2022 USG COMPARISON GUIDE

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

Section 1

Welcome to USG!

Introduction

Table of contents

The University System of Georgia (USG) is comprised of 26 higher education

institutions, including four research universities, four comprehensive

About USG........................................................................................................................................................................................... 3

universities, nine state universities, and nine state colleges, as well

Your USG benefits.............................................................................................................................................................................. 4

USG healthcare plan surcharges.................................................................................................................................................... 6 as the Georgia Public Library Service and the Georgia Film Academy.

Managing your benefits ................................................................................................................................................................... 7 Your benefits are provided through the University System of Georgia. We

2022 premium rates for active employees ................................................................................................................................. 9

2022 premium rates for pre-65 retirees .....................................................................................................................................10

know that USG benefits are important to you and your family. They offer

2022 healthcare benefits at a glance .........................................................................................................................................11 protection, peace of mind, and comfort ― and we want you to make the

Accolade ...........................................................................................................................................................................................16

most of them. Your life changes and your needs may change, so it is always

CVS pharmacy..................................................................................................................................................................................20

HMO service area by county..........................................................................................................................................................23 a good idea to review your options so you can make benefit choices that

Kaiser Permanente..........................................................................................................................................................................24

work for you and your family.

USG Well-being Program ...............................................................................................................................................................28

Dental .................................................................................................................................................................................................30

Vision .................................................................................................................................................................................................31

Flexible Spending Accounts..........................................................................................................................................................33

Health Savings Accounts...............................................................................................................................................................35

Life insurance...................................................................................................................................................................................38

Disability insurance ........................................................................................................................................................................39

Employee Assistance Program (EAP) ........................................................................................................................................41

USG Accident Plan ..........................................................................................................................................................................42

USG Hospital Indemnity Plan .......................................................................................................................................................43

USG Critical Illness Plan ................................................................................................................................................................44

USG Legal Plan ................................................................................................................................................................................46

Identity protection ...........................................................................................................................................................................47

Pet insurance ...................................................................................................................................................................................48

Purchasing Power ...........................................................................................................................................................................49

USG Perks at Work ..........................................................................................................................................................................49

USG retirement ................................................................................................................................................................................50

Important numbers .........................................................................................................................................................................54

Notes..................................................................................................................................................................................................57

2 3Section 1

Cover those who matter

When you elect coverage for yourself, you may also When you first enroll or if you change coverage

Your USG benefits cover your eligible dependents, which includes: mid-year due to an IRS qualified life event, you are

Introduction

required to provide proof of relationship

• Your legal spouse

documentation to add your dependents to your

• Your natural, adopted, or stepchildren up to age 26 coverage. Your coverage will not become effective

until the documentation is reviewed and approved.

• Your disabled child(ren) over the age of 26 with

proof of disability

Our comprehensive benefits package is designed to support your personal health, well-being, Dependent verification of eligibility documentation

and retirement needs, now and in the future. In this section, you will find information to help you Documentation needed

understand what benefits are available to you, who you can cover, and how to enroll.

You must provide two: Marriage certificate and proof of joint debt

Your legal spouse

(for example, financial or residential documents).

Eligibility

Your child(ren), adopted, or stepchildren up to age 26 Birth certificate OR adoption/legal guardianship documents.

Regular employees working 30 hours or more per Even if you do not work 30 hours or more per

week are eligible to enroll in the USG healthcare or week, USG offers a number of benefits and benefit Your disabled child(ren) over the age of 26 For disabled dependents enrolling in the healthcare plan, the

voluntary benefits plans. Employees working 20 programs that you and your eligible dependents can with proof of disability child must be disabled prior to age 26 in order to be eligible for coverage.

hours or more per week must enroll in a mandatory participant in. See the eligibility chart below for

retirement plan. more details.

If you are adding a dependent due to a qualifying mid-year event, documentation must be received within 30 days of the enrollment change.

USG benefits eligibility chart If both spouses are USG employees they may NOT have duplicate coverage under any plan by covering each other under separate enrollments. Also, children of

spouses who are both USG employees may NOT be covered twice under both parents’ plans.

Regular Regular Regular Temporary Temporary

Benefit

(30 hours or more) (20-29 hours) (less than 20 hours) (30 hours or more) (20-29 hours)

Healthcare, dental, vision (Pretax)

Basic life insurance with accidental

death and dismemberment (AD&D)

Supplemental life insurance When to enroll and when coverage begins

Dependent life insurance

You have 30 days from your date of hire or date of If you are an exempt (salaried) employee who works

AD&D

eligibility to enroll in your healthcare and voluntary 20 hours or more per week, you must enroll in one of

Long-term disability

benefits. If you do not elect benefits within your first USG’s mandatory retirement plans: Teachers

Short-term disability

30 days, you will not have coverage and your next Retirement System of Georgia (TRS) Plan or the

Flexible Spending Account

opportunity to enroll will be during the next Open Optional Retirement Plan (ORP), within 60 days of

Health Savings Account

Enrollment period, unless you experience a your date of hire or date of eligibility. If you are a

Employee Assistance Program

qualifying life event. nonexempt (hourly) employee, you will automatically

USG Well-being Program *

be enrolled into the TRS plan.

Accident Plan With a few exceptions, your coverage will become

Hospital Indemnity Plan effective the first day of the month following your You may enroll in a 403(b) or 457(b) voluntary

Critical Illness Plan date of hire (unless you become benefits-eligible on savings plan at any time during the year.

Identity protection the first of the month, in which case your coverage

The date your mandatory retirement coverage

Pet insurance would begin immediately.

becomes effective depends on the plan you elect. If

Purchasing Power

Because your contributions to your flexible spending you enroll in TRS, your coverage is effective on your

Perks at Work

account (FSA) or health savings account (HSA) date of hire. If you enroll in ORP, your coverage will

529 College Savings Plan

cannot be retroactive, they will become effective the be effective the first of the month following your

Tuition reimbursement

first of the month following the date of your election. election. Once you make your election your decision

Mandatory retirement

is irrevocable.

403(b) and 457(b)

*Daily live event and campus programming is available to all, regardless of how many hours worked. However only employees enrolled in a USG Healthcare plan are eligible to earn well-being credits.

