Demand for meat substitutes is growing - blw.admin

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Swiss Meat Substitutes Report, May 2021

Demand for meat substitutes is growing

Against the backdrop of climate change and the consumer trend towards an increasingly meat-

free diet, sales of meat substitutes have become established in the Swiss retail sector in recent

years. To date, however, no comprehensive overview of the Swiss market has been available. How

has demand for meat substitutes developed in recent years? What is the potential for Swiss agri-

culture and the economy? The Federal Office for Agriculture has analysed the market for meat

substitutes in the Swiss retail sector from various perspectives: answers are provided by the first

Swiss Meat Substitutes Report.

The growing importance of meat alternatives in 3. to identify possible potentials for production

Switzerland has previously been described on of plant protein for human nutrition in Swiss

the basis of ad hoc surveys or using qualitative agriculture.

approaches (e.g. GDI, 2019; SwissVeg, 2020).

Other studies on this topic have focused on indi- Content of the study

vidual companies (Coop, 2021). A quantitative, The study examines developments in the market

data-driven analysis of the development of the for meat substitutes in the Swiss retail sector

meat substitutes market has not been available from 2016 to 2020. The category of meat substi-

to date – a gap now filled by this study. The tutes is first placed in the context of the develop-

present analysis was prepared by the Market ment of demand for meat, so as to illustrate the

Analysis Unit of the Federal Office for Agriculture relative proportions and thus the current im-

on the basis of the most recent retail and portance of meat and meat substitutes overall

consumer panel data from Nielsen Schweiz. The (see the chart on the next page). The develop-

report has three aims: ment of sales value and volume, prices and mar-

1. to provide a quantitative account of develop- ket share is analysed overall and for various

ments in the meat and meat substitutes mar-

ket, thus creating a better understanding of

the market;

QUICK START

2. to increase transparency in rapidly evolving

food markets; The Table of Contents is on page 3

Key Points in Brief is on page 4

The Market Analysis starts on page 8

1Swiss Meat Substitutes Report, May 2021

M E AT S U B STITU TES I N T H E S WI SS R E TAI L T R AD E

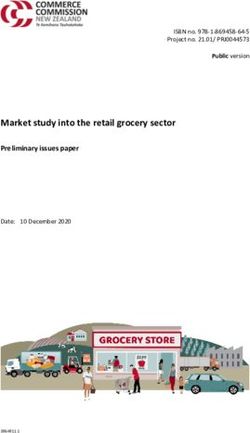

Revenue of meat and meat substitute products

Revenue in millions CHF

2020

Fresh meat Deli meats Canned & rest of meat Meat substitute

00

Total

2 275 998 815 583

5 433

243 128

117

166

77 31

Diverse meat

Canned

Meat

Insects 0,29 million CHF

Sources: FOAG, Market Analysis; Nielsen Switzerland

product groups. Within the meat substitutes cat- Retail trade vs overall market

egory, the three product groups Currently, the development of the meat substi-

“tofu/tempeh/seitan”, “vegetarian convenience” tutes market is essentially determined by the re-

and “meat analogue” are examined in more de- tail sector. The study therefore focuses on this

tail, using the combined retail and consumer key market. Out-of-home consumption of meat

panel data from Nielsen. In addition, using con- substitutes is not discussed, as so far, com-

sumer panel data, the purchasing behaviour of pared to the retail trade, this has been of minor

households with regard to meat substitutes and importance for the overall market development

in comparison with meat is considered in rela- of this product category.

tion to sociodemographic characteristics. The

analysis section concludes with a comparison of Supplementary information and data

consumer expenditure on meat substitutes in

The various info boxes included in the report are

various countries, considering not only Nielsen

designed to explain or define key terms, to

data for Switzerland but also market data from

provide further information on methodology, or

Nielsen MarketTrack and Eurostat. Finally, the

to explore additional topics in more depth. The

study looks ahead to possible future develop-

various charts, with the underlying data and fur-

ments for meat substitutes at the global level

ther information, can be found in a separate Ex-

and considers the implications of these demand

cel file on the website of the Federal Office for

trends for Swiss agriculture.

Agriculture (supplementary tables).

The Table of Contents can be found on page 3.

By way of introduction, the study begins on page

5 with a brief review of current consumer trends

2Swiss Meat Substitutes Report, May 2021

which are important in the context of demand for RECOMMENDED CITATION

meat and meat substitutes.

Federal Office for Agriculture, Market Analysis

Unit (2021): Report on the Swiss meat substitutes

market.

CONTENTS

Content of the study ...............................................1 One in six burgers plant-based ................................. 15

Retail trade vs overall market ......................................2 Strong growth in share of sales by value ................. 17

Supplementary information and data .........................2 Price development driven by product launches ....... 17

Current consumer trends ........................................5 Price differentials: a mixed picture ........................... 18

Consumer decisions now influenced by many factors Discounters advancing.............................................. 20

......................................................................................5

Discounters favour meat analogue, the specialist

Meat substitutes: a social trend and a growth market trade tofu & co ........................................................... 21

......................................................................................5

Increase in households purchasing meat substitutes

Market analysis ......................................................8 .................................................................................... 21

Meat substitutes currently a niche..............................8 Meat substitutes popular among young, high-income

families in German-speaking Switzerland ................ 22

Strong growth for meat substitutes ............................9

Differences at the household level ........................... 24

Retail demand: special situation in 2020....................9

UK is Europe’s largest meat substitutes market...... 26

49% increase in sales volume in 2020 ......................11

Meat substitutes most expensive in Switzerland .... 27

Record sales of meat substitutes in 2020 ................12

Outlook: studies forecast strong growth worldwide 28

Continuous expansion of the meat substitute product

range ..........................................................................13 Swiss agriculture not currently benefiting from

growth of meat substitutes....................................... 29

Traditional meat substitutes dominant ....................13

Burger: fastest-growing product group.....................14

3Swiss Meat Substitutes Report, May 2021

KEY POINTS IN BRIEF

• Against the backdrop of societal debate on climate change and livestock-based food production, alternative

protein sources for human nutrition in the form of meat substitutes are of growing importance. In the present

report, the development of the meat substitutes market in the Swiss retail sector is comprehensively ana-

lysed for the first time.

