House Prices, Borrowing Constraints, and Monetary Policy in the Business Cycle

←

→

Page content transcription

If your browser does not render page correctly, please read the page content below

House Prices, Borrowing Constraints, and Monetary Policy in

the Business Cycle

By MATTEO IACOVIELLO*

I develop and estimate a monetary business cycle model with nominal loans and

collateral constraints tied to housing values. Demand shocks move housing and

nominal prices in the same direction, and are amplified and propagated over time.

The financial accelerator is not uniform: nominal debt dampens supply shocks,

stabilizing the economy under interest rate control. Structural estimation supports

two key model features: collateral effects dramatically improve the response of

aggregate demand to housing price shocks; and nominal debt improves the sluggish

response of output to inflation surprises. Finally, policy evaluation considers the

role of house prices and debt indexation in affecting monetary policy trade-offs.

(JEL E31, E32, E44, E52, R21)

“The population is not distributed between A long tradition in economics, starting with

debtors and creditors randomly. Debtors Irving Fisher’s (1933) debt-deflation explana-

have borrowed for good reasons, most of tion of the Great Depression, considers financial

which indicate a high marginal propensity factors as key elements of business cycles. In

to spend from wealth or from current in- this view, deteriorating credit market condi-

come or from any other liquid resources

they can command. Typically their indebt- tions, like growing debt burdens and falling

edness is rationed by lenders [...]. Business asset prices, are not just passive reflections of a

borrowers typically have a strong propen- declining economy, but are themselves a major

sity to hold physical capital [...]. Their de- factor depressing economic activity.

sired portfolios contain more capital than Although this “credit view” has a long his-

their net worth [...]. Household debtors are tory, most theoretical work on this subject had

frequently young families acquiring homes been partial equilibrium in nature until the late

and furnishings before they earn incomes to 1980s, when Ben Bernanke and Mark Gertler

pay for them outright; given the difficulty of (1989) formalized these ideas in a general equi-

borrowing against future wages, they are librium framework. Following their work, var-

liquidity-constrained and have a high mar-

ginal propensity to consume.” ious authors have presented dynamic models in

—James Tobin, Asset Accumulation and which financing frictions on the firm side may

Economic Activity amplify or propagate output fluctuations in re-

sponse to aggregate disturbances: examples in-

clude the real models of Nobuhiro Kiyotaki and

* Department of Economics, Boston College, Chestnut John Moore (1997) and Charles Carlstrom and

Hill, MA 02467 (e-mail: iacoviel@bc.edu). I am deeply

indebted to my Ph.D. advisor at the London School of

Timothy Fuerst (1997), and the sticky-price

Economics, Nobuhiro Kiyotaki, for his continuous help and model of Bernanke et al. (1999). Empirically,

invaluable advice. I thank Fabio Canova, Raffaella Giaco- various studies have shown that firms’ invest-

mini, Christopher House, Peter Ireland, Raoul Minetti, ment decisions are sensitive to various measures

Claudia Oglialoro, François Ortalo-Magné, Marina Pavan, of the firms’ net worth (see Glenn Hubbard,

Christopher Pissarides, Fabio Schiantarelli, two anonymous

referees, and seminar participants at the Bank of England, 1998, for a review). At the same time, evidence

Boston College, the European Central Bank, the Ente Luigi of financing constraints at the household level

Einaudi, the Federal Reserve Bank of New York, the Fed- has been widely documented by Stephen Zeldes

eral Reserve Bank of St. Louis, the London School of (1989), Tullio Jappelli and Marco Pagano

Economics, the NBER Monetary Economics Meeting, and

Northeastern University for their helpful comments on var-

(1989), John Campbell and Gregory Mankiw

ious versions of this work. Viktors Stebunovs provided (1989), and Christopher Carroll and Wendy

superb research assistance. Dunn (1997).

739740 THE AMERICAN ECONOMIC REVIEW JUNE 2005

While these studies have highlighted the im- itive demand shock. When demand rises, con-

portance of financial factors for macroeconomic sumer and asset prices increase: the rise in asset

fluctuations, to date there has been no system- prices increases the borrowing capacity of the

atic evaluation of the extent to which a general debtors, allowing them to spend and invest

equilibrium model with financial frictions can more. The rise in consumer prices reduces the

explain the aggregate time-series evidence on real value of their outstanding debt obligations,

the one hand, and be used for monetary policy positively affecting their net worth. Given that

analysis on the other. This is the perspective borrowers have a higher propensity to spend

adopted here. From the modeling point of view, than lenders, the net effect on demand is posi-

my starting point is a variant of the Bernanke et tive, and acts as a powerful amplification mech-

al. (1999) new-Keynesian setup in which en- anism. However, while it amplifies the demand

dogenous variations in the balance sheet of the shocks, consumer price inflation dampens the

firms generate a “financial accelerator” by en- shocks that induce a negative correlation between

hancing the amplitude of business cycles. To output and inflation: for instance, adverse supply

this framework, I add two main features: collat- shocks are beneficial to borrowers’ net worth if

eral constraints tied to real estate values for obligations are held in nominal terms. Hence, un-

firms, as in Kiyotaki and Moore (1997); and, for like the previous papers, the financial accelerator

a subset of the households, nominal debt. The really depends on where the shocks come from:

reason for housing1 collateral is practical and the model features an accelerator of demand

substantial: practical because, empirically, a shocks, and a “decelerator” of supply shocks.

large proportion of borrowing is secured by real The transmission mechanism described above

estate; substantial because, although housing is at the root of the model’s success in explaining

markets seem to play a role in business fluctu- two salient features of the data. First, collateral

ations,2 the channels by which they affect the effects on the firm and the household allow match-

economy are far from being understood. The ing the positive response of spending to a housing

reason for having nominal debt comes from the price shock.3 Second, nominal debt allows the

widespread observation that, in low-inflation model to replicate the hump-shaped dynamics of

countries, almost all debt contracts are in nom- spending to an inflation shock.4 Such improve-

inal terms, even if they appear hard to justify on ments in the model’s ability to reflect short-run

welfare-theoretic grounds: understanding their dynamic properties are especially important,

implications for macroeconomic outcomes is a given that several studies (e.g., Jordi Galı́, 2004;

crucial task. Peter Ireland, 2004b) have stressed the role of

In addition, I ask whether the model is able to nontechnology and nonmonetary disturbances

explain both key business cycle facts and the in understanding business fluctuations.

interaction between asset prices and economic Finally, I address and answer two important

activity. To this end, I estimate the key struc- policy questions. First, I find that allowing the

tural parameters by minimizing the distance be- monetary authority to respond to asset prices

tween the impulse responses implied by the yields negligible gains in terms of output and

model and those generated by an unrestricted inflation stabilization. Second, I find that nom-

vector autoregression. The estimates are both inal (vis-à-vis indexed) debt yields an improved

economically plausible and statistically signifi- output-inflation variance trade-off for the cen-

cant. They also provide support for the two tral bank: this happens because the sources of

main features of the model (collateral con- trade-offs in the model do not get amplified,

straints and nominal debt). In the concluding since such shocks, ceteris paribus, transfer re-

part of the paper, therefore, I use the estimated sources from lenders to borrowers during a

model for quantitative policy analysis. downturn.

The model transmission mechanism works as

follows. Consider, for sake of argument, a pos-

3

In the VAR below I document a significant two-way

interaction between housing prices and GDP. Aggregate de-

1

With a slight abuse of notation, I use the terms “real mand effects from changes in housing wealth have also been

estate,” “assets,” and “houses” interchangeably in the paper. documented elsewhere; see, for instance, Case et al. (2001).

