Clearance Pricing Optimization for a Fast-Fashion Retailer

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

OPERATIONS RESEARCH

Vol. 60, No. 6, November–December 2012, pp. 1404–1422

ISSN 0030-364X (print) ISSN 1526-5463 (online) http://dx.doi.org/10.1287/opre.1120.1102

© 2012 INFORMS

Clearance Pricing Optimization for a

Fast-Fashion Retailer

Felipe Caro

UCLA Anderson School of Management, Los Angeles, California 90095, fcaro@anderson.ucla.edu

Jérémie Gallien

London Business School, London NW1 4SA, United Kingdom, jgallien@london.edu

Fast-fashion retailers such as Zara offer continuously changing assortments and use minimal in-season promotions. Their

clearance pricing problem is thus challenging because it involves comparatively more different articles of unsold inventory

with less historical price data points. Until 2007, Zara used a manual and informal decision-making process for determining

price markdowns. In collaboration with their pricing team, we since designed and implemented an alternative process relying

on a formal forecasting model feeding a price optimization model. As part of a controlled field experiment conducted in all

Belgian and Irish stores during the 2008 fall-winter season, this new process increased clearance revenues by approximately

6%. Zara is currently using this process worldwide for its markdown decisions during clearance sales.

Subject classifications: retailing; markdown pricing; clearance sales; fast-fashion; revenue management; forecasting; field

test; model implementation.

Area of review: OR Practice.

History: Received June 2011; revision received May 2012; accepted June 2012.

1. Introduction For example, stores have to ensure that groups of similar

Markdown pricing is an important activity for many retail- articles (e.g., men’s shirts) do not include too many dif-

ers of seasonal goods (Talluri and van Ryzin 2004), and ferent price points, that a minimum amount of inventory

with more than a billion euros generated through clear- across different articles is associated with any advertised

ance sales in 2008, this is certainly true of Spanish apparel price point, that two groups of articles merged under a com-

retailer Zara. However, clearance pricing is arguably more mon price point will not be subsequently separated again,

challenging for Zara than for many of its competitors. etc. (a complete discussion of these and other store-level

This is because its innovative fast-fashion model (also markdown implementation issues associated with the fast-

adopted by Sweden-based H&M, Japan-based World Co., fashion model is provided later).

and Spain-based Mango) involves selling many more arti- The present paper describes the development, implemen-

cles with shorter life-cycles that are almost never dis- tation, and evaluation in the field of the markdown opti-

counted during the regular selling season (Caro 2012). As mization system that Zara has since deployed worldwide to

a result, when Zara decided in 2007 to develop internally address these challenges. To the best of our knowledge, this

a markdown optimization system, it quickly realized that constitutes the first large-scale application of a multiprod-

its needs were at the forefront of revenue management uct price optimization model by a firm for which all rele-

practice, for two main reasons. First, almost no histori- vant technical and implementation details as well as related

cal price response data are available for its articles at the impact estimation results are made public. In the remainder

beginning of each clearance period. As a result, it had to of this introduction, we provide additional background on

devise a methodology for estimating price elasticity based Zara’s clearance sales period (in §1.1) and then describe

exclusively on features common with articles sold in previ- its legacy clearance pricing process (in §1.2). Some of the

ous seasons, and updating this estimation based on actual data presented in this paper have been disguised to protect

sales information once the clearance period starts. Second, its confidentiality, and we emphasize that the views pre-

and perhaps most importantly, it could not rely on any sented in this paper do not necessarily represent those of

of the published price optimization models known to have the Inditex Group.

been implemented or tested with real data (e.g., Smith and

Achabal 1998, Bitran et al. 1998, Heching et al. 2002, 1.1. Clearance Sales at Zara

Smith 2009), which all consider each article independently. Like many other apparel retailers, Zara holds its clearance

Indeed, the high number of different articles available dur- sale periods for about two months following each bian-

ing clearance sales makes it impractical for its stores to nual selling season, with country-specific starting dates at

implement pricing policies determined at the article level. the beginning of January (fall/winter season) and late June

1404Caro and Gallien: Clearance Pricing Optimization for a Fast-Fashion Retailer Operations Research 60(6), pp. 1404–1422, © 2012 INFORMS 1405 or early July (spring/summer season). The generic goal of regions (e.g., U.S. east and west coasts). During clearance clearance sales for any retailer is to maximize the rev- sales, another barrier to price segmentation shared with enue derived from merchandise that is still unsold when many other apparel retailers is the strong appeal to visitors a new collection is about to be introduced, so it works of a limited number of signs displayed within the store to as a final correction mechanism for products that did not signal specific price points or markdowns (e.g., “everything sell as expected during the regular season. At Zara, mer- at E4.99,” or “−20%”). In addition, during both clearance chandise is often deliberately withdrawn from the store dis- sales and the regular season Zara uses prices from only a play area during the season to make room for more recent discrete and finite set of so-called commercial prices all incoming articles. As a result, clearance sales offer a bian- ending with “0.99” which, as discussed in the marketing nual opportunity to reduce the cost of not only the tra- literature (Anderson and Simester 2003), tend to be more ditional assortment/collection transitions between seasons appealing to customers. Another key feature more specific mentioned above, but also the frequent in-season assort- to fast-fashion is the substantial increase of the number ment transitions associated with the fast-fashion model. of different articles present in the starting clearance sale While some of that inventory withdrawn during the sea- inventory compared to that found in stores at any time dur- son is sometimes kept in the store backroom, the major- ing the regular season (which results from the short season ity of it is returned to a warehouse to subsequently enable life-cycles). As a result, it would be neither easy nor desir- a more efficient re-distribution before the clearance sales. able for stores to implement a different pricing policy for Because clearance selling rates exceed the replenishment each article during the clearance period, as is done dur- capacity of Zara’s distribution system, however, this re- ing the regular season. In particular, because the current distribution of clearance inventory to stores takes place over price display technology is paper-based, the implementa- a period of several weeks preceding the sales period. As the tion of markdowns requires store associates to locate and sales period unfolds, Zara dedicates an increasing portion of retrieve articles from the store backroom or display area its store space to the new collection; this overlap strategy is and attach a price update sticker on each article tag. In this designed to promote the new collection and induce upsales. environment, Zara learned that the retrieving workload and Some transfers of remaining clearance inventory may also probability of costly mislabeling errors associated with an be organized between nearby stores to aggregate merchan- independent pricing policy for each individual article are dise in fewer locations and improve their display quality particularly high. (e.g., complete missing sizes). Finally, the sales period ends To address these challenges, Zara makes clearance pric- with the step known as liquidation, when all remaining ing decisions in each country instead at the level of a set clearance inventory is collected from Zara stores and sold of articles called a group, which corresponds to a relatively (sometimes by weight) to wholesale buyers working for high-level descriptor encompassing anywhere from 30 to low-price channels, typically in developing countries. 700 different articles; examples of groups include “woman At the store level, clearance sales induce many substan- blazers,” “man knitwear,” “basic skirts,” etc. Each group is tial changes. The price reductions consented then, which partitioned into clusters, which are subsets of articles that are visibly advertised, attract substantially more visitors, were sold at the same price during the regular season; each and the volume of merchandise sold drastically increases. group typically includes between 4 and 12 clusters. Finally, As a result, the store workload increases both before and clearance pricing decisions are implemented by aggregat- during clearance sales. In the weeks before the sales, the ing one or several clusters into a category, and assigning a clearance inventory must be received, labeled and stored in different clearance sales price to each category. A impor- the backroom. The day (and night) before the sale begins, tant feature is that categories are almost always defined the store display is entirely rearranged: while garments are as an interval of regular season prices. For example, the displayed with a relatively low density according to match- group “basic skirts” could include 4 clusters of 9, 15, 25, ing colors and styles during the regular season, during the and 12 articles sold, respectively, at E19.99, E24.99, E29.99, sales period they are displayed with a very high density and E35.99 during the regular season; at a specific time according to their type (e.g., men’s shirts) and selling price. during the clearance period Zara might decide to form a During the sales, store associates are solicited by many first category comprising the E19.99 cluster and assign it a more customers, must re-fold and re-place many more tried marked-down price of E9.99, and form a second category garments, replenish and/or rearrange display areas from the comprising all the articles with a regular season selling backroom, update price labels and signs more frequently, price between E24.99 and E35.99 (i.e., the three remaining process more customers at the register, etc. Consequently, clusters) and assign it a clearance price of E19.99. store staffing must be substantially increased during clear- A key rationale for the clearance pricing methodology ance sales, often with temporary employees. just described is that it is particularly easy to communi- For legal, marketing, and organizational reasons, Zara’s cate and implement at the store level. This is because dur- pricing policy during both the regular season and the clear- ing clearance sales articles are both displayed (in stores) ance period is country-specific, and to date Zara is not and stored (in their backrooms) by group. In addition, by considering segmenting large countries into smaller pricing design the regular season selling price is the feature of