• Over the past five years, demand for meat substitutes has risen sharply. In 2020 – partly as a result of the

pandemic – Swiss retail sales of meat substitutes totalled CHF 117m, compared to CHF 60m in 2016. With

a compound annual growth rate of 18.4%, sales thus almost doubled over this period. Compared to meat,

however, meat substitutes are still a niche market, with a market share of 2.3% in the retail sector.

• The highest growth rates were achieved by so-called meat analogue products (i.e. products designed to look

and taste like meat). This subcategory – alongside the tofu/tempeh/seitan and vegetarian convenience sub-

categories – now accounts for over 60% of total sales of meat substitutes.

• Over the past five years, the number of retail products launched in the meat analogue and vegetarian conven-

ience subcategories has more than doubled; these include, in particular, burgers, cold cuts, or reformed meat,

such as schnitzel and nuggets.

• Particularly in demand are plant-based burgers. One in six burgers sold in the retail sector is now plant-

based. With sales of CHF 22.2m, tofu/tempeh/seitan is still the best-selling subcategory in the entire meat

substitutes range.

• In 2020, the average price (in unit value terms) paid by Swiss consumers for a kilogram of meat substitutes

was CHF 20.53 – 5.1% less, on average, than for meat products. However, direct comparison of individual

product groups shows that meat substitutes are significantly more expensive than meat products. For exam-

ple, plant-based burgers cost 42% more, on average, than meat burgers, and for shredded meat the price

differential is +16%. Overall, since 2016, the price gap between meat and meat substitutes has closed, with

meat substitutes becoming less expensive.

• With a market share of 90%, traditional retailers are the most important distribution channel for meat substi-

tutes. Over the past five years, however, sales have grown most strongly at discounters, with average annual

growth exceeding 60%. Here, meat analogue products accounted for the bulk of sales.

• Purchases of meat substitutes by households are strongly influenced by their sociodemographic character-

istics. Demand for meat substitutes is markedly higher in households (a) with up to two children, (b) in Ger-

man-speaking Switzerland, (c) headed by a person under 50, (d) with a high income and (e) in urban areas.

Conversely, demand for meat substitutes is lower in rural areas, in French-speaking Switzerland, and in low-

income households.

• With sales of around EUR 500m, the UK is Europe’s largest meat substitutes market. Switzerland is the coun-

try with the highest per capita expenditure (EUR 11.50) on meat substitutes in Europe. This high per capita

expenditure is essentially due to the fact that the sales value of meat substitutes is, on average, around

EUR 8 per kilogram (71.8%) higher in Switzerland than elsewhere (EUR 19.0 vs 11.1). Comparison of the quan-

tities purchased shows that both the Netherlands and the UK (0.86 kg per capita in each case) are ahead of

Switzerland.

• Various studies forecast a continued growth trend for meat substitutes over the next 5–20 years. In addition

to existing product groups, it is expected that cultured (lab-grown) meat will also be commercialised and

become established on the market.

• For Swiss agriculture, the meat substitutes market also offers considerable potential, especially with regard

to the production of raw materials for plant-based meat alternatives. To date, this potential has scarcely been

exploited. At present, virtually all vegetable raw materials for domestic production of meat substitutes are

imported.

4Swiss Meat Substitutes Report, May 2021

Current consumer trends as climate change, sustainable use of scarce re-

sources (e.g. water, soil and biodiversity) and

Consumer decisions now influenced by fair trade (Bolliger, 2012). In the age of social

many factors media, food, diet and cooking have also become

lifestyle topics (GDI, 2019).

The needs of consumers in industrialised coun-

tries are becoming increasingly individual and

Meat substitutes: a social trend and a

thus also more diverse. A shift in values is ob-

growth market

servable in the development of society, with a

general decline in “obligation and acceptance Against this complex background, meat con-

values” and a general rise in “self-realisation val- sumption has been the subject of intense social

ues” (Klages & Gensicke, 2002). The focus is no debate for around ten years now. In particular, in-

longer on basic physiological needs, such as tensive animal farming – with its adverse im-

hunger or thirst, but on the human need for self- pacts on the environment, the climate and ani-

fulfilment. Deficit needs, formerly more im- mal welfare – has been criticised by some parts

portant, are being replaced by the desire for per- of society, thus promoting the rise of diets in

sonal development. What we eat now depends which the consumption of animal products or

on numerous criteria. Consumer needs are meat is avoided or reduced, such as vegetarian-

much more multifaceted than in the past and ism, veganism or flexitarianism (for explana-

can be roughly divided into three levels tions of the various types of diet see page 6).

(Dürnberger, 2020): These societal requirements have now been rec-

ognised by the domestic and international food

• Level I: energy intake, price, health, taste,

trade and industry, which have been investing

quantity

heavily in the development of meat substitutes

• Level II: habit, status, naturalness,

for a number of years (GDI, 2017). Numerous

enjoyment, convenience

plant-based meat alternatives have already been

• Level III: ecological, social and ethical

successfully established on the market, with the

aspects (climate, fair trade, animal welfare)

total number steadily rising. Products made

The importance of the various criteria has

from cultured meat, however, have yet to be

changed over time. With economic growth since

launched, though there is also intense research

the beginning of the 1960s, the mere satisfac-

and investment in this area.

tion of physical needs has increasingly given

Meat substitutes have become a social trend.

way, in the western industrialised world, to a de-

But how has the market for meat substitutes de-

sire for health, convenience, enjoyment and a

veloped in Switzerland in recent years, and how

lifestyle that conserves natural resources

does it compare with the meat market? These

(Siegrist, 2005). Increasingly associated with

and other questions are addressed in the market

this trend are considerations such as the tracea-

analysis starting on page 8.

bility of products from farm to fork, the avoid-

The meat substitutes referred to in this study

ance of residues of any kind (hormones, antibi-

are defined on page 7. Explanatory notes on the

otics, pesticides), animal welfare, but also rapid

data used in the analysis can be found on page

meal preparation or the fortification of products

30.

with health-promoting additives. In addition, over

the last two decades, there has increasingly

been a broad consumer focus on aspects such

5Swiss Meat Substitutes Report, May 2021

TYPES OF DIET INVOLVING MEAT AVOIDANCE

People reduce their consumption of meat and animal products, or avoid them altogether, for a variety of reasons,

and such diets thus take various forms:

Vegetarianism/veganism

Vegetarians abstain from eating products derived from slaughtered animals, such as meat and fish.