4 5Section 1

USG healthcare plan surcharges

Tobacco surcharge Working spouse surcharge

Introduction

Employees enrolled in a USG healthcare plan must To keep costs as low as possible for all of our

certify their spouse and their covered dependents’ employees and the State of Georgia’s taxpayers, the

(age 18+) tobacco user status upon initial enrollment USG will apply a $100 per month working spouse

Managing your benefits

and annually each enrollment period. Employees who surcharge for employees who choose to cover their

certify that they are a tobacco user will incur an spouse under a USG healthcare plan, if the employee’s

additional $100 per month for each tobacco user spouse works for another employer and receives an

age 18+. Additionally, employees who do not offer of coverage from that employer. The working

complete their tobacco user certification each year, spouse surcharge does not apply to USG retirees.

through OneUSG Connect- Benefits will be subject to

The working spouse surcharge applies if your spouse:

the $100 surcharge.

• Works for any employer other than the USG

‘Tobacco user’ refers to the use of tobacco products

and has an offer of other coverage from that

within the past three consecutive months, but does

employer where the employer makes a

After your initial benefit elections, you may only

How to make benefit changes

not include religious or ceremonial use of tobacco. change your benefit elections during the Open

contribution to the cost of the healthcare If you experience a qualifying life event, benefit

The term ‘tobacco products’ refers to any tobacco Enrollment period, unless you experience a qualifying

coverage. Non USG employers include private updates must be completed within 30 days of the

product including cigarettes, cigars, pipes, all forms life event, as defined by IRS 125 guidelines. The most

sector organizations, the State of Georgia, and/or life event.

of smokeless tobacco, clove cigarettes, and any other government agencies. common life events are listed below:

other smoking devices that use tobacco, such as Visit oneusgconnect.usg.edu, select

• Birth and adoption of a child (including

hookahs, or simulate the use of tobacco, such as The working spouse surcharge does not apply if Manage My Benefits, and select the

stepchildren and legally placed foster children)

electronic cigarettes. your spouse:

Change Your Coverage tile, or you

• Death of a covered dependent

• Works for the USG. can call OneUSG Connect - Benefits Call Center at

• Marriage or divorce 844-587-4236. 8 a.m. - 5 p.m., ET, Monday - Friday.

Resources to help you quit • Is covered under COBRA and/or is eligible or

enrolled in Medicare or TRICARE. • Change in employment status that impacts You may be required to provide documentation to

We know it’s not easy to quit, but we’ll give you the benefits eligibility (for covered employee and

• Is unemployed, self-employed, or ineligible for support the Life Event change and dependent

support you need. Therefore, a reasonable alternative is eligible dependents)

healthcare coverage. status if adding new dependents.

made available during the certification process for

individuals who want to quit using tobacco. The • Has healthcare available through their employer For a complete list of qualifying life events and

opportunity allows 90 days to complete a tobacco but the employer does not contribute to insurance. documentation required to make a change,

cessation program. visit oneusgconnect.usg.edu.

During benefits enrollment, employees who elect to

Tobacco cessation programs are available at no cost to cover a spouse in the USG healthcare plan will be

you and your dependents. Please contact these helpful required to complete the working spouse certification

resources to help you quit: through OneUSG Connect – Benefits. This certification

• Georgia Tobacco Quit Line: 877-270-7867

is required upon initial enrollment and annually during

each open enrollment period. Employees who cover a

OneUSG Connect - Benefits Call Center has translation

• Kaiser Permanente: 866-862-4295 spouse with an offer of other coverage or who do not services at 844-587-4236

certify their working spouse status will have the $100

• Virgin Pulse: Schedule by going to the USG The OneUSG Connect - Benefits Call Center offers translation services for all calls in over 160 languages.

surcharge applied. Refunds will not be given.

Well-being platform. Select Programs > Coaching

by phone with Virgin Pulse > Start Now > Be If you have questions or need to update your surcharge A Customer Care representative will contact an interpreter by phone, remain on the line during the entirety

Tobacco-Free. certifications, please visit oneusgconnect.usg.edu or of your phone call, and be available if any follow-up calls are required. Our interpreters are available during

call the OneUSG Connect – Benefits Call Center at all hours that the OneUSG Connect - Benefits Call Center is operating. All you need to do is call the

If you quit using tobacco or complete a cessation

844-5-USGBEN (844-587-4236). OneUSG Connect - Benefits Call Center and ask for an interpreter. The Customer Care representative will

program, you must update your tobacco user status

with OneUSG Connect — Benefits within 90 days of your take care of the rest!

cessation election.

6 7Section 2

USG Healthcare Plans 2022 premium rates for active employees

The University System of Georgia offers four comprehensive healthcare options. Regardless of the

2022 monthly plan costs

Healthcare, pharmacy, and well-being

plan you choose, each plan protects you and your family’s health. The main differences between the

Consumer Kaiser

plans comes down to things like how much you pay when you get care, how much you pay each Choice HSA

Comprehensive Care BlueChoice HMO

Permanente HMO

paycheck, and how much flexibility you have in choosing providers and where you can receive care.

Employee only $83.20 $193.34 $228.32 $171.64

Employer $473.12 $473.12 $473.12 $383.42

Total rates $556.32 $666.46 $701.44 $555.06

Employee + child(ren) $176.64 $374.92 $437.88 $329.30

Consumer Choice HSA Employer $824.72 $824.72 $824.72 $669.82

Total rates $1,001.36 $1,199.64 $1,262.60 $999.12

This plan has the lowest

Employee + spouse $206.12 $437.42 $510.88 $384.18

monthly premium but the

highest deductible. With this Employer $962.16 $962.16 $962.16 $781.46

plan, you pay 100% of cost up to Total rates $1,168.28 $1,399.58 $1,473.04 $1,165.64

the deductible before the plan’s Family $294.44 $624.88 $729.82 $548.84

coinsurance kicks in, except for

Employer $1,374.52 $1,374.52 $1,374.52 $1,116.38

in-network preventative care.