Caro and Gallien: Clearance Pricing Optimization for a Fast-Fashion Retailer

1406 Operations Research 60(6), pp. 1404–1422, © 2012 INFORMS

each article which is most prominently displayed on its tag. income level, competitive positioning), and communicated

This methodology also makes it easy to ensure that clear- to all the country managers for review. Finally, the initial

ance prices are always lower than regular season prices markdown lists were finalized as part of subsequent meet-

by a sufficient amount (a legal requirement in many coun- ings where country managers would discuss possible mod-

tries), and that the total number of different price points ifications to the default list for their country with one or

for each group (which is often constrained by store dis- several members of the pricing committee, based on their

play space limitations) remains sufficiently low. Finally, experience and judgment. An important challenge for this

with this method clearance pricing decisions can be updated first step was the lack of data, as for nearly all articles no

for each country and group on a weekly basis. In each price markdowns are performed during the season, which

such update the clearance price of a given cluster is never made it difficult to predict the response to a given price cut

allowed to increase, in part to avoid arbitrage and returns. in the first week of sales.

In addition, to simplify store execution and progressively The second step focused on updating the categories and

reduce the store space dedicated to clearance sales, cate- markdowns after the clearance sale had started. This was

gories are allowed to merge but not split over time. In the performed independently by each country manager, typi-

next subsection, we describe the legacy process used by cally on a weekly basis, in consultation with one or sev-

Zara to make the clearance pricing decisions just described. eral members of the pricing committee. The main source

of information used to make these update decisions was

1.2. Legacy Clearance Pricing Decision Process the weekly country clearance sales report generated at least

every week for each country and each group of articles, as

Until 2007, the decision process used by Zara for clear- shown in Figure 1.

ance pricing consisted of two steps. The first consisted of Specifically, the country manager and pricing commit-

determining initial categories and markdowns (see §1.1) tee representative would typically review then the estimated

for the very first week of the sales, and it took place time to sell the remaining stock of each category at the cur-

over a period of about a month preceding the beginning rent price (calculated based on the average sales rate over

of the clearance period. This started with a systematic the last three days) and compare it with the time remaining

review of the unsold inventory and sales performance dur- in the clearance period. When these time comparisons indi-

ing the selling season for all the product groups in Spain cated a substantial risk of unsold inventory at the end of

(Zara’s top sales country to date), performed by the pric- clearance sales, they would further markdown the category

ing committee—a small group of 4–5 key executives com- but otherwise leave the current price unchanged. In other

bining financial, commercial and distribution expertise that words, the primary heuristic pursued qualitatively consisted

included Zara’s CFO, in conjunction with the two sales in minimizing the amount of inventory sold through liqui-

managers for that country. This team then determined all dation, but keeping prices as high as possible when doing

the categories and markdowns for Spain, based on an so. Additionally, markdowns of individual categories were

exchange of views and experience by its members. These sometimes determined so that two separate adjacent cate-

decisions were then transposed to all the other countries gories would merge into a single one, in particular near the

using standard conversion tables, taking into account dif- end of the clearance period when the inventory remaining

ferences in national factors (e.g., overall pricing strategy, in one category would not be deemed sufficient to justify

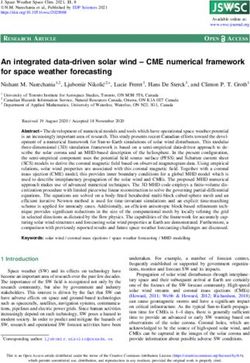

Figure 1. Example of a weekly country clearance sales report (second week of the winter 2009 clearance sales in Italy

for the group “basic skirts”).

Cumulative Estimated remaining

clearance sales time to sell stock

Current

clearance Remaining store Percentage

Last three days of sales

prices inventory stock sold

Current

clearance

Stock/

categories Precio Venta día Venta día Venta día Venta Acumul Stock Tienda %

Venta Día

Saldo 17/01/2009 18/01/2009 19/01/2009 19/01/2009 19/01/2009 Éxito

19/01/2009

FROM 49.90 to 29.90 19.95 24 5 12 534 1.218 102 31

OF 24.90 14.95 21 8 8 466 1.006 126 32

OF 19.90 9.95 16 14 6 420 384 64 54

FROM 14.90 to 12.90 6.95 21 22 12 519 322 27 64

Totale… 82 49 38 1.939 2.930 77 41Caro and Gallien: Clearance Pricing Optimization for a Fast-Fashion Retailer

Operations Research 60(6), pp. 1404–1422, © 2012 INFORMS 1407

a separate price point in stores. An important observation, make the simplifying assumption of unrelated products

however, is that no formal or explicit guidelines were fol- and independent demand and solve a collection of single-

lowed when making these decisions. Rather, country man- product models as an approximation.” While our model

agers and members of the pricing committee would rely assumes independent demand across products, it does cap-

then on their experience and an exchange of views with ture the many dependencies between pricing decisions for

their colleagues. Finally, the price update decisions for all different products that are introduced by store-level imple-

categories in each country had to be made under significant mentation constraints. Finally, our paper relies on a rigor-

time pressure. This was due to both the short delay between ously designed controlled field experiment spanning several

the availability of the country clearance sales report and the countries to estimate the resulting impact on both prices

desirable time for communicating price update decisions to and revenue. This also seems significant, because we are

stores, and to the labor-intensive nature of this process for aware of no other markdown optimization paper reporting

the members of the pricing committee. an estimation of impact involving a control for external

factors.