Vegans abstain from eating any animal products, including those obtained from live animals, such as eggs, milk

or honey. The motives for adopting these diets vary. They include environmental reasons and ethical concerns

about farm animal welfare, as well as health and religious aspects. The proportion of vegetarians and vegans in

the Swiss population is estimated by SwissVeg at around 5% (SwissVeg 2020), with a slightly rising trend.

Flexitarianism

Flexitarians’ avoidance of meat is less pronounced. Members of this growing consumer group enjoy eating meat,

but deliberately restrict their consumption, without wishing to forgo the experience altogether. Their reasons vary

and include concerns about the effects of livestock production on climate change, the welfare of farm animals,

and their own health. According to SwissVeg, almost 20% of the Swiss population can be classified as flexitarians

(as of 2020).

Flexitarianism is focused on enjoyment. Seeking to meet this need, in particular, are imitation meat products

(designed to mimic the texture, taste, appearance and protein content of meat).

6Swiss Meat Substitutes Report, May 2021

DEFINITION OF MEAT SUBSTITUTES REFERRED TO IN THE ANALYSES

A large number of products can essentially be subsumed under the term “meat substitutes”. This term generally

covers all products designed as alternatives to meat, mimicking its various characteristics (e.g. its texture and

taste or its function as a source of protein or a regular dietary component). For the purposes of the present study,

to facilitate interpretation of the results, the term “meat substitutes” needs to be more precisely defined. The def-

inition used in this study is based on the data provided by Nielsen Schweiz, in consultation with Proviande and the

Federal Office for Agriculture. For the present study, “meat substitutes” thus comprises the following three sub-

categories: “tofu/tempeh/seitan”, “vegetarian convenience” and “meat analogue”.

Tofu/tempeh/seitan

Tofu, a traditional meat substitute, is primarily made from coagulated soya milk and has a high protein content.

Tempeh is also made from soya, but the whole beans are fermented with a fungus, forming a solid mass. Seitan

is a wheat gluten product, prepared by mixing the protein with water prior to cooking.

Vegetarian convenience

Vegetarian and vegan convenience are processed products of which the defining feature is essentially the vege-

table component, rather than plant-based protein. They are often eaten instead of meat but have their own partic-

ular taste. This category includes, for example, falafel. In some cases, these products also include tofu ingredients,

but they are processed to a much greater extent.

Meat analogue

Products in the “meat analogue” category are primarily defined by their taste, texture, appearance and protein

content. These products seek to imitate meat and are thus primarily designed for consumers who essentially enjoy

eating meat but are open to alternatives. The product names used are therefore largely based on the original meat

products (“burger”, “nuggets”, “cold cuts”, “chicken/pork”, “meat”, etc.)

Cultured meat/lab-grown meat

Cultured meat is defined by the way in which it is produced: it is not plant-based, but is “grown” synthetically in a

sterile environment (hence the informal term “lab-grown meat”). Required for the production of cultured meat are

animal stem cells, but not animal muscle meat. At the time of publication, no cultured meat products were yet

commercially available. This product category is therefore of no relevance in the analysis of the current develop-

ment of the market in Switzerland.

Not covered by the definition used here are processed ready meals with the character of a meat substitute, where

the meat content of the standard product does not represent a significant proportion, as in vegetarian lasagne,

ready-made kebab, vegetarian pizza, etc. Likewise not covered by the definition or considered in this analysis are

distinct product categories such as eggs, cheese, fish, fresh and canned peas/lentils, etc., which may potentially

serve as substitutes for meat protein but are traditionally assigned to a separate segment.

Meat substitutes must not necessarily be purely plant-based. In some cases, they are produced using egg or milk

protein components as well as plant-based ingredients. However, as the great majority of the product groups

considered in the analysis are based on plant materials or fungi, the term “plant-based alternatives” is widely used

in practice.

7Swiss Meat Substitutes Report, May 2021

Market analysis MEAT MARKET

More detailed information on the Swiss retail

Meat substitutes currently a niche meat market is to be found in the Meat Market

Based on the evaluation of the combined (re- Report published by the Federal Office for

tail/consumer) panel data from Nielsen Schweiz, Agriculture in February 2021 (available in French,

German and Italian).

total sales of meat and meat substitutes in the

Swiss retail sector amounted to CHF 5.43bn in

2020. Fresh meat (CHF 2.93bn) and deli meats important fresh meat category – sales of

(CHF 2.27bn) together accounted for more than minced meat, steak/schnitzel and prime cuts ac-

95% of total sales. While deli meats cannot be count for the bulk of the total of CHF 815m. With

clearly segmented by animal type (many pro- sales of CHF 583m, pork – the most important

cessed meat products contain meat from differ- animal type in the Swiss meat market – is only

ent types of animal), the importance of each an- the third best-selling fresh meat product, with

imal type can be unequivocally quantified in the chops, fillets, loins, escalopes and roasts being

case of fresh meat. particularly popular. Pork is, however, the main

With sales of almost CHF 1bn, the highest-sell- component of the various deli meat products

ing fresh meat category is poultry (primarily (sausage, bacon and ham). Veal (CHF 166m)

chicken and turkey); this is essentially attributa- and lamb (CHF 128m) have a high seasonal im-

ble to high sales volumes of chicken breast and portance – for example, at Easter or during the

the success of take-away sales of whole and half Christmas period. The lowest-selling category is

chickens. In the case of beef – the second most canned meat (CHF 31m). Compared with the

M E AT S U B STITU TES I N T H E S WI SS R E TAI L T R AD E

Revenue of meat and meat substitute products

Revenue in millions CHF

2020

Fresh meat Deli meats Canned & rest of meat Meat substitute

00

Total

2 275 998 815 583

5 433

243 128

117

166

77 31

Diverse meat

Canned

Meat

Insects 0,29 million CHF

Sources: FOAG, Market Analysis; Nielsen Switzerland

8Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Evolution of sales volume and revenue of meat and meat substitute products

Sales value 2020 in millions (bubble size), Sales value growth in %, sales growth in %

2016..2020 (average yearly growth rates)

Sales value evolution

+20 %

Meat substitute

Deli meats 117 in million CHF

+10 % 2 275 in million CHF

0%

Canned

Fresh meat

31 in million CHF

2 933 in million CHF

-10 %

Insects*

0.29 in million CHF

-20 %

-20 % -10 % 0% +10 % +20 %

Sales volume evolution

* Yearly evolution of sales and revenue 2018-2020

Sources: FOAG, Market Analysis; Nielsen Switzerland

sales reported for the various meat categories, declined sharply shortly afterwards (see Info box

meat substitutes (CHF 117m) occupy a niche on insects on page 12).

position. The market share for meat substitutes In contrast to meat substitutes, before 2020,

in 2020 was 2.2% of total sales value. sales of meat products were declining slightly.