2 4

See, for instance, International Monetary Fund (2000); See, for instance, Jeffrey Fuhrer (2000), as well as the

Matthew Higgins and Carol Osler (1997); Karl Case (2000). VAR evidence below.VOL. 95 NO. 3 IACOVIELLO: HOUSE PRICES, BORROWING CONSTRAINTS, AND MONETARY POLICY 741

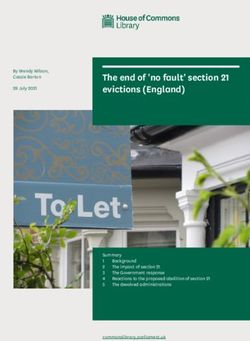

FIGURE 1. VAR EVIDENCE, UNITED STATES

Notes: VAR estimated from 1974Q1 to 2003Q2. The dashed lines indicate 90-percent confidence bands. The Choleski

ordering of the impulse responses is R, , q, Y. Coordinate: percent deviation from the baseline.

The paper is organized as follows. Section I from a VAR with detrended real GDP (Y),

presents some VAR evidence on housing prices change in the log of GDP deflator (), de-

and the business cycle. Section II presents the trended real house prices (q), and Fed Funds

basic model. Section III extends the basic model rate (R) from 1974Q1 to 2003Q2.5 I use this

by including a constrained household sector and VAR to document the key relationships in

by allowing for variable capital. Section IV esti- the data and, later in the paper, to choose the

mates the structural parameters of the model. Sec-

tion V analyzes its dynamics, while Section VI

looks at housing prices and debt indexation for the 5

formulation of systematic monetary policy. Con- The Fed Funds rate is the average value in the first

month of each quarter. The house price series (deflated with

cluding remarks are contained in Section VII. the GDP deflator) is the Conventional Mortgage Home

Price Index from Freddie Mac. The VAR included a time

I. VAR Evidence on Housing Prices and the trend, a constant, a shift dummy from 1979Q4, and one lag

Business Cycle of the log of the CRB commodity spot price index. Two lags

of each variable were chosen according to the Hannah-

Quinn criterion. The logs of real GDP and real housing

Figure 1 presents impulse responses (with prices were detrended with a band-pass filter that removed

90-percent bootstrapped confidence bands) frequencies above 32 quarters.742 THE AMERICAN ECONOMIC REVIEW JUNE 2005

parameters of the extended model in a way to estate is fixed in the aggregate, however, which

match the VAR impulse responses. guarantees a variable price of housing. This

Here and in the rest of the paper, the variables assumption is not crucial to the propagation

are expressed in percentages and in quarterly mechanism: I will show below that collateral

rates. The shocks are orthogonalized in the or- effects can generate sizeable amplification, even

der R, , q, and Y. The ordering did not affect when the share of real estate in production is

the results substantially: as I will show below, small.

such an ordering also renders the VAR and the As their activities are somewhat conven-

model more directly comparable. The results tional, I start with the patient households’

suggest that a model of the interaction between problem.

house prices and the business cycle has to de-

liver: A. Patient Households

(a) A negative response of nominal prices, real The household sector (denoted with a prime)

housing prices, and GDP to tight money is standard, with the exception of housing (ser-

(Figure 1, first row); vices) in the utility function.6

(b) A significant negative response of real Households maximize a lifetime utility func-

housing prices and a negative but small tion given by

response of output to a positive inflation

冘  共ln c⬘⫹ j ln h⬘⫺ 共L⬘兲 / ⫹ ln共M⬘/P 兲兲

disturbance (second row); and ⬁

(c) A positive comovement of asset prices and t

E0 t t t t t

output in response to asset price shocks t⫽0

(third row) and to output shocks (fourth

row). Taken together, the two rows high- where E0 is the expectation operator,  僆 (0, 1)

light a two-way interaction between hous- is the discount factor, c⬘t is consumption at t, h⬘t

ing prices and output. denotes the holdings of housing, L⬘t are hours of

work (households work for the entrepreneurs),

In the rest of the paper, I develop and esti- and M⬘t /Pt are money balances divided by the

mate a model that is consistent with these facts price level. Denote with qt ⬅ Qt/Pt the real

and that can be used for policy analysis. I start housing price, with w⬘t ⬅ W⬘t /Pt the real wage.

with a basic model, which conveys the intuition. Assume that households lend in real terms ⫺b⬘t

(or borrow b⬘t ⬅ B⬘t /Pt) and receive back

II. The Basic Model ⫺Rt ⫺ 1B⬘t ⫺ 1/Pt, where Rt ⫺ 1 is the nominal in-

terest rate on loans between t ⫺ 1 and t, so that

Consider a discrete time, infinite horizon obligations are set in money terms. Denoting

economy, populated by entrepreneurs and pa- with ⌬ the first difference operator, the flow of

tient households, infinitely lived and of measure funds is

one. The term “patient” captures the assumption

that households have lower discount rates than (1) c⬘t ⫹ q t ⌬h⬘t ⫹ R t ⫺ 1 b⬘t ⫺ 1 / t

firms and distinguishes this group from the im-

patient households of the extended model (in ⫽ b⬘t ⫹ w⬘t L⬘t ⫹ Ft ⫹ T⬘t ⫺ ⌬M⬘t /Pt

Section III). Entrepreneurs produce a homoge-

neous good, hiring household labor and com- where t ⬅ Pt/Pt ⫺ 1 denotes the gross inflation

bining it with collateralizable real estate. rate, Ft are lump-sum profits received from the

Households consume, work, and demand real

estate and money. In addition, there are retailers

and a central bank. Retailers are the source of 6

Javier Diaz-Gimenez et al. (1992) use a similar device

nominal rigidity. The central bank adjusts in an OLG model of the banking and household sector. I do

money supply and transfers to support an inter- not include imputed rents in my model definition of output;

est rate rule. this does not affect the results of the paper in any significant

way. I also assume that housing and consumption are sep-

In order to have effects on economic activity arable: Bernanke (1984) studies the joint behavior of the

from shifts in asset holdings, I allow housing consumption of durable and nondurable goods and finds that

investment by both sectors. I assume that real separability across goods is a good approximation.VOL. 95 NO. 3 IACOVIELLO: HOUSE PRICES, BORROWING CONSTRAINTS, AND MONETARY POLICY 743

retailers (described below), and the last two b t ⱕ mE t 共q t ⫹ 1 h t t ⫹ 1 /R t 兲.

terms are net transfers from the central bank that

are financed by printing money. Solving this To make matters interesting, one wants a

problem yields first-order conditions for con- steady state in which the entrepreneurial return

sumption (2), labor supply (3), and housing to savings is greater than the interest rate, which

demand (4): implies a binding borrowing constraint. At the

冉 冊

same time, one has to ensure that entrepreneurs

1 Rt will not postpone consumption and quickly ac-

(2) ⫽ Et

c⬘t t ⫹ 1 c⬘t ⫹ 1 cumulate wealth so that they are completely

self-financed and the borrowing constraint be-

(3) w⬘t ⫽ 共L⬘t 兲 ⫺ 1c ⬘t comes nonbinding. To deal with this problem, I

assume that entrepreneurs discount the future

(4)

qt j

⫽ ⫹ Et

c⬘t h⬘t

qt ⫹ 1

c⬘t ⫹ 1

.冉 冊 more heavily than households. They maximize

冘 ␥ ln c

⬁

The first-order condition with respect to E0 t

t

M⬘t /Pt yields a standard money demand equa- t⫽0

tion. Since I focus in what follows on interest

rates rules, money supply will always meet where ␥ ⬍ ,7 subject to the technology con-

money demand at the desired equilibrium nom- straint, the borrowing constraint, and the fol-

inal interest rate. As utility is separable in lowing flow of funds:

money balances, the quantity of money has no

implications for the rest of the model, and can (6) Y t /X t ⫹ b t ⫽ c t ⫹ q t ⌬h t

be ignored.