2. Literature Review Because of the impact estimation methodology just men-

tioned, our work is also related to the set of papers dis-

Within the relatively vast literature on markdown optimiza- cussing empirical tests in retail networks. Those tests are

tion and dynamic pricing (see the survey by Elmaghraby typically designed to estimate the effects of many possible

and Keskinocak 2003 and the monograph by Talluri and marketing interventions such as packaging, shelf place-

van Ryzin 2004), this paper is characterized by its consid- ment or price on sales, or to estimate network-wide sea-

eration of a multiproduct pricing problem (see Maglaras son demand based on preliminary sales observations from

and Meissner 2006, Gallego and van Ryzin 1997 for sem- a limited set of stores—see Fisher and Rajaram (2000)

inal theoretical models, and Soon 2011 for a recent sur- and Gaur and Fisher (2005) for discussions on experimen-

vey). Its main distinguishing feature, however, is a focus on tal design methodologies, application examples, and refer-

the development, implementation, and use of a novel oper- ences. In particular, several such studies show how valuable

ational markdown optimization model by an actual firm. insights on customers’ price response behavior can be gen-

That is, we seek to shed light on the frontier of clearance erated by testing empirically the impact of various price

pricing optimization practice through a rigorous case study points on sales (e.g., Gaur and Fisher 2005, Sigurdsson

of a pricing system development and implementation in a et al. 2010). As previously mentioned, however, our paper

challenging environment. seems to be the first one among this group to describe the

With a similar concern for application, Bitran et al. test of a markdown optimization system (as opposed to spe-

(1998), Mantrala and Rao (2001), and Heching et al. (2002) cific price points) as part of a controlled field experiment.

analyze historical demand and pricing data from various Finally, this paper is relevant to the literature investigat-

firms in order to generate useful insights on the likely ing the operational problems that are specific to fast-fashion

additional revenue and qualitative pricing policy differ- retailing, including the studies of assortment by Caro and

ences associated with the potential implementation of a Gallien (2007), of distribution by Caro and Gallien (2010),

markdown optimization model. An important additional and of operations strategy by Cachon and Swinney (2009)

step is taken in Smith and Achabal (1998), Smith (2009), and Caro and Martinez de Albeniz (2010). Among this

and Valkov (2006), which describe the implementation and group, our paper is the first to investigate the clearance

use of markdown optimization systems by various compa- pricing problem faced by a fast-fashion retailer. This seems

nies and report some related results. However, these last an important endeavor, both because the fast-fashion retail

three references contain only limited example data and model might provide some important competitive advan-

do not discuss the methodology used for calculating the tages (Caro 2012) and because clearance pricing is arguably

impact estimates provided. In addition, Valkov (2006) does more challenging in that specific context (see §1).

not contain a detailed description of the pricing optimiza-

tion models used as part of the implementations reported.

In contrast, our paper contains complete descriptions of the 3. Demand Prediction Model

clearance pricing process of the firm under study and the Key input data to a markdown optimization system are the

technical details of the pricing system developed, and pro- predictions of demand for the various clearance prices con-

vides an extensive discussion of its implementation. A sec- sidered. Given the pricing process described in §1.1, for

ond critical difference is our focus on the implementation of Zara these predictions (and the ensuing price optimization

a multiproduct markdown optimization model, whereas all to be described in §4) must be performed independently

the existing application-oriented pricing papers cited dis- for each group of articles in each country. We discuss next

cuss only single-product models. That difference is signifi- the two steps we followed in order to develop these fore-

cant and positions our work at the forefront of OR practice casts, namely the construction of a historical demand data

because, as stated in Talluri and van Ryzin (2004), “60 0 07 set (in §3.1) and the specification and fitting of a predic-

many commercial applications of dynamic-pricing models tion model (in §3.2).1 We then conclude this section in §3.3Caro and Gallien: Clearance Pricing Optimization for a Fast-Fashion Retailer

1408 Operations Research 60(6), pp. 1404–1422, © 2012 INFORMS

with a brief discussion of the resulting model’s underly- accuracy was measured as part of a field implementation

ing assumptions. It is worth noting that here we describe (see §5.2.2 for a discussion of these results). Although

the development of the forecasting method that gave the our forecasting model was thus derived through extensive

best results in our application. A comprehensive theoreti- experimentation, we describe here only the final imple-

cal analysis of the forecasting problem itself is beyond the mented result and refer the reader to Carboni (2009) for

scope of this paper but would be an interesting avenue for more details on that development process.

future research. The process just described resulted in the selection of

the following functional form:

3.1. Demand Data Set Construction wr = F 4Cr 1 Awr 1 w−1 1 Irw 1 prw 5

r

Let R and J denote all the articles and stores in a given

group and country, respectively, and let s ∈ S4r5 denote the = exp 0r + 1 ln4Cr 5 + 2 Awr + 3 ln4w−1

r 5

size-color combinations available for each article r ∈ R.

Iw pw

An SKU (fully specified article) corresponds then to a pair + w4 ln min 11 r + w5 ln rT 1 (1)

4r1 s5 ∈ R×S4r5, which for brevity we write rs. Let w ∈ f pr

denote a clearance sales period which is usually a week. By where the dependent variable is the demand rate of article r

convention, we write w = 1 and w = c to denote the first in period w and the regressors are:

and the current period of clearance sales, respectively, and • Purchase quantity (Cr ): size of the purchase made for

we write w < 1 to represent the weeks during the regular article r (measured in number of units). We explain the

selling season, i.e., prior to clearance sales. For article r, let selection of this variable by its correlation with the “fash-

Irw 2= s∈S4r51 j∈J Irsj

w

P

be the inventory position of article r ion” component of an article. Usually, articles with low

available in the entire country at the beginning of period w, fashion content (also known as “basic”) are purchased in

w

where Irsj is the inventory position of SKU rs at store j large quantities, whereas more trendy items are deliberately

at the beginning of that period. Let wr denote the demand purchased in small amounts. Because each article purchase

rate in period w for article r, which is roughly computed covers Zara’s entire store network, this variable is the same

as the sales observed in period w divided by the number of across countries. Note that the purchase quantity is decided

days the article was on display. The exact computation of several weeks or months before clearance sales start so it

wr is described in the e-companion, and it presents some acts as a predetermined variable at the time of the fore-

challenges due to the presence of seasonality effects (e.g., cast estimation. This contrasts with studies that use panel