Total rates $1,668.96 $1,999.40 $2,104.34 $1,665.22

This plan also provides in- and

out-of-network coverage and

access to a pretax Health BlueChoice HMO

Savings Account (HSA), with

This plan has the highest monthly premium Healthcare Questions? Important note:

an employer HSA match.

but has more predictable copay costs Surcharge certifications

when you use the plan. This plan does not For employees enrolled in a

Please be advised that when you certify your tobacco

have a deductible and provides in-network USG Anthem Healthcare plan,

use or working spouse status, you are attesting that

coverage only (except for emergencies). you continue to have the

the information is true and correct to the best of your

Although costs are more predictable, flexibility to see the doctors you knowledge. USG expects employees to uphold the

this plan requires a PCP and referrals to want, with the added support of highest standards of intellectual honesty and integrity,

see specialists. an Accolade personal healthcare in compliance with the USG Ethics policy. Therefore,

assistant who will help answer you should respond honestly in regards to your

your questions, coordinate status. If you knowingly and willfully make a false

care, and support you along or fraudulent statement to the USG regarding your

Comprehensive Care

your healthcare journey. Your insurance coverage, you may be subject to criminal

This is a traditional healthcare plan with deductibles, copays, and prosecution. Under state law (at OCGA Section

Accolade health assistant is

Kaiser Permanente HMO 16-10-20), if you are convicted, you shall be punished

coinsurance. This plan offers a great deal of flexibility as it does not require your single point of contact

a primary care physician (PCP) or referral to see specialists. Additionally, it by a fine no more than $1,000 or by imprisonment for

See page 24 in this booklet for for all your healthcare and

no less than one nor more than five years, or both.

information about the Kaiser provides both in-network and out-of-network coverage. There is a separate pharmacy questions!

HMO plan. out-of-pocket maximum for medical and pharmacy benefits.

8 9Section 2

2022 premium rates for pre-65 retirees 2022 healthcare benefits at a glance

1

2022 monthly plan costs Consumer Choice HSA Comprehensive Care BlueChoice HMO Kaiser Permanente HMO

Healthcare,

Lorum ipsum

In network Out of network In network Out of network In network In network

Consumer Comprehensive BlueChoice Kaiser

Non-Medicare eligible Lifetime maximum

Choice HSA Care HMO Permanente HMO

Unlimited Unlimited Unlimited Unlimited

Non-Medicare retiree only $83.20 $193.34 $228.32 $171.64

Network name

Non-Medicare spouse only $122.92 $244.08 $282.56 $212.54

pharmacy, and well-being

Open Access POS Open Access POS BlueChoice HMO Kaiser facilities

Child(ren) $93.44 $181.58 $209.56 $157.66

Deductible: All services are subject to the deductible unless otherwise indicated

Non-Medicare retiree + child(ren) $176.64 $374.92 $437.88 $329.30

Employee only $2,200 $4,400 $750 $2,250

Non-Medicare spouse + child(ren) $216.36 $425.66 $492.12 $370.20

Employee + 1

Non-Medicare retiree + non-Medicare spouse $206.12 $437.42 $510.88 $384.18 $4,400 $8,800 $1,500 $4,500 None None

(spouse or child)

Family (non-Medicare retiree + non-Medicare Employee + 2 or more

$4,400 $8,800 $2,250 $6,750

$294.44 $624.88 $729.82 $548.84 covered members

spouse + child(ren))

Family (non-Medicare retiree + child(ren)) $176.64 $374.92 $437.88 $329.30 Maximum annual out-of-pocket limit

Family (non-Medicare spouse + child(ren)) $216.36 $425.66 $492.12 $370.20 Employee only $4,000 $8,000 $1,750 $5,250 $5,500 $6,350

Employee + 1

$8,000 $16,000 $3,500 $10,500 $9,900 $12,700

(spouse or child)

2022 monthly plan costs Employee + 2 or more

$8,000 $16,000 $3,500 $10,500 $9,900 $12,700

covered members

Consumer Comprehensive BlueChoice Kaiser Notes Employee only: Responsible for Employee only: Responsible for the Employee only: Responsible Member copays for physician

Pre-65 Medicare eligible

Choice HSA Care HMO Permanente HMO the single deductible or out-of-pocket single deductible or out-of-pocket (OOP) for the single out-of-pocket office visit services, inpatient

(OOP) amount only. amount only. (OOP) amount only. admission, ER visits, and pharmacy

copays apply toward the annual

Pre-65 Medicare retiree or Employee + 1 or more covered Employee + 1 or more covered Employee + 1 or more covered

out-of-pocket. See page 27.

Pre-65 Medicare spouse only or $83.20 $169.17 N/A $136.00 members: Each member responsible for members: Each member

members: Responsible for family

single deductible or OOP amount within responsible for single OOP

Pre-65 Medicare child +26 yrs old deductible or OOP as a whole; one

the family deductible or OOP amount up amount within the family

family member could meet the entire

to the maximum amount. deductible or OOP amount up

Pre-65 Medicare retiree or amount or it could be met

$176.64 $350.75 N/A $293.66 in a combination. Member deductible, copays,

to the maximum amount.

Pre-65 Medicare spouse + child(ren)

and coinsurance apply toward Member copays for office

OOP includes the annual deductible.

Non-Medicare retiree + Pre-65 Medicare spouse $166.40 $362.51 $510.88 $307.64 the annual medical OOP. visits, inpatient admissions, and

In- and -out-of-network coinsurance emergency room services apply

The prescription drug benefits have

Pre-65 Medicare retiree + Pre-65 Medicare spouse $166.40 $338.34 N/A $272.00 amounts accumulated remain toward the annual medical OOP.

a separate OOP. See page 20.

separate. Both medical and pharmacy

The prescription drug benefits

Family (non-Medicare retiree + coinsurance apply toward the

have a separate out-of-pocket

$259.84 $544.09 $729.82 $465.30 deductible and OOP limit. See page 20.

Pre-65 Medicare spouse + child(ren)) limit. See page 20.

Pre-65 Medicare retiree + non-Medicare spouse $206.12 $413.25 N/A $348.54 Pre-existing conditions

Family (pre-65 Medicare retiree + N/A N/A N/A N/A

$299.56 $594.83 N/A $506.20

Non-Medicare spouse + child(ren))

Out-of-state/out-of-country coverage

Family (pre-65 Medicare retiree + child(ren)) $176.64 $350.75 N/A $293.66

You’re covered for emergency

Family (pre-65 Medicare spouse + child(ren)) $176.64 $350.75 N/A $293.66 and urgent care anywhere in the

world. Call the new Away From

In-network coverage that is out-of-state utilizes the BlueCard national program.