Strong growth for meat substitutes Retail demand: special situation in 2020

Even though meat substitutes currently The official measures taken to control the

represent a niche market, this category has COVID-19 pandemic – in particular, the partial

grown strongly in recent years. From 2016 to closure of the hospitality sector and restrictions

2020, sales volumes (in tonnes) of meat substi- on cross-border travel – led to a sharp rise in re-

tutes showed a compound annual growth rate tail demand for meat. Overall, Swiss retailers re-

(CAGR) of 18.1%, while the CAGR for sales value ported record sales of food (including bever-

was even higher (18.4%). Over the same period, ages). Compared to the previous year, total sales

the retail meat market (fresh meat, deli meats, value rose by 11.3% to CHF 29.9bn (BLW 2021c).

canned meat and insects) showed a CAGR of Sales value of meat and meat substitutes rose

2.0% (sales volume) and 3.0% (sales value). by 14.0%. Accordingly, some of the growth seen

Sales of insect products, only launched in 2017, in the meat substitutes market in 2020 can also

9Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Sales value in the course of the year during the pandemic compared to the same

month of the previous year

Sales value as index values (100 ≙ monthly value 2019)

2020 (monthly value)

Meat substitute Deli meats Fresh meat Canned Insects

178

180 164 161 156 154 157

160 148 150 144 148

132 137

140

120

100

80

85 90 85

60 80 77 82

68 73

40 53 54

41 42

20

1st wave 2nd wave

0

1 2 3 4 5 6 7 8 9 10 11 12

Sources: FOAG, Market Analysis; Nielsen Switzerland

be explained by the extraordinary situation aris- the rest of the year, the growth rates seen for

ing from the pandemic. fresh meat, canned meat and deli meats were

From the above chart showing monthly sales of not nearly as high as those achieved by meat

meat and meat substitutes, it is evident that de- substitutes. It should, however, be noted that, in

mand for meat substitutes had already risen absolute terms, the increase in sales value and

sharply before the pandemic, and that this trend volume during the pandemic was much greater

was further accentuated during the pandemic. for meat than for meat substitutes. Sales of

For example, sales in January 2020 – i.e. before meat rose by 27,000 tonnes (12.4%) in 2020,

the outbreak of the pandemic in Switzerland – compared to an increase of just under 2000

were 32% higher than in January 2019. With the tonnes for meat substitutes (i.e. just 7% of the

lockdown in March, sales of all other product overall increase for meat). Given the increase in

groups, except insect products, increased mark- food consumption at home, pandemic-related

edly. Over the whole year, except in February and effects are a clear driver for the retail meat sub-

March, sales of meat substitutes consistently stitutes market. Demand for meat substitutes is

showed the highest growth rates. The highest

growth was recorded in April, with an index value

SPECIAL REPORT

of 178. In February and March, canned meat

showed the highest growth rates. This develop- More detailed information on the development of

selected Swiss agricultural and food markets in

ment at the start of the pandemic can be ex-

2020 can be found in the fourth Special Report

plained by widespread stockpiling of non-perish- published by the Federal Office for Agriculture

able goods, which include canned meat. During (available in French, German and Italian).

10Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Sales volume of meat substitute products by subcategory

Sales volume in tons, total evolution compared to previous year in %

2016..2020

Meat analogue Vegetarian convenience Tofu/ Tempeh/ Seitan Total

5 705

+49.4 %

1 590

3 818

3 445

2 936 3 115 +10.8 % 1 058

+10.6 % 1 126

+6.1 % 1 028

814 927

939

714 841

685

3 057

1 436 1 473 1 576 1 752

2016 2017 2018 2019 2020

Sources: FOAG, Market Analysis; Nielsen Switzerland

also likely to have been further boosted by the In 2020, sales of meat substitutes rose by 49.4%

issues of climate change and livestock produc- to 5705 tonnes, an increase clearly exceeding

tion. the record 12.1% overall rise in the volume of

meat products sold (see BLW 2021b). This year

49% increase in sales volume in 2020 saw the highest growth ever recorded for meat

The development of the value and volume of substitutes, both in absolute and in relative

Swiss retail sales of meat substitutes is ana- terms. Since 2016, sales of meat substitutes

lysed using the subcategories have almost doubled in value (from 2936 tonnes

tofu/tempeh/seitan, vegetarian convenience to 5705 tonnes).

and meat analogue. Definitions of these subcat- Among the various meat substitutes, the strong-

egories can be found on page 7. est-growing subcategory is meat analogue. In

2020, sales of meat analogue products rose by

74.5% over 2019, and these products now

FISH SUBSTITUTES account for more than 50% of the total sales vol-

ume of meat substitutes. As meat analogue

The present analysis focuses on the meat substi-

tutes market. Fish substitutes are not examined in products appeal to a wide range of consumers,

depth in this report. major market potential exists. Drivers of con-

Unlike meat substitutes, fish substitutes are not sumer demand for meat analogue products are

yet of any importance. In 2020, Swiss retail sales taste aspects, a basic openness and curiosity to-

of fish substitutes amounted to CHF 2.3m. The

wards new products, and environmental aware-

market is, however, growing strongly. Since 2017,

with prices stable at around CHF 20 per kg, sales

ness.

have grown on average by 23% per year. Sales vol-

ume was around 102 tonnes in 2020.

11Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Sales value of meat substitute products by subcategory

Sales value in millions CHF, total evolution compared to previous year in %

2016..2020

Meat analogue Vegetarian convenience Tofu/ Tempeh/ Seitan Total

117

+52.3 % 22

77 23

69

60 62 +11.3 % 16

+10.8 % 15

13 +4.5 % 14

21

16 19

15 72

32 32 35 39

2016 2017 2018 2019 2020

Sources: FOAG, Market Analysis; Nielsen Switzerland

In 2020, demand also grew – though to a lesser 2020, with sales also reaching a record value of

extent – both for vegetarian convenience CHF 117m. The top-selling category was meat

(12.7%) and for tofu/tempeh/seitan (41.1%). analogue (CHF 72m), accounting for over 60% of

total sales. The growth rate for meat analogue,

Record sales of meat substitutes in 2020 compared to 2019, was 82.1% – substantially

The sales value of meat substitutes developed in higher than those seen for vegetarian conven-

line with sales volumes. The highest growth rate ience (10.0%) or tofu/tempeh/seitan (35.2%).

in terms of volume (52.3%) was achieved in

INSECTS

Since 1 May 2017, house crickets, migratory lo-

custs and mealworms have been approved as

foodstuffs in Switzerland (FSVO 2017). In August

2017, the first insect products were launched in the

retail sector. In 2018, sales of these products

amounted to just over CHF 0.4m. Since then, sales

have declined, totalling only CHF 0.29m in 2020.