Christmas or weekends), which cause variations in demand data across several seasons and treat aggregate purchasing

that are unrelated to prices, and because of stockouts and decisions endogenously (see Kesavan et al. 2010).

inventory display policies, which cause demand censoring. • Age of an article (Awr ): number of days since article r

Historical sales and inventory data for each SKU at the was introduced at the stores. The selection of this variable

store level are readily available at Zara. Using this informa- is intuitive because sales typically peak shortly after a prod-

tion we constructed a data set of historical weekly demand uct is introduced, then gradually decrease as weeks go by.

wr and inventory Irw spanning four representative product This variable can be country-dependent.

groups and the three years from 2006 to 2008. This data • Previous period demand (w−1 r ): the demand rate

set was further split into a training set (all data from 2006 showed some degree of autocorrelation. We considered a

and 2007 and regular selling season of 2008) and a testing first-order autoregressive term because it gave a good fit

set (2008 clearance sales). and kept the model simple. We used the Dickey-Fuller test

to discard the presence of a unit root.

3.2. Forecasting Model Specification • Broken assortment effect (min811 Irw /f 9): in retailing

it has been well documented that the demand rate of an

The main challenge when forecasting the demand rate wr article usually declines when the inventory goes below a

for future periods is the initial lack of price sensitivity data, certain level. This fact is known as the broken assortment

due to the fixed-price policy that Zara applies to most of its effect, and it is especially prevalent in apparel because,

articles in the regular season. To overcome this, we relied when inventory is low, the remaining items are usually

on a two-stage estimation procedure, which we describe those that are less attractive to customers (see Smith and

shortly. For many different model specifications, we applied Achabal 1998, Fisher and Raman 2010, §A-3).2 To incorpo-

this procedure to the training data set defined above and rate this in our model, we define the threshold f , which can

computed predictions for the sales realized in the clearance be article-dependent and represents the minimum on-hand

period of 2008 (testing data set). The final model selec- inventory required for an adequate in-store presentation of

tion was based on a combination of managerial judgment, the product. Although this parameter can be defined for an

the t-statistics and overall goodness-of-fit in the two-stage individual store, we calibrated it for the entire country to

procedure, and most importantly, the aggregate forecast- keep the regression aggregated at that level.

ing error for the testing data set. The final validation took • Price discount (prw /prT ): price is obviously a key sales

place during the live pilot described in §5, when forecast driver in the clearance period. The selection of this specificCaro and Gallien: Clearance Pricing Optimization for a Fast-Fashion Retailer

Operations Research 60(6), pp. 1404–1422, © 2012 INFORMS 1409

variable reflects, however, that customers are more sensi- effects—i.e., those estimated in the first stage—are more

tive to the relative markdown than to the absolute price stable than the key parameters that are updated in the sec-

cut. Indeed, a common practice at Zara and other apparel ond stage. Therefore, in Equation (3) the effects of the

retailers is to advertise specific markdowns (expressed as nonupdated regressors from Stage 1 are removed to obtain

negative percentages) using signs posted in various areas the residuals that contain only the effects of the updated

of the store. In addition, Zara deliberately shows the cur- regressors. Note that t4 was included in the Stage 1 regres-

rent price prw together with the regular season price prT on sion to improve the fit, but it is disregarded in Equation (3)

the article’s price tag, so customers immediately know how because the broken assortment effect is particularly relevant

big is the markdown. The selected regressor captures these during clearance sales, and therefore the parameter should

features as the ratio between the two prices. be updated. Then Stage 2 is accomplished by regressing

The parameters 0r 1 1 1 0 0 0 1 5 in Equation (1) are the residuals with respect to the broken assortment effect

regression coefficients. In particular, 5 represents the price and the price markdowns:

elasticity, which in this model is constant and identical for

Iw

w

p

all articles in the given product group for each country. wr = w4 ln min 11 r + w5 ln rT + rw 1

f pr

This gave better results than alternative specifications with

price- or article-dependent elasticities. Similarly, the multi- ∀ r ∈ R1 w ¾ 11 (4)

plicative/exponential functional form in (1) provided a bet- where rw is the regression error term. This yields the esti-

ter fit for price response than a linear model, as is also

mated parameters ˜ 4 and ˜ 5 .

noted by other studies in the literature (Smith et al. 1994).

To leverage data from the past and current seasons, the

To linearize the regression model, we took logarithms in

aforementioned two-stage procedure was executed twice.

Equation (1). Note that the error term in the linearized

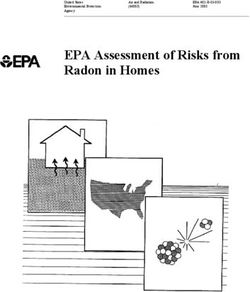

This is depicted in Figure 2. First, the procedure was exe-

model becomes a multiplicative error factor in the origi-

cuted pooling the data from past seasons, which generated

nal model—this apparently innocuous transformation has

the set of estimated parameters 8˜ P4 1 w 1 ˜ P5 1 w 9w¾1 , where we

important consequences when forecasting, as will be seen

use the superscript P to denote that it comes from past sea-

later.

son data. Of course, from Stage 1 we also obtained the set

An important observation is that when applying Equa-

of parameters ˜ P0r , ˜ P1 , ˜ P2 , ˜ P3 , but these played a role only

tion (1) to predict demand during clearance sales, the desir-

in the computation of the residuals. The two-stage proce-

able frequencies at which the regression coefficients should

dure was then executed using current season data up to the

be updated vary for different regressors. Specifically, while

most recent period available (w = c − 1). From Stage 1 we

0r , 1 , 2 , and 3 may be estimated once using regular

obtained the set of estimated parameters ˜ C0r , ˜ C1 , ˜ C2 , ˜ C3 ,

season data, it is desirable to update the estimation of 4

and from Stage 2 we obtained 8˜ C1 4

w ˜ C1 w

1 5 91¶w 11 (6)

updated as clearance sales data becomes available. Note

that this approach closely resembles the two-stage method where i = 41 5 and 1 + 2 + 3 = 1.