⫹ Rt ⫺ 1 bt ⫺ 1 /t ⫹ w⬘t Lt

B. Entrepreneurs

where Rt ⫺ 1bt ⫺ 1/t in (6) reflects the assump-

Entrepreneurs use a Cobb-Douglas constant tion that debt contracts are set in nominal terms,

returns-to-scale technology that uses real estate so that price changes between t ⫺ 1 and t can

and labor as inputs. They produce an interme- affect the realized real interest rate. I use this

diate good Yt according to assumption on empirical grounds: in low-inflation

countries, almost all debt contracts are set in

(5) Y t ⫽ A共h t ⫺ 1 兲 共L t 兲 1 ⫺ nominal terms.8

7

where A is the technology parameter, h is real Entrepreneurs are not risk neutral. Models of agency

costs and business cycles typically assume risk-neutral en-

estate input, and L is the labor input. Output trepreneurs. Carlstrom and Fuerst (2001) discuss the issue.

cannot be transformed immediately into con- In modeling firms’ behavior in a model of monetary shocks,

sumption ct: following Bernanke et al. (1999), I agency costs, and business cycle, they consider two alter-

assume that retailers purchase the intermediate natives. In one, entrepreneurs are infinitely lived, risk neu-

good from entrepreneurs at the wholesale price tral, and more impatient than households: net worth sharply

responds to shocks, as the elasticity of entrepreneurial sav-

Pwt and transform it into a composite final good, ings to changes in the real rate of interest is infinite. In the

whose price index is Pt. With this notation, Xt ⬅ other, a constant fraction of entrepreneurs dies each period, so

Pt /Pw

t denotes the markup of final over interme- that net worth responds passively and slowly to changes in the

diate goods. real rate: in the aggregate, this is equivalent to a formulation in

which entrepreneurs are extremely risk averse. Log utility can

As in Kiyotaki and Moore (1997), I assume a be considered as shorthand between these two extremes.

limit on the obligations of the entrepreneurs. 8

With risk-averse agents, nobody seems to get any ben-

Suppose that, if borrowers repudiate their debt efit in terms of expected utility from lack of indexation:

obligations, the lenders can repossess the bor- presumably, if contracts were indexed, there would be wel-

rowers’ assets by paying a proportional trans- fare gains. However, surprisingly few loan contracts are

indexed in the United States, where even 30-year govern-

action cost (1 ⫺ m) Et(qt ⫹ 1ht). In this case the ment and corporate bonds are not indexed. In Sections II E

maximum amount Bt that a creditor can borrow and VI A, I discuss how the results of the paper change

is bound by mEt(Qt ⫹ 1ht /Rt). In real terms: when indexed debt is assumed.744 THE AMERICAN ECONOMIC REVIEW JUNE 2005

Define t as the time t shadow value of the In this case, the model would become asymmet-

borrowing constraint. The first-order conditions ric around its stationary state. In bad times,

for an optimum are the consumption Euler entrepreneurs would be constrained; in good

equation, real estate demand, and labor demand: times, they might be unconstrained. In such a

case, a linear approximation around the deter-

(7)

1

ct

⫽ Et 冉 冊

␥Rt

t ⫹ 1 ct ⫹ 1

⫹ t Rt

ministic steady state might give misleading re-

sults. In the paper, I take as given that

uncertainty is “small enough” relative to degree

(8)

1

ct

qt ⫽ Et

␥

冉 冉

ct ⫹ 1

Yt ⫹ 1

Xt ⫹ 1 ht

⫹ qt ⫹ 1 冊 of impatience so as to rule out this possibility.

In Appendix C, I present evidence from nonlin-

ear simulations that backs this assumption.9

⫹ t mt ⫹ 1 qt ⫹ 1 冊 C. Retailers

To motivate sticky prices I assume implicit

(9) w⬘t ⫽ 共1 ⫺ 兲Y t /共X t L t 兲. costs of adjusting nominal prices and, as in

Bernanke et al. (1999), monopolistic competi-

Both the Euler and the housing demand tion at the retail level. A continuum of retailers

equations differ from the usual formulations be- of mass 1, indexed by z, buy intermediate goods

cause of the presence of t, the Lagrange multi- Yt from entrepreneurs at Pw t in a competitive

plier on the borrowing constraint. t equals the market, differentiate the goods at no cost into

increase in lifetime utility that would stem from Yt(z), and sell Yt(z) at the price Pt(z). Final

borrowing Rt dollars, consuming (equation [7]) or goods are Y ft ⫽ (兰10 Yt(z) ⫺ 1/ dz)/ ⫺ 1 where

investing (equation [8]) the proceeds, and reduc- ⬎ 1. Given this aggregate output index,10 the

ing consumption by an appropriate amount the price index is Pt ⫽ (兰10 Pt(z)1 ⫺ dz)1/1 ⫺ , so that

following period. each retailer faces an individual demand curve

Without uncertainty, the assumption ␥ ⬍  of Yt(z) ⫽ (Pt(z)/Pt)⫺Y ft.

guarantees that entrepreneurs are constrained in Each retailer chooses a sale price Pt(z) taking

and around the steady state. In fact, the steady- Pwt and the demand curve as given. The sale

state consumption Euler equation for the house- price can be changed in every period only with

hold implies, with zero inflation, that R ⫽ 1/, probability 1 ⫺ . Denote with P*t(z) the “reset”

the household time preference rate. Combining price and with Y*t ⫹ k(z) ⫽ (P*t(z)/Pt ⫹ k)⫺Yt ⫹ k

this result with the steady-state entrepreneurial the corresponding demand. The optimal P*t(z)

Euler equation for consumption yields: ⫽ solves:

( ⫺ ␥)/c ⬎ 0. Therefore, the borrowing con-

straint will hold with equality: (11)

冘 E 再 ⌳ 冉 PP*共z兲 ⫺ XX 冊 Y* 共z兲冎 ⫽ 0

(10) b t ⫽ mE t 共q t ⫹ 1 h t t ⫹ 1 /R t 兲. ⬁

k t

t t,k t⫹k

Matters are of course thornier when there is t⫹k t⫹k

k⫽0

uncertainty. The concavity of the objective

function implies in fact that, in some states of

the world, entrepreneurs might “self-insure” by 9

The Appendix is available on the AER Web site (http://

borrowing less than their credit limit so as to www.aeaweb.org/aer/contents). Specifically, I construct a

buffer their consumption against adverse partial equilibrium model of consumption and housing

choice which features an amount of volatility and a borrow-

shocks. That is, there is some target level of ing limit similar to that assumed here. I show that the

their net worth such that, if their actual net conditions under which precautionary saving arises are very

worth falls short of that target, the precautionary restrictive if the volatility is parameterized to reflect the

saving motive might outweigh impatience, and amount observed in macroeconomic aggregates.