Family (pre-65 Medicare retiree + Emergency care only Home Travel Line from both

$259.84 $519.92 N/A $429.66 Out-of-country uses Blue Cross Blue Shield Global Core® at 800-810-2583.

inside and outside the U.S. at

Pre-65 Medicare spouse + child(ren))

951-268-3900 for assistance

before, during, and after travel.

Primary care physician/referral required

Important note: No No Yes No

All in-network services are subject to the deductible unless otherwise stated. All out-of-network services are subject to the out-of-network deductible and balance

All Pre-65 Medicare eligible retirees and dependents will remain on the USG healthcare billing unless otherwise stated.

plans until they reach age 65. At age 65, they will move to the Aon Exchange where Annual deductibles, annual maximum out-of-pocket limits, and annual visit limitations are based on a January 1 to December 31 plan year. BlueChoice HMO and

Medicare will become their primary health plan. Kaiser Permanente HMO have no out-of-network coverage.

BlueChoice HMO members must receive referrals from a Primary Care Physician (PCP). No referrals needed to see most Kaiser Permanente specialists. Referral

If you would like to review the total cost of your healthcare plan, including the required for non-Kaiser Permanente, independent specialists.

employer contribution, please visit the USG website: benefits.usg.edu. All Anthem Blue Cross and Blue Shield healthcare plans and the Kaiser Permanente HMO cover the surgical extraction of impacted wisdom teeth only, and claims

should be filed with your medical benefits.

10 11Section 2

2022 healthcare benefits at a glance (Continued) 2022 healthcare benefits at a glance (Continued)

1

Consumer Choice HSA Comprehensive Care BlueChoice HMO Kaiser Permanente HMO Consumer Choice HSA Comprehensive Care BlueChoice HMO Kaiser Permanente HMO

Healthcare,

Lorum ipsum

In network Out of network In network Out of network In network In network In network Out of network In network Out of network In network In network

Physician services provided in an office or virtual setting Allergy testing

Primary care physician visit

80% 60% 90% 60% 100% after $70 copay 100% after $35 copay

100% after $20 copay per visit; not

pharmacy, and well-being

Plan pays 100% after

80% 60% subject to deductible; $20 copay 60% Plan pays 100% after $20 copay Allergy shots & serum

$35 copay

applies to office visit service only

100%; not subject to deductible

Retail health clinics if a physician is seen, the visit 100% after $35 copay;

80% 60% 60% 100% after $70 copay

is treated as an office visit and $0 copay for serum

Plan pays 100% after Plan pays 100% after subject to the $35 copay per visit.

80% N/A N/A N/A

$15 copay $15 copay

Inpatient hospital services – precertification required, except for emergencies

LiveHealth Online visit

Physician services (may include surgery, anesthesiology, pathology, radiology, and/or maternity care/delivery)

Plan pays 100% for the first Plan pays 100% for the first

80%; $59 prior

N/A 3 visits; then 100% after N/A 3 visits; then 100% after Plan pays 100%; no visit limit 80% 60% 90% 60% 100% 100%

to deductible

$15 copay per visit $15 copay per visit

Hospital facility services inpatient care (includes inpatient short-term rehabilitation services)

Wellness/preventive care* (calendar year)

Not covered; 90% limited to

80% 60% 60% 100% after $500 copay 100% after $250 copay

Paid at 100%; Paid at 60%; noncovered charges semi-private room

Paid at 100%; not subject

not subject not subject do not apply to annual Plan pays 100% Plan pays 100%

to deductible Maternity delivery

to deductible to deductible deductible or annual

out-of-pocket maximum

80% 60% 90% 60% 100% after $500 copay 100% after $250 copay

Routine eye exam with ophthalmologist or optometrist

Not covered; Laboratory services (LabCorp is in network)

Paid at 100%; Paid at 60%; noncovered charges

Paid at 100%; not subject Plan pays 100% after $35 copay

not subject not subject do not apply to annual Not covered 80% 60% 90% 60% 100% 100%

to deductible to Optometrist

to deductible to deductible deductible or annual

out-of-pocket maximum

Skilled nursing facility

Specialist visit

80% 60% 90% 60%

100% after $35 copay per visit; not 100%; 30-day limit per 100%; 60-day limit per

80% 60% subject to deductible; $35 copay 60% 100% after $70 copay 100% after $35 copay 30 days per calendar year combined 30-day calendar-year maximum combined calendar year calendar year

applies to office visit service only in network and out of network in network and out of network

Laboratory services Hospice care

80% 100% covered in Kaiser 100% 100% 100% 60% 100% 100%

when lab is 60% 90% when lab is LabCorp 60% 100% when lab is LabCorp Permanente medical office; $100

LabCorp copay in outpatient setting

Outpatient hospital/facility services – precertification required except for emergency

Maternity care Physician services (may include surgery, anesthesiology, pathology, radiology, and/or maternity care/delivery)

All physician charges related

90% after an initial visit copay

to prenatal, delivery and 80% 60% 90% 60% 100% 100%

of $20; not subject to deductible; Prenatal and first postpartum

80% 60% 60% postpartum care covered at

no copays charged for visit covered at 100%

100% after an initial copay of Hospital facility services outpatient care (including outpatient surgery and diagnostic testing)

subsequent visits

$70 at first office visit

Surgery in office 80% 60% 90% 60% 100% after $250 copay 100% after $100 copay

100% after $35 copay in Kaiser

80% 60% 90% 60% 100% after $70 copay Permanente medical office;

$100 copay in outpatient setting All in-network services are subject to the deductible unless otherwise stated. All out-of-network services are subject to the out-of-network deductible and balance

billing unless otherwise stated.

Annual deductibles, annual maximum out-of-pocket limits, and annual visit limitations are based on a January 1 to December 31 plan year. BlueChoice HMO and

* Preventive 3-D mammograms are covered by Anthem. Kaiser Permanente HMO have no out-of-network coverage.

* For at-home colon cancer screening test options, please call the number on the back of your ID card. BlueChoice HMO members must receive referrals from a Primary Care Physician (PCP). No referrals needed to see most Kaiser Permanente specialists. Referral

required for non-Kaiser Permanente, independent specialists.