developed by Smith et al. (1994) in the context of tempo- The recursion (6) is a direct generalization of the one-

rary in-season promotions. dimensional exponential smoothing, which is a common

More specifically, in Stage 1 we used regular selling sea- procedure used to update parameters in adaptive systems

son data (w < 1) and ran the regression (see Little 1966). In the first period of clearance sales, all

the weight was given to the historical parameters due to the

ln4wr 5 = 0r + 1 ln4Cr 5 + 2 Awr + 3 ln4rw−1 5

w lack of current pricing information. For subsequent periods,

I the value of 2 determined the weight given to the most

+4 ln min 11 r +uwr 1 ∀ r ∈ R1 w < 11 (2)

f recent data.3 Note that as clearance sales progressed, only

with error term uwr , from where we obtained the set of the residual regression for the most recent period had to be

parameters ˜ 0r , ˜ 1 , ˜ 2 , ˜ 3 . In Stage 2, we used clearance run. With the parameters ˆ w4 and ˆ w5 obtained from Equa-

sales data (w ¾ 1) to compute the residuals tions (5)–(6) we forecasted the demand rate for the current

period (w = c) according to the formula

wr = ln4wr 5 − ˜ 0r − ˜ 1 ln4Cr 5 − ˜ 2 Awr − ˜ 3 ln4w−1

r 51

˜ wr ≈ exp ˜ C0r + ˜ C1 ln4Cr 5 + ˜ C2 Awr + ˜ C3 ln4w−1 5

∀ r ∈ R1 w ¾ 10 (3) r

Irw

w

As in Smith et al. (1994), this two-stage procedure ˆ ˆ p

is based on the pragmatic assumption that season-wide

w

+ 4 ln min 11 + 5 ln rT

w

0 (7)

f prCaro and Gallien: Clearance Pricing Optimization for a Fast-Fashion Retailer

1410 Operations Research 60(6), pp. 1404–1422, © 2012 INFORMS

Figure 2. Two-stage estimation procedure using past 4P 5 and current 4C5 season data.

Regular selling season Clearance sales

(1st stage estimation) (2nd stage)

Past 2006

seasons

2007

˜ P0r ˜ P1 ˜ P2 ˜ P3 ˜ P4 w ˜ P5 w

Current

2008

season

˜ C0r ˜ C1 ˜ C2 ˜ C3 ˜ C

4

w ˜ C w

5

Current period c

(weighted update)

ˆ ci = 1 ˆ ic−1 + 2 ˜ C

i

c−1

+ 3 ˜ Pi c i = 4 5

Note. The current period is denoted by w = c.

There is one caveat to the forecasting formula (7): it requirements make them more suitable for in-season pro-

ignores the fact that the expectation of the regression error motions rather than markdown sales. Moreover, finding the

term 4 rw 5 is usually greater than one when the logarithmic dynamic pricing solution becomes very challenging even in

transformation is reversed. Indeed, by Jensen’s inequality, stylized settings where the substitution structure is known

Ɛ6e 7 ¾ 1 when Ɛ6 7 = 0, and in many cases the inequality (e.g., Dong et al. 2009). Given the additional complexity

is strict, which introduces a systematic downwards bias if that cross-product dependencies impose, we chose not to

ignored. In the test runs we observed a tendency to under- model them explicitly. For the same reason, we did not con-

estimate demand. Therefore, we multiplied the forecast (7) sider directly the impact of competition (see Gallego and

by a correction factor and specifically used the smearing Hu 2007) or strategic customers (see Cachon and Swinney

factor H w introduced by Duan (1983): 2009). While some of these effects may be incorporated

indirectly by restricting the range of feasible prices based

1 X

H w 2= exp4 ˜rw 51 w ¾ 11 (8) on Zara’s informed judgment, these observations certainly

R r∈R constitute limitations of our model. Note, however, that

these limitations also apply to the legacy pricing process,

where ˜rw corresponds to the estimated errors in Equa-

which constitutes our benchmark in this particular prac-

tion (4). The bias in the retransformation can be even

tical setting. Overall, our demand model as described in

more significant in the presence of heteroscedasticity; see

Equation (1) is a particular case of the general demand

Manning and Mullahy (2001). To avoid this issue, we

model introduced in Smith and Achabal (1998), and we

tested systematically for heteroscedasticity, and if present,

we modified the correction factor (8) accordingly (see the also borrow from that paper the specific formulation for

e-companion for details). In general, the correction factor the broken assortment effect. However, in contrast with

took values ranging from 1.2 to 1.6. the specific model definition estimated for application pur-

poses in Smith and Achabal (1998) and featuring exponen-

tial price sensitivity—see Equation (30) in that paper—our

3.3. Demand Model Discussion

specification is a log–log model with a constant price elas-

We now provide a brief discussion on the assumptions ticity, which also captures additional idiosyncratic explana-

underlying the demand model presented in §§3.1 and 3.2. tory variables and temporal auto-correlation. We refer the

Note first that the estimation of the demand rate wr for reader to §5.2.2 for a discussion of the actual forecasting

article r only uses sales data of that article. Similarly, accuracy performance achieved by our demand model when

the functional form in Equation (1) depends only on the implemented in the field, which constitutes in our view an

price and inventory of article r. Therefore, the model important validation of this model and its assumptions.

does not capture substitution or complementarity effects

between products. Although there exists recent literature

on how to estimate primary demand for substitutable prod- 4. Price Optimization Model

ucts under the presence of stockouts (e.g., Vulcano et al. This section describes the development and formulation

2012 and Musalem et al. 2010), the data and computational of the markdown optimization model we implementedCaro and Gallien: Clearance Pricing Optimization for a Fast-Fashion Retailer

Operations Research 60(6), pp. 1404–1422, © 2012 INFORMS 1411

(in §4.1) and contains a brief discussion of its underlying the most expensive items, and RN the cheapest. Let W 2=

assumptions (in §4.2). 8w c ¶ w < W 9 be the remaining pricing periods, where

W is the last period when all the remaining inventory will

4.1. Model Development be liquidated at price p0 . As before, w = c − 1 represents

The decision problem considered arises at least every week the most recent period for which there are data available.

w

during the clearance sales period for every combination of For the decision variables, xnk ∈ 801 19 indicates whether

country (e.g., Belgium) and product group (woman blazer cluster n should be sold at clearance price pk or lower

w

or T-shirts). It consists of partitioning each product group during pricing period w ∈ W, with xn0 = 0 for all