10

entrepreneurs will try to restore some assets, The CES aggregate production function makes exact

aggregation difficult. However, a linear aggregator of the

borrowing less than the limit. Specifically, en- form Y ft ⫽ 兰10 Yt(z) dz equals Yt within a local region of the

trepreneurs might not hit the borrowing limit steady state. In what follows, I will consider total output

after a sufficiently long run of positive shocks. as Yt.VOL. 95 NO. 3 IACOVIELLO: HOUSE PRICES, BORROWING CONSTRAINTS, AND MONETARY POLICY 745

where ⌳t,k ⫽ k(c⬘t /c⬘t ⫹ k) is the patient household forever. The equilibrium is an allocation {ht, h⬘t,

relevant discount factor and Xt is the markup, Lt, L⬘t, Yt, ct, c⬘t, bt, b⬘t}⬁

t⫽0 together with the

which in steady state equals X ⫽ /( ⫺ 1). This sequence of values {w⬘t, Rt, Pt, P*t, Xt, t, qt}⬁

t⫽0

condition states that P*t equates expected dis- satisfying equations (2) to (13) and the market

counted marginal revenue to expected dis- clearing conditions for labor (Lt ⫽ L⬘t), real

counted marginal cost. Profits Ft ⫽ (1 ⫺ 1/Xt)Yt estate (ht ⫹ h⬘t ⫽ H), goods (ct ⫹ c⬘t ⫽ Yt), and

are finally rebated to patient households. loans (bt ⫹ b⬘t ⫽ 0), given {ht ⫺ 1, Rt ⫺ 1, bt ⫺ 1,

As a fraction of prices stays unchanged, the Pt ⫺ 1} and the sequence of monetary shocks

aggregate price level evolution is {eR,t}, together with the relevant transversality

conditions.

(12) P t ⫽ 共 P t1−ε

⫺ 1 ⫹ 共1 ⫺ 兲共P *

t兲

1 ⫺ 1/共1 ⫺ 兲

兲 . Appendix A describes the steady state. Let

hatted variables denote percent changes from

Combining (11) and (12) and linearizing the steady state, and those without subscript

yields a forward-looking Phillips curve, which denote steady-state values. The model can be

states that inflation depends positively on ex- reduced to the following linearized system

pected inflation and negatively on the markup Xt (which I solve numerically using the methods

of final over intermediate goods. described by Harald Uhlig, 1999):

D. Central Bank Policy and the Interest Rate (L1) Ŷ t ⫽ 共c/Y兲ĉ t ⫹ 共c⬘/Y兲ĉ⬘t

Rule

(L2) ĉ⬘t ⫽ E t ĉ⬘t ⫹ 1 ⫺ rr

ˆt

The central bank makes lump sum transfers

of money to the real sector to implement a (L3) cĉ t ⫽ bb̂ t ⫹ Rb共 ˆ t ⫺ R̂ t ⫺ 1 ⫺ b̂ t ⫺ 1 兲

Taylor-type interest rate rule. The rule takes the

form

⫹ 共Y/X兲共Ŷt ⫺ X̂t 兲 ⫺ qh⌬ĥt

1 ⫹ r 1 ⫺ rR

(13) R t ⫽ 共R t ⫺ 1 兲 共

rR

t⫺1 共Y t ⫺ 1 /Y兲 rr兲

rY

e R,t

(L4) q̂ t ⫽ ␥ e E t q̂ t ⫹ 1 ⫹ 共1 ⫺ ␥ e 兲E t

where rr and Y are steady-state real rate and

output, respectively. Here, monetary policy re- ⫻ 共Ŷt ⫹ 1 ⫺ ĥt ⫺ X̂t ⫹ 1 兲

sponds systematically to past inflation and past

output.11 If rR ⬎ 0, the rule allows for interest ⫺ mrr

ˆt ⫺ 共1 ⫺ m兲Et⌬ĉt ⫹ 1

rate inertia. eR,t is a white noise shock process

with zero mean and variance 2e . (L5) q̂ t ⫽  E t q̂ t ⫹ 1 ⫹ ĥ t ⫹ ĉ⬘t ⫺  E t ĉ⬘t ⫹ 1

E. Equilibrium (L6) b̂ t ⫽ E t q̂ t ⫹ 1 ⫹ ĥ t ⫺ rr

ˆt

Absent shocks, the model has a unique sta-

tionary equilibrium in which entrepreneurs hit (L7) Ŷ t ⫽ ĥ

the borrowing constraint and borrow up to the ⫺ 共1 ⫺ 兲 t ⫺ 1

limit, making the interest payments on the debt

and rolling the steady-state stock of debt over 1⫺

⫺ 共X̂ ⫹ ĉ⬘t 兲

⫺ 共1 ⫺ 兲 t

ˆ t ⫽  E t ˆ t ⫹ 1 ⫺ X̂ t

11

A backward-looking Taylor rule has the advantage of (L8)

isolating in a neat way the exogenous component of mon-

etary policy from its endogenous counterpart. As will be

shown later, given that the interest rate is assumed to re- (L9) R̂ t ⫽ 共1 ⫺ r R 兲共共1 ⫹ r 兲 ˆ t ⫺ 1 ⫹ r Y Ŷ t ⫺ 1 兲

spond only with one lag to all other variables, it offers some

convenient zero restrictions when taking the model to the ⫹ rRR̂t ⫺ 1 ⫹ êR,t

data. Fuhrer (1997) shows that the data offer more support

for a backward rule than for a forward rule. Bennett Mc-

Callum (1999) has emphasized a related point, since output where ⬅ (1 ⫺ )h/h⬘, ⬅ (1 ⫺ )(1 ⫺  )/,

and inflation data are reported with a lag and therefore

cannot be known to the policymaker in the current quarter. ␥e ⬅ m ⫹ (1 ⫺ m)␥, and rrˆt ⬅ R̂t ⫺ Etˆ t ⫹ 1 is746 THE AMERICAN ECONOMIC REVIEW JUNE 2005

the ex ante real rate. (L1) is total output. (L2) is plays a role, too: as obligations are not indexed,

the Euler equation for household consumption. deflation raises the cost of debt service, further

(L3) is the entrepreneurial flow of funds. (L4) depressing entrepreneurial consumption and

and (L5) express the consumption/housing mar- investment.

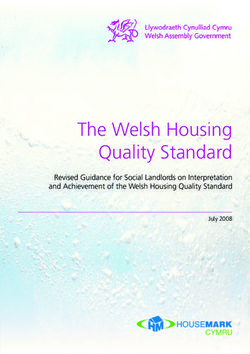

gin for entrepreneurs and households, respec- How big are these effects? Figure 2 provides

tively. (L6) is the borrowing constraint. The a stylized answer for three economies subject to

supply side includes the production function the same shock, showing the total loss in output

(L7) (combined with labor market clearing) and following a one-standard deviation increase

the Phillips curve (L8). Finally, (L9) is the (0.29 percent on a quarterly basis) of the interest

monetary policy rule. rate.12 The solid line illustrates the case when

both collateral and debt deflation effects are

F. The Transmission Mechanism: Indexation shut off, so that only the interest rate channel

and Collateral Effects works (see Appendix B for the technical de-

tails): output falls by 3.33 percent. Here, the

The basic model shows the key links between output drop is mainly driven from intertemporal

the interest rate channel, the house price chan- substitution in consumption. The dashed line

nel, and the debt deflation channel. I now focus plots the response of output when the collateral

on one standard deviation (as estimated in the channel becomes operational: the decline in

VAR) negative monetary shock; in the full output is larger, and the total decline is 3.82

model, I will look at other disturbances, too, and percent. Finally, in the starred line, both collat-

will estimate some of the structural parameters eral and debt deflation channels are at work:

of the model. The parameters chosen here re- output falls by 4.42 percent.13

flect the estimates and the calibration of the full

model. III. The Full Model: Household and

The time period is one quarter. The entrepre- Entrepreneurial Debt

neurial “loan-to-value” ratio m is set to 0.89.