The low and declining market importance of insect

products is attributable to the low level of con-

sumer acceptance, the relatively high average

prices (CHF 76/kg in 2020) and the small range of

products. In view of this poor performance, certain

market players have scaled back their efforts to

develop the market for insect products for the time

being.

12Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Number of meat substitute products in the Nielsen panel

Number of products covered, evolution compared to previous year in %

2016..2020 (annual data)

Meat analogue Vegetarian convenience Total

823

+22.5 %

672

287

539 +24.7 %

249

454 +18.7 %

200

334 +35.9 %

156

103 536

423

298 339

231

2016 2017 2018 2019 2020

Sources: FOAG, Market Analysis; Nielsen Switzerland

Continuous expansion of the meat substi- Comparison with the meat product range (over

tute product range 37,000 items recorded in the Nielsen data panel)

shows that there is still substantial market po-

In recent years, the variety of meat substitutes

tential for meat substitutes.

available on the market has expanded signifi-

cantly. Compared to 2016, the number of prod- Traditional meat substitutes dominant

ucts recorded in the Nielsen data panel has more

While the meat analogue and vegetarian conven-

than doubled, with 823 items recorded at the end

ience subcategories can be divided into further

of 2020. In 2020 alone, 150 new items (+22.5%)

product groups, the tofu/tempeh/seitan subcat-

were introduced by Swiss retailers, including

egory – comprising classical or traditional plant-

over 100 meat analogue products.

based meat substitutes – is not further subdi-

It is not surprising to see a sharp rise in new

vided. Meat analogue is subdivided into

products being launched in a growing market.

steak/schnitzel, burger, shredded meat, sau-

The trends for sales value and volume in recent

sage, minced meat, nuggets and cold cuts. The

years show that increased sales are driven both

vegetarian convenience subcategory also in-

by greater demand for existing products and by

cludes a burger product group, together with fal-

the introduction of new products. According to a

afel, bites and balls. In the treemap chart above,

ProVeg study (European Consumer Survey on

sales for the three subcategories in 2020 are

Plant-Based Foods 2020), this reflects con-

broken down by product group. With sales of

sumer demand for a wider product range. The re-

CHF 22.2m, tofu/tempeh/seitan was the best-

sults of the survey indicate that, with regard to

selling product group, followed by meat ana-

plant-based alternatives, consumers want to see

logue steak/schnitzel (CHF 19.5m).

more variety in terms of product types, raw ma-

terials, textures and flavours.

13Swiss Meat Substitutes Report, May 2021

M E AT S U B STITU TES I N T H E S WI SS R E TAI L T R AD E

Revenue of meat substitute products by product group

Revenue in millions CHF

2020

Meat substitute Vegan convenience Tofu/ Tempeh/ Seitan

00

22.2 19.5 12.7 9.5 6.3 6.3 Total

117

6.0 5.2

10.6

6.8

5.9 4.2 1.1

0.8

Balls

Diverse

Sources: FOAG, Market Analysis; Nielsen Switzerland

A Total sales of plant-based burgers, to be found In recent years, no other product group has

in the meat analogue (more meat-like) and vege- matched the growth of plant-based burgers. The

tarian convenience subcategories, amounted to CAGR for the period 2016–2020 was 62%. Over-

CHF 19m. For the first time, sales of over all, all product groups showed above-average

CHF 10m (CHF 10.6m) were recorded for plant- growth rates. For example, a CAGR of over 30%

based alternatives to shredded meat, closely fol- was also recorded for sausage, minced meat

lowed by plant-based sausage (CHF 9.5m). and shredded meat, while the CAGR for nuggets

The leading product group in the vegetarian con- was over 20%. In contrast, plant-based

venience subcategory is falafel, with sales of steak/schnitzel showed relatively low growth

CHF 6.8m in 2020. (6.6%).

The value of sales of all minced products com- Sales of vegetarian convenience products also

bined (including burger and balls) was over showed strong growth. The CAGR was 23% for

CHF 30m. In terms of volume, this amounted to falafel and 22% for burgers in this subcategory.

1355 tonnes. The volume of steak/schnitzel Demand for tofu/tempeh/seitan also increased

sales was 880 tonnes. The highest sales volume significantly. However, the CAGR was somewhat

(1590 tonnes) was achieved by lower (15%), largely as a result of the baseline ef-

tofu/tempeh/seitan. fect. Products such as tofu, tempeh or seitan

have been on the market for many years, and

Burger: fastest-growing product group substantial sales were already recorded before

In this section, multi-year trends for the various 2016. With a larger market volume, high growth

product groups are compared on the basis of the rates are more difficult to achieve. In addition,

compound annual growth rate (CAGR). An expla- tofu/tempeh/seitan is increasingly subject to

nation of this method can be found on page 30. competition from vegetarian convenience and

14Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Annual growth rates in sales value of meat substitute products

Average growth rate per year in %, highest value per product group

2016..2020

Meat analogue Vegetarian convenience Tofu/ Tempeh/ Seitan

Meat analogue

Burger 0 62

Shredded meat 35

Minced meat without burger/balls 34

Sausage 32

Diverse 26

Nuggets 21

Cold cuts 19

Steak / cutlet 6.6

Balls 2.2

Vegetarian convenience

Falafel 23

Burger 22

Balls 4.6

Bites 0.4

Tofu/ Tempeh/ Seitan

Tofu/ Tempeh/ Seitan 15

Sources: FOAG, Market Analysis; Nielsen Switzerland

meat analogue products. The products in these One in six burgers plant-based

subcategories offer consumers a superior expe- Within the meat segment as a whole, meat sub-

rience in terms of taste and texture and are also stitutes are a rapidly growing niche. In terms of

generally easier to prepare. sales volumes, market share rose from 1.3% in

The exceptional growth seen in the case of burg- 2016 to 2.3% in 2020. With regard to market de-

ers is driven by a large number of new products. velopment and market share, however, a differ-