4n1 w5 ∈ N × W. The prices from the previous period are

in each country into price categories (e.g., woman blazer c−1

given by xnk , which is input data in the current period. In

from E99 to E55), and assign to each subset a clearance

particular, recall that w = 1 corresponds to the first period,

price (e.g., E29.99) at which all the articles in that subset 0

therefore one can use xnk to impose a minimum markdown

will be sold. An important general constraint is that differ-

at the beginning of clearance sales. The auxiliary variable

ent articles with the same regular season price or the same w

ynk ∈ 801 19 indicates whether cluster n should be sold at

price at some point during the clearance period are always

clearance price pk during period w; wnk ¾ 0 represents the

sold subsequently at the same clearance price. That is, price

expected sales for cluster n in period w ∈ W if sold at

categories aggregate but do not separate over time. As a

price pk ; zwk ∈ 801 19 indicates whether clearance price pk

result, instead of considering individual articles we can use

is used for any cluster (zwk = 1) P or not at all (zwk = 0) dur-

the concept of a cluster (see §1.1), which are articles that

ing period w ∈ W; and Inw 2= r∈Rn 1 s∈S4r51 j∈J Irsj w

repre-

were sold for the same price during the regular selling sea-

sents the inventory of cluster n available at the beginning

son. Also, all clearance prices for a given product group

of period w. Note that the inventory level for the current

must be chosen within a discrete feasible price set (e.g.,

period Inc is input data. The uncertainty in the problem is

{E9.99, E14.99, E19.99, E24.99, E29.99, E34.99}).

given by Saleswrsj , the sales of SKU rs at store j in period

A natural approach to model clearance pricing is

w, which is a random variable for w ∈ W that depends on

dynamic programming (DP) (Talluri and van Ryzin

price and the inventory position. Finally, let Qw and N w

2004). Such formulation for our problem is given in the

be input parameters that represent the minimum inventory

e-companion, but as with most DPs it is subject to the

per category and the maximum number of distinct prices in

curse of dimensionality (Bertsekas 1995) and therefore dif-

period w respectively. We formulate the pricing optimiza-

ficult to implement in a practical setting. This leads us

tion model as follows:

to consider approximate formulations. Specifically, for the

pk wnk + p0 InW 1

X X

inventory dynamics we use a certainty equivalent approxi- max (9)

mation by which future sales are replaced by their expected w∈W1 n∈N1 k∈K n∈N

values (see Bertsimas and Popescu 2003). Although each s.t. wnk w

= ynk

X X X

Ɛ6Saleswrsj pk 1 Irsj

w

71

period the problem is solved for the entire horizon, only r∈Rn s∈S4r5 j∈J

the actions suggested for the current period are imple-

∀ w ∈ W1 n ∈ N1 k ∈ K1 (10)

mented. After sales are observed, the input data, including

w w w

the forecast, are updated and the model is solved again. ynk = xnk − xnk−1 1 ∀ w ∈ W1 n ∈ N1 k ∈ K1 (11)

Besides its advantages from an implementation standpoint, w w

xnk−1 ¶ xnk 1 ∀ w ∈ W1 n ∈ N1 k ∈ K1 (12)

the certainty equivalent controller also has a good theoret-

w w

ical performance as discussed in Jasin and Kumar (2010). xnk ¶ xn+1k 1 ∀ w ∈ W1 n ∈ N1 k ∈ K1 (13)

For small instances with a single article we performed a X w

X w

numerical study, and the suboptimality gap was below 0.5% xnk = xn+1k 1 ∀ n such that

w∈W1 k∈K w∈W1 k∈K

on average and less than 3% in the worst case (see the

c−1 c−1

X X

e-companion for details). xnk = xn+1k 1 (14)

In what follows, we assume that customers demanding k∈K k∈K

SKU rs at store j in period w arrive according to a Poisson w−1 w

xnk ¶ xnk 1 ∀ w ∈ W1 n ∈ N1 k ∈ K1 (15)

process with arrival rate rsj ˜ wr , where ˜ wr is given by the

Inw+1 = Inw − wnk 1 ∀ w ∈ W1 n ∈ N

X

(16)

forecast formula (7) and rsj is the sales weight of SKU

k∈K

rs at store j (see the e-companion for details on the com- w

putation of this last parameter). Let k ∈ K 2= 811 0 0 0 1 K9 ynk ¶ zwk 1 ∀ w ∈ W1 n ∈ N1 k ∈ K1 (17)

be the clearance price index. The set of clearance prices is

X w

zk ¶ N w 1 ∀ w ∈ W1 (18)

8pk 1 k ∈ K9, which by convention is increasing, i.e., p0 ¶ k∈K

p1 ¶ p2 ¶ · · · ¶ pK , and p0 is the final unit salvage value or X w

Inw ynk ¾ Qw zwk 1 ∀ w ∈ W1 k ∈ K1 (19)

liquidation price. Let n ∈ N 2= 811 0 0 0 1 N 9 denote clusters n∈N

and let Rn be the set of S products in cluster n, so the entire

Inw 1 wnk ¾ 01 xnk

w

∈ 801 191 zwk ∈ 601 171

product group is R = n∈N Rn . Clusters are ordered in

reverse order of regular season prices. That is, R1 contains ∀ w ∈ W1 n ∈ N1 k ∈ K0 (20)Caro and Gallien: Clearance Pricing Optimization for a Fast-Fashion Retailer

1412 Operations Research 60(6), pp. 1404–1422, © 2012 INFORMS

The objective (9) is the sum of the revenue from all evaluated at prw = pk . The first equality is the definition

clusters up until the last week, and the revenue from liq- of wrk . The second equality follows from the Poisson pro-

w

uidation at price p0 after clearance sales. Constraint (10), cess where rsj is the stopping time until when SKU rs is

which we soon discuss further, links predicted sales volume on display at store j in period w (the same property is used

with prices, i.e., it represents the underlying price response in Caro and Gallien 2010). The third step follows from

model. Constraints (11) and (12) follow from the definition w

Irsj ¶ Iˆrsj

w

for all stores and SKUs. The fourth step uses

of the xnkw w

and ynk variables. Constraint (13) ensures that the the definition of ˜ wr 4pk 1 Irw 5 and again the Poisson property,

initial ordering of clusters by prices is maintained through- and the last step is just the definition of Erw 4pk 5.

out the clearance period. Constraints (14) make sure that We linearize the broken assortment term in Equation (21)

clusters that were priced together, remain together. Con- by fitting the linear form used in Smith and Achabal (1998).

straint (15) ensures that the clearance sales price for any While details are given in the e-companion, the resulting

cluster decreases over time. Constraint (16) implements the expression is

inventory dynamics as a function of the pricing decisions. ˜

I w 4 Erw 4pk 5

Note that inventory is aggregated by cluster because pric-

min 11 r

ing decisions are made at that level. Constraint (17) imple- f 4min811 Iˆrw /f 95˜ 4

ments the definition of zwk . Constraint (18) ensures that

Irw Erw 4pk 5

the number of distinct price categories in period w does ≈ min 11 1 − + 1 (22)

not exceed N w . Constraint (19) ensures that the amount of f 4min811 Iˆrw /f 95˜ 4

inventory available at the beginning of period w is at least

Qw for each category.4 Finally, constraint (20) imposes the where 2= 432 + 95/422 + 6 + 45 and 2= ˜ 4 . We

nonnegative or binary requirements for the decision vari- can use Equation (22) to write the following (approximate)

ables. Observe that variables ynk w

and zwk do not need to linear constraints for wrk :

w

be defined as binary provided that xnk is. Also, the non-

wrk ¶ Erw 4pk 5ynk

w

1 ∀ w ∈ W\8c91 r ∈ Rn 1

negativity of Inw+1 together with the inventory balance con-

straint (16) ensure that the expected sales wnk never exceed n ∈ N1 k ∈ K1 (23)

the available inventory Inw .