The probability of not changing prices is set to The basic model assumes that all mortgaged

0.75. The discount factors are  ⫽ 0.99 and ␥ ⫽ real estate is used by firms. In reality, financial

0.98. I set the elasticity of output to real estate frictions apply to both firms and households.

to 0.03. (With j ⫽ 0.1, this yields a steady The previous section models entrepreneurial

state value of h, the entrepreneurial asset share, consumption, but lacks the descriptive realism

of 20 percent.) The household labor supply emphasized, for example, in the quote from

schedule is assumed to be virtually flat: ⫽ Tobin at the beginning of the paper. In addition,

1.01. investment occurs in the form of real estate

For the Taylor rule, I set rY ⫽ 0, r ⫽ 0.27, transfers between agents, but net investment is

rR ⫽ 0.73. These are the parameters of an zero. Before taking the model to the data, I

estimated policy rule for the VAR period, with extend it along two dimensions. On the one

the exception of rY, which is reset to zero. hand, I add a constrained, impatient household

Imposing rY ⫽ 0 amplifies the financial accel- sector, that ends up facing a binding borrowing

erator since the central bank does not intervene constraint in equilibrium. On the other, I allow

when output falls. However, it allows isolating variable capital investment for the entrepre-

the exogenous component of the reaction func- neurs. This allows a more realistic analysis of

tion from its endogenous component, while en- the impact of a various range of disturbances: in

suring determinacy of the rational expectations

equilibrium.

The transmission mechanism is simple: con- 12

The figure shows the cumulative drop in output after

sider a negative monetary shock. With sticky 40 quarters. This is approximately the horizon at which

prices, monetary actions affect the real rate, and output has returned to the baseline, so that the cumulative

its increase works by discouraging current con- impulse responses level off.

13

sumption and hence output. The effect is rein- It would be tempting to rank the two effects. There is

no way of doing so, however. For instance, depending on

forced through the fall in housing prices, which how aggressive the central bank is on inflation, the debt

leads to lower borrowing and lower entrepre- deflation effect can be larger or smaller than the collateral

neurial housing investment. Debt deflation effect.VOL. 95 NO. 3 IACOVIELLO: HOUSE PRICES, BORROWING CONSTRAINTS, AND MONETARY POLICY 747

FIGURE 2. TOTAL OUTPUT LOSS IN RESPONSE TO A MONETARY SHOCK IN THE BASIC MODEL:

COMPARISON BETWEEN ALTERNATIVE MODELS

Notes: Ordinate: time horizon in quarters. Coordinate: percent deviation from initial steady

state.

particular, I add inflation, technology, and taste symmetric for each agent: such a cost might

shocks. As before, a central bank and retailers proxy for transaction costs, conversion costs of

complete the model. residential housing into commercial housing

The problems of patient households, retailers, and vice versa, and so on. The remainder of the

and the central bank are unchanged. I consider problem is unchanged: entrepreneurs maximize

therefore the slightly modified entrepreneurial E0 ¥⬁ t⫽0 ␥ log ct, where ␥ ⬍ , subject to

t

problem and then move to impatient households. technology (14) and borrowing constraint (10),

as well as the flow of funds constraint:

A. Entrepreneurs

(15) Y t /X t ⫹ b t ⫽ c t ⫹ q t ⌬h t ⫹ R t ⫺ 1 b t ⫺ 1 / t

Entrepreneurs produce the intermediate good

⫹ w⬘t L⬘t ⫹ w⬙t L⬙t ⫹ It

according to:

⫹ e,t ⫹ K,t .

(14) Yt ⫽ A t K t⫺ 1 h t⫺ 1 L⬘t ␣ 共1 ⫺ ⫺ 兲 L ⬙t 共1 ⫺ ␣ 兲共1 ⫺ ⫺ 兲

where At is random. L⬘ and L⬙ are the patient The first-order conditions for this problem

and impatient household labor (␣ measures the are fairly standard and are reported in Appen-

relative size of each group) and K is capital (that dix A.

depreciates at rate ␦) created at the end of each

period. For both housing and variable capital, I B. Impatient Households

consider the possibility of adjustment costs:

capital installation entails a cost K,t ⫽ (It / Impatient households discount the future

Kt ⫺ 1 ⫺ ␦)2Kt ⫺ 1/(2␦), where It ⫽ Kt ⫺ (1 ⫺ more heavily than the patient ones. They choose

␦) Kt ⫺ 1. For housing, changing the stock entails consumption c⬙t, housing h⬙t, labor L⬙t (and

a cost e,t ⫽ e(⌬ht /ht ⫺ 1)2qtht ⫺ 1/2, which is money M⬙t/Pt) to maximize748 THE AMERICAN ECONOMIC REVIEW JUNE 2005

moving to the estimation strategy, I present two

冘 共⬙兲 共ln c⬙⫹ j ln h⬙⫺ 共L⬙兲 /

⬁

E0 t direct implications of the main model features

t t t t

t⫽0

which can replicate key dynamic correlations in

the data: the collateral effect allows pinning

⫹ ln M⬙t /Pt ) down the elasticity of consumption to a housing

preference shock; the nominal debt effect allows

where ⬙ ⬍ . Like for entrepreneurs, this guar- matching the delayed response of output to an

antees an equilibrium in which impatient house- inflation shock.

holds will hit the borrowing constraint. Here,

the subscript under jt allows for random distur- D. Collateral Effects and Effects on

bances to the marginal utility of housing, and, Consumption of a Housing Price Shock

given that it directly affects housing demand,

offers a parsimonious way to assess the macro Several commentators have expressed the

effects of an exogenous disturbance on house consideration that rising house prices have kept

prices.14 The flow of funds and the borrowing consumption growth high throughout the 1990s.

limit are Case et al. (2001) find long-run elasticities of

consumption to housing prices of around 0.06

(16) c ⬙t ⫹ q t ⌬h ⬙t ⫹ R t ⫺ 1 b ⬙t ⫺ 1 / t for a panel of U.S. states. Morris Davis and

Michael Palumbo (2001) estimate a long-run

⫽ b⬙t ⫹ w⬙t L⬙t ⫹ T⬙t ⫺ ⌬M⬙t /Pt ⫺ h,t elasticity of consumption to housing wealth of

0.08. These positive elasticities are hard to rec-

(17) b ⬙t ⱕ m⬙E t 共q t ⫹ 1 h ⬙t t ⫹ 1 /R t 兲 oncile with the traditional life-cycle model.

Think about the simplest case, an exogenous

where h,t ⫽ h(⌬h⬙t/h⬙t ⫺ 1)2qth⬙t ⫺ 1/2 denotes the increase in housing prices. If the gains were

housing adjustment cost (an analogous term equally distributed across the entire population,

also appears in the budget constraint of the if all agents had the same propensity to con-

patient households). The borrowing constraint sume, and if all agents were to spend these gains

is consistent with standard lending criteria used on housing, total wealth less housing wealth

in the mortgage market, which limit the amount would remain unchanged, and so would the

lent to a fraction of the value of the asset. One demand for non-housing consumption. However,

can interpret the case m⬙ ⫽ 0 as the limit situ- if liquidity-constrained households value current

ation when housing is not collateralizable at all, consumption a great deal, they may be able to

so that households are excluded from financial increase their borrowing and consumption more

markets. than proportionally when housing prices rise, so

Like for the entrepreneurs, the equations for that increases in prices might have positive ef-

consumption and housing choice (shown in Ap- fects on aggregate demand.

pendix A) hold with the addition of the multi- The mechanism described above is at work

plier associated with the borrowing restriction.15 in the paper, and it is straightforward in dem-

onstrating its ability to produce an empiri-

C. The Linearized Model cally plausible response of consumption to

housing price shocks. Figure 3 displays the

The equations describing the steady-state and impulse response of consumption to a persis-

the linearized model are isomorphic to those of tent housing price increase, generated from a

the basic model and are in Appendix A. Before shock to the marginal rate of substitution j

between housing and consumption for all

households. Such an experiment offers a par-

14

I assume that the disturbance to jt is common to both simonious way to model any kind of distur-

impatient and patient households. This way, variations in jt bance that shifts housing demand, such as

can also proxy for exogenous variations in, say, the tax code temporary tax advantages to housing invest-

that shift housing demand for all households. ment or a sudden increase in demand fuelled