The success of the Beyond Meat Burger as a ent picture emerges if individual subsegments of

classic meat substitute burger led to a me-too meat and meat substitutes are considered in de-

effect. At the same time, the taste of the tradi- tail.

tional (meat) burger is being imitated increas- In the burger product group, by 2020, one in six

ingly successfully. In addition, meat substitutes burgers sold was plant-based; in 2016, it had

– especially burgers – have been discovered as been one in fourteen. No other product group

a growth market not only by traditional retailers shows such a high share of meat substitutes. In

but also by discounters (for an analysis of distri- the case of nuggets, plant-based alternatives

bution channels see page 20). now account for almost 10% of sales volumes

(vs 6.6% in 2016). For shredded meat, the share

15Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Sales volume shares of meat substitute products compared with the whole segment

Sales volume in %

2016..2020

2016 2017 2018 2019 2020

16.6 %

7.1 % 9.5 %

6.6 %

5.1 %

2.2 % 1.8 % 1.7 % 2.3 %

0.9 % 1.3 %

0.6 %

Burger Nuggets Shredded meat Cold cuts Minced meat Total

without

burger/balls

Sources: FOAG, Market Analysis; Nielsen Switzerland

is now 5%; this is mainly attributable to the intro- points become apparent: firstly, there is a strik-

duction of new retail products (e.g. ing difference in the size of the market and, sec-

planted.chicken). ondly, with the current market growth and devel-

From a food technology perspective, burgers, opment of demand for plant-based alternatives

minced meat and cold cuts can be more readily in this area, these product groups have further

imitated, as they have a more homogeneous growth potential.

structure and a less complex texture than (natu-

ral) grown meat, such as fillet or entrecôte. It is

therefore not surprising that burgers have be-

come the best-established product group on the

market. In addition, no lab-grown meat products

are as yet ready for commercialisation in Swit-

zerland. In the longer term, with this technology,

the aim is to develop grown pieces of meat, such

as fillets or entrecôtes.

With sales of 22.6m kilograms in 2020, tradi-

tional minced meat products were – after poultry

breast (24.1m kilograms) – the second most

popular fresh meat products. If these figures are

compared with the total volume of 1355 tonnes

for all plant-based minced meat products, two

16Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Sales value shares of meat substitute products compared with the whole segment

Shares in %

2016..2020

2016 2017 2018 2019 2020

22.1 %

10.7 %

12.0 %

7.8 %

5.9 %

2.1 % 2.8 % 2.1 % 2.2 %

1.5 % 0.8 % 1.2 %

Burger Nuggets Shredded meat Cold cuts Minced meat Total

without

burger/balls

Sources: FOAG, Market Analysis; Nielsen Switzerland

Strong growth in share of sales by value Price development driven by product

Sales of meat substitutes as a proportion of the launches

whole meat and meat substitutes market show In 2020, the average price (in unit value terms)

a similar picture to the share of sales by volume. paid by Swiss consumers was CHF 20.53 per kil-

Overall, meat substitutes have a low market ogram of meat substitutes. This price has re-

share (2.2%). Certain product groups, however, mained relatively constant over the years (2016:

show disproportionately high growth. CHF 20.31 per kilogram).

The highest sales growth was seen for burgers, Clear price trends can, however, be observed

nuggets and shredded meat. In 2020, over 20% when individual product groups are considered

of burger sales were generated with plant-based in detail. Within four years, the price of plant-

alternatives. For nuggets the share was 12%, and based burgers rose by 13.5% (2020: CHF 23.80

for shredded meat almost 6%. The highest per kilogram). Similar price trends can be seen

growth rates were recorded in 2020, the year of for nuggets (+13.8%) and shredded meat

the pandemic. (+21.7%).

This development is attributable not only to Conversely, prices for cold cuts and minced

growth in sales of existing products but also, es- products (excluding burgers/balls) decreased.

pecially, to expansion of the range by the intro- Tofu/tempeh/seitan also became steadily

duction of new products (for expansion of the cheaper, and this continues to be the most at-

product range, see page 13). tractive subcategory of meat substitutes in

terms of price (CHF 13.97 per kilogram). The

price trends cannot be explained solely in terms

of price increases or reductions for existing

17Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Prices of meat substitute products by subcategory

Prices in CHF / kg

2016..2020

2016 2017 2018 2019 2020

27.5 27.9 26.7

23.8 22.6

21.0 20.6 20.3 20.5

18.6 19.0

16.4 15.5

14.0

Burger Nuggets Shredded Cold cuts Minced meat Tofu/ Total

meat without Tempeh/

burger/balls Seitan

Sources: FOAG, Market Analysis; Nielsen Switzerland

products. The large increases seen for nuggets to 42.4% by 2020. Conversely, the price differen-

and shredded meat are primarily attributable to tial in the case of shredded meat rose from -3.1%

the introduction of new, higher-priced products. to +16.2%, which is primarily attributable to the

Price differentials: a mixed picture launch of more expensive plant-based products.

In 2020, consumers paid on average 5.1% less For nuggets, the price differential also increased

for a kilogram of meat substitutes than for a kil- – to +30.1%. For cold cuts and minced products

ogram of meat products (vs 2.3% less in 2016). (excluding burgers/balls), the differential de-

This means that, across the entire product range, creased: in the case of cold cuts, the price differ-

a kilogram of meat substitutes is on average ential in 2020 (2.8%) was the lowest among all

cheaper than a kilogram of meat. The average the product groups considered.

price differential has developed in favour of The development of price differentials is partly

meat substitutes; this is essentially due to an in- determined by the development of prices for

creased unit value per kilogram of meat. plant-based products. At the same time, the in-

In some cases, direct comparison of individual troduction of increasing numbers of premium

product groups of meat and meat substitutes re- meat products – e.g. Wagyu or Black Angus

veals a different picture with regard to price dif- burgers – has led to an increase in the average

ferentials. At the subgroup level, meat substi- price of meat burgers.

tutes show significantly higher prices, even The fact that, overall, prices for meat substitutes

though the price gap has closed overall over the are lower than for meat is primarily attributable

past five years. While plant-based burgers were to the fact that, at present, most meat substi-

57.7% more expensive than traditional (meat) tutes are launched in lower-price product groups

burgers in 2016, the differential had decreased such as cold cuts, burgers or nuggets, whereas

18Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Price difference of meat substitute products compared to meat products

Shares in %

2016..2020

2016 2017 2018 2019 2020

+57.7 %

+42.4 %

+42.7 %

+30.1 % +21.2 %

+20.7 %

+16.2 % +9.5 %

+2.8 %

-3.1 % -2.3 % -5.1 %

Burger Shredded meat Nuggets Cold cuts Minced meat Total

without

burger/balls

Sources: FOAG, Market Analysis; Nielsen Switzerland

far fewer alternative products are as yet availa-

ble in the case of grown meat – and thus more

expensive – products such as fillet, entrecôte,

steak or dried meat.