Irw

The formulation above is still hard to solve in prac- wrk ¶ 1 − + Frw 4pk 51 ∀ w ∈ W\8c91

f

tice due to the nonlinearity of Constraint (10). Therefore,

we linearize these equations. This requires some attention r ∈ R1 k ∈ K1 (24)

because the random variables Saleswrsj depend on inventory ˜

in two ways. First, sales are bounded by the inventory avail- where Frw 4pk 5 2= Erw 4pk 5/4min811 Iˆrw /f 954 . Con-

able (as in the usual newsvendor); and second, the demand straint (23) is the relevant bound when 1 − + 4Irw /f 5 ¾ 1

w

or ynk = 0, and Constraint (24) captures the complementary

rate of the Poisson process is affected by inventory level

case. Note that in the first case the denominator in the

through the broken assortment effect (see §3). Moreover,

right-hand side of Equation (22) is equal to one (here

the latter takes place at the article level, while our problem

we are using again the fact that Irw ¶ Iˆrw ). Note that

is formulated at the cluster level. Taking this into account,

Constraints (23) and (24) do not need to be defined for

our approximation is based on the following observation:

w = 1 because the inventory levels for the current period

Let Iˆrsj

w

be an upper bound for the inventory level of SKU

are known so Erw 4pk 5 and Frw 4pk 5 can be computed exactly.

rs at store j in period w. Then, we have that

Constraints (23) and (24) linearize Constraint (10) in

our pricing optimization model. Note that Constraints (23)

wrk 2= Ɛ6Saleswrsj pk 1 Irsj

w

X X

7

and (24) are defined at the article level r, while the con-

s∈S4r5 j∈J

straint they replace is defined at cluster level n. There-

= ˜ wr 4pk 1 Irw 5 w w

X X

rsj Ɛ6rsj pk 1 Irsj 7 fore, a completeP formulation would also have to include the

s∈S4r5 j∈J identity wnk 2= r∈Rn wrk and an inventory balance equa-

¶ ˜ wr 4pk 1 Irw 5

X X w

rsj Ɛ6rsj pk 1 Iˆrsj

w

7 tion at the article level. An alternative is to aggregate con-

s∈S4r5 j∈J straints (23) and (24) across articles of the same cluster.

˜

This reduces the size of the model and is also consistent

4min811 Irw /f 954 X X with the fact that pricing decisions are made at the cluster

= Ɛ6Saleswrsj pk 1 Iˆrsj

w

7

4min811 Iˆrw /f 95˜ 4 s∈S4r5 j∈J level. In the e-companion we provide the details on how to

˜ aggregate these constraints and how to compute the param-

I w 4 Erw 4pk 5

eters Erw 4pk 5 and Frw 4pk 5 for w > 1.

= min 11 r 1 (21)

f 4min811 Iˆrw /f 95˜ 4

4.2. Optimization Model Discussion

w ˆw

where Erw 4pk 5 2=

P

s∈S4r51 j∈J Ɛ6Salesrsj pk 1 Irsj 7 and The premise in the pricing optimization model described

˜w 4pk 1 I w 5 is the arrival rate given by the forecast (7) in §4.1 is that the firm’s objective is to maximize the total

r rCaro and Gallien: Clearance Pricing Optimization for a Fast-Fashion Retailer

Operations Research 60(6), pp. 1404–1422, © 2012 INFORMS 1413

revenue across the entire duration of clearance sales. This to March 2009, corresponding to clearance sales of the

seems natural because at the time of clearance sales, inven- 2008 fall-winter season. The objective of the live pilot was

tory is a sunk cost. However, in practice many retailers threefold: First, establish the applicability of the model in

make pricing decision with the de facto objective of liqui- the field. Second, refine the solution based on user feed-

dating inventory to open up space for the upcoming sea- back. Third, quantify the model’s specific impact on mark-

son. The consequences of this is discussed later in §5, but down decisions, which is the main issue discussed in this

for the model formulation the question is how to account section. Specifically, the details of our methodology are

for the fact that markdown items hold up valuable retail given in §5.1, where we present the experimental design (in

display area. One approach is to include an opportunity §5.1.1) and the performance metrics used (in §5.1.2). The

cost that captures the relative value between old and new results of the pilot are then reported in §5.2, specifically

items (see Araman and Caldentey 2009), but estimating this the observed forecast accuracy (in §5.2.2), pricing behavior

parameter can be a difficult task. An alternative approach (in §5.2.3), and financial impact (in §5.2.5).

preferred by Zara is to deliberately reduce the number of

posted prices as clearance sales goes by. That is the purpose 5.1. Methodology

of Constraint (18), and the rationale is that having fewer

5.1.1. Experimental Design. Zara’s assortment in the

prices allows the store manager to consolidate the inventory

women section consists of 20 product groups, not includ-

on display so it uses less store space. In some situations, it

ing accessories. For the pilot, we divided the assortment in

is imperious that most of the inventory is sold, e.g., when

two large sets of product groups: groups 1–12, that include

there is little opportunity to salvage stock and disposing

relatively more classic designs targeted to women in their

of it would imply a cost. For those cases, we included late twenties and above; and groups 13–20, that include

an optional constraint that explicitly limits the amount of more fashionable items targeted to younger women. Arti-

inventory left over. cles in the latter groups tend to have lower prices than

The Poisson assumption is another central premise in those in the former. Zara gave our team the entire countries

the model formulation, which is needed for tractability rea- of Belgium (BEL) and Ireland (IRL) to run the experi-

sons as in many revenue management problems. We specif- ment. We carefully designed the pilot in the following way:

ically take advantage of it to approximate the price response In Belgium, the optimization model was used to suggest

where the demand rate also depends on the inventory level prices for groups 1–12, whereas the manual legacy process

(see Equation (21)). We believe this feature constitutes a was used to price groups 13–20. Conversely, in Ireland, the

novel feature of the model because most of the literature manual process was used for groups 1–12, and the model

on inventory-dependent demand is for the single-period suggested prices for groups 13–20. Finally, in the rest of

newsvendor (e.g., Dana and Petruzzi 2001). Finally, it must western Europe (RWE), the manual process was used to

be noted that we rely on the certainty equivalent approx- price all the product groups.5

imation to solve a math program instead of a DP. This is The groups subject to the model, i.e., groups 1–12 in

driven by the need of efficient run times because there is a Belgium and 13–20 in Ireland, represented the treatment

small time window to make the pricing decisions. set, while the rest served as the control set. On one hand,

