

The Editorial Board welcomes comments

Predicting the market 60 years into the future is extremely and reactions on this edition under

info@theeuropeanactuary.org.

uncertain. There is no market information available that can

be used as a basis for such an estimate. Hence, analysis has to THE EDITORIAL BOARD CONSISTS OF

be based on models and expert judgement and has to consider Pierre Miehe, France

experience of the last 60 years. Without any doubt we have been in (Pierre.Miehe@Milliman.com)

a low interest rate environment for more than 10 years. This was Peter Tompkins, United Kingdom

certainly intensified by ECB’s quantitative easing programme in (PeterDGTompkins@aol.com)

the last years. So the biggest challenge is to compensate this effect Birgit Kaiser, Germany

because it cannot be continued over the next 60 years. (Birgit.Kaiser@aktuar.de)

Robert van Leeuwen, The Netherlands

Looking at Omnibus II, the approach for this crucial estimate is (for (leeuwer@hotmail.com)

currency Euro) to have an extrapolation method starting at year Giampaolo Crenca, Italy

(g.crenca@studio-cea.it)

20 (the last point in time with a market deep and liquid enough to

Gunn Albertsen, Norway

be used as an estimator for the risk-free rate) and being after 40 (gunn.albertsen@storebrand.no)

years near the Ultimate Forward rate (UFR) with a maximum 3bp

difference.

Now EIOPA’s opinion on the Solvency II review has been published.

The AAE agrees with many of the changes proposed (see also

Article on p. 12), like the introduction of negative interest rate Actuarial Association of Europe

stress and not to change year 20 as last liquid point. But it is Maison des Actuaires

certainly not justified to use swap positions (without underlying) 1 Place du Samedi

between years 20 and 50 to propose an extrapolation method B-1000 Brussels, Belgium

which deliberately does not ensure that the UFR will be reached https://actuary.eu/publications/

after 60 years with a predefined difference. This proposal will have the-european-actuary/

extreme consequences for long term life and pension insurance For futher informations contact

business and will increase capital requirements significantly. Monique Schuilenburg

(moniques@actuary.eu)

Overall, the proposals will lead to a weakening of the financial

positions of insurers, as a balancing of the outcome will not Lay-out Manager: Linda van den Akker

Magazine Manager: Frank Thooft

be possible. Another consequence will be a significantly lower

capacity for investment in sustainable assets. Undertakings will

NEXT ISSUE:

refrain from offering products with guarantees and thus shift The next issue will appear 1 June 2021.

higher performance risk to policyholders. This can result in an Suggestions can be e-mailed

increase of the pension gap once these clients retire (and the to info@theeuropeanactuary.org

current gap is already too high). The deadline is 1 May 2021.

The AAE advises not to change the convergence target at year 60 EUROPEAN AGENDA

Please check

and not to implement EIOPA’s extrapolation proposal. A wide and

http://actuary.eu/event-calendar/

deep impact study can help to balance all aspects: Solvency II for the most actual forthcoming events.

should safeguard clients. There is no convincing reason to change

this fundamental element of the Omnibus II Directive shortly after ADVERTISING IN THE

the start of Solvency II. EUROPEAN ACTUARY

The European Actuary (TEA) is sent as an

online magazine to 25,000 actuaries and

Wilhelm Schneemeier financial professionals throughout Europe.

Chairperson Actuarial Association of Europe An advertisement in TEA, size 210 x 145 mm

(half A4 and seen as full-screen),

costs only 3,500 euros. Information on

info@theeuropeanactuary.org

THE EUROPEAN ACTUARY NO 25 - MAR 2021You can also read