Overall, meat substitute prices equal to or lower

than those for meat are an important factor pro-

moting (increased) consumer demand for meat

substitutes, especially among price-sensitive

groups. In a survey conducted by ProVeg, 12% of

vegetarian and flexitarian respondents stated

that meat alternatives are too expensive (ProVeg

2020).

19Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Evolution of sales volume and sales value of meat and meat substitute products by

distribution channel

Sales value 2020 in millions (bubble size), Sales value growth in %, sales growth in %

2016..2020 (average yearly growth rates)

Annual sales value evolution

+90 % Discounters

10 million CHF

+60 %

+30 %

0%

Standard retail

Specialised 105 million CHF

-30 % trade & rest

2 million CHF

-60 %

-90 %

-90 % -60 % -30 % 0% +30 % +60 % +90 %

Annual sales volume evolution

Sources: FOAG, Market Analysis; Nielsen Switzerland

Discounters advancing age annual growth was around 69% for sales vol-

Meat substitutes – particularly meat analogue ume and 67% for sales value, with the highest

products – are now well established in the tradi- growth being observed from 2019 to 2020.

tional retail sector. In 2020, this distribution This delayed, but all the more vigorous, response

channel accounted for the highest sales on the part of discounters is not unusual. As a

(CHF 105m), with a market share of almost 90%. result of their dominant position, traditional re-

Here, from 2016 to 2020, average annual growth tailers more frequently serve as trendsetters, be-

amounted to around 16% for sales volume and ing the first to test new products and concepts.

17% for sales value. If these prove successful on the market, dis-

With sales of CHF 10m in 2020, discounters had counters respond by introducing a limited, low-

a share of almost 9% of the meat substitutes priced range, consisting of the products with the

market. At the same time, discounters’ share of highest sales potential (e.g. plant-based burg-

meat and meat substitute sales in 2020 was ers).

15%. In the case of meat substitutes, the dis- A slightly negative trend was observed for meat

counter market thus lies below the market po- substitutes in the specialist trade and other dis-

tential. In recent years, however, growth of meat tribution channels (petrol station shops, farm

substitutes has been much stronger in the dis- outlets, etc.). Here, sales of meat substitutes

counter than in the traditional retail sector: aver-

20Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Sales value and sales value structure of meat substitute products by distribution channel

Sales value in millions CHF, sales structure 2020 in %

2016..2020

Standard retail Discounters Specialised trade & rest

Revenue in millions Sales structure 2020 in %

71

2020 105 10 2 61

48

2019 71 4 2

32

2018 64 3 3 19 20 17 20

12

2017 59 2 2

Meat Tofu/ Vegetarian

2016 56 1 3 analogue Tempeh/ convenience

Seitan

Sources: FOAG, Market Analysis; Nielsen Switzerland

amounted to around CHF 2.5m in 2020, com- structure and in the small proportion of conven-

pared to CHF 2.7m in 2016 – an annual average ience products offered by the specialist trade in

decrease of 2.4%. general.

As regards the distribution of sales among sub-

Discounters favour meat analogue, the spe- categories, traditional retailers – the most im-

cialist trade tofu & co portant sales channel for meat substitutes – oc-

In 2020, the leading subcategory in the meat cupy an intermediate position between

substitutes market – with the highest retail sales discounters and the specialist trade.

– was meat analogue. However, the composi- Increase in households purchasing meat

tion of sales of meat substitutes varies from one substitutes

channel to another. In the discount sector, meat As a measure of market penetration, Nielsen

analogue products account for more than 70% of consumer panel data is analysed to determine

sales, while vegetarian convenience (17%) and how many households have purchased a partic-

tofu/tempeh/seitan (12%) are much less signifi- ular product group at least once in the course of

cant. By contrast, in specialist and other chan- a year.

nels, meat analogue products account for less From 2016 to 2020, the market penetration of

than 50% of sales, while tofu/tempeh/seitan is meat substitutes rose markedly, from 19% to

responsible for 32%. The explanation for this can 26%. This means that, while almost one in five

be assumed to lie essentially in the customer households in Switzerland purchased a meat

substitute at least once in 2016, it was already

over one in four households in 2020.

21Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Market penetration of meat substitute products

Penetration in %, share of resellers in %

2016 & 2020

Meat analogue Vegetarian convenience Tofu/ Tempeh/ Seitan

65 65

61

57 57 57

48 51

44

39 41 39

26

19 16 21

15

10

2016 2020 2016 2020 2016 2020

Penetration 1x 2x and more

in % ...of which repeat purchasers

Sources: FOAG, Market Analysis; Nielsen Switzerland (consumer panel)

For vegetarian convenience, penetration rose (61%) were somewhat lower than for meat ana-

from around 16% (one in six households) to 21% logue. While the repeat purchase rate for

(one in five households). For tofu/tempeh/seitan rose between 2016 and

tofu/tempeh/seitan, penetration rose from 10% 2020, it remained constant for vegetarian con-

(one in ten households) in 2016 to 15% (one in venience. In 2020, 39% of all households pur-

seven households) in 2020. For many house- chasing vegetarian convenience products repur-

holds, interest in meat substitutes has been chased them at least twice, and this was true of

aroused by a wider selection of products, in- 44% of households purchasing

creased market presence (e.g. at discounters) tofu/tempeh/seitan products (3% more than in

and additional media attention. 2016).