12 13Section 2

2022 healthcare benefits at a glance (Continued) 2022 healthcare benefits at a glance (Continued)

1

Consumer Choice HSA Comprehensive Care BlueChoice HMO Kaiser Permanente HMO Consumer Choice HSA Comprehensive Care BlueChoice HMO Kaiser Permanente HMO

Healthcare,

Lorum ipsum

In network Out of network In network Out of network In network In network In network Out of network In network Out of network In network In network

Care in hospital Emergency Room Behavioral health and substance abuse

Inpatient

90% after a $250 copay per 90% after a $250

visit; subject to deductible; copay per visit; subject

80% 80% 100% after $300 copay 100% after $250 copay

pharmacy, and well-being

copay waived if admitted to deductible; copay waived if 80% 80% 90% 60% 100% after $500 copay 100% after $250 copay

within 24 hours admitted within 24 hours

Partial hospitalization

Ambulance services (land or air ambulance for medically-necessary emergency transportation only)

80% 60% 90% 60% 100% Contact plan for details.

80% 60% 90%; subject to in-network deductible 100% 100% after $75 copay per trip

Office visit

Urgent care services

100% after $35 copay; not 80% 60% $20 60% 100% Contact plan for details.

80% 60% 60% 100% after $70 copay 100% after $30 copay

subject to deductible

Outpatient facility

Subject to balance billing for nonparticipating providers; balance bill amounts will not apply to the deductible or out-of-pocket maximum.

Other services 80% 60% 90% 60% 100% 100% after $20 copay

Home health

Intensive outpatient

80% 60% 90% 60% 100%; up to 120 visits 100%; 120 visits

80% 60% 90% 60% 100% Contact plan for details.

Home nursing care

Applied behavioral analysis (ABA)/autism therapy

80% 60% 90% 60% 100% Contact plan for details 100% after $20 copay per 100% after $35 copay per

100% after $20 copay per office

office visit; refer to plan benefits office visit; refer to plan benefits

80% 60% above for treatment outside

60% above for treatment outside of

visit; unlimited visits; treatment

Durable medical equipment requires prior authorization

of office visit setting office visit setting

Pharmacy services

80% 60% 90% 60% 100% 50%

Prescription drugs

Hearing aids — children (18 years of age and under)

See page 20. See page 20. See page 20. See page 27.

80% 60% 90% 60% 100% 50%

Initial: 1 hearing aid per ear, with a Initial: 1 hearing aid per ear, with a limit of $3,000 per ear Initial: 1 hearing aid per ear, Initial: 1 hearing aid per ear, with

All in-network services are subject to the deductible unless otherwise stated. All out-of-network services are subject to the out-of-network deductible and balance

limit of $3,000 per ear Replacement: 1 hearing aid per ear every 48 months with a limit of $3,000 per ear a limit of $3,000 per ear

Replacement: 1 hearing aid per ear Replacement: 1 hearing aid Replacement: 1 hearing aid per billing unless otherwise stated.

every 48 months per ear every 48 months ear every 48 months Annual deductibles, annual maximum out-of-pocket limits, and annual visit limitations are based on a January 1 to December 31 plan year. BlueChoice HMO and

Kaiser Permanente HMO have no out-of-network coverage.

Cochlear implants - covered if deemed medically necessary; preauthorization required

BlueChoice HMO members must receive referrals from a Primary Care Physician (PCP). No referrals needed to see most Kaiser Permanente specialists.

Covered if deemed Referral required for non-Kaiser Permanente independent specialists.

80% 60% 90% 60% 100% medically necessary;

preauthorization required

Chiropractic care; physical therapy; speech therapy; occupational therapy; cardiac therapy

100% after $35 copay;

80% 60% 90% 60% 100% after $70 copay;

20 visits

Physical, occupational, Chiropractic care: 40 visits Chiropractic care: 20 visits 100% after $35

and chiropractic care: Physical, speech, occupational, and cardiac Physical and occupational copay; up to 20 visits for

combined 20 visits therapies: 40 visits per therapy in and out of network therapy: 40 visits physical, occupational, and

Speech therapy: 20 visits visit limits are combined Speech therapy: 30 visits speech combined

Respiratory therapy: 30 visits Cardiac rehabilitation: 100% after $35 copay:

in and out of network no visit limit up to 36 visits for

visit limits are combined. Cardiac rehabilitation

Cardiac rehabilitation: no visit limit

14 15Section 2

Accolade Accolade

1

Personalized health and benefits You can ask your Health Assistant Save money, time and stress. Your Accolade Health

Healthcare,

Lorum ipsum

Assistant understands the healthcare system and can

support from Accolade and nurse questions like these: help you get the information you need to make the best

decisions for you and your family. From choosing a

For employees enrolled in a USG Anthem Healthcare

What other benefit programs might help me? health plan to finding a lower price for your prescription,

plan, you continue to have the flexibility to see the

ask Accolade.

pharmacy, and well-being

doctors you want, with the added support of an

Accolade personal healthcare assistant who will help When am I eligible for benefits election? Understand coverage and costs. Your Health Assistant Keep your ID card handy on

answer your questions, coordinate care, and support

you along your healthcare journey.

can help you understand your coverage and estimate

your out-of-pocket healthcare costs ahead of time, so

your mobile device.

I was just diagnosed with diabetes — now what?

you can be financially prepared. You can also use the When you download the Accolade

Your Accolade health assistant is your single point

Estimate Costs tool in the Accolade member portal or

of contact for all your healthcare and pharmacy

Why was I billed for this test? mobile app you can view, email, or fax

mobile app to find out the cost of a test or procedure.

questions! They will take the time to get to know you your ID card to your provider whenever

and understand your needs, while partnering with a

Can you help me find an in-network provider?

or wherever you are.

team of nurses, doctors, pharmacists, and claims

specialists to help support you each step of the way 1. D

ownload the Accolade mobile app

and guide you to the right care. Whether you have

What questions should I ask my doctor? on the App Store or Google Play and

questions about your benefits, need advice about a new

diagnosis, scheduling an appointment, or finding the register or log in.

best doctor for your situation, your personal health

Just Ask Accolade 2. Select Profile.

assistant is there to help you and your family.