However restrictive the assumptions and approximations this partition allowed to rule out country and store specific

discussed here may seem, we note in closing that they are factors, i.e., whether the conditions in a given country or

supported and partially justified from a practical standpoint store were intrinsically more (or less) favorable for clear-

by the implementation results to be presented next. ance sales. On the other hand, the fact that the treatment

and control groups were inverted between Belgium and Ire-

5. Pilot Implementation Study land made sure that the particular selection of the treatment

set was not driving the results. Finally, any base difference

A working prototype of the entire new pricing system was between groups 1–12 and 13–20 was captured by using the

completed in 2008. The forecast described in §3 was imple- rest of western Europe as a reference point, against which

mented in Java, and the optimization model from §4 was Belgium and Ireland were compared. This design was

coded in AMPL and solved with CPLEX (later the model also constructed to minimize potential demand substitution

was also migrated to Java). Pulling the data from Zara’s across test and control groups. Specifically, Zara managers

databases to feed the forecast was the most time-consuming felt that demand substitutions would be plausible between

task and was usually done over the weekend. Solving the any two articles within either groups 1–12 or groups 13–20,

optimization problem was done overnight, and the usual but unlikely across those two sets of groups because they

instance for a group in a given country would have up to appealed to fairly different customer types. These consid-

12 prices, 15 clusters, and 8 periods. Therefore, the number erations ruled out designs involving (say) even-numbered

of binary variable in the model rarely exceeded 1,500, and groups for the intervention and odd-numbered group for

each instance was typically solved in a few minutes. the control. Finally, the inventory available at the begin-

We tested the resulting model-based pricing process in ning of clearance sales, while not explicitly controlled for,

a controlled field experiment that took place from January was fairly uniform across groups and countries (i.e., theCaro and Gallien: Clearance Pricing Optimization for a Fast-Fashion Retailer

1414 Operations Research 60(6), pp. 1404–1422, © 2012 INFORMS

amount of initial inventory relative to past season demand the average price P w in period w, defined as

was about the same everywhere). This resulted from the

period w initial inventory valued at period w prices

use by Zara of the same pre-clearance inventory positioning P w 2= 0

process worldwide (Verdugo 2010). period w initial inventory (in units)

Note that for the treatment groups, the model was used (27)

to suggest markdowns, but the manual prices were still gen-

erated in parallel. In other words, at each price revision, Note that P w is computed at the beginning of period w and

two lists of suggested prices were available for the treat- reflects the pricing decisions, while X w and Y w are trailing

ment set: one list from the model, and the other from the metrics that are computed at the end of period w once sales

legacy pricing process (followed as usual without knowl- have been observed.

edge of the model pricing recommendations). The actual Historically, the fraction sold X w , the average price P w

decision to follow the model prices required the approval and the (trailing) average markdown 1 − Y w had been the

from Zara’s pricing committee together with the country metrics most closely monitored by managers at Zara, usu-

managers of Belgium and Ireland. Although in an ideal ally comparing them across different countries. For the

experiment we would have liked the model to dictate the pilot, we were also interested in the trajectory followed by

prices for the treatment groups, this was not allowed given these metrics. However, for our purpose of comparing two

that there was still uncertainty, and even some skepticism, pricing methods, the key metric was the realized income Y

on whether the model would perform well. Moreover, the at the end of clearance sales. The live experiment was pur-

model had always been envisioned as a support tool rather posely designed to measure the model’s impact on that

than an automated decision maker. Hence, letting the pric- metric by using a difference-in-differences statistical pro-

ing committee and country manager have the final say not cedure. Difference-in-differences is a standard technique to

only was pivotal for the experiment to happen, but also evaluate the impact of a change/treatment in an experimen-

was closer to the actual use intended for the model. We did tal setting in which one group of subjects has experienced

keep track of the adherence to the model’s suggestion and the treatment, whereas another, comparable group has not

report it in §5.2.3. (Kennedy 2003). The estimated impact corresponds to the

5.1.2. Metrics. The primary financial metric used by difference between the changes experienced by the two

Zara to evaluate its clearance sales performance is the real- groups.6 Specifically, for each store in Belgium we com-

ized income Y defined as puted the aggregate realized income for groups 1–12 and

clearance period income+liquidation income 13–20 (denoted Y1–12 and Y13–20 , respectively). Then, we

Y 2= 1 took first differences and computed the average across all

value of clearance inventory at regular season prices BEL BEL

stores (denoted Y1–12 − Y13–20 ). We did the same for the

(25) stores in Ireland and in RWE. Finally, we computed the

which can be calculated for a store, country, or the entire (second) difference between the averages in Belgium and

chain. If only the inventory sold until period w is consid- RWE to obtain

ered in Equation (25), then the metric is denoted Y w . The

realized income measures the ratio of the actual revenue ãBEL 2= 4Y1–12

BEL BEL

− Y13–20 RWE

5 − 4Y1–12 RWE

− Y13–20 51 (28)

from clearance sales to the maximum revenue achievable

and we did the same between Ireland and RWE to

by selling the inventory at regular season prices. A higher

obtain ãIRL .

realized income is better because it reflects more revenue

As mentioned in §5.1.1, the first difference in Equa-

generated out of a given amount of initial stock, valued

tion (28) removed any country or store specific factors,

at the prices prior to markdowns. Note that if the numer-

while the second difference removed any intrinsic perfor-

ator and denominator in Equation (25) are divided by the

mance differential between groups 1–12 and 13–20. Aver-

inventory expressed in units, then the metric Y can be seen

aging across stores removed any random noise. Moreover,

as the ratio of the average price in clearance sales to the

we used the store sample to perform a t-test comparing

average price in the regular season. Therefore, 1 − Y is the BEL BEL RWE RWE

average markdown, or the average price cut, as it is known the means Y1–12 − Y13–20 and Y1–12 − Y13–20 , which deter-

internally at Zara. mined whether the expression in Equation (28) was signif-

As discussed before, even though the objective of clear- icantly different from zero. Similarly, we used the Mann-

ance sales is to maximize revenue, an indirect goal is also Whitney test to determine whether the medians of the first

to liquidate stock. Therefore, a secondary metric that is differences across stores in Belgium and RWE were sig-

very relevant to Zara is the percentage sold X w , internally nificantly apart. The same calculations were repeated for

known as the fraction sold, which is defined as Ireland and RWE.

units sold up to period w

X w 2= 0 (26) 5.2. Results

initial clearance sales inventory (in units)

Because the fraction sold can always be improved by intro- 5.2.1. Summary Statistics. To forecast sales, we fol-

ducing more aggressive markdowns, it is complemented by lowed the two-stage estimation procedure described in §3.2.You can also read