In addition to market penetration, the repeat pur-

chase rate is an important measure for the eval- Meat substitutes popular among young,

uation of market development. Here, too, it is ap- high-income families in German-speaking

parent that a growing proportion of households Switzerland

are repeat purchasers of meat substitutes. In The market penetration of meat substitutes can

65% of the households that purchased meat an- be analysed in relation to household characteris-

alogue products in 2020, these products were re- tics such as age, income, number of children or

purchased once (same rate as in 2016), and in region of residence. According to their purchas-

51% they were repurchased at least twice (3% ing behaviour, the households can then be as-

more than in 2016). signed to various customer segments. With re-

The repeat purchase rates both for vegetarian gard to age, in 2020, across all meat substitute

convenience (57%) and for tofu/tempeh/seitan subcategories, households headed by a person

22Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Market penetration of meat substitute products by household characteristics

Penetration in %, highest value per household characteristic

2020

Meat analogue Vegetarian convenience Tofu/ Tempeh/ Seitan

Age of the head of household

34 or less 31 25 20

0

35 to 49 31 25 17

50 to 64 27 21 15

over 64 18 13 9

Number of children in the household

no children 26 19 15

1 child 29 27 14

2 children 34 26 16

3+ children 19 21 11

Household income

35 000 CHF or less 23 16 14

35 001 to 50 000 CHF 22 17 11

50 001 to 70 000 CHF 23 19 12

70 001 to 90 000 CHF 27 22 15

90 001 to 110 000 CHF 31 25 17

over 110 000 CHF 36 28 22

Structure

country 24 18 17

city 28 22 15

Language region

German-speaking 28 21 15

French-speaking 21 21 14

Sources: FOAG, Market Analysis; Nielsen Switzerland (consumer panel)

under 50 showed higher market penetration than more children purchased meat substitutes much

those headed by a person over 50. Demand was less frequently (in percentage terms) than those

lowest in the segment consisting of households with one or two children. Demand for meat sub-

headed by a person over 64. stitutes was also generally lower in households

For households with or without children, the pic- without children, which may be linked to the fact

ture is more diverse. Households with three or that the proportion of older persons was higher

23Swiss Meat Substitutes Report, May 2021

in this segment. In 2020, the highest market pen- can be observed between the language regions,

etration for meat analogue and either for organic products or for

tofu/tempeh/seitan was seen in households tofu/tempeh/seitan. Accordingly, demand for

with two children, while demand for vegetarian meat analogue products in French-speaking

convenience was highest in households with Switzerland is also expected to reach a level sim-

one child. ilar to that in German-speaking Switzerland after

Household income was a key factor determining a certain delay.

demand for meat substitutes in 2020. A clear

correlation was seen between increasing house- Differences at the household level

hold income and higher demand for meat substi- Also of interest, as well as market penetration,

tutes, while market penetration was low among are the amounts of meat substitutes/meat prod-

low-income households. A significant role here ucts actually purchased in relation to house-

is played by the fact that prices for meat substi- holds’ sociodemographic characteristics. In the

tutes are higher than those for meat products in chart on the next page, the quantities purchased

the case of burgers, stripped meat, nuggets, cold in 2020 are broken down by various sociodemo-

cuts or minced meat (see page 18). graphic characteristics.

Region of residence was also a factor influenc- While the largest quantities of meat substitutes

ing households’ demand for meat substitutes in were purchased by households headed by a per-

2020. Overall, demand for meat analogue and son under 35, meat purchases were highest

vegetarian convenience products was higher among households headed by a person aged be-

among households in urban areas, while de- tween 50 and 64.

mand for tofu/tempeh/seitan was higher among Owing to the size of the household, families with

households in rural areas. The precise reasons three or more children purchased the most meat

for this are not known. (96.4 kg), while also purchasing the lowest quan-

Demand for meat substitutes in 2020 was also tities of meat substitutes (0.8 kg). As regards

influenced by a household’s language region. the quantities of meat substitutes purchased,

While market penetration for vegetarian conven- there is virtually no difference between house-

ience and tofu/tempeh/seitan was similar in holds in urban and rural areas (1.2 kg in both

German- and French-speaking Switzerland, de- cases). However, rural households purchased

mand for meat analogue products was higher in over 12 kg more meat than urban households

German-speaking Switzerland (28% vs 21%). (68.7 kg vs 56.5 kg).

This finding may possibly be explained by differ- Households in French-speaking Switzerland pur-

ences in consumer behaviour: overall, house- chased almost a kilogram more meat than those

holds in French-speaking Switzerland have a in German-speaking Switzerland. At the same

greater sense of tradition and generally have a time, their purchases of meat substitutes

strong attachment to regional specialities and (0.8 kg) were around a third lower than those in

meat and fish products. By contrast, households German-speaking Switzerland.

in German-speaking Switzerland tend to be more With regard to household income, it can be seen

open to new food trends. This was already ap- that high-income households purchased both

parent in the development of the organic market more meat and more meat substitutes. This is

or in demand for products in the attributable to the greater purchasing power as-

tofu/tempeh/seitan subcategory, which also sociated with a higher household budget.

first became established in German-speaking

Switzerland. Today, however, no clear difference

24Swiss Meat Substitutes Report, May 2021

M E A T SU B ST IT U T E S IN T H E SW ISS R E T A IL T R A D E

Quantities purchased of meat and meat substitute products by household characteristics

Sales volume in kg, highest value per household characteristic

2020

Meat Meat substitute

Age of the head of household

34 or less 45.7 1.4

35 to 49 0

64.0 1.4

50 to 64 66.4 1.2

over 64 59.3 0.5

Number of children in the household

no children 55.2 1.1

1 child 67.8 1.4

2 children 81.8 1.3

3+ children 96.4 0.8

Household income

35 000 CHF or less 37.9 1.0

35 001 to 50 000 CHF 50.3 0.8

50 001 to 70 000 CHF 61.4 0.9

70 001 to 90 000 CHF 62.2 1.2

90 001 to 110 000 CHF 72.6 1.4

over 110 000 CHF 77.6 1.9

Structure

country 68.7 1.2

city 56.5 1.2

Language region

German-speaking Switzerland 60.4 1.3

French-speaking Switzerland 61.2 0.8

Sources: FOAG, Market Analysis; Nielsen Switzerland (consumer panel)

The comparison of quantities purchased at the order to determine statistically significant rela-

household level confirms the niche position oc- tionships between purchases of meat/meat sub-

cupied by meat substitutes. Nonetheless, it is ev- stitutes and household characteristics, more in-

ident that meat substitutes account for a notice- depth modelling would be required.

able proportion of food expenditure, particularly

among younger people and families. However, in

25You can also read