Occasionally, your Health Assistant may check in with Accolade can help you and your family: 3. Select Benefits Cards.

you to make sure you and your family are doing well Find great doctors and healthcare facilities in your

and are getting the care you need. Whether it’s

4. Select + to add your benefits card.

network. Speak with your Accolade Health Assistant or

following up on a doctor’s visit or hospital stay, or use the Find Care tool on your Accolade member portal

Resolve billing and claims issues. If you have 5. S

elect which type of card to add

understanding a treatment plan, your Health Assistant or mobile app, for help finding an in-network doctor who

and nurse are here to help you navigate your healthcare

questions about your healthcare costs, select the (Medical, pharmacy, etc.).

is experienced in the care you need and meets your

Spending tab in your account to view your claims and

and make the best decisions possible. preferences on location, gender, language and more.

keep track of your spending. You can also connect with 6. S

nap a photo of the front and back

Accolade is completely confidential and takes the Get personalized support from someone who knows your Accolade Health Assistant for one-on-one support of the ID card, and select Save.

hassle out of benefits for USG employees. your USG benefits, inside and out. Not only can your to understand a medical bill or identify next steps

Accolade Health Assistant help you understand your toward resolution — and we take on the legwork so you

healthcare plan, but they can also educate and connect don’t have to.

Call your Accolade Health Assistant you with all of your other USG benefit plans, programs

Helpful tip!

and nurse at 866-204-9818, Monday to and resources.

Friday, 8 a.m. to 11 p.m. ET. Get the guidance and answers you need to make an

informed decision about your healthcare. Talk to Nurse support

member.accolade.com Accolade’s team of nurses, doctors, and pharmacists Connect to a nurse for medical questions, day or

Send a secure message through about symptoms, medications, new diagnosis, or

Accolade is listed as the phone

night. Your nurse will take the time to understand your

the member website or the Accolade ongoing conditions and treatment options. They can care needs, and then help you take the next steps number on the back of your ID

mobile app. also provide you with questions to ask your doctor so such as understanding symptoms, finding a specialist, card, so you can call with your

you can make an informed decision about your medical getting help for a chronic condition, or discussing health and benefits questions,

care and treatment options.

treatment options. big or small!

Accolade does not practice medicine or provide patient care. It is an independent resource to support and assist you as you use the healthcare system and receive medical care from your own doctors, nurses and healthcare

professionals. If you have a medical emergency, please contact 911 immediately. ©2020 Accolade. All rights reserved. All product names, logos, and brands are the property of their respective owners.

16 17Section 2

1

Start your Livongo

journey today, offered for

Healthcare,

Lorum ipsum

Anthem members Find affordable care options

pharmacy, and well-being

We understand the importance of keeping yourself and your family healthy. When you need immediate care, there may

be better choices than the emergency room (ER).

Livongo provides Diabetes Management,

Who can join

Diabetes Prevention and weight loss For more details around these options, reach out to Accolade, your personal

The program is offered at no additional cost to qualified

programs at no additional cost to help you

employees and pre-65 retirees and their spouses who

healthcare assistant.

live a healthier life. are enrolled in one of the USG Anthem healthcare plans.

What you receive Here’s what to do when you need care fast:

Diabetes management: Make Integrated tools. Receive a new blood glucose meter • If it is an emergency, head straight to the closest – Retail health clinic ― Often part of a major

diabetes management easier. with unlimited strips and lancets at no additional cost ER or call 911. pharmacy or retail store, these clinics are staffed

to you. Track your progress and manage your health by healthcare professionals who provide basic

• Connected meter and real-time insights • If you are not sure or want advice about where to

in the Livongo app. medical services to walk-in patients. To find a

• Unlimited strips shipped right to you go, contact Accolade to speak with your personal

provider near you, call the number or visit the

Better health monitoring. Livongo’s connected healthcare assistant or nurse at 866-204-9818.

• 24/7 support from expert coaches website on the back of your ID card.

devices automatically upload your readings right to

• Smart scale and/or blood pressure • If it is not an emergency, consider a walk-in center

your app. You’ll also get personalized tips to support – Urgent care center ― These centers treat

monitor (depending on your health or one of these convenient alternatives:

you on your health journey. problems that need attention, such as stitches,

status) – LiveHealth Online ― Talk to doctors face-to-face, X-rays, or lab work, but are not true emergencies.

Expert support when you need it. Expert health 24/7, through your mobile device or a computer Like walk-in centers and retail health clinics,

coaches are ready to help, on your terms. Get tips on with a camera. For employees enrolled in they’re typically open evenings and weekends.

Diabetes prevention: managing your blood sugar, healthy eating, weight, Comprehensive Care or BlueChoice HMO, the

Lower your risk of developing blood pressure, and more. first three visits are free.

type 2 diabetes. USG Well-being: For participants in USG Well-being, LiveHealth Online is the trade name of Health Management Corporation.

by completing 16+ weeks of Weight Management,

• Connected smart scale

Diabetes Prevention Program (DPP), or Diabetes

• Unlimited one-on-one coaching Management, you can earn a $50 well-being credit

• Community support and more (1x/year). Only active employees and spouses on a Coverage while traveling or living outside the U.S.

USG healthcare plan can earn the credit.

Even when traveling abroad you have coverage

Weight Management: Take the To sign up or to learn more about this program, visit available to you through the Blue Cross Blue

well.livongo.com/USGBENEFITS or you can call Before you travel, contact

guesswork out of weight loss. Livongo Member Support at 800 945-4355 and have

Shield Global Care Program:

Accolade for coverage details

• Connected smart scale • Comprehensive Care – doctor, hospital, and

your registration code USGBENEFITS ready. and instructions on how to

emergency care

• Unlimited one-on-one coaching locate a doctor or hospital.

• Consumer Choice – doctor, hospital, and

• Mini guided challenges and more emergency care

• Always carry your Anthem ID card.

• BlueChoice HMO – emergency care only

18 19Section 2

CVS pharmacy benefits summary

When you enroll in an Anthem healthcare plan, you are automatically enrolled in the prescription drug benefit through Understanding your benefits

Healthcare, pharmacy, and well-being

CVS Caremark. Your formulary offers a wide selection of clinically-sound, cost-effective generic, and brand-name

prescription drugs. Additionally, CVS Caremark offers many convenient and affordable options to fill your prescriptions,

such as retail pharmacies, mail-order, and specialty orders.