15

The money demand condition is redundant under in-

terest rate control, so long as the central bank respects, for by optimistic consumer expectations. The pa-

each group, the equality between money injections and rameters are those calibrated and estimated

transfers. using the method described in Section IV,VOL. 95 NO. 3 IACOVIELLO: HOUSE PRICES, BORROWING CONSTRAINTS, AND MONETARY POLICY 749

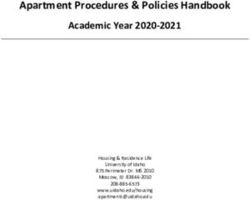

FIGURE 3. RESPONSE OF AGGREGATE CONSUMPTION TO A HOUSING PRICE SHOCK: VARIOUS

VALUES OF m AND m⬙

Notes: Ordinate: time horizon in quarters. Coordinate: percent deviation from initial steady

state.

except that here I compute responses for sev- loan-to-value ratios of 89 percent for entre-

eral values of the loan-to-values m and m⬙, preneurial loans and 55 percent for residential

and compare them with the impulse response loans, can generate responses of consumption

from a housing price shock in a VAR. (and income, as will be shown below) to a

The VAR is estimated from 1974Q1 to housing price shock that are not only qualita-

2003Q2 on quarterly data for the federal tively but also quantitatively in line with the

funds rate, log real housing prices, log real VAR estimates. In particular, the impact elas-

personal consumption expenditures, log real ticity of consumption to a persistent 1-percent

GDP, and log change in the GDP deflator, in increase in housing prices is around 0.2. This

that order.16 The figure illustrates an impor- is slightly larger than reduced-form estimates

tant point: the greater the importance of col- found in the studies above; however, both in

lateral effects (higher m and m⬙), the closer the model and in the VAR, consumption falls

the simulated elasticity of consumption to a below the baseline during the transition,

housing price shock. A wage share of the hence the medium-run elasticities are some-

constrained sector (1 ⫺ ␣) of 36 percent, and what smaller. Instead, the model without collat-

eral effects (m, m⬙ 3 0) predicts a negative

response of consumption to housing prices—

16

Consistent with the theoretical model, I allow for all

mainly driven by a substitution effect between

the variables (except the interest rate) to respond contem- housing and consumption—which is clearly at

poraneously to a housing price shock. The results were, odds with the data.

however, robust to alternative orderings. The lags and the While I will conduct more formal estima-

set of exogenous variables are the same as in the VAR of

Section I. Consumption, GDP, and house prices were de-

tion and testing below, this pictures highlights

trended with a band-pass filter-removing frequencies above the reason behind the success of the model in

32 quarters. tracking down the empirical positive elastic-750 THE AMERICAN ECONOMIC REVIEW JUNE 2005

FIGURE 4. RESPONSE OF OUTPUT TO AN INFLATION SHOCK: NOMINAL VERSUS INDEXED DEBT

Notes: Ordinate: time horizon in quarters. Coordinate: percent deviation from initial steady state.

ity of spending to housing prices. To better changes in q t can be rather large, and is

understand the result, it is useful to reinterpret strongly increasing with m, the loan-to-value

the borrowers’ asset demand as determining ratio. Instead, as shown by equation (L5), for

consumption given asset prices and payoffs, lenders the effects of q t on c t are simply

rather than determining today’s asset prices one-for-one, and therefore much smaller in

in terms of consumption and payoffs. For magnitude.

entrepreneurs, for instance, the linearized op-

timality condition between housing and E. Debt Deflation and the Stabilizing Effects

consumption can be written (neglecting ad- of an Inflation Shock

justment costs) as

Starting from the steady state, I assume a

1 1-percent, persistent inflation surprise.17 It

(18) ĉ t ⫽ E t ĉ t ⫹ 1 ⫹ is informative to contrast the response of

1 ⫺ m

output with nominal debt to the model with in-

⫻ 共q̂t ⫺ ␥e Etq̂t ⫹ 1 ⫺ 共1 ⫺ ␥e 兲EtŜt ⫹ 1 兲 dexed debt. Figure 4 displays the results of the

simulation.

m With nominal debt (the solid line), the rise in

⫹ ˆ

rr prices reduces the desired supply of goods at a

1 ⫺ m t

where ␥ e ⬅ m  ⫹ (1 ⫺ m) ␥ and E t Ŝ t ⫹ 1 is

17

the expected marginal product of housing. The inflation shock shows up as a residual in

This equation clearly shows how, keeping the Phillips curve. It could be justified by assuming

that the elasticity of demand for each intermediate

constant expected consumption, expected re- good is time-varying, and varies exogenously, as

turns on housing, and real interest rates, the done, for instance, by Frank Smets and Rafael Wouters

multiplier effect on consumption of given (2003).VOL. 95 NO. 3 IACOVIELLO: HOUSE PRICES, BORROWING CONSTRAINTS, AND MONETARY POLICY 751

given price level; at the same time, it transfers Next, I set ␥ and ⬙. I match the reciprocal of

wealth from the lenders toward the borrowers, ␥, which proxies for the firm’s internal rate of

who, ceteris paribus, have a higher propensity return. I assume this is twice as big as the

to consume. Initially, the two effects go in op- equilibrium real rate, and set ␥ ⫽ 0.98. I then

posite directions, and output falls by a small pick a value for ⬙: Emily Lawrance (1991)

amount. Later, the first effect dominates, and estimates discount factors for poor households

the output drop is larger: overall, output dis- (which are more likely to be debtors) between

plays a hump-shaped pattern and a slow return 0.95 and 0.98 at quarterly frequency, depending

to its initial steady state. on the specification. Carroll and Andrew Sam-

This contrasts with the responses that would wick (1997) calculate an empirical distribution

occur in a model without debt deflation effects of discount factors for all agents using informa-

(the dashed line): with indexed debt, the drop in tion on the elasticity of assets with respect to

output is immediate and stronger in magnitude, uncertainty: the two standard deviation bands

because the beneficial effects of inflation are range in the interval (0.91, 0.99). Samwick

absent. Hence, the assumption of nominal debt (1998) uses wealth holdings at different ages to

helps capture not only qualitatively but also infer the underlying distribution of discount fac-

quantitatively the hump-shaped and persistent tors: for about 70 percent of the households, he

response of output to inflation found in the VAR. finds mean discount factors of about 0.99; for

Interestingly, the negative correlation be- about 25 percent of households, he estimates

tween inflation and output induced by an infla- discount factors below 0.95. With  set at 0.99,

tion shock acts as a built-in stabilizer for the I choose ⬙ ⫽ 0.95, in the ballpark of these

economy. Debt deflation thus adds a new twist estimates.

to the theories of financial accelerator men- I set , the elasticity of output to entrepre-

tioned in the introduction: while it amplifies neurial real estate, to 0.03. This number implies

demand-type disturbances, it can stabilize those a plausible 62 percent for the steady-state value

that generate a trade-off between output and of commercial real estate over annual output.

inflation. I will return to this issue in Section VI. The parameter j mainly controls the stock of

residential housing over annual output (see Ap-

IV. Econometric Methodology pendix A): j ⫽ 0.1 fixes this ratio at 140 percent,

in line with data from the Flow of Funds ac-

I now discuss the methodology for evaluating counts (see, e.g., Table B.100, row 4).

the model. I partition the model parameters in I then pick values for the adjustment cost

three groups. parameters. Preliminary attempts to estimate

these parameters (using the methods described

A. Calibration in Section IV C) led to estimates of the capital

adjustment cost around 2 and pushed the

The first group includes the discount factors: housing adjustment cost parameters e and h

, ⬙, ␥; the housing weight j; the technology toward zero. These results suggest that the data

parameters , , ␦, , e, h; the markup X; the appear to favor a version of the model in which

labor disutility ; and the degree of price rigid- variable capital moves more slowly than hous-

ity . I calibrate these parameters on the basis of ing in response to disturbances. Although this

the data sample means and other studies be- finding is not in contradiction to the cyclical

cause they contain relatively more information properties of the actual data,19 it is likely that

on the first moments of the data.

For the standard parameters, I choose values

that are within the range considered in the mon- studies would suggest, but has the virtue of rationalizing the

etary/real business cycle literature. Thus, , ␦, weak observed response of real wages to macroeconomic

, X, , and equal 0.99, 0.03, 0.3, 1.05, 0.75, disturbances. With approaching 1, the utility function

and 1.01, respectively.18 becomes linear in leisure, as proposed and explained in

Gary Hansen (1985).

19

For the period 1974Q1–2003Q2, the standard devia-

tion of (a) structures investment, (b) residential investment,

18

A value of ⫽ 1.01 implies a virtually flat labor (c) equipment and software investment, and (d) change in

supply curve: this is higher than what microeconometric inventories are, respectively, 0.8, 0.5, 0.58, and 0.94 per-752 THE AMERICAN ECONOMIC REVIEW JUNE 2005

the solution algorithm has difficulty in estimat- TABLE 1—CALIBRATED PARAMETERS IN THE EXTENDED

ing these parameters without data on the types MODEL

of investment spending. At the same time, one Description Parameter Value

has to consider that, ceteris paribus, the fixity of

the housing stock in the aggregate works by Preferences: Discount factors

itself as an adjustment cost on housing invest- Patient households  0.99

ment: given that the total supply of structures is Entrepreneurs ␥ 0.98

fixed, additional housing investment in any Impatient households ⬙ 0.95

given period drives up the price of the existing Other preference parameters

stock, so that, from each agent’s point of view,

Weight on housing services j 0.1

every unit of new investment is more costly at Labor supply aversion 1.01

the margin. In what follows, therefore, I esti-

mate the model by calibrating ⫽ 2 and e ⫽ Technology: Factors productivity

h ⫽ 0.20 The former implies an elasticity of 1⁄2 Variable capital share 0.3

of investment to the capital shadow price, fol- Housing share 0.03

lowing Robert King and Alex Wolman (1996):

Other technology parameters

this value is well within the range of estimates

reported in the literature (see Robert Chirinko, Variable capital adjustment cost 2

1993). Table 1 summarizes the parameters. Variable capital depreciation rate ␦ 0.03

Housing adjustment cost 0

B. Policy Rule Sticky prices

Steady-state gross markup X 1.05

The second group includes the parameters Probability fixed price 0.75

that can be recovered from the estimates of the

Taylor rule. For the period 1974Q1–2003Q2, an

OLS regression of the Fed Funds rate on its own eters by minimizing a measure of the distance

lag, past inflation, and detrended output yields between the empirical impulse responses (Sec-

rR ⫽ 0.73, rY ⫽ 0.13, r ⫽ 0.27.21 tion I) and the model responses, which were

obtained from the reduced form of the model by

C. Estimation ordering and orthogonalizing the shocks as in

the VAR.

The third group includes the autocorrelation As is well known (see, e.g., Ireland, 2004a),

and the standard deviation of each shock (A, j , the number of data series in the VAR represen-

u, A, j , u), the loan-to-value ratios (m, m⬙), tation cannot exceed the number of structural

and the wage income share of the patient house- disturbances in the model. With four distur-

holds, measured by ␣. I estimate these param- bances (monetary, inflation, taste, productivity),

I select (R, , q, Y) as the variables of interest.

Denote with ⌿() the vector collecting the

cent. (All variables were normalized by GDP. The data were model orthogonalized impulse responses, ob-

then filtered using a band-pass filter that removed the low- tained from the reduced form of the model by

frequency component above 32 quarters.)

20

The results with e, h ⬎ 0 are qualitatively as fol-

ordering and orthogonalizing the impulse re-

lows: housing adjustment costs reduce the fluctuations in sponses as in the VAR. Let ⌿̂ be the n ⫻ 1

the housing stock variables but generate slightly larger vector of empirical estimates of the VAR im-

changes in housing prices and output, which the data appear pulse responses.22 I include the first 20 elements

to reject. Closer inspection of the impulse responses shows of each impulse response function, excluding

that, when facing costs of adjusting both k and h, entrepre-

neurs vary labor input more strongly in response to distur- those that are zero by the recursiveness assump-

bances, which in turn affects output.

21

The standard deviation of the monetary shock e is

taken from the standard error of the interest rate equation in

the VAR below, which equals 0.29. In principle, one could 22

n ⫽ n21 ⫻ n2 ⫺ n3, where n1 is the number of variables

also obtain all the parameters of a more involved policy rule in the VAR, n2 are the elements to match for each impulse

from the VAR. I use a shift dummy from 1979Q4 to capture response, and n3 are the elements of ⌿ which are zero by

monetary policy changes that are known to have occurred assumption (because of the zeros imposed by the Choleski

around that time. ordering).VOL. 95 NO. 3 IACOVIELLO: HOUSE PRICES, BORROWING CONSTRAINTS, AND MONETARY POLICY 753

TABLE 2—ESTIMATED PARAMETERS AND THEIR STANDARD their wage share (1 ⫺ ␣) is around 36 percent

ERRORS IN THE EXTENDED MODEL and is precisely estimated:24 interestingly, this

Description Parameter Value s.e.

number is within the range of the various stud-

ies that, since Campbell and Mankiw (1989),

Factor shares and loan-to-values have estimated from consumption Euler equa-

Patient households wage share ␣ 0.64 0.03 tions the fraction of rule-of-thumb/constrained

Loan-to-value entrepreneur m 0.89 0.02 agents in an economy. At the same time, they

Loan-to-value household m⬙ 0.55 0.09

support strong effects on demand from changes

Autocorrelation of shocks in asset values, as shown by the high values of

m and m⬙. The former is 89 percent, whereas the

Inflation u 0.59 0.06

Housing preference j 0.85 0.02 latter is 55 percent. Hence, the estimates suggest

Technology A 0.03 0.10 that entrepreneurial real estate is more easily

collateralizable than household real estate. A

Standard deviation of shocks joint test of the hypothesis that collateral con-

Inflation u 0.17 0.03 straints are unimportant—that the m and m⬙ are

Housing preference j 24.89 3.34 equal to zero—is overwhelmingly rejected.

Technology A 2.24 0.24

High values of m and m⬙ are in fact needed to

generate strong and persistent effects on aggre-

gate demand from given changes in asset val-

tion. The estimate of , a vector of parameters, ues, something that a model without these

solves effects cannot replicate.