The plan includes several utilization management programs to promote safety along with appropriate and cost-effective

use of prescription medications.

Consumer Choice HSA Comprehensive Care BlueChoice HMO How it works

coinsurance after deductible copay/coinsurance copay/coinsurance

Prescription coinsurance: Exceptions:

Generic 20% $15 $15

Retail 20% with $40 minimum 20% with $40 minimum • If the full cost of the medication is less than the If a generic is available, but you or your doctor request

Preferred brand 20%

and $100 maximum and $100 maximum

(30 day supply) minimum amount listed, you will pay the full cost a brand name drug, you will pay the generic copay

Nonpreferred brand 20%

35% with $100 minimum 35% with $100 minimum of the medication. plus the cost difference between the generic and

and $200 maximum and $200 maximum

brand-name drug. In this case, the cost could exceed

Generic 20% $45 $45 • If the coinsurance is less than the minimum

the copay maximum.

20% with $120 minimum 20% with $120 minimum

amount listed, you pay the minimum.

Mail order Preferred brand 20%

and $300 maximum and $300 max

(90 day supply) • If the coinsurance calculation is greater than Specialty:

35% with $300 minimum 35% with $300 minimum

Nonpreferred brand 20%

and $600 maximum and $600 maximum

the maximum amount, you pay the

Specialty medications are often used to treat

maximum amount.

Generic

20% 20% with maximum of $75. 20% with maximum of $75. complex, chronic conditions, such as multiple

Limited to 30-day supply. Limited to 30-day supply. Limited to 30-day supply.

sclerosis, rheumatoid arthritis, hepatitis C, and

20% 20% with maximum of $150. 20% with maximum of $150. Example assumes 30-day prescription, under

Specialty Preferred brand hemophilia. They are expensive, require complicated

Limited to 30-day supply. Limited to 30-day supply. Limited to 30-day supply. Comprehensive Care Plan (does not include specialty)

treatment regimens, may have many side effects,

20% 35% with maximum of $200. 35% with maximum of $200.

Nonpreferred brand Limited to 30-day supply. Limited to 30-day supply. Limited to 30-day supply. Type Generic Preferred Nonpreferred and require special storage which may lead to

Out-of-pocket adherence issues.

Employee The annual out-of-pocket $1,500 $ $$ $$$

maximum amounts for members costs

Annual Employee + child(ren) enrolled in the Consumer Choice $3,000 As a result, beginning January 1, 2022, the pharmacy

out-of-pocket HSA plan will be combined with If the cost is $200 $350 $650

the medical out-of-pocket benefit will limit all new specialty medications to a

maximum Employee + spouse $3,000 Coinsurance/

maximum amounts (for example,

copay $15 copay 20% ($40 minimum) 35% ($100 minimum) 30-day supply per fill. Additionally, we are introducing

Family single or family coverage). $4,500

a new specialty tier for the BlueChoice HMO and

You pay $15 copay $70 $200

If approved for a 60-90-day supply, you will be responsible for 2x or 3x the coinsurance. Comprehensive Care plans in which you will pay a

Maximum per percentage of the drug cost, also known as

medication $15 copay $100 maximum $200 maximum

coinsurance up to a maximum per 30-day supply.

Important information Example assumes 30-day supply of a specialty medication

Did You Know?

If your doctor prescribes a brand-name drug when Comprehensive Care BlueChoice HMO

equivalent generic drugs are available, you will To promote good health and help prevent

Drug costs Coinsurance You pay Coinsurance You pay

automatically receive an FDA-approved generic the need for costly care, your plan covers a

Generic $750 20%, with $75 maximum $75 20%, with $75 maximum $75

drug unless: number of preventive medications at $0 copay.

These include women’s contraceptives, Preferred $2,500 20%, with $150 maximum $150 20%, with $150 maximum $150

• Your doctor writes “dispense as written” (DAW) on

diabetes supplies, and hypertension drugs Nonpreferred $7,500 35%, with $200 maximum $200 35%, with $200 maximum $200

the prescription.

recommended for coverage by the U.S. Annual out-of-pocket

Preventive Services Task Force. Coverage of Pharmacy costs are not combined with your medical out-of-pocket maximum. See page 20.

• You request the brand-name drug at the time you maximum

fill your prescription. these drugs requires a prescription (even for

over-the-counter items) and are subject to For a list of specialty medications that fall under this tier, review the Specialty Drug list on benefits.usg.edu website.

When more than one generic drug is approved, CVS certain age and gender criteria. Learn more

Caremark may fill your prescription with any approved at benefits.usg.edu.

generic equivalent.

20 21Section 2

CVS pharmacy benefits summary (Continued) HMO service area by county

Save money BlueChoice HMO service area by county

Healthcare, pharmacy, and well-being

If you are taking a brand-name or nongeneric Abbeville Cobb Hall McIntosh Stewart

drug, talk to your doctor to determine if

switching to a lower-cost alternative medication

Helpful tip! Aiken-Augusta (Border)

Anderson

Columbia

Coweta

Hamilton

Hampton-Augusta (Border)

Meriwether

Monroe

Sumter

Talbot

Appling Crawford Hancock Montgomery Taliaferro

may be an option for you. If your doctor

Bacon Dade Haralson Morgan Tattnall

prescribes a brand-name drug when an

Use your HSA or FSA to pay for Banks Dawson Harris Murray Taylor

equivalent generic is available, you will

automatically receive a generic. your prescriptions Barbour DeKalb Hart Muscogee Telfair

Barnwell Dodge Heard Newton Toombs

Mail order. If you are taking ongoing Barrow Dooly Henry Oconee Towns

maintenance medication, save time Bartow Douglas Houston Oglethorpe Treutlen

by trying mail order. Sign up at Bibb Eadgefield Jackson Paulding Troup

caremark.com/mailservice. Prior authorization Bleckley Edgefield-Augusta (Border) Jasper Peach Twiggs

Bradley Effingham Jefferson Pickens Union

Copay card programs. You can use a Prescriptions for certain medications require a prior Bryan Elbert Jenkins Pierce Upson

manufacturer copay card program with your authorization, also known as a coverage review, to Bulloch Emanuel Johnson Pike Walker

prescription benefit. These programs may ensure the drug is safe, clinically appropriate, and cost Burke Evans Jones Polk Walton

lower your copay or coinsurance amounts for effective for your condition. The review uses both Butts Fannin Lamar Pulaski Warren

prescription drugs. formulary and clinical guidelines to determine if the Candler Fayette Laurens Putnam Washington

Don’t trade up. Generics are typically the most plan will pay for certain medicines. If your prescription

Carroll Floyd Lee Quitman Webster

cost-effective option. With a generic medication, requires a prior authorization, your doctor must submit

Catoosa Forsyth Liberty Rabun Wheeler

you get the same high-quality, effective a request for coverage review for approval.