Finally, the estimate of the autocorrelation in

(19) min共⌿共兲 ⫺ ⌿̂兲⬘⌽共⌿共兲 ⫺ ⌿̂兲 the technology shock is low (A ⫽ 0.03) and

less precisely estimated: one explanation might

be the detrending method used in the VAR,

where ⌽ is a n ⫻ n weighting matrix. Under the which takes away the low-frequency compo-

null hypothesis that the VAR model is true and nent of GDP. Instead, the autocorrelations in the

that the model fits the data, the optimal weight- preference and in the inflation shock are pre-

ing matrix ⌽ would equal ⌽ ⫽ ⌼⫺1, the inverse cisely estimated and highlight moderate persis-

of the matrix with the sample variances of the tence in the shock processes (j ⫽ 0.85, u ⫽

VAR impulse responses on the main diagonal. 0.59). Interestingly, such autocorrelations are

Given that the cross-correlations between q and lower than what is found in estimates of stan-

Y are likely to be relatively more informative for dard monetary business cycle models: one pos-

m, m⬙, and ␣, I specify ⌽ ⫽ ⍀⌼⫺1, where ⍀ is sibility is that the endogenous propagation

a n ⫻ n diagonal matrix of weights that gives a mechanisms that are at work in the model re-

weight four times larger to all the dynamic quire less persistent shocks to fit the second

cross-correlations involving q and Y. This way, moment properties of the data.

I still get consistent (yet inefficient) estimates of While the estimates of ␣, m, and m⬙ are all

all the parameters, but at the same time I fit the statistically significant,25 I reject the null

moments of highest interest.23 The results were,

however, robust to the choice of ⍀.

Table 2 summarizes the estimates of the pa- 24

Standard errors were computed using the asymptotic

rameters in . The results strongly support the delta function method applied to the first-order condition

presence of borrowing-constrained households: associated with the minimization problem.

25

These findings are robust to changes in the estimation

horizon and in the weighting matrix. As a robustness check,

I included the discount factors among the parameters to

23

As suggested by a referee, housing collateral is inter- estimate. The resulting values for ⬙ and ␥ were, respec-

esting because of the potential spillovers to other consump- tively, around 0.4 and 0.9; the other parameter estimates

tion goods as housing price increases relax borrowing were unchanged, with the exception of m⬙, whose estimate

constraints. By focusing on the parameters that best match was marginally positive. Loosely speaking, a reduction in

the dynamic cross-correlation between house prices and the discount factor works to strengthen the preference for

output (and therefore consumption), the estimation proce- current consumption, thus working in the same direction as

dure selects these particular moments as most informative at an increase in the loan-to-value when it comes to explaining

the margin for the values of m, m⬙, and ␣. the high sensitivity of demand to aggregate shocks. How-754 THE AMERICAN ECONOMIC REVIEW JUNE 2005

FIGURE 5. RESPONSES TO ALL SHOCKS, MODEL VERSUS VAR

Note: Coordinate, percent deviation from steady state. Solid lines: estimated model. Dotted lines: VAR model with 90-percent

bands.

hypothesis of equality between the model and V. More on the Model Dynamics

the data. Perhaps the simplest explanation for

this finding is that the model lacks such features Figure 5 shows the model impulse responses

as expectational delays, inertial adjustment of and compares them with the VAR impulse re-

prices, or habit persistence, which elsewhere sponses. This way, I can assess the key proper-

authors have shown can help replicate the de- ties of the model and its consistency with

layed responses of macroeconomic variables to empirical evidence.26

various shocks (see, e.g., Julio Rotemberg and The top row shows a monetary tightening.

Michael Woodford, 1997; Galı́ and Gertler,

1999; Fuhrer, 2000).

26

One caveat: the impulse responses from the VAR and

those from the structural model are not strictly comparable,

since the restrictions implied by the two representations are,

ever, although empirical estimates of the discount factor are in general, different. See Fuhrer (2000) for a discussion: an

surrounded by large uncertainty, values below 0.9 appear alternative could be to compare the autocorrelation func-

too low to be considered reasonable (see Carroll and Sam- tions implied by the various models. The results using this

wick, 1997). representation were qualitatively similar.VOL. 95 NO. 3 IACOVIELLO: HOUSE PRICES, BORROWING CONSTRAINTS, AND MONETARY POLICY 755

The drop in output is immediate in the model, transmission mechanism: rather, it is the general

while it is delayed in the data, although the total equilibrium effects working through the de-

output sacrifice is in line with the VAR esti- mand for all factors of production that affect the

mate. As in the basic model, money shocks have aggregate outcomes.28

heterogeneous effects: debtors bear most of the

brunt of the monetary contraction, while con- VI. Systematic Monetary Policy and Policy

sumption of lenders is mildly affected and can Frontiers

be shown to rise above the baseline in the tran-

sition to the steady state. In turn, the real rate, Shocks that generate a negative correlation be-

which prices lenders’ behavior, falls below the tween output and inflation force the central bank

baseline in the transition. Real housing prices to face a trade-off between the variability of out-

initially fall below the baseline, deepening the put and that of inflation. A natural question is:

recession, and then overshoot above the base- how do different monetary policy rules and con-

line, preceding the economy’s recovery. tractual arrangements affect the cyclical properties

The previous section has already shown how of output and inflation? This section gives an

nominal debt is successful in capturing the slug- answer, based on the assumption that output and

gish response of output to an inflation shock. inflation volatility are the only two goals of mon-

The second row of Figure 5 shows that the model etary policy. I consider whether interest rates

does very well at capturing the positive response should respond to housing prices; and how differ-

of the interest rate and the negative response of ent financing arrangements (nominal versus in-

housing prices to an inflation surprise. dexed debt) affect the volatility of the economy.

For the preference shock, the third row of

Figure 5 shows that the model does well in A. Should Central Banks Respond to Housing

capturing the positive elasticities of demand and Prices?

inflation to a housing price shock. Figure 3 has

already shown how a model without collateral I compute the inflation-output volatility fron-

effects predicts a small, even negative, response tiers for alternative parameterizations of the in-

of aggregate demand to a housing price shock.27 terest rate rule, as in Andrew Levin et al.

The last row of Figure 5 shows the responses (1999), subject to a constraint on interest rate

to a transitory productivity rise. Here it is harder volatility.29 The class of rules I consider is

to compare the responses of the model with the

data, especially because it is harder to consider (20) R̂ t ⫽ 0.73R̂ t ⫺ 1

the VAR disturbance as a pure productivity

shock: for instance, a government spending ⫹ 0.27共rqq̂t ⫹ 共1 ⫹ r 兲ˆ t ⫺ 1 ⫹ rYŶt ⫺ 1 兲.

shock could be observationally equivalent. In the

model, output and asset prices peak only with a In other words, I assume that the central bank

delay following the improvement in productivity. can respond to current asset price movements:

In simulations not reported here, I find that

the model predicts a standard deviation for en-

28

trepreneurial housing investment that is twice One drawback of the model is that it predicts that

that of variable capital investment: this number households’ housing holdings are countercyclical: with a

fixed supply, this sector absorbs in fact the reduction in the

is slightly bigger but roughly in line with the demand by the entrepreneurs. This need not be unrealistic if

data (see footnote 19). Not shown in figure, I housing is given a broad interpretation, which also includes

find that in response to, say, a negative mone- land. In Japan, for instance, households and the government

tary shock (positive preference shock), h falls have traditionally been net purchasers of land in periods of

falling land prices (see the 2003 Annual Report on National

(rises) on impact by 4 percent (3 percent). Accounts of Japan).

Given that the elasticity of output to real estate 29

I compute the Taylor curves tracing out the minimum

is very small (0.03), this shows that changes in weighted unconditional variances of output and inflation at

housing ownership per se are not crucial to the different relative preferences for inflation versus output

variance. I constrain interest rate volatility by imposing an

upper bound 25 percent larger than the estimated standard

deviation generated by the benchmark model. I also impose

27

Given the adjustment cost for capital, the initial re- r, rY ⬎ 0 to generate a unique rational expectations equi-

sponse of output is roughly equal to that of consumption. librium for each policy.You can also read