Chambers Franklin Lincoln Randolph White

treatment that you get with its brand-name Chatham Fulton Long Richmond Whitfield

counterpart — without the high cost. Chattahoochee Gilmer Lumpkin Rockdale Wilcox

Dispense as written (DAW) Chattooga Glascock Macon Russell-Columbus (Border) Wilkes

If you are not able to take the generic medicine, your Cherokee Gordon Madison Schley Wilkinson

doctor can request a brand penalty exception that may Clarke Greene Marion Screven

allow you to purchase the brand-name drug without Clayton Gwinnett McCormick Spalding

paying the ancillary charge. The brand penalty Cleburne-Rome (Border) Habersham McDuffie Stephens

exception process may be initiated by contacting CVS

Caremark customer care.

Kaiser Permanente Georgia service area by county

Prescription questions?

Barrow Cobb Fulton Madison Pike

Your Accolade Health Assistant can help you with

Bartow Coweta Gwinnett Meriwether Rockdale

things like understanding your pharmacy benefit

Butts Dawson Hall Newton Spalding

coverage and claims, what medications are covered,

Carroll DeKalb Haralson Oconee Walton

as well as, understanding the costs and/or discount

Cherokee Douglas Heard Oglethorpe

available. Contact Accolade at member.accolade.com

or 866-204-9818. Clarke Fayette Henry Paulding

Clayton Forsyth Lamar Pickens

22 23Section 2

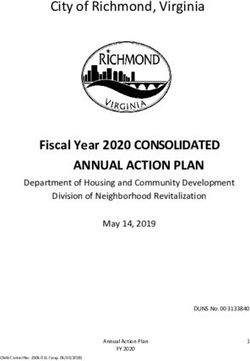

Kaiser Permanente Kaiser Permanente

A DIFFERENT experience from the start.

Healthcare, pharmacy, and well-being

PICKENS H

There’s only one healthcare company that’s refreshingly unlike the others. The Kaiser HMO plan makes healthcare DAWSON

U

simple with everything you need, including PCPs, specialty care providers, lab, and pharmacy, all conveniently located

under one roof. However, if you select this plan, you will have to use Kaiser Permanente providers and facilities. There H 575

are no out-of-network benefits (except in case of an emergency), and you must designate a PCP who will coordinate all UU

of your care. BARTOW CHEROKEE

U H 985

What makes Kaiser Permanente DIFFERENT? U Forsyth

Holly Springs U U KP

75

KP

U U

U FORSYTH Sugar Hill–Buford U

A better way to do care. DIFFERENT means you’re at the center of a 360-degree care experience. Our physician-led U U

TownPark KP

KP FULTON KP U UU

teams work together to tailor the most effective evidence-based care plan for your every need. U U U KP Alpharetta H

85

U U U U U

U H

Convenient ways to get care. DIFFERENT means access to your doctor your way. Not some doctor, some way. Whether 400 BARROW

U

U U U U

by phone, email, video, or 24/7 advice, your Kaiser Permanente care team has access to your real-time medical record U H U H

U COBB U U U U KP

Lawrenceville Athens

and is ready to see you. U U

316

316 KP

75

U KP Glenlake KP Gwinnett U

West Cobb KP 10 ATHENS-

Healthy resources and perks. DIFFERENT means taking care of the whole you, not just the sick you. It also means you U H KP Sandy Springs 78 CLARKE

HH U GWINNETT

KP Snellville U

get exclusive access to rich content, healthy resources, and members-only perks!

PAULDING

Cumberland KP U

400

85 Crescent KP

H KP Brookwood at Peachtree 78

U

U HH U

HARALSON

Locations. DIFFERENT means having state-of-the-art medical facilities with lab, radiology, pharmacy, and more all under 285

U

20 H KP Downtown Decatur

one roof. KP

285

WALTON

U Douglasville U U U KP Panola

Cascade KP

166

KP KP Conyers

DOUGLAS DEKALB

UU U 285 Stonecrest

U U U

20

75

H

FULTON 675 ROCKDALE

H

Choose a doctor who’s right Get care on your schedule

CARROLL

Southwood KP

KP

KP Southwood Specialty

NEWTON

U U

for you Need to schedule an appointment? Have a H CLAYTON U

HENRY

nonurgent question you’d like to email to your COWETA Fayette KP KP 75

Our online doctor profiles let you browse the many 85

U Henry Towne

doctor? Want your prescription refill mailed to Newnan

FAYETTE

Centre

excellent doctors and convenient locations in your KP

U

your home? After you enroll, register for an online

HEARD

H U

area, even before you enroll. This helps you choose U

account at kp.org or get our mobile app and find

from hundreds of board-certified doctors and

out just how easy DIFFERENT can be.

specialists who fits your needs. You’re also free to BUTTS

change at any time, for any reason. SPALDING

MERIWETHER

Transition your care How to find a provider: Want to find PIKE

LAMAR

With 26 Kaiser Permanente offices and more

seamlessly out more? We’re than 600 doctors throughout metro Atlanta —

1 Visit kp.org/facilities.

Easily move prescriptions and find a location that’s here to help. plus pharmacy, lab, and X-ray usually right in the

close to your home, work, or school. Many services 2 Select the Find a Doctor link on the same building — you’ll enjoy convenience you

are often under one roof, making it easy to see your home page. Scan the QR code.

won’t find with other plans. Plus, you won't have

doctor, get a lab test, and pick up prescriptions — all to pay for parking.

in one trip.

24 25